The One Crypto Trade That Still Makes Sense Right Now

10x Research

10x Research

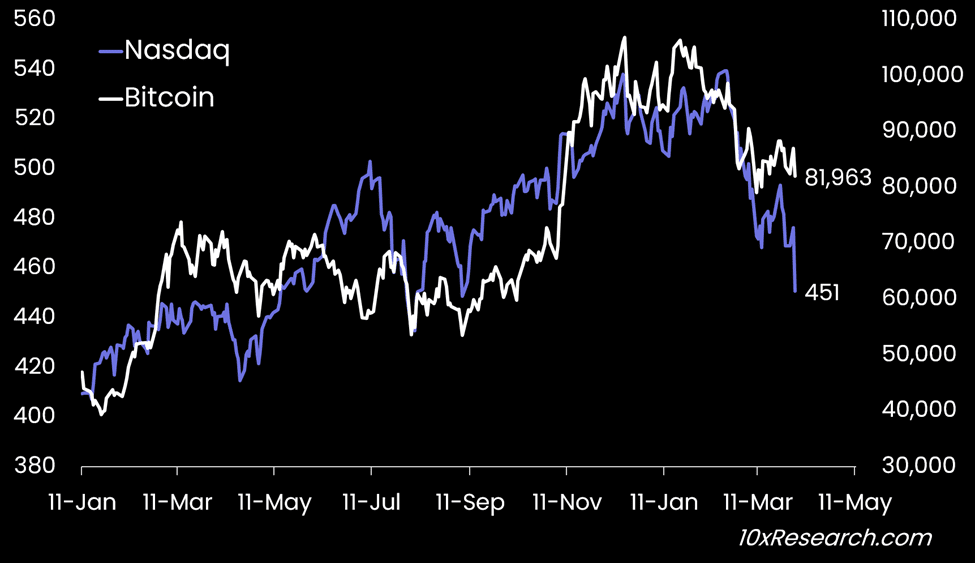

1-12) Bitcoin is showing notable resilience compared to U.S. tech stocks. If its historical correlation with the Nasdaq had held, Bitcoin could have fallen into the low $60,000 range. However, the relationship appears to be shifting—Bitcoin may no longer follow tech stocks with a predictable beta. Instead, it’s increasingly acting as a refuge and potential store of value for U.S. asset holders.

Nasdaq (LHS) vs. Bitcoin (RHS)

2-12) It’s not just global trade that Trump is reshaping—he’s also challenging the international security framework, where the U.S. military has long been the central and reliable anchor of transatlantic security. With America signaling a retreat from that leadership role, this could mark a broader decline in global military influence. While no apparent alternative power is ready to step in, the shift may contribute to a reassessment of the U.S. dollar’s overvaluation and its role as a safe-haven asset.

3-12) While Fed Chair Powell remains in his role until May 15, 2026, his consistently hawkish stance has previously clashed with Trump’s economic views. Trump would likely move to replace Powell with someone who sees the natural real interest rate as significantly lower. Such a shift could set the stage for broader market expectations of U.S. policy easing, potentially leading to sustained dollar weakness—not just in 2025 but well into 2026.

4-12) Fixed income markets are now pricing in four rate cuts for the U.S. this year, but whether those cuts materialize depends entirely on Fed Chair Powell’s actions. If the Fed accelerates its cutting cycle, the U.S. dollar could weaken rapidly, potentially triggering a strong rally in Bitcoin.

5-12) Four rate cuts signal that markets are firmly expecting a Powell pivot, even though the U.S. labor market remains resilient. Today’s Nonfarm Payrolls report may still show moderate strength, but the real focus is on Powell’s upcoming remarks. While he previously suggested the Fed could look through short-term inflation pressures, those pressures have intensified since he last spoke. If Powell strikes a more hawkish tone today, there’s a real risk that equities and other risk assets will sell off—potentially making him the scapegoat for renewed market weakness.

6-12) During Trump’s first trade war, tariff announcements were followed by a stronger U.S. dollar. This time, however, the opposite may unfold. Unlike his first term, when globalization was the foundation of global trade, today’s political climate is shifting, with leaders increasingly focused on domestic priorities over international cooperation. A weaker dollar could also reflect shifting expectations that less global trade will be settled in dollars, with foreign governments moving away from U.S. assets—a potentially catastrophic miscalculation by the Trump team.

7-12) Everyone is arguing that Trump will negotiate before those reciprocal tariffs take effect on April 9. Still, there is a possibility that these were not negotiation tactics, but rather a new level of providing access for foreign companies to the US consumer.

8-12) Historical evidence suggests that in trade wars, countries with trade surpluses tend to lose out to those with deficits. Unlike during Trump’s first term—when the focus was on incremental gains—he now appears to be seeking a more decisive victory rather than settling for minor adjustments in America’s favor.

9-12) The key signal will be bond yields: if they fall, markets are bracing for recession; if they rise despite recession risks, it could signal broader dislocations. In 2015, Chinese investors turned to Bitcoin as a safe haven amid yuan devaluation; this time, it might be U.S. investors seeking the same.

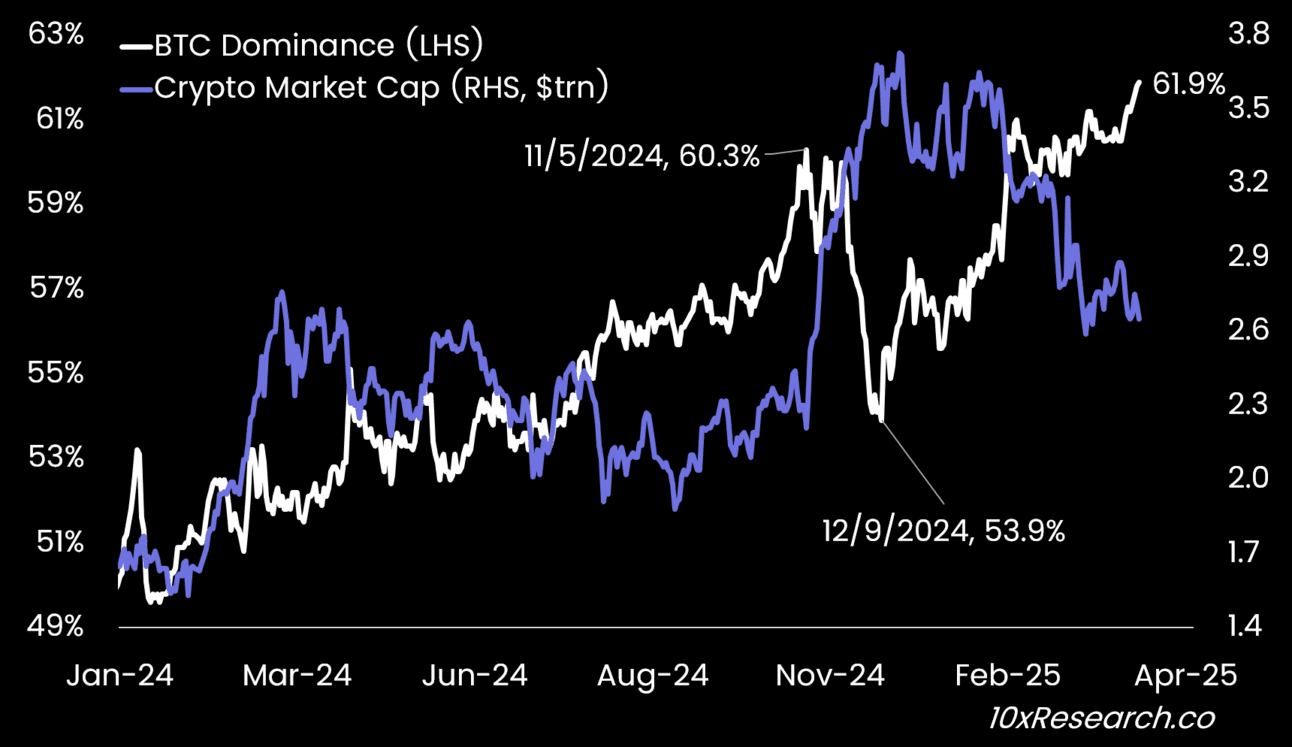

10-12) We maintain a mildly bullish view on Bitcoin, particularly in relation to U.S. stocks and altcoins. With altcoins already deep in a bear market, it's unlikely that consumers or speculators will divert spare capital into high-risk, low-conviction cryptocurrencies. In this environment, Bitcoin's dominance is likely to continue rising as more discerning investors choose to allocate capital to the most established cryptocurrency. This may even extend to U.S. dollar holders, given the lack of compelling alternatives.

Bitcoin Dominance (LHS) vs. Crypto Market Cap ($ trillion, RHS)

11-12) The one clear takeaway is that altcoins are likely to continue underperforming. If U.S. equities extend their decline, the dollar weakens, and the tariff war drags on without resolution, Bitcoin could emerge as the relative winner (vs. US dollar, or vs. US stocks, or vs. altcoins → see our report from January 15 here). In a market clouded by uncertainty, even identifying the smallest outperformer could prove to be a successful trade.

12-12) Europe and China are both pursuing fiscal expansion, and retaliation to U.S. tariffs appears likely—moves that typically support their respective currencies. In such an environment, there may be few safe havens, but distinguishing winners from losers becomes essential to preserving capital. A long Bitcoin versus short altcoins position could be one of the clearest trades in this landscape.

Favorite Trade: Long Bitcoin vs Short any altcoin

As foreign capital exits U.S. markets and the dollar weakens, Bitcoin may face continued short-term pressure. Rising credit spreads, fading Chinese demand, and shifting global capital flows reduce immediate bullish momentum. U.S. investors could become marginal BTC buyers, but a sustained recovery likely depends on renewed fiat inflows into crypto.

10x Research/2025.04.11

Despite bullish sentiment, Bitcoin remains vulnerable as the U.S.-China trade war intensifies and global credit markets flash warning signs. CNY devaluation risks, rising bond yields, and widening credit spreads point to continued volatility. With no coordinated support from central banks, BTC may test key support at $73K or drop further. Markets could be entering a prolonged downturn, not a quick rebound.

10x Research/2025.04.11

Amid market turmoil, the White House attempts to calm investors while the U.S.-China trade war intensifies. China resists U.S. tariff demands and may respond by weakening the yuan or selling U.S. Treasuries. With deep VIX inversion and threats of more tariffs, volatility is expected to rise. The USDCNY rate remains a key signal in this escalating showdown, while markets brace for continued turbulence.

10x Research/2025.04.11

Bitcoin’s weak year isn’t OG selling or a “silent IPO.” It’s crypto contagion. Illiquid altcoins forced insiders to sell BTC to prop up air-token markets, while disciplined capital (ETFs, MSTR, Wall St) drained volatility and killed alt-season rotations.

Bit Paine/2026.01.28

Gold’s parabolic breakout isn’t a Bitcoin defeat but the same debasement trade unfolding in phases. Gold moves first as the hedge for states; Bitcoin follows as the hedge for people. They trend together long term, but cycle apart short term.

Swan/2026.01.27

This article dissects why Bitcoin’s latest bull cycle felt muted despite historic adoption. As ETFs, DATs, miners, and institutions reshaped liquidity, volatility collapsed, retail faded, and crypto-native capital sold into strength—marking BTC’s transition into a fully financialized asset.

DoveyWan/2026.01.14

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link