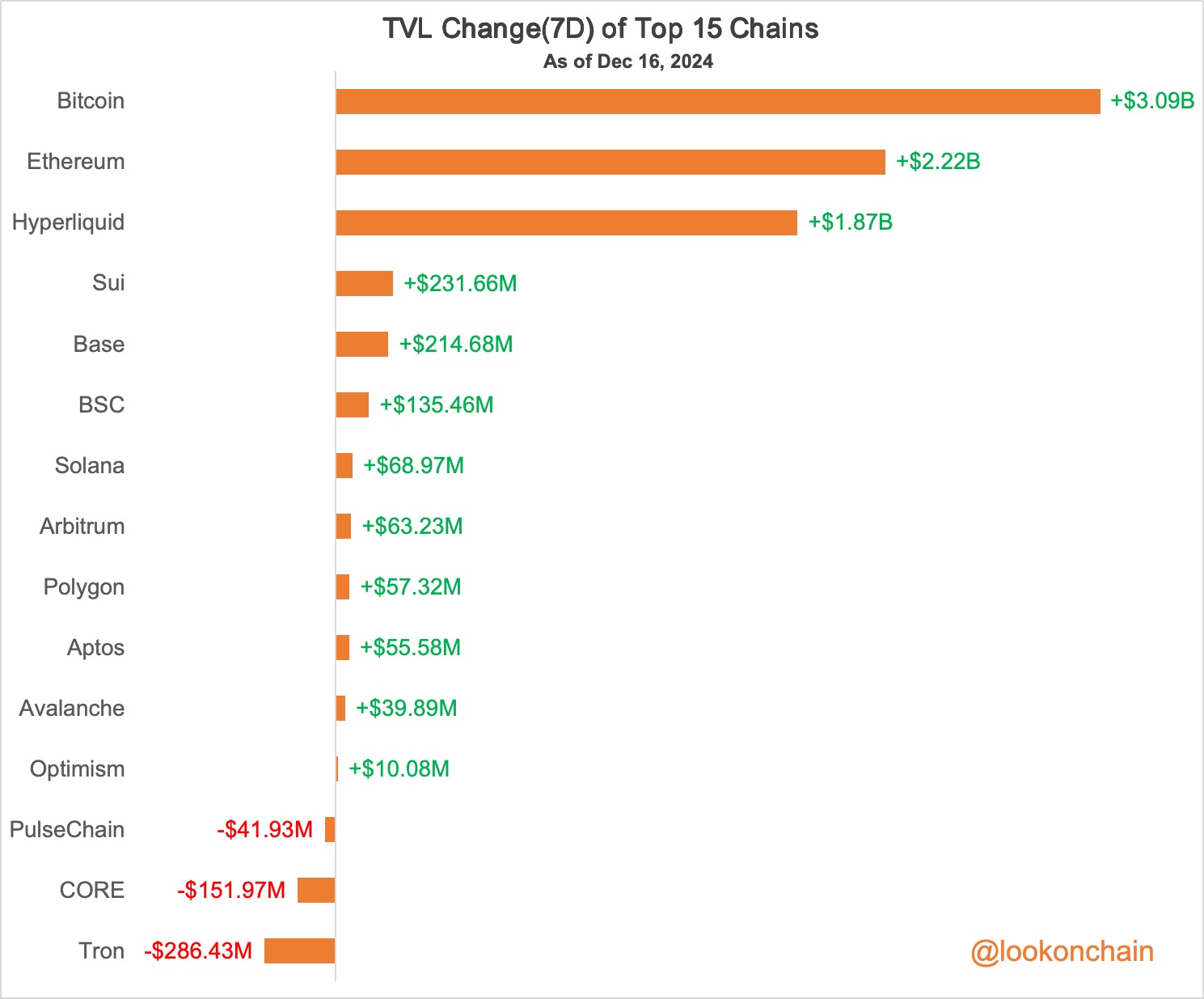

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

In the past 7 days, #Bitcoin's TVL increased by $3.09B, #Etherum's TVL increased by $2.22B, and #Hyperliquid's TVL increased by $1.87B.

Funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

The US PCE Beforehand Whale Shorts $13.5M Ahead of Release, Betting on Higher-than-Expected Inflation to Suppress Nasdaq

9 minutes ago

Analyst: Since the US-Iran conflict broke out, Bitcoin has been one of the best-performing macro assets

9 minutes ago

TRUMP Surges Past $3.7, Up Over 32% in 24 Hours

9 minutes ago

Trump Claims Iran 'Ready to Surrender' in G7 Call

9 minutes ago

Pacifica's total transaction volume surpasses $136 billion, completing the distribution of 10 million weekly normalization points

9 minutes ago

TOKEN2049 Dubai Summit announced to be postponed to April 21-22, 2027

9 minutes ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store

Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link