The Biggest Crypto Liquidation in History: $19B Wiped Out in 24 Hours

The Kobeissi Letter

The Kobeissi Letter

It's official:

Crypto just saw its LARGEST liquidation event in history with 1.6 MILLION traders liquidated.

Over $19 BILLION worth of leveraged crypto positions were liquidated in 24 hours, 9 TIMES the previous record.

Why did this happen? Let us explain.

(a thread)

To put this into perspective:

The liquidation event we saw over the last 24 hours was ~$17 BILLION larger than the February 2025 crash.

It was more than 19 TIMES larger than the March 2020 crash and collapse of FTX.

Never in history have we seen anything even close to this.

Amid the liquidation, Bitcoin recorded a $20,000 DAILY candlestick.

This marks a $380 BILLION swing in Bitcoin's market cap alone, in a single-day.

That's more than the market cap of all but 25 public companies in the world.

Once again, this has never happened in history.

But, why did this happen? To better understand, take a look at the timeline below:

At 9:50 AM ET, crypto began selling off before the 10:57 AM ET Trump tariff post.

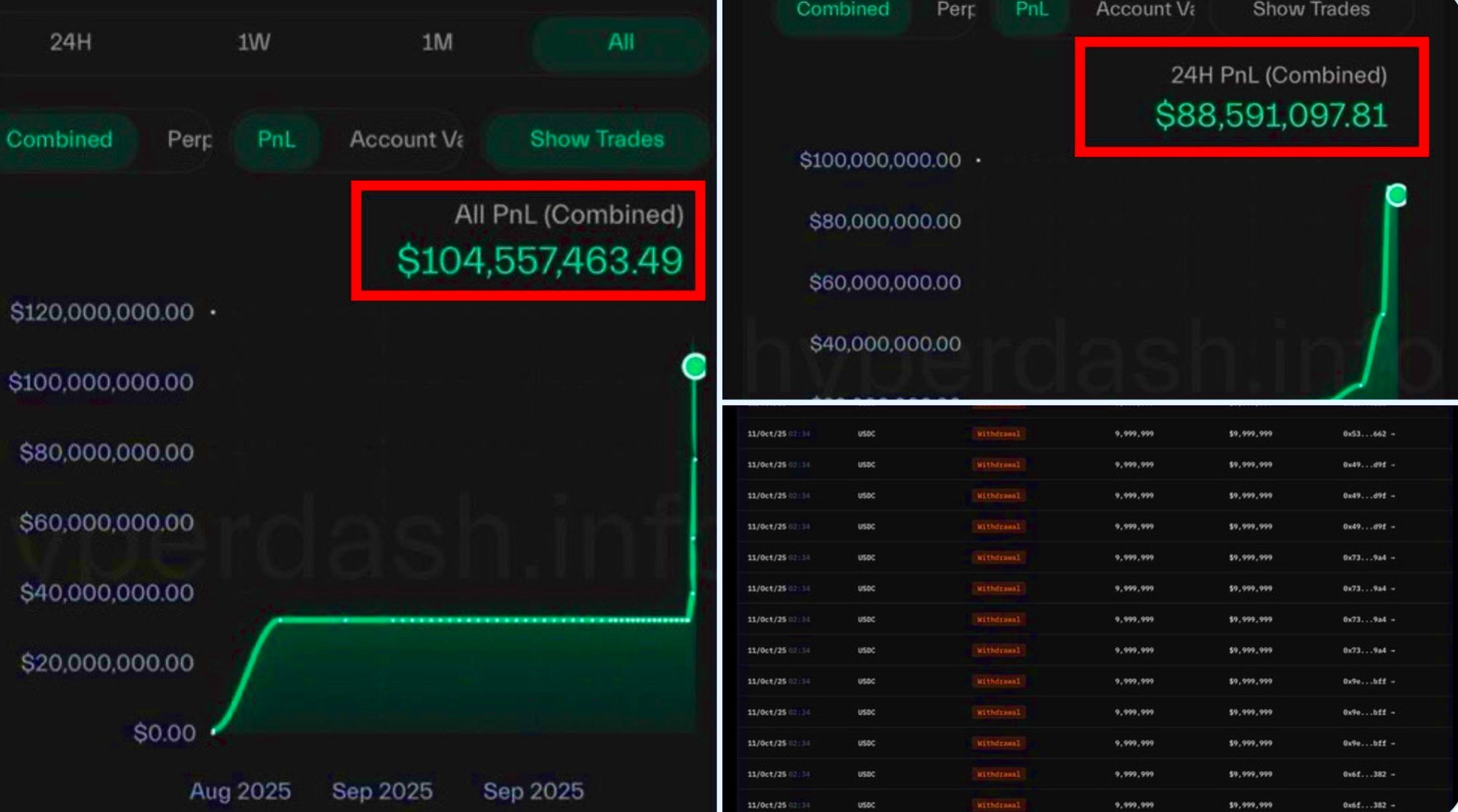

At 4:30 PM ET, a large "whale" took shorts in crypto.

At 4:50 PM ET, Trump announced a 100% tariff on China.

The first question becomes, how did this large "whale" time the drop so perfectly?

By 5:20 PM ET, 30 minutes after Trump's tariff announcement, liquidations hit -$19.5 billion.

The shorts were closed promptly after the drop for +$192M in profit.

But, there's more.

The main culprit of this appears to be a combination of excessive leverage and risk.

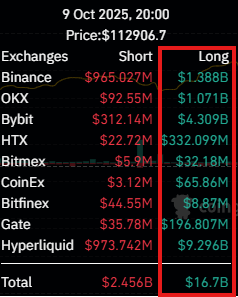

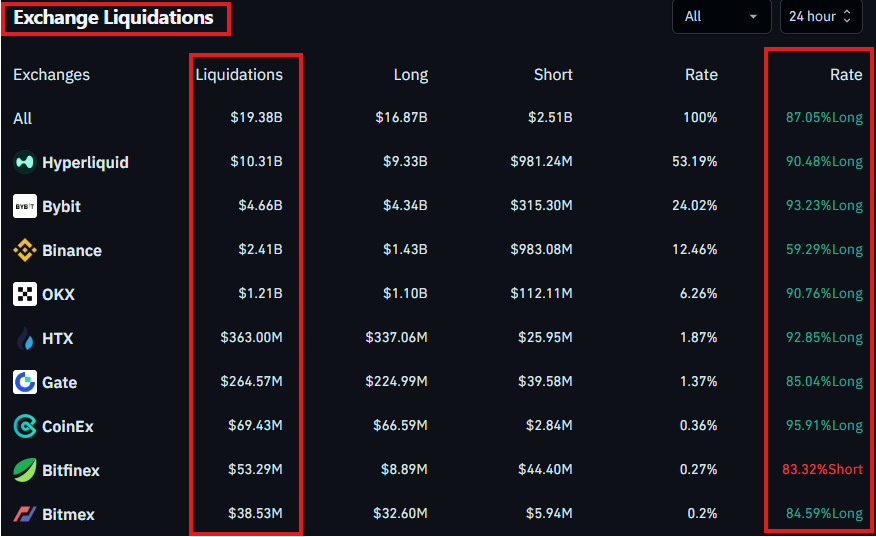

If you take a look at the breakdown of liquidations it was heavily skewed towards longs.

$16.7 billion in longs were liquidated compared to ~$2.5 billion in shorts.

That's a 6.7:1 ratio.

Even more evidence of the excessive long leverage in the market:

ALL major exchanges except for Bitfinex saw an overwhelming percentage of long liquidations.

Most were 90%+ long including a massive $10.3 BILLION on Hyperliquid alone.

The same exchange the "whale" used.

The next component was the "shock effect."

Markets became excessively crowded to the long direction after a historic run from the April 2025 low.

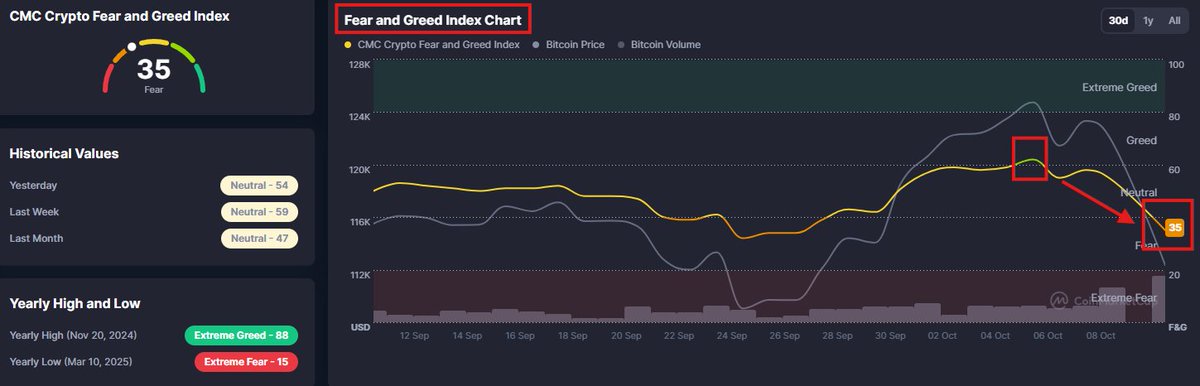

Greed exceeded 60, as shown below, days before the crash.

The sudden shock of the tariff post led to a MASSIVE shift in sentiment.

Liquidity was the next issue:

Trump's announcement came 50 minutes after US markets closed Friday.

As seen many times, Friday night and Sunday night often come with LARGE crypto moves.

Why? Liquidity is thin.

The sudden rush of volume after the post led to a domino effect.

So, what's next?

We believe this crash was due to the combination of multiple sudden technical factors.

It does NOT have long-term fundamental implications.

A technical correction was overdue, we think a trade deal will be reached, and crypto remains strong.

We are bullish.

This week's rebound in volatility means opportunity for investors.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Yesterday's drop was a reminder of how fragile yet profitable markets have become.

Between 9:30 AM ET and 5:20 PM ET, crypto erased -$800 BILLION of market cap.

Remain objective and capitalize on volatility.

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/4 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/4 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/4 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/5 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/7 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link