Seven Trading Lessons That Turned Pain Into Process

Morin

Morin

7 Trading Lessons That Would've Saved Me Years of Pain

If I could sit my younger trading self down for 10 minutes, this is exactly what I'd tell him. No fluff. No clichés. Just the lessons that saved me from blowing accounts, overtrading, and coping on crypto Twitter.

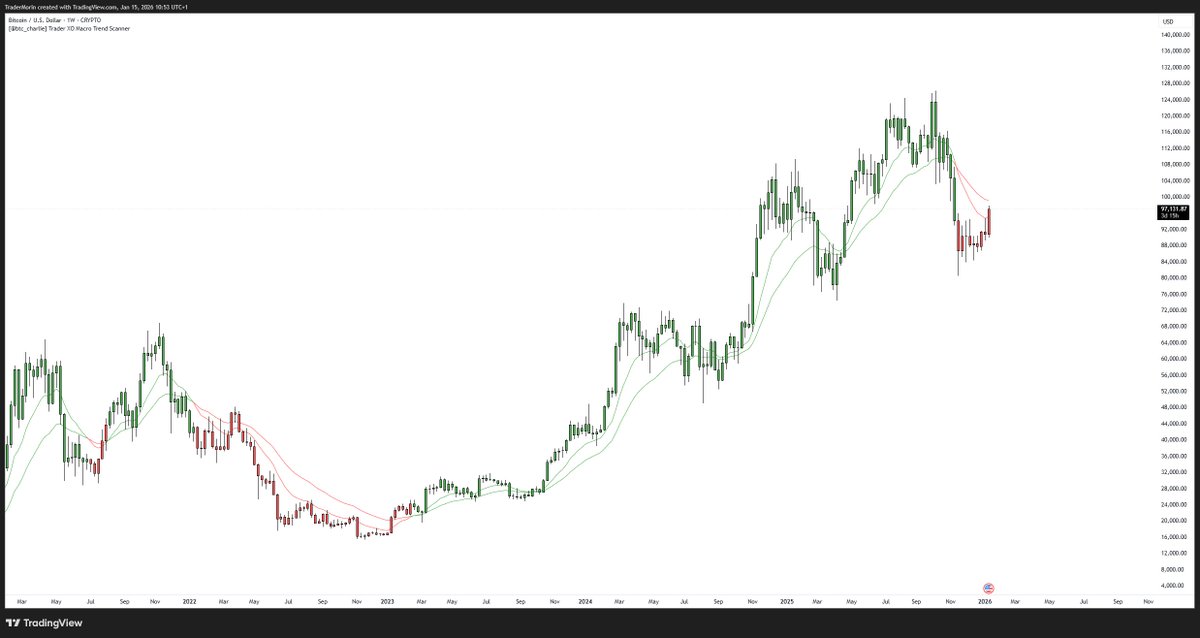

1. Understanding Market Context

If you have been on CT for a while, then you have probably realized that markets don't move in a straight line (Up-Only). They experience different environments such as downtrends, uptrends, and ranging markets, which consist of both Accumulation and Distribution ranges. Being able to identify what trading environment you are in is vital for understanding how to trade them.

Many traders fail simply because they try to force the same strategy onto every market condition. I primarily trade two strategies: Range extremes, which means that I look for both longs and shorts at the extremes of range-bound environments, and I trade Mean reversions, which can be traded both in range-bound and trending environments.

But there is a catch... the way that I approach my trades will vary largely based on the context. That also includes any indicators/momentum oscillators that I use as a form of secondary confluence. Each tool in my trading system has a specific purpose, and how I use it depends on the market context.

To help me identify which environment we are in, I use a set of daily and weekly exponential moving averages. I personally use the 12/25 EMAs + Price Action in order to identify the market context.

2. Risk Management Above All Else

I have been very fortunate in my trading career to have never blown up any trading accounts. The closest experience I had was during my first few months of trading, where in two days I saw my account go up 70% to, only lose all those gains the next day in one trade. After that experience, I vowed never be a cunt when it comes to risk management again.

One of my favourite quotes comes from TraderXO: "I am a risk manager first, trader second". This is something I internalized very early on into my trading; it's also why I am still around today.

For new traders, a static risk approach is essential; more advanced traders understand that their real edge lies in knowing when to size up, hence they have a more dynamic risk approach.

If you're new, then risk no more than 0.5% to 1% of your account per trade. This might feel conservative when you're eager to make money quickly, but it's the difference between surviving your learning curve and becoming another cautionary tale. Remember that when you first start trading, your priority is not to make money. It is to demonstrate to yourself that you have an edge, and you need to be able to survive long enough to do so.

Beyond per-trade risk, I also recommend you implement both daily and weekly maximum drawdown limits. When you hit these thresholds, stop trading immediately and review what went wrong. Take the time to go back over each trade and ask yourself, "Did I follow my system/process?" This forced pause can save you from the emotional spiral that turns a bad day into a blown account.

3. Building Your Trading Playbook

Without a playbook, you're not trading, you're gambling. You might as well take a trip to the local casino instead.

A trading playbook documents your best setups, the market context in which they work, and exactly how to execute them. When you know what you're looking for and have clear criteria for entry, management, and exit, you're already 90% ahead of the crowd on crypto Twitter who trade on hopes and dreams.

I personally have a written document for each of my playbooks, which consists of:

Context Type:

Tools Used:

Edge Type:

Step-by-Step Play:

Data Gathering:

Entry Rules:

Management Rules:

Closure Rules:

Notes:

This isn't something you create once and forget. It evolves as you learn and as markets change, but having this foundation transforms trading from chaos into a repeatable process. If you want to take it one step further, then I highly recommend developing an "Execution Playbook" which encompasses how you approach the different execution variances during your playbook setups.

4. Developing a Clear Trading Process

A clear trading process is a game-changer for how you approach each trading day. Without one, you're making decisions based on the emotions the market makes you feel.

Here is an example of a framework I shared a while back on CT:

https://x.com/TraderMorin/status/1987171112627884228

Consider implementing a Daily + Weekly routine. For example, every Sunday, I fill out a custom prep sheet that I created that helps me identify where the key levels are on the chart, what market regime we are in, the levels I am looking to trade, and the types of setups I am planning on executing.

Then I review this plan every morning before the market opens to ensure I stick to my plans and stay aware of the current market context.

This proactive approach keeps you grounded. Instead of chasing every move, you're executing a plan. For deeper insights into building robust trading processes, "Mastering the Mental Game of Trading" by Steven Goldstein is an excellent resource.

That book is what inspired my trade sheets + a special shoutout to XO, who also provided initial inspiration. While I based a lot of my own current resources on his knowledge, it was important for me to tailor them to my own trading system/process, as there is no one-size-fits-all in trading

While I do share all my trade sheets in MHC, I will give a little sneak peek into my own process below:

A) Daily Market sheet:

Every day, I write down what my objectives are for the day, whether trading-related or just a simple to-do list. I also make a note of any Macro Events that are taking place to ensure I don't open any trades right before any announcement.

B) Market Outlook:

This sheet is filled in once a week on Sundays. It includes mapping out all the levels of interest on the charts (Supply, demand, swing high/low, and monthly opens). I also make a note of all the HTF oscillators I use and explain how they impact the trades I plan on taking.

C) Trade Plan:

I don't know about you, but for me, all my trades are planned days and even weeks in advance. As the saying goes, "Failing to plan is planning to fail". When I am filling out my trade plan sheets, my main focus is listing all the confluences, knowing what I want to see unfold, and reasons not take the trade.

It's also important to clearly define other factors of the trade, such as:

Strategy Type, Entry Zone, Stop Zone, FTA, Risk Amount, and if you want to take it one step further, you can put "Why" next to each of them so that you can actually write out your thought process behind the decisions you are making.

5. The Non-Negotiable Practice of Trade Journaling

How can you possibly know if you have an edge if you're not tracking your results? How can you identify your best setups without data?

Trade journaling is non-negotiable. It helps you find patterns in your performance, your best trading hours, most profitable days of the week, highest win-rate setups, and most effective confluence factors.

Considering I average around 1.2 trades per week, most of my repetition/pattern recognition comes from reviewing my journal daily. I put lots of attention into my journal and try to be consistent with the way I journal my trades.

For example, I like to have multiple pictures of the trade's lifecycle, which allows me to better relive the trades during my review process. Some of the types of pictures I gather are as follows:

Trade Plan

Trade Execution

Trade Closure

Dom During Execution

Footprint During Execution

TPO Chart

A comprehensive journaling system might include both written and digital components. I print out detailed sheets for every trade, capturing all relevant information, which I then put into a large binder. Complement this with software like Edgewonk that aggregates your data and generates performance analytics. The combination gives you both the granular detail and the big-picture view you need to improve systematically.

My current priority in my trading is sizing up my higher conviction setups. How can I do that if I don't have the data that tells me which of my setups has a higher expectancy?

My current priority in my trading is sizing up my higher conviction setups. How can I do that if I don't have the data that tells me which of my setups has a higher expectancy?

6. Tracking Your Emotional State

Most traders journal their trades but overlook something equally important: their emotional state throughout the trade lifecycle.

For every trade, document what you felt during three critical phases: trade execution, trade management, and trade closure. Were you confident or anxious at entry? Did you feel the urge to move your stop loss or take profit early? Did you close the trade based on your plan or your emotions?

You'll never eliminate emotions from trading, and trying to do so is stupid. What matters is understanding what triggers certain emotional responses and how those emotions affect your decision-making. This self-awareness is a genuine game-changer. When you recognize your patterns, you can catch yourself before making emotionally driven mistakes.

As part of my trading process sheets, I have one that is solely dedicated to tracking my emotions during my trades.

If you want to take it further, then you can also record your trading sessions or even trade executions. I like to do this as I can just express my real-time thoughts while I am watching the footprint and executing my trades.

Another reason that I take journaling trades + emotions very seriously all comes down to my review process. I can look back at any trade I took in 2025 and tell you exactly what I was thinking during the execution, management, and closure of the trade. Can you say the same?

7. Process Over Outcome

I first got into trading solely for the "easy money" and "financial freedom" it offered, but that quickly changed once I realized how difficult this journey was going to be.

2+ years into my career, and the reason I show up day in and day out is for true love of the game. Nothing I have ever done in my life has been as challenging as pursuing a career in trading.

I made it this far by following one simple motto (Process > Outcome).

"Ordinary People Focus on the Outcome. Extraordinary People Focus on the Process."

During my first 1.5 years, I was a break-even trader, all because I had no edge, no system, or process.

Spending every day on CT, it took close to 2 years before someone told me to build a playbook and focus on creating a solid foundation.

Trade outcomes are a byproduct of respecting your system and following your process. When you have no edge and no process, focusing on profit targets is putting the cart before the horse. Instead, focus on building a strong foundation for your trading.

The hardest part of trading isn't finding a profitable strategy. It's bringing the best version of yourself to the desk every single day. A clear, repeatable process helps you achieve that consistency. When your process is sound, and you follow it with discipline, the results take care of themselves.

When I have a losing streak, I ask myself two simple questions:

1) Was the trade part of my playbook?

2) Did I follow my process?

If the answer to both of these questions is yes, then I journal the trade, mentally reset, and move on to the next one.

Final Thoughts

If you take one thing from this, let it be this: your success won't come from a secret indicator or a magic strategy that someone sells you.

It comes from your process, your discipline, and your ability to show up every day with intent.

Master that, and trading becomes a lot less chaotic. The market will always be unpredictable, but your approach to it doesn't have to be.

If you made it this far, thank you for reading, and I hope you found these words of wisdom helpful. If you did, be sure to follow me @TraderMorin - I'll be sharing many more articles like this in 2026.

A trader pulled off a $233K overnight play on Polymarket by exploiting thin weekend liquidity. By baiting market-making bots in 15-minute markets and briefly nudging spot price, he forced mispricing and cashed out risk-efficiently.

PredictTrader/3 days ago

After years as a retail trading hub, BNB Chain is evolving into a rare ecosystem where retail users, institutions, and builders coexist. With RWAs, stablecoins, and real yield products expanding, 2026 positions BNB Chain as a key bridge between TradFi and crypto.

Biteye/7 days ago

This article dissects why Bitcoin’s latest bull cycle felt muted despite historic adoption. As ETFs, DATs, miners, and institutions reshaped liquidity, volatility collapsed, retail faded, and crypto-native capital sold into strength—marking BTC’s transition into a fully financialized asset.

DoveyWan/2026.01.14

This article breaks down how a Polymarket bot exploits short-term mispricings without predicting direction. By asymmetrically buying YES and NO and keeping their combined cost below $1, traders can mathematically lock in profit on Polymarket—pure structure, no luck.

Jayden/2026.01.13

The “Jesus Christ return” market on Polymarket isn’t about belief—it’s about structure. Low liquidity, recurring whale sell-offs, and attention cycles create repeatable 2–3 trades for those who buy panic and sell rebounds, year after year.

Dexter's Lab/2026.01.10

A deep dive into how trader “beachboy4” lost over $2M on Polymarket despite a 51% win rate. The analysis shows how overpaying for consensus, all-in bets, and ignoring probability-based risk management made losses inevitable.

Lookonchain/2026.01.05Original

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link