Unmasking the $AURA Surge: Behind the Pump

Splin Teron

Splin Teron

What kind of cabal is behind $AURA?

$1M > $180M markecap in days.

Read before you become exit liquidity.

you've probably heard it already, no one remembers a coin bouncing back this hard in a single day after 4 months of silence like $aura just did.

i'm not an exception.

so i started digging to find out who pulled the strings, and turns out there's more to it than just a lucky pump.

first, i dive on-chain.

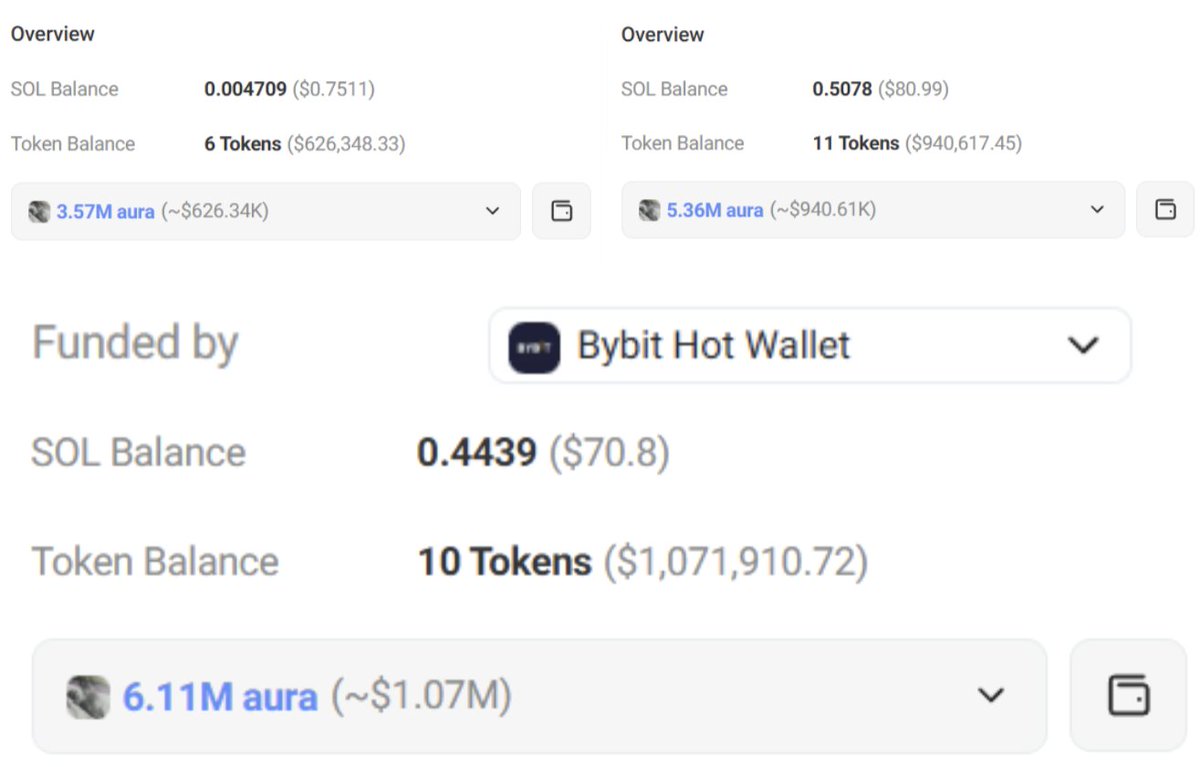

and found, wallets funded in the past month from bybit and miraculously only bought $aura. sitting in huge profit rn.

> 8c9AHEM2G6oW4sceY1bvU6jeKe2BfuqrRL7oLDAXYuAG

> 9MUNVQqZz4d6CMyhXK1L8vrG4CXBveFixY7bvGsQvQgH

> 64WEZi55vkMvsueruvEE1doXTgXvYnC9KqxMBP2DcLUU

pure coincidence? doubtful. all the wallets are still being held and not sold yet.

https://x.com/bubblemaps/status/1932906744893595948

but among similar wallets, one stood out:

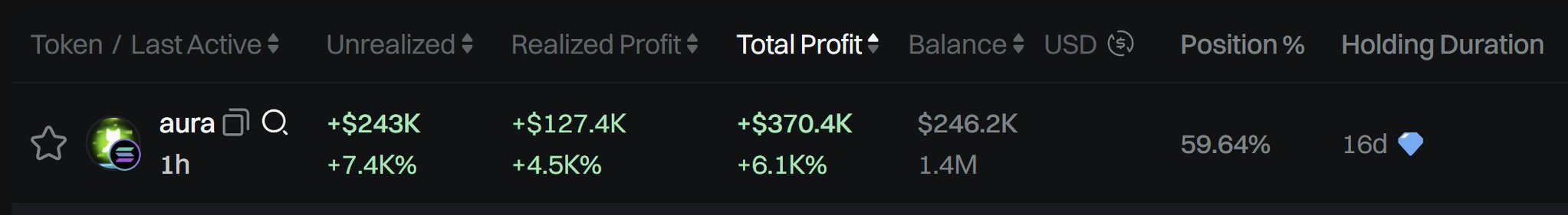

> 2xEYbZJqVpLK8GfxozfGQPdJKbCeb7f56odKyvDa4P98

unlike the rest, it wasn’t funded by a bybit hot wallet.

and by now, it's already sold part of holdings, locking in a $127.4k profit.

the wallet was funded by:

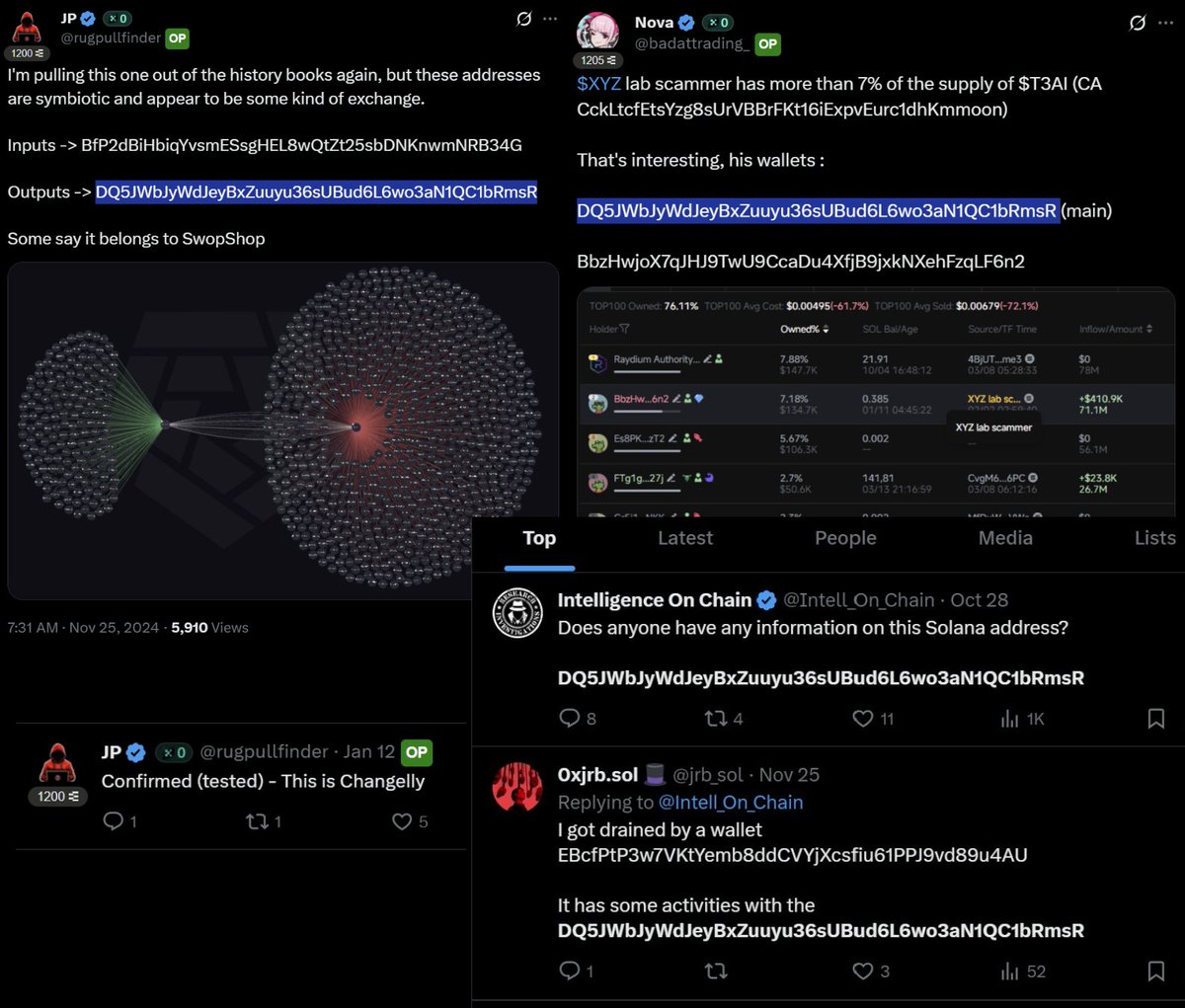

> DQ5JWbJyWdJeyBxZuuyu36sUBud6L6wo3aN1QC1bRmsR

if you search this address on x, you'll find it's been mentioned in various rugs. some claim it belongs to an exchange called "changelly".

kept digging through posts, and came across one from @the_bendoor.

he mentioned “solstice” and said he doesn’t trust anyone touching that scammy wallet.

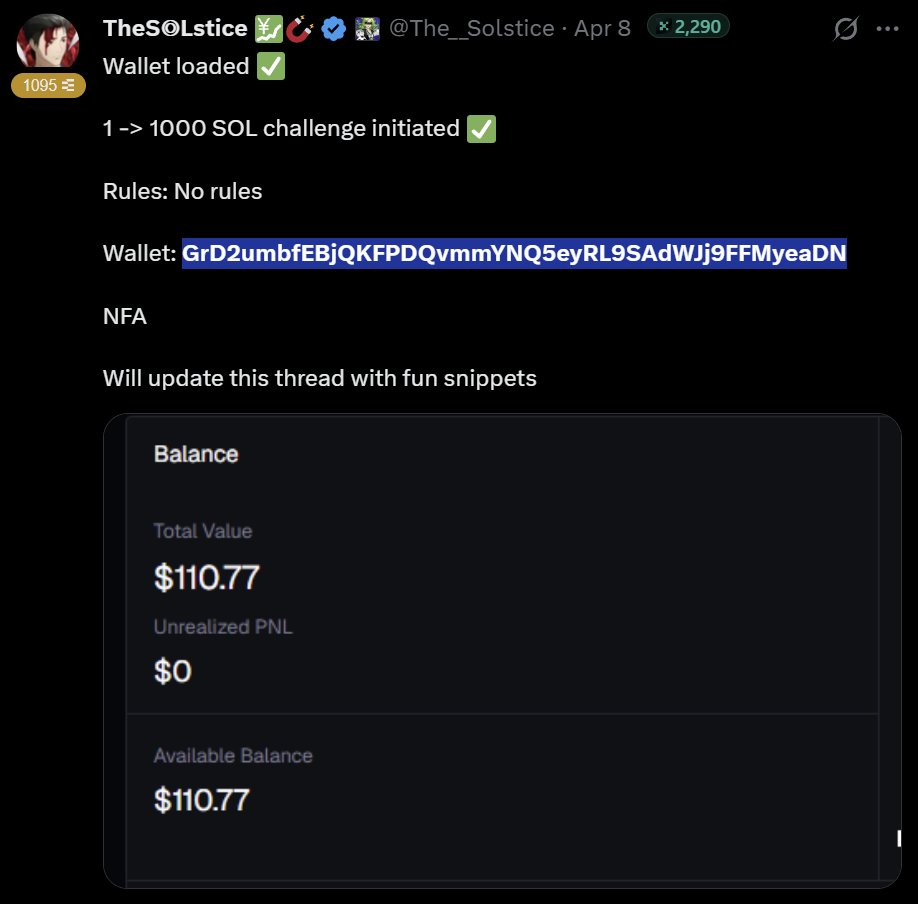

the screenshot shows his wallet. it was topped up from the changelly-linked address for a 1 to 1000 $sol challenge.

https://x.com/The_BenDoor/status/1932169389354414381

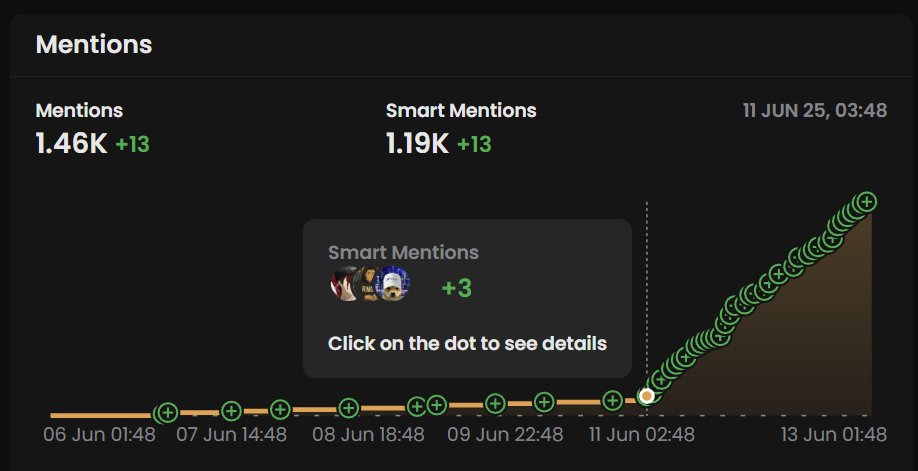

then i remembered i could use @getmoni_io to check who first mentioned the $aura ticker on x.

to my surprise, solstice was among the earliest, in first hours of pump.

coincidence? maybe. i'm not here to accuse - just connecting the dots.

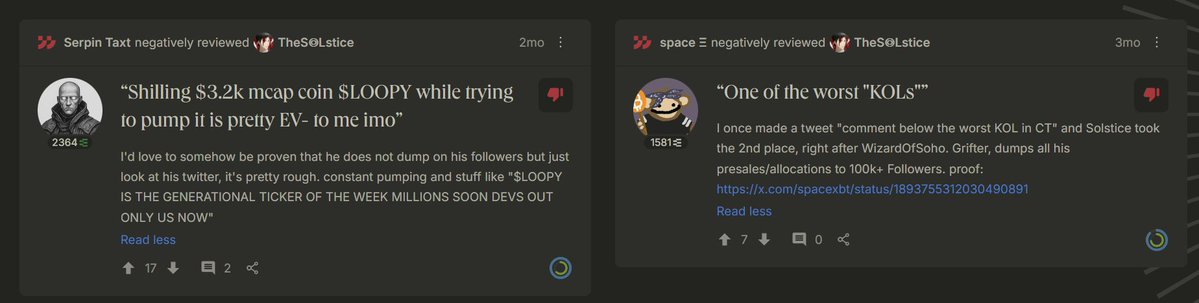

checked @ethos_network - found only 2 negative reviews. not enough to draw any solid conclusions from that.

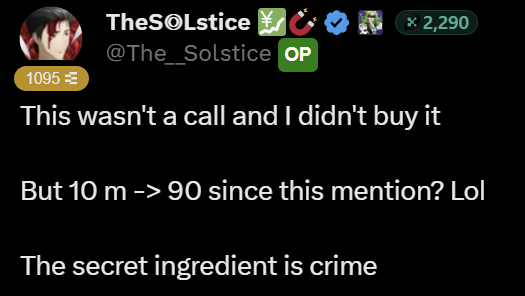

i'd also like to add that a day later, Soltice wrote that he didn't buy anything himself and think that the secret ingredient of the token is crime.

as @imperooterxbt rightly noted, this is a textbook case of exit liquidity creation.

an old token + "well-timed" entry + a bit of noise = and hundreds of millions in marketcap with minimal effort.

https://x.com/imperooterxbt/status/1933199580486848534

how to keep yourself from becoming an exit liqudity for others?

> old token ≠ safe

> avoid narrative-induced fomo

> price action isn't proof of legitimacy

> if a coin is trending, you’re probably already late

> don’t trade on emotions

> you’re not fighting whales, you’re being lined up by them

> your money is the target, not your loyalty

> you don’t need to farm every coin, just avoid the worst ones

> if it feels too coordinated, it probably is

> if you're the last to know, you're the first to pay

> always use tools to verify and explore on-chain

survival > profit.

live to trade again.

stay safe chat.

scammers never sleep.

99% of BTC will be mined by 2040, leaving miners reliant on transaction fees. With current fees covering just 7% of costs, Bitcoin faces tough questions on security and incentives post-halving. Can it stay secure without changing its rules?

Leshka.eth/1 days ago

A Satoshi-era whale sold 80,000 BTC ($9B) through Galaxy Digital with barely a 3.5% dip. This historic holder rotation moved decade-old coins to institutional hands, tightening supply and signaling a new phase for Bitcoin’s price discovery.

Swan/1 days ago

Bitcoin shows signs of a short-term downtrend reversal after a strong bounce at $114,700. With supports at $112K and resistances at $121K-$123.25K, targets of $133K-$140K are expected soon. Mid-term top likely in Q4 before a bear market, but long-term outlook remains highly bullish.

Mr. Wall Street/2 days ago

Bitcoin remains range-bound between key liquidation clusters at $121k–$120k and $114.5k–$113.6k. While an upside move to the top cluster is possible first, the $113.8k level and unfilled CME gap at $114.3k suggest the downside cluster is the mid-term target.

CrypNuevo/2 days ago

Every historical Altseason started in August. Bitcoin dominance is slipping, and capital is rotating into alts. This could be the setup for 200x+ lowcap rallies like past cycles. Here’s my 2025 portfolio picks before the bull run kicks off.

0xNobler/5 days ago

After 3 full market cycles, 5 major indicators—Pi Cycle Top, AHR999, Puell Multiple, Rainbow Chart, and Bubble Index—show no signs of a peak. Bitcoin remains mid-cycle, and altseason hasn’t even begun.

Leshka.eth/5 days agoOriginal

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link