$BTC Sunday Update: Range-Bound Market With Key Liquidation Clusters in Play

CrypNuevo

CrypNuevo

$BTC Sunday update:

Still monitoring that past PA we focused last Sunday.

We saw the wicks to the upside and price not progressing any further, that helped us trade the drop this week.

However, it created a long wick to the downside that can potentially get filled.

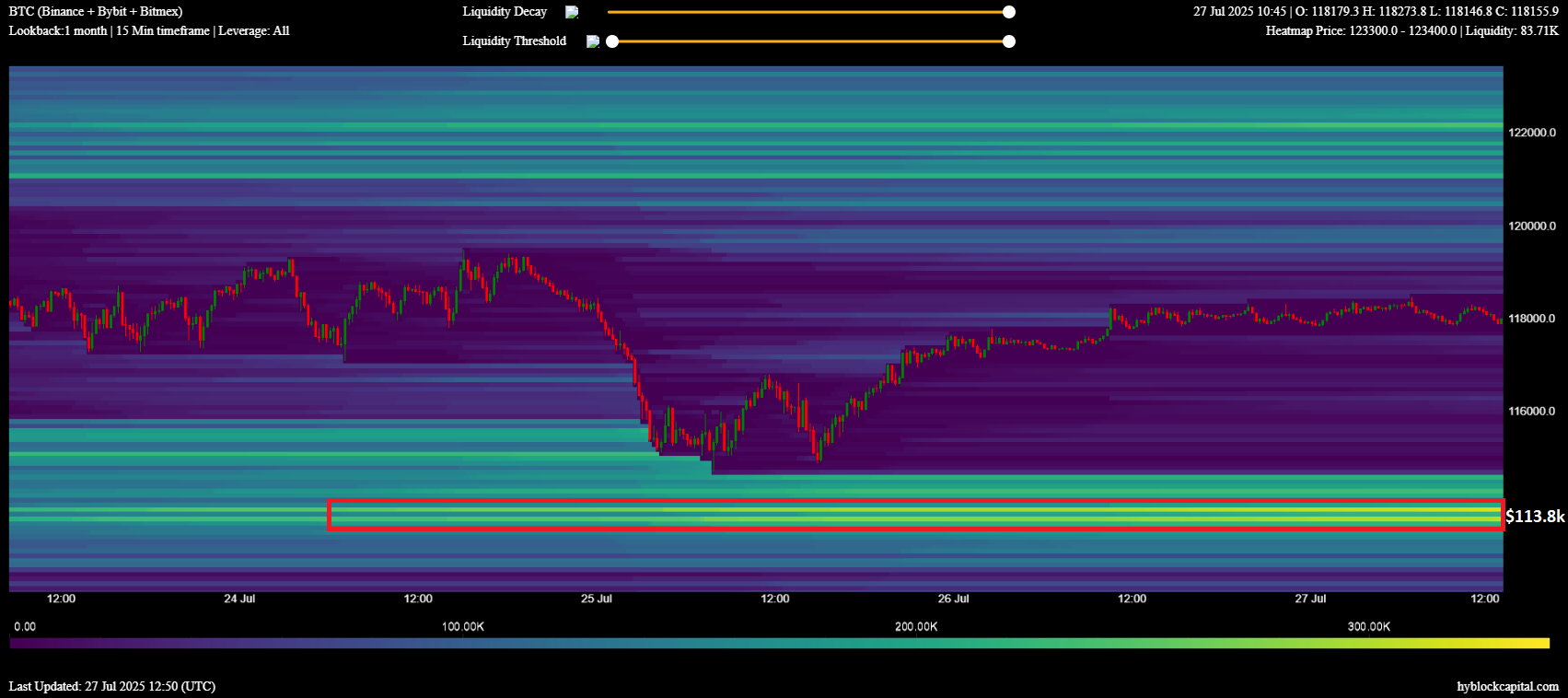

Liquidation clusters: we're in-between 2 liquidation clusters located at:

• $121k - $120k

• $114.5k - $113.6k

Based on similarities with previous cases, we could go for the cluster above first, and then reverse again to the bottom one. It's a range-bound environment.

If we zoom out, we can see that the main liquidation level is at $113.8k.

Consequently, I consider the downside liquidation cluster to be the natural target in the mid-term ($114.5k-$113.6k).

Again, it's possible and logical to hit first the cluster above - I'm going with that.

CME gap:

As said in my last tweet: "CME gap didn't hit by just a few hundreds - they'll probably try again".

This unfilled CME gap at $114.3k supports my projection of Bitcoin possibly attacking that liquidation cluster at $114.5k-$113.6k in the next 1-2 weeks.

A network of wallets linked to Faze Banks was found buying tokens like $MLG and $LIBRA before promotion, controlling supply and cashing out after marketing pumps. Evidence shows coordinated accumulation, sales, and Coinbase cashouts.

dethective/15 hours ago

99% of BTC will be mined by 2040, leaving miners reliant on transaction fees. With current fees covering just 7% of costs, Bitcoin faces tough questions on security and incentives post-halving. Can it stay secure without changing its rules?

Leshka.eth/2 days ago

A Satoshi-era whale sold 80,000 BTC ($9B) through Galaxy Digital with barely a 3.5% dip. This historic holder rotation moved decade-old coins to institutional hands, tightening supply and signaling a new phase for Bitcoin’s price discovery.

Swan/2 days ago

Bitcoin shows signs of a short-term downtrend reversal after a strong bounce at $114,700. With supports at $112K and resistances at $121K-$123.25K, targets of $133K-$140K are expected soon. Mid-term top likely in Q4 before a bear market, but long-term outlook remains highly bullish.

Mr. Wall Street/3 days ago

Every historical Altseason started in August. Bitcoin dominance is slipping, and capital is rotating into alts. This could be the setup for 200x+ lowcap rallies like past cycles. Here’s my 2025 portfolio picks before the bull run kicks off.

0xNobler/6 days ago

After 3 full market cycles, 5 major indicators—Pi Cycle Top, AHR999, Puell Multiple, Rainbow Chart, and Bubble Index—show no signs of a peak. Bitcoin remains mid-cycle, and altseason hasn’t even begun.

Leshka.eth/6 days agoOriginal

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link