Uncovering the Wallet Network Behind Faze Banks’ Token Scandals

dethective

dethective

Meet the side wallets of Faze Banks

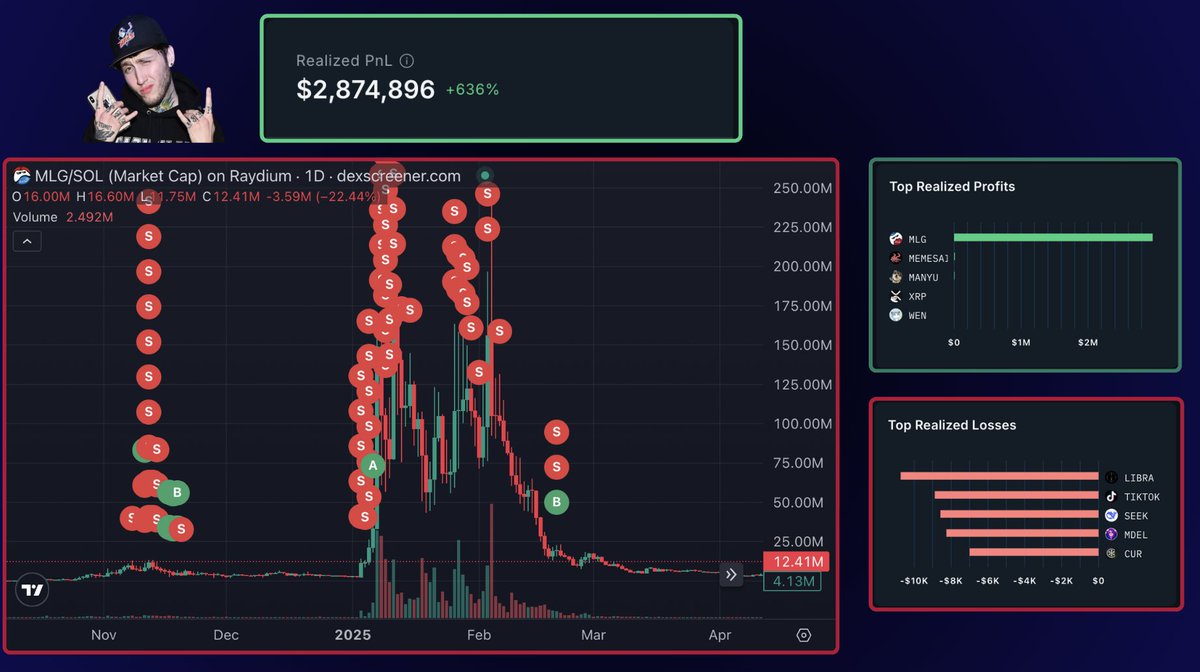

• Made 2M profit on $MLG

• Lost money on $LIBRA

• Part of a network of wallets that bought before the promotion

Just a coincidence? Details in this thread 🧵

A suspicious wallet

We know the streamer promoted $MLG and was aware of $LIBRA, likely getting scammed by Hayden Davis.

This wallet follows the exact same pattern:

• Bought a dead token before the stream

• Set up a Raydium LP

• Bought $LIBRA using an algo, ending in a loss

But there’s more than one address, more of a network

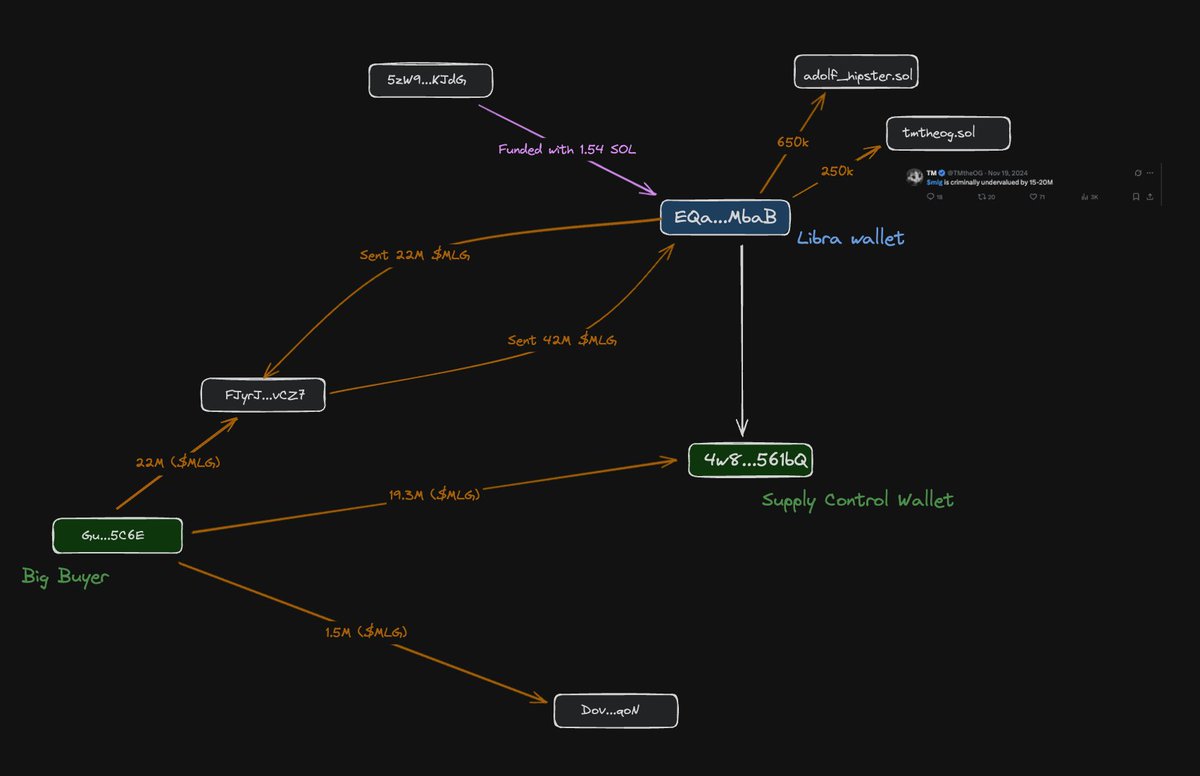

The network of addresses

I followed the money and noticed that some wallets, with strong connections between them, bought a lot of the supply before the pump.

There are 3 main actors:

• Supply control wallet

• Libra related wallet

• Big buyer wallet

Big Buyer wallet

All three wallets bought before the marketing pump.

As you can see in the chart this wallet was:

• Buying before the pump

• Selling the pump

• Transfer the supply to other wallets

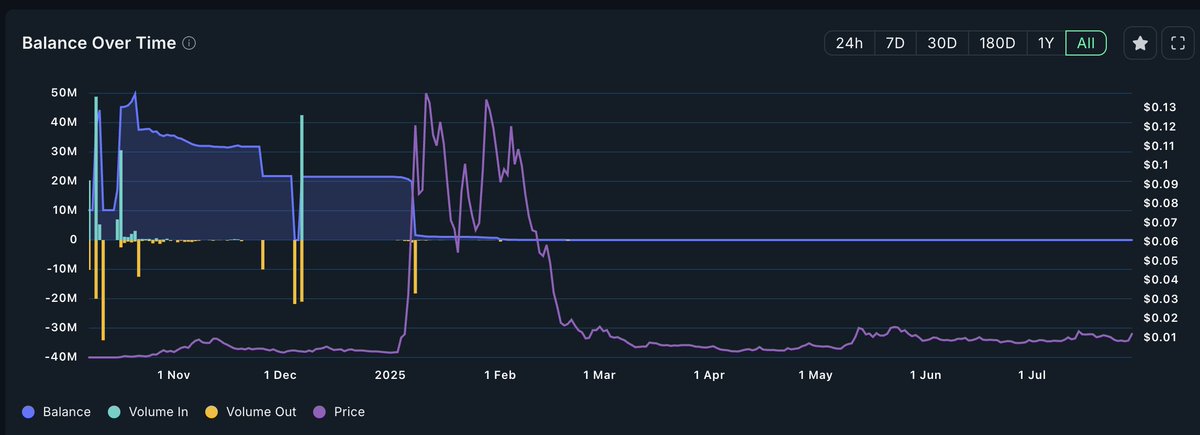

Supply control wallet

This wallet is meant to transmit trust.

The big whale is holding and not selling.

But the buy price was of course insanely low

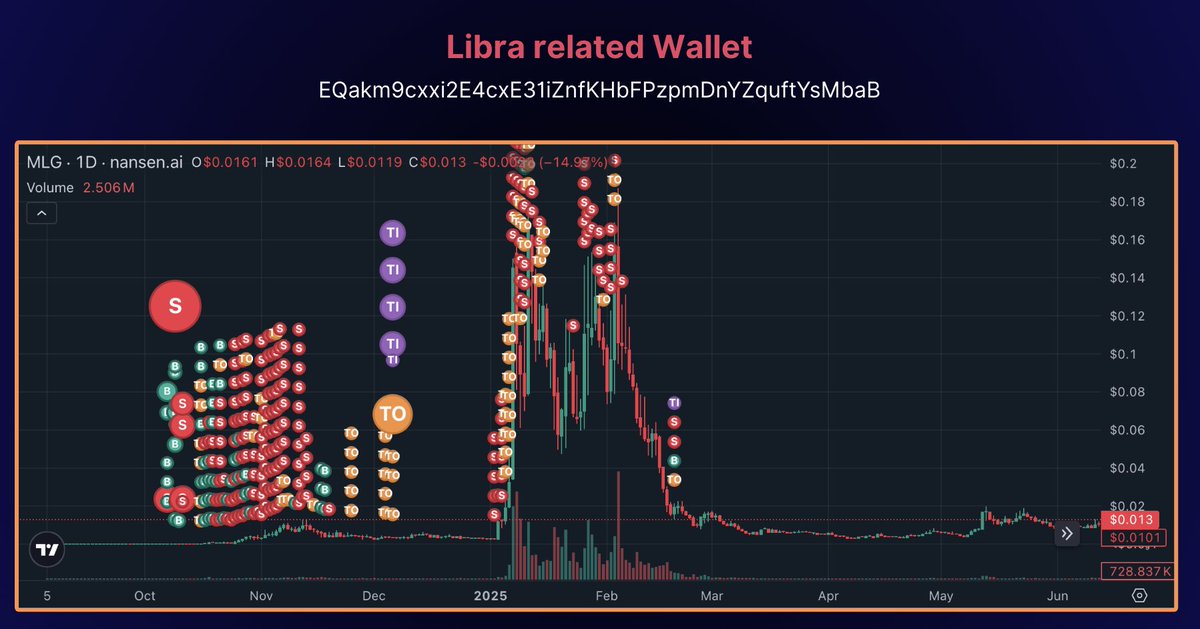

Libra wallet

I called it $LIBRA for simplicity since it was rugged by the same team behind Milei's token

This wallet is cashing out heavily and is also likely paying some callers.

For example it sent free tokens to tmtheog.sol

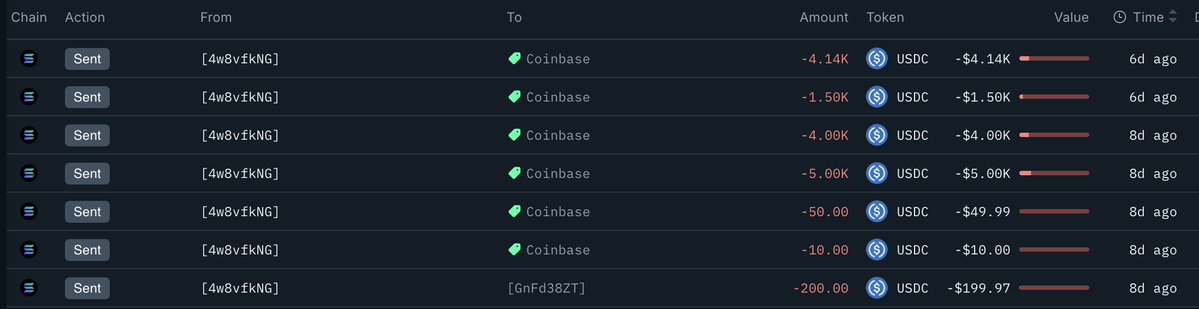

Recent cashout

Another link between the recent scandal and this wallet network is that the supply control wallet, after being dormant for 60 days, started cashing out to Coinbase over the last 22 days

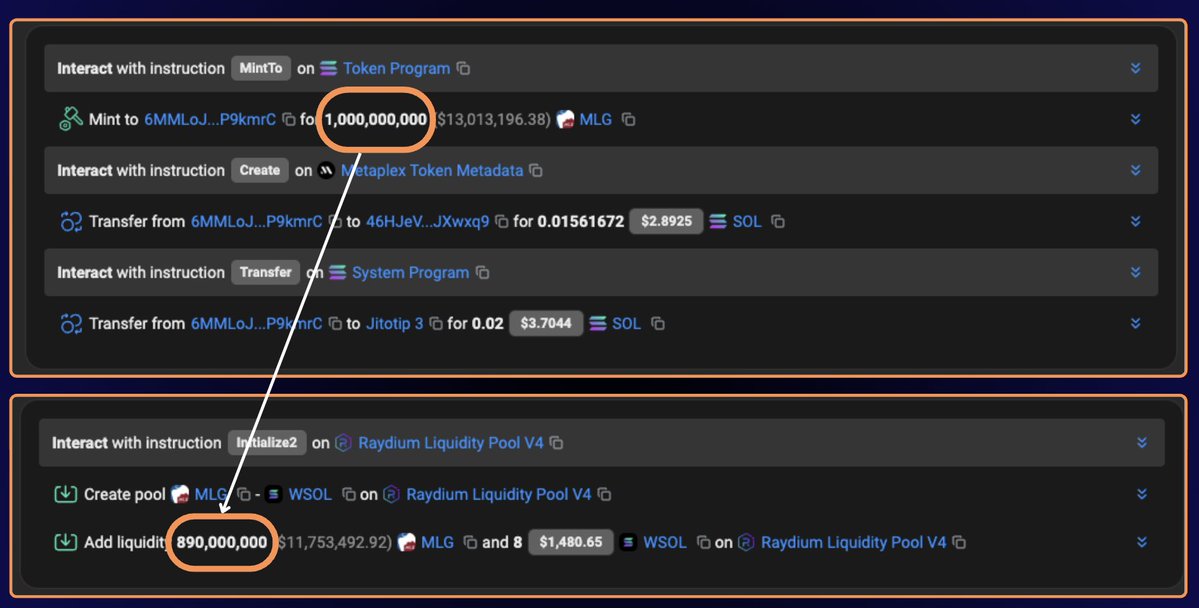

Backstory: The origin of the token

The token was not launched through any launchpad and the LP was created manually.

12 minutes passed between the mint and the burn.

• Minted 1B tokens

• Added 890M to the LP

Where did the remaining 110M go?

Supply control, but this time it doesn't matter

The 110M were simply spread through 9 wallets and used to rug the launch from 290k to 3k MC.

This "free" supply was used to extract the first couple of thousands and bring the token from 200MC to 2k.

Why it doesn't matter? Because it was just the original team extracting 20k. Nothing to do with Banks.

Conclusion

This case is very different from a typical low level influencer pump and dump

• The token was not launched through a launchpad

• The original team did a quick cash grab

• The token had been dead for about 170 days

• A new team took over and slowly accumulated a large part of the supply

• Then they pushed the price with marketing and false promises to dump on the audience

• Final step was crying about not making any money and claiming it only hurt their brand, which is not true

Ben.eth went from a small NFT influencer to raising millions during the 2023 memecoin boom with $BEN, $PSYOP, and $LOYAL. Backed by BitBoy and hyped by rumors of Andrew Tate, his projects crashed, lawsuits followed, and he vanished—identity still unknown.

StarPlatinum/5 hours ago

99% of BTC will be mined by 2040, leaving miners reliant on transaction fees. With current fees covering just 7% of costs, Bitcoin faces tough questions on security and incentives post-halving. Can it stay secure without changing its rules?

Leshka.eth/2 days ago

A Satoshi-era whale sold 80,000 BTC ($9B) through Galaxy Digital with barely a 3.5% dip. This historic holder rotation moved decade-old coins to institutional hands, tightening supply and signaling a new phase for Bitcoin’s price discovery.

Swan/3 days ago

Bitcoin shows signs of a short-term downtrend reversal after a strong bounce at $114,700. With supports at $112K and resistances at $121K-$123.25K, targets of $133K-$140K are expected soon. Mid-term top likely in Q4 before a bear market, but long-term outlook remains highly bullish.

Mr. Wall Street/3 days ago

Bitcoin remains range-bound between key liquidation clusters at $121k–$120k and $114.5k–$113.6k. While an upside move to the top cluster is possible first, the $113.8k level and unfilled CME gap at $114.3k suggest the downside cluster is the mid-term target.

CrypNuevo/3 days ago

Every historical Altseason started in August. Bitcoin dominance is slipping, and capital is rotating into alts. This could be the setup for 200x+ lowcap rallies like past cycles. Here’s my 2025 portfolio picks before the bull run kicks off.

0xNobler/6 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link