Bitcoin Poised to Surge as Production Cost Signals Bottom

Mitchell

Mitchell

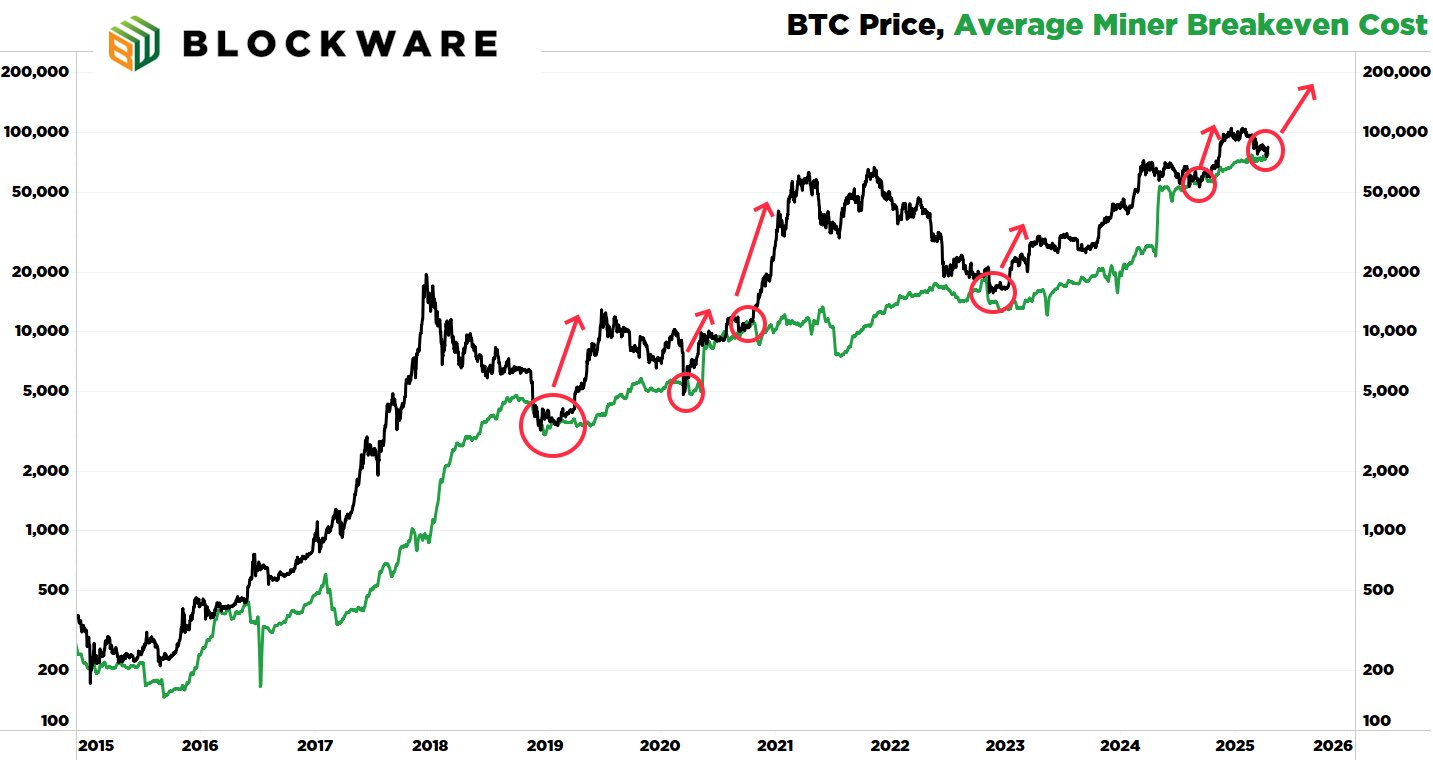

BREAKING 🚨 : Miner Cost of Production signals bottom is in and BTC will surge soon 🚀

The historical accuracy of this metric makes logical sense.

An asset is not going to trade for less than its cost of production. ⚡️

I’ve circled in red each prior instance in which the Bitcoin price intersected with the average cost of production – all of these intersections were followed by the Bitcoin price making a significant move higher. 📈

I expect this time to be no different – Bitcoin is going to make a move up before the end of Q2.

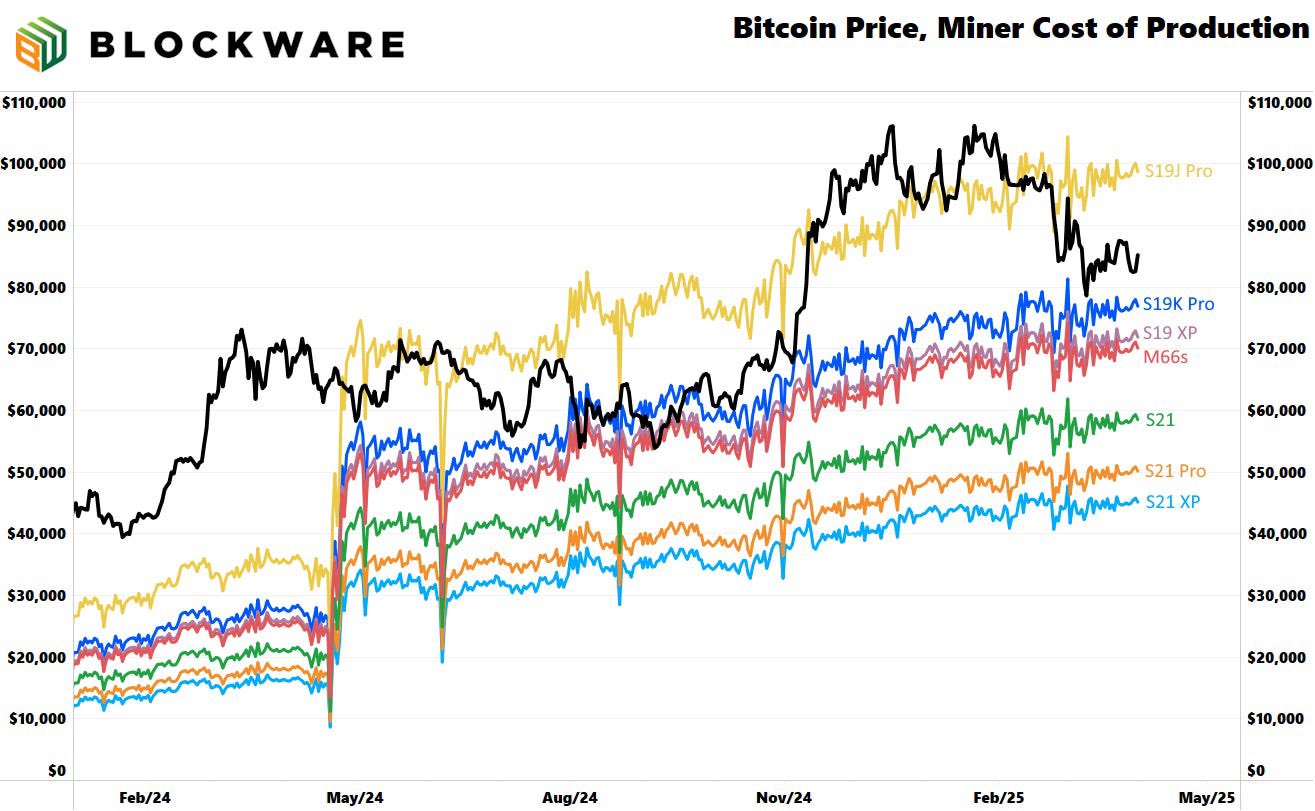

The chart above aggregates the cost of production across all miner types to come up with a singular industry average, but not all miners are made equal. The cost of production varies depending on electricity rate and machine type.

In the chart below we break down the ‘cost of production’ for various machine types based on an electricity rate of $0.078/kWh.

All 3 variations of the ‘Antminer S21’ have a breakeven price of $60,000 or less.

Miners hosted with @BlockwareTeam get access to these profitable economics — meaning they stack BTC everyday at a 50%+ discount to the spot price.

$AURA surged from $1M to $180M in days, but on-chain data reveals suspicious wallet behavior tied to Bybit and alleged scam-linked addresses. Early buyers made major profits, while social and on-chain clues suggest coordinated manipulation. This may be a textbook case of exit liquidity. Traders are urged to stay alert and avoid emotionally driven decisions.

Splin Teron/2 days ago

Most traders lose not from bad picks but from poor exits. This thread outlines a structured take-profit system using DCA entries, real-time analysis, partial exits, and emotionless execution. It emphasizes adaptability, risk management, and chart awareness — helping traders turn gains into lasting profits while avoiding panic, greed, and regret.

Atlas/2025.05.23

Cetus Protocol, the largest LP on Sui Network, was exploited due to an oracle bug, draining over $200M in liquidity. The attacker is converting stolen funds to ETH via Tornado Cash. Sui Network remains unaffected; the issue is isolated to Cetus. The team is working with Mysten Labs to resolve the problem.

StarPlatinum/2025.05.22

Altcoins don’t need billions to pump—just thin liquidity. A $10M market cap coin can 2x with $500K of buy pressure and crash with just $200K of sells. This thread breaks down the role of liquidity vs. market cap, why FDV and unlocks matter, and how smart traders exploit low float tokens for explosive gains.

cyclop/2025.05.19

$USELESS flips the crypto hate narrative into fuel. From being called “useless” by critics like Bill Gates and Jamie Dimon, this memecoin turns mockery into virality. Backed by elite alpha groups, fast-growing holders, and strong price action, $USELESS could be the next $FARTCOIN or $PEPE-level breakout.

Unipcs/2025.05.18

A savvy whale who made over $1.1M on $LaunchCoin and $ICM is now quietly accumulating new Internet Capital Markets (ICM) tokens. His wallet shows early entries into low-cap alts like $DUPE, $SKYAI, $HOUSE, $GORK, and more—each with growing whale volume. ICM, the new Solana meta, turns app ideas into tradable assets and is fueling a fresh memecoin supercycle.

Tracer/2025.05.17

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link