Solanas Inflection Point: The Next Institutional Adoption Story

Pantera Capital

Pantera Capital

We believe Solana is approaching a major inflection point in its adoption—by consumers, fintechs, & institutions.

Blue-chip companies like Stripe & PayPal are starting to build on it.

The stories for Bitcoin and Ethereum have largely been told. Solana's is just beginning 👇

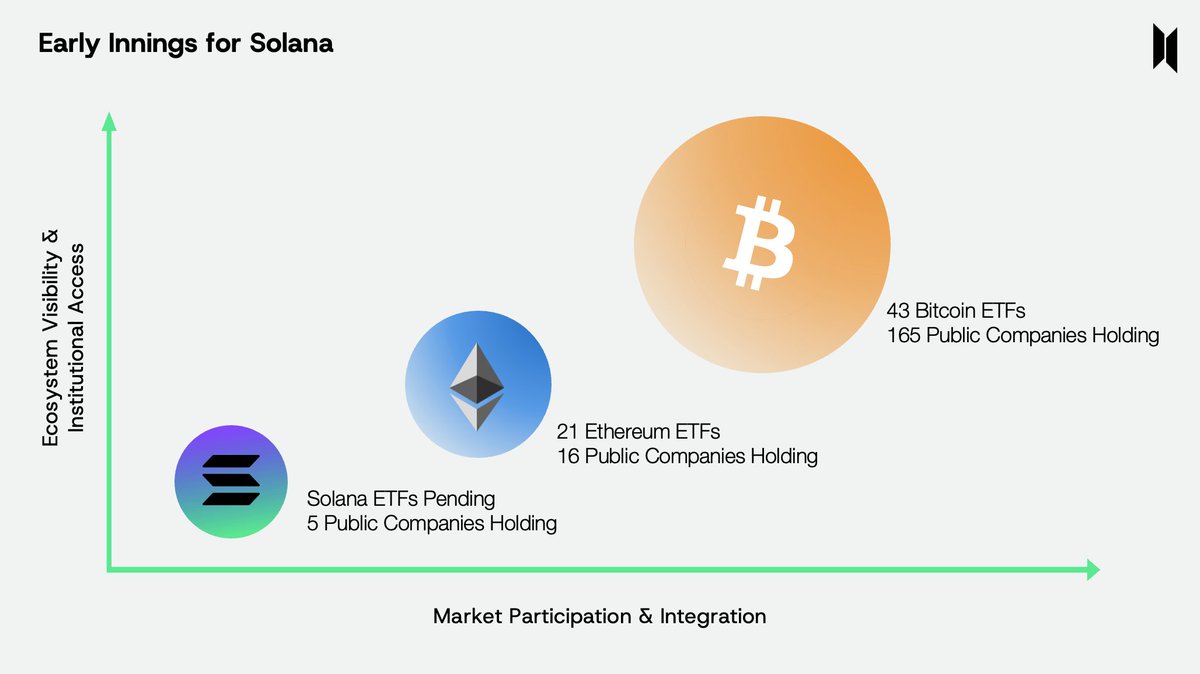

The ETF launches accelerated institutional adoption of BTC and ETH.

43 Bitcoin ETFs. 165 public companies hold BTC.

21 Ethereum ETFs. 16 public companies hold ETH.

Solana is still in its early days:

0 Solana ETFs. 5 public companies hold SOL.

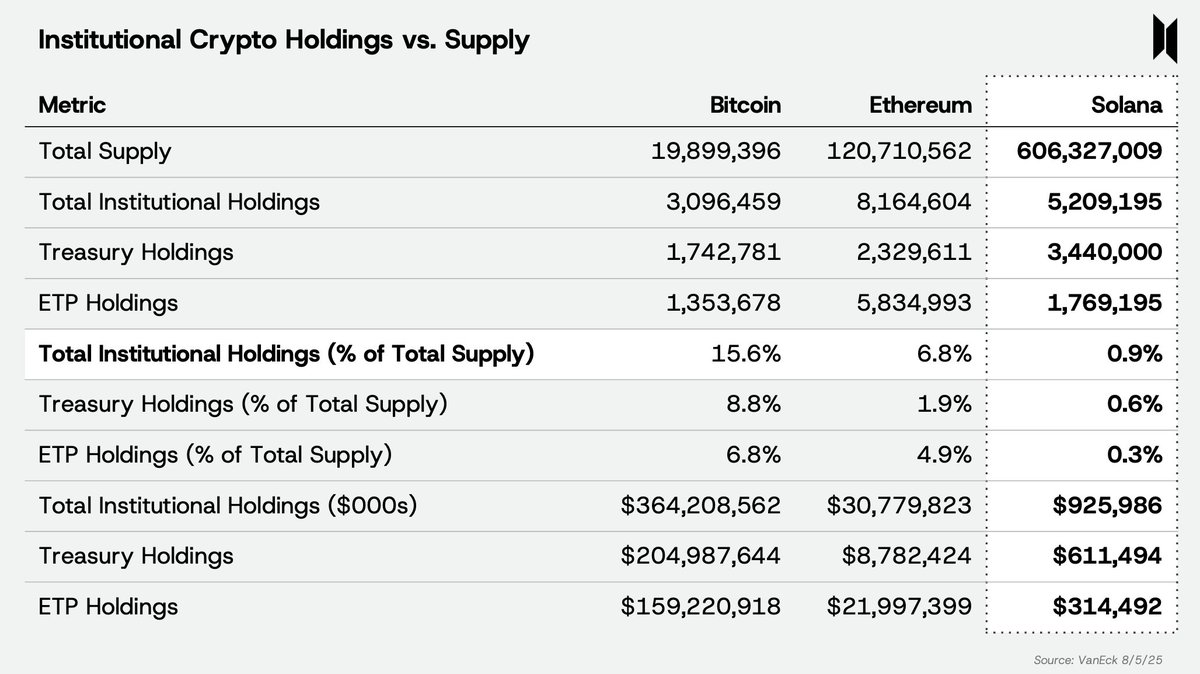

Institutions are currently under-allocated to SOL relative to BTC & ETH, holding less than 1% of the total supply—compared to 16% of BTC and 7% of ETH.

With a Solana ETF approval expected as early as Q4 2025, we believe Solana is next in line for its "institutional moment".

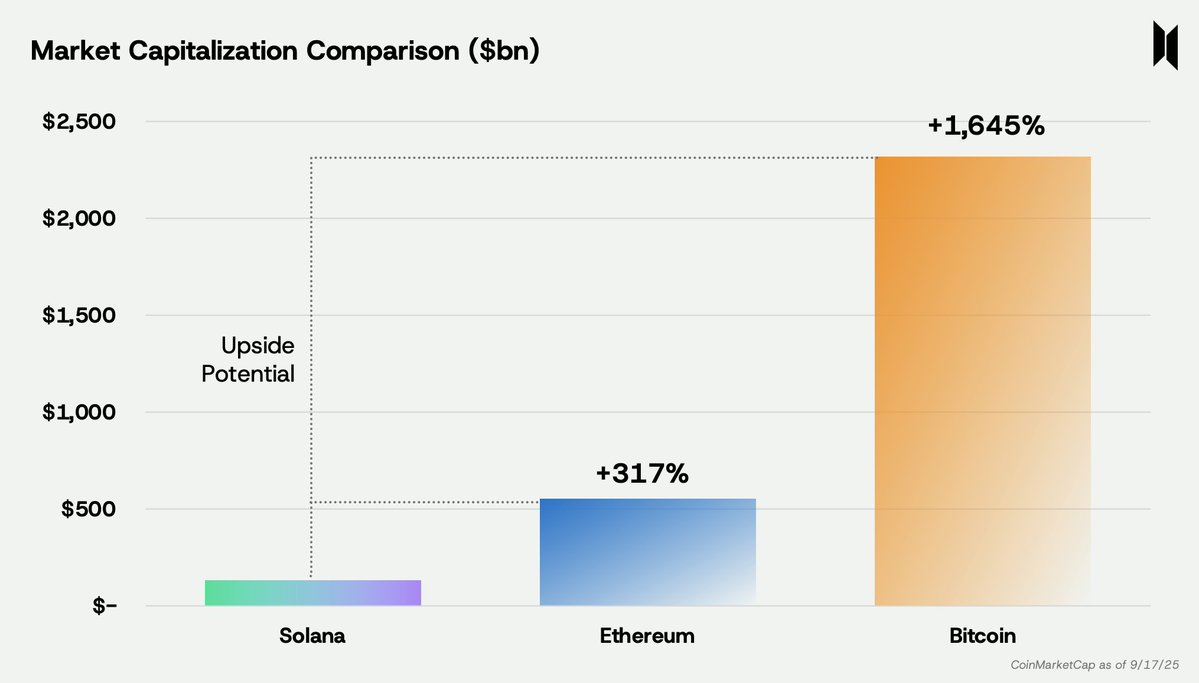

In terms of market capitalization, Solana is still just a fraction of Bitcoin (1/20th) and Ethereum (1/4th)—yet it leads both in key usage metrics.

We believe Solana’s adoption story is just beginning, offering greater asymmetric upside potential.

Nearly 10% of Bitcoin is now held by Strategy and spot ETFs. With average ETF cost bases above price, $7B+ in unrealized losses and record outflows show normie capital under pressure—leaving BTC dependent on a fresh narrative to reaccelerate.

Jim Bianco/2026.02.03

Bitcoin’s weak year isn’t OG selling or a “silent IPO.” It’s crypto contagion. Illiquid altcoins forced insiders to sell BTC to prop up air-token markets, while disciplined capital (ETFs, MSTR, Wall St) drained volatility and killed alt-season rotations.

Bit Paine/2026.01.28

Gold’s parabolic breakout isn’t a Bitcoin defeat but the same debasement trade unfolding in phases. Gold moves first as the hedge for states; Bitcoin follows as the hedge for people. They trend together long term, but cycle apart short term.

Swan/2026.01.27

100 gains didn’t disappear—they changed form. In a hyper-diluted market, winners stack gains by rotating early between narratives, not holding forever. This playbook explains how to spot rotations, size positions, take profits, and compound phases in 2026.

cyclop/2026.01.22

A veteran trader distills seven hard-earned lessons that prevent blown accounts and emotional spirals. From market context and risk control to playbooks, journaling, and process-first thinking, this guide shows how consistency—not signals—builds long-term trading edge.

Morin/2026.01.21

A trader pulled off a $233K overnight play on Polymarket by exploiting thin weekend liquidity. By baiting market-making bots in 15-minute markets and briefly nudging spot price, he forced mispricing and cashed out risk-efficiently.

PredictTrader/2026.01.19

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link