$330M Bitcoin Heist Sparks 50% Surge in Monero

Neel (Crypto Jargon)

Neel (Crypto Jargon)

Someone just stole $330 million in Bitcoin.

They then exchanged it for Monero and skyrocketed XMR’s value by 50% overnight.

It’s an unbelievable story about one of the biggest heists in the crypto world.

Let’s dive into the Thread: 🧵

A huge Bitcoin hack just occurred, with $330 million stolen!

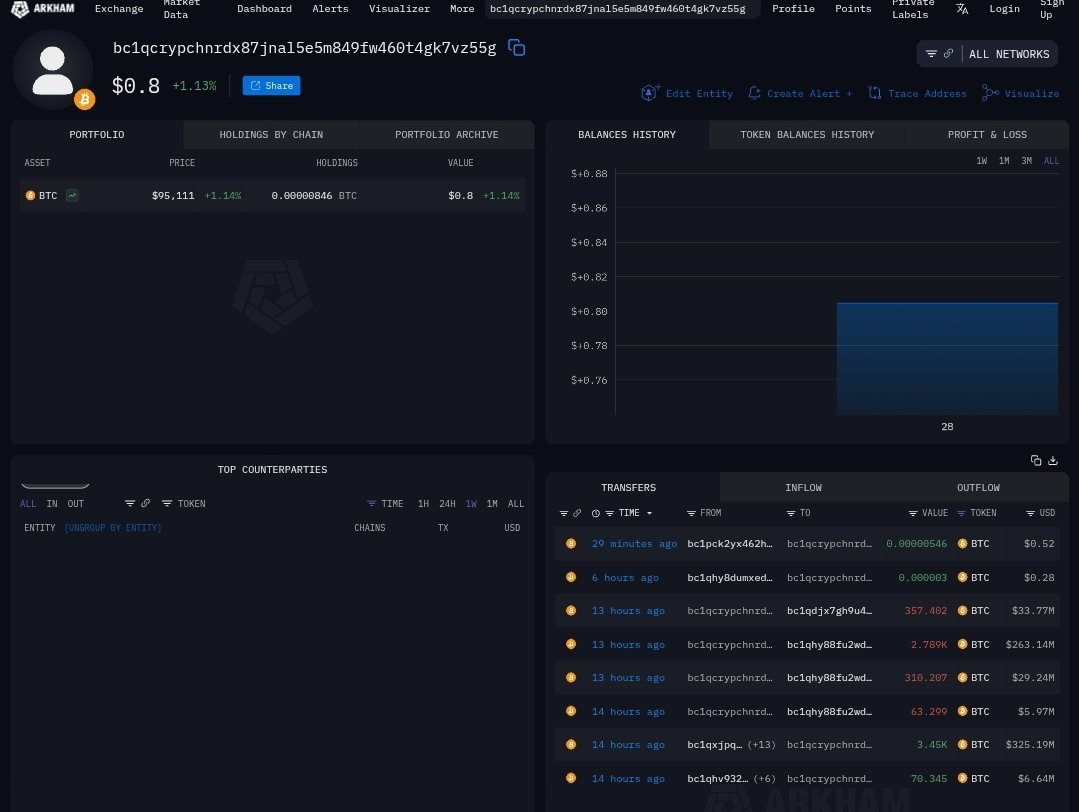

A total of 3,520 BTC (~$330.7 million) was taken from an original holder.

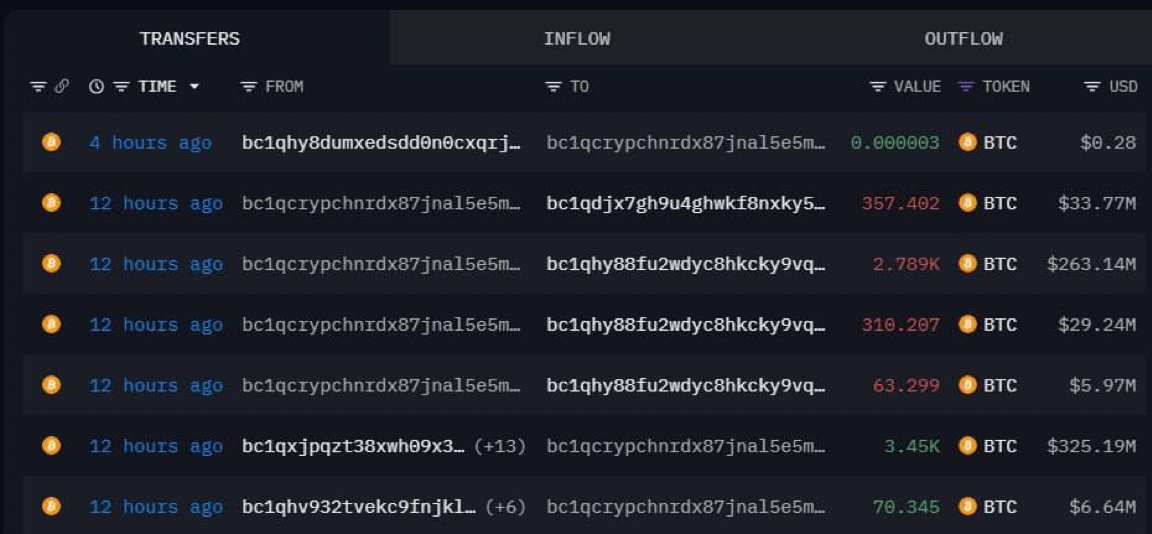

The thief used this address: bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55g.

On April 28, 2025, stolen Bitcoin (BTC) was quickly converted into Monero ($XMR), a privacy-focused cryptocurrency.

The thief used exchanges like KuCoin and MEXC to make the swap.

As a result, the price of Monero jumped 50%, rising from $227 to $391.

However, withdrawing the XMR has been reported as difficult.

The thief didn't act smart—they made quick exchanges with 1–3% fees for each transaction.

After hundreds of small swaps, the demand for XMR increased, causing its price to rise from $227 to $391!

ZachXBT believes the victim was an OG Whale BTC holder using platforms like Gemini.

https://x.com/zachxbt/status/1916773121652318500?s=61

Those fees are outrageous!

Zachxbt explained it: a long-time Bitcoin holder moved $330 million in small amounts through many swaps, which cost them millions in fees.

No one serious moves money like that.

It seems like an experienced Bitcoin investor without security got destroyed. Ouch.

Why did they choose Monero?

It is very private, like a ninja in the world of cryptocurrency.

It uses features like stealth addresses and RingCT, making transactions untraceable.

In contrast, Bitcoin transactions are easy to track.

However, this privacy can create sudden drops in XMR's liquidity, causing wild price changes for smaller coins.

The victim is an “OG BTC holder with weak security.”

Bitcoin is priced at $94,736 (BanklessTimes), so 3,520 BTC is a huge amount of money!

Older wallets often do not use two-factor authentication or hardware wallets, making them easy targets for theft.

$AURA surged from $1M to $180M in days, but on-chain data reveals suspicious wallet behavior tied to Bybit and alleged scam-linked addresses. Early buyers made major profits, while social and on-chain clues suggest coordinated manipulation. This may be a textbook case of exit liquidity. Traders are urged to stay alert and avoid emotionally driven decisions.

Splin Teron/2 days ago

Most traders lose not from bad picks but from poor exits. This thread outlines a structured take-profit system using DCA entries, real-time analysis, partial exits, and emotionless execution. It emphasizes adaptability, risk management, and chart awareness — helping traders turn gains into lasting profits while avoiding panic, greed, and regret.

Atlas/2025.05.23

Cetus Protocol, the largest LP on Sui Network, was exploited due to an oracle bug, draining over $200M in liquidity. The attacker is converting stolen funds to ETH via Tornado Cash. Sui Network remains unaffected; the issue is isolated to Cetus. The team is working with Mysten Labs to resolve the problem.

StarPlatinum/2025.05.22

Altcoins don’t need billions to pump—just thin liquidity. A $10M market cap coin can 2x with $500K of buy pressure and crash with just $200K of sells. This thread breaks down the role of liquidity vs. market cap, why FDV and unlocks matter, and how smart traders exploit low float tokens for explosive gains.

cyclop/2025.05.19

$USELESS flips the crypto hate narrative into fuel. From being called “useless” by critics like Bill Gates and Jamie Dimon, this memecoin turns mockery into virality. Backed by elite alpha groups, fast-growing holders, and strong price action, $USELESS could be the next $FARTCOIN or $PEPE-level breakout.

Unipcs/2025.05.18

A savvy whale who made over $1.1M on $LaunchCoin and $ICM is now quietly accumulating new Internet Capital Markets (ICM) tokens. His wallet shows early entries into low-cap alts like $DUPE, $SKYAI, $HOUSE, $GORK, and more—each with growing whale volume. ICM, the new Solana meta, turns app ideas into tradable assets and is fueling a fresh memecoin supercycle.

Tracer/2025.05.17

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link