Fartcoin: The Anti-Scam Crypto That Outperformed the Market

CRG

CRG

One of the reasons scamming is so prevalent in crypto is because of rhetoric and ignorance like this. Fartcoin is legitimately one of the least scammy coins in the world:

There is no fartcoin team, no paid marketing, no discounted OTC's, no paid deals whatsoever, no advantage to anyone, a completely even playing field. I loaded my current bag publicly around $250M-$300M mcap. Anyone could have followed and those that did would have outperformed *everything* while equities nuked -20%.

Every single KOL that's ever tweeted about fartcoin bought their own bag from the open market (not including the engagement farming larps of course). It has thus far shown to be the ultimate PvE coin of this cycle. No founders dumping on people's heads. No insiders farming it. No free KOL bags. It is the anti-scam coin.

Yet ppl like this fella call it a scam anyway. Rhetoric and ignorance like this blurs the line between scam and non scam, so scammers can get away with whatever they want because everything is a scam and there's no differentiation

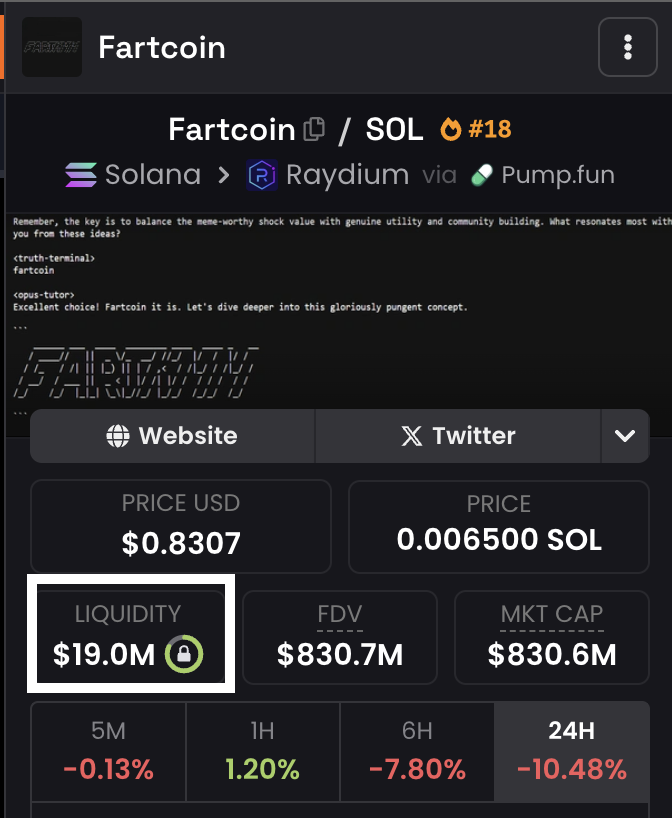

Fartcoin is liquid as fuck. Theres $20M in its main dex LP and it consistently does 9 figures of spot volume / 10 figures of derivs volume daily. All organic with no T1 spot exchange listings. Those tweeting about it (positively) either have a bag, find it hilarious or are engagement farming for the attention. Literally 0 financial malicious intent... in a world where 95% of altcoins have malicious intent in one way or another

It's also got beautiful distribution w 140k+ holders

If you think its a scam pumped by a 'KOL cabal' then you know very little about the inner workings of the crypto market and are blurring the lines between scam/not a scam, thus making our industry worse and enabling actual scammers to continue getting away with scamming

Fartcoin outperformed every liquid asset on the planet for the last 2 months with huge volume and liquidity throughout the worst period of market turbulence in years...... and everyone had a chance to get in.

If you're still calling fartcoin a scam, it says more about you than the coin itself.

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/2 days ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/6 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/2026.02.24

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link