What If You Bought $100K of BTC vs ETH in 2017? The Results Are Brutal for ETH Holders

Alec Bakhouch

Alec Bakhouch

You bought $100k of Bitcoin or Ethereum in Sept 2017.

It’s now 2025.

How bad was the decision to buy ETH instead?

I ran the real numbers.... and it's rough for ETH holders 🧵👇

The setup:

• Bitcoin (BTC) price in Sept 2017 = $4,000

• Ethereum (ETH) price in Sept 2017 = $400

Your $100k investment would have bought:

• 25 BTC

• 250 ETH

Pretty even math. But the outcomes?

Wildly different.

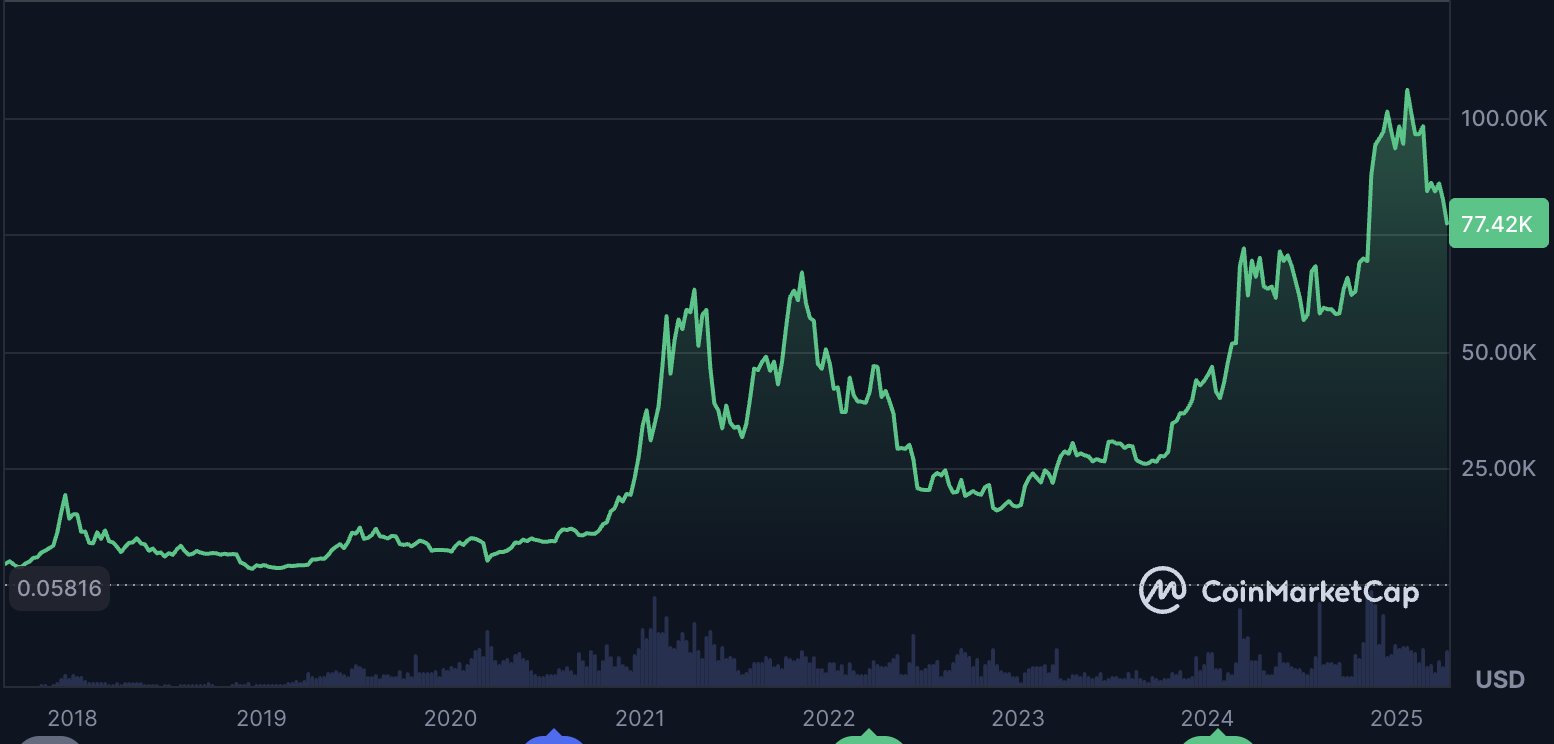

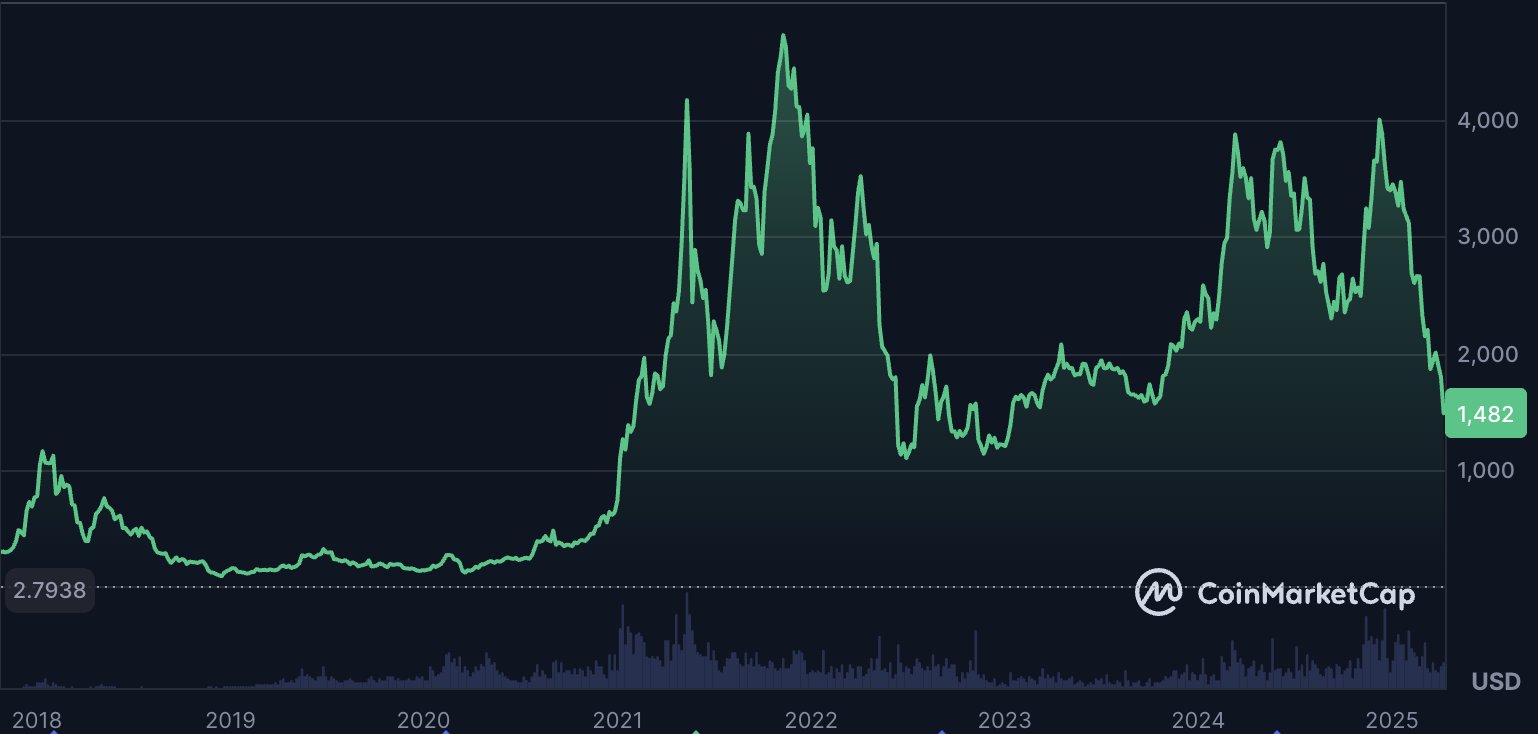

Today’s prices:

• BTC ≈ $80,000

• ETH ≈ $1,500

So today your stack would be worth:

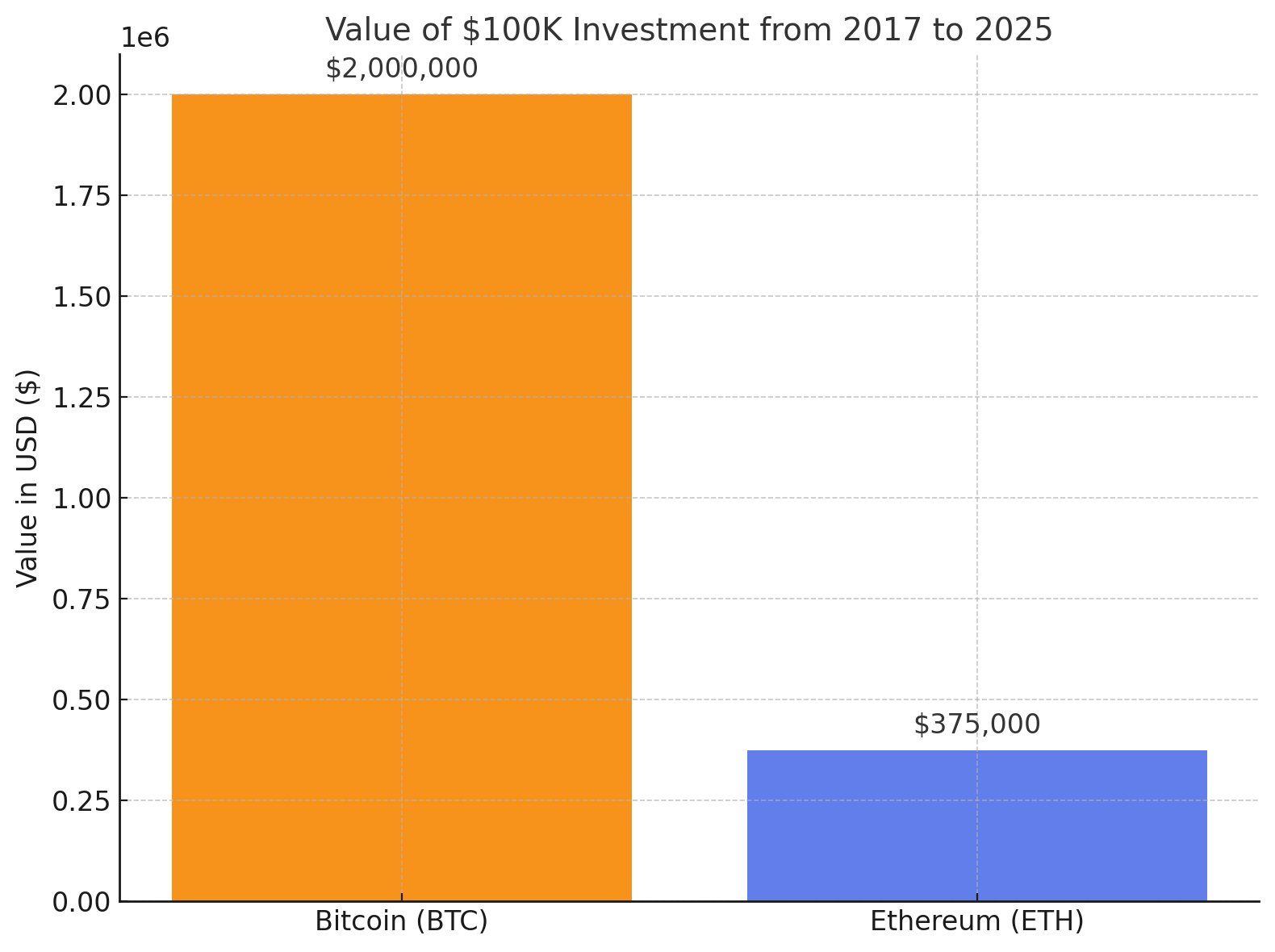

• 25 BTC × $80,000 = $2,000,000

• 250 ETH × $1,500 = $375,000

Bitcoin turned $100k into $2M.

Ethereum turned $100k into $375k.

Simple ROI:

• Bitcoin = +1,900%

• Ethereum = +275%

In other words:

Bitcoin outperformed Ethereum by 7x.

And that’s before considering risk.

Let’s talk about that…

• Bitcoin = 1 chain, 1 mission, 1 monetary policy.

• Ethereum = hard forks, experiments, pivots.

Ethereum went from:

• PoW → PoS

• “World Computer” → “Settlement Layer” → “Everything Chain” → “Restaking Casino”

If you bought ETH in 2017, you’re not holding the same asset anymore.

Meanwhile, Bitcoin has done exactly what it promised:

• Stayed decentralized

• Stayed predictable

• Stayed unstoppable

No pivots.

No drama. (Only on Twitter 😂)

No Hard Forks. (Blocksize Wars)

That’s the whole point.

Volatility hits differently too:

• Bitcoin had -84% drawdowns

• Ethereum had -95% drawdowns

Bitcoin punished weak hands.

Ethereum obliterated them.

Almost nobody rode ETH from 2017 → 2025 without getting wrecked along the way.

Today’s momentum:

• Bitcoin = Clear regulatory approval, ETFs, sovereign accumulation, global money narrative, corporate adoption.

• Ethereum = Fighting for relevance vs alt-L1s, regulatory scrutiny, endless scaling issues.

Bitcoin keeps winning bigger battles.

Ethereum keeps trying to reinvent itself.

The real conclusion:

In 2017, Bitcoin looked "boring" and "old."

In 2025, Bitcoin looks inevitable.

Meanwhile, Ethereum looks more and more like Silicon Valley tech — trendy, fragile, replaceable.

You don’t build generational wealth chasing experiments.

You build it by owning certainty.

Summary:

• $100k BTC in 2017 → $2M

• $100k ETH in 2017 → $375k

It’s not even close.

Bitcoin didn’t just protect your wealth better.

It multiplied it better.

And the best part?

The next 10 years will be even bigger.

Stack accordingly. 🧠

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/5 days ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2026.02.27

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/2026.02.24

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link