The Hidden Puppeteers: How Insiders Orchestrate Bitcoin Crashes and Bull Runs

Tracer

Tracer

These insiders manipulate all crypto market...

Over 90% of all money are controlled by them

They initialize bull runs, altseasons and dumps...

Here's 6 secrets they hide and what's next for $BTC 🧵👇

I think the latest market moves opened your eyes to the real game

Most of these moves were straight-up orchestrated

Insiders literally run this market

They build a perfect trap for retail and a fat income stream for themselves

The Oct 10 incident ain’t a secret for anyone

A lot of theories popped up but only one thing matters

Some wallets started stacking $500M worth of shorts 30 minutes before the crash

You think that’s random? - I DON’T

https://x.com/DeFiTracer/status/1977693236777939215

nd the same stuff happens every time before Trump’s big announcements

But I think I found something hidden

These “coincidences” are anything but random

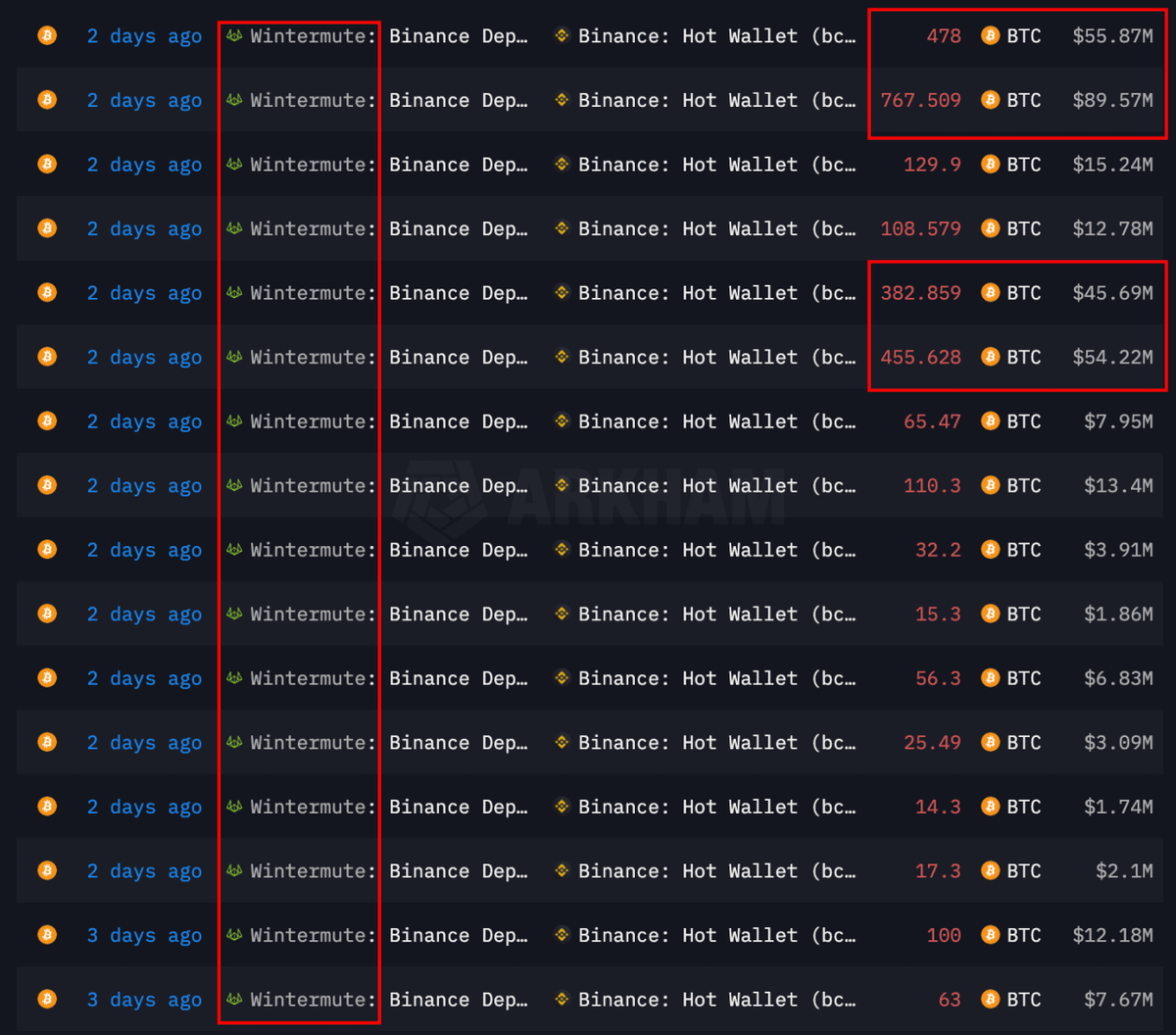

Right before the meltdown, one insider moved $700M to Binance

Almost nobody noticed it back then

And on a Friday, right before stock market close

Clearly prepped in advance, totally predictable if you were watching close

Then we saw nothing but a bottomless dump

Some highlights:

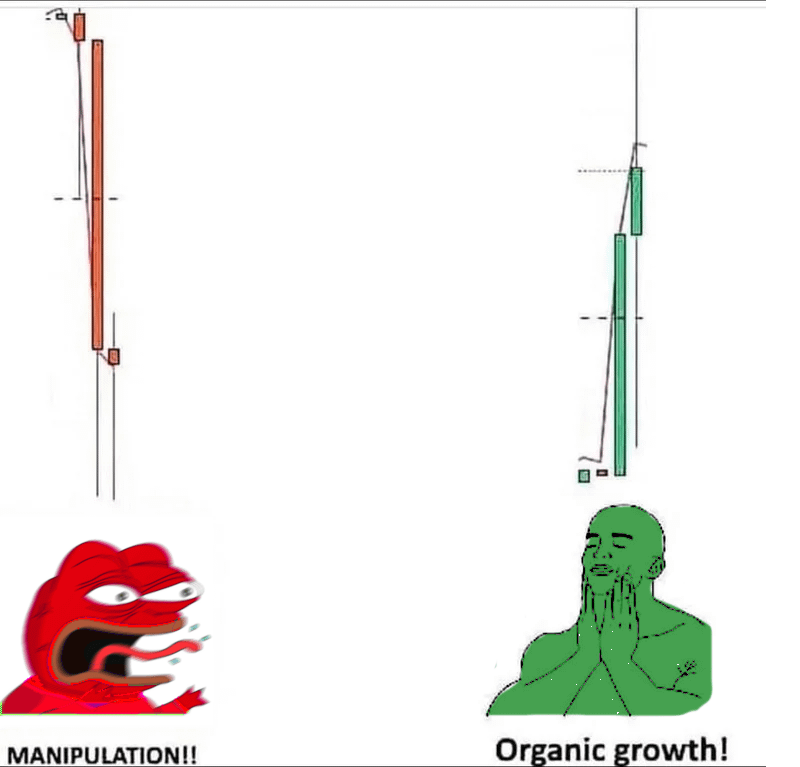

- No liquidity in the order books

- One-minute candle had 1k BTC inside

Doesn’t sound organic at all, straight-up MM setup

And those wallets on Hyperliquid? Probably theirs too

Why do I think these insiders are the real deal?

Cuz the main theories blamed the CEO of @XHash_com

Even Binance dropped some “leaks” about him to blind the crowd

Ever seen that before?

A clear fall guy to take all the blame

https://x.com/eyeonchains/status/1977215003741602014

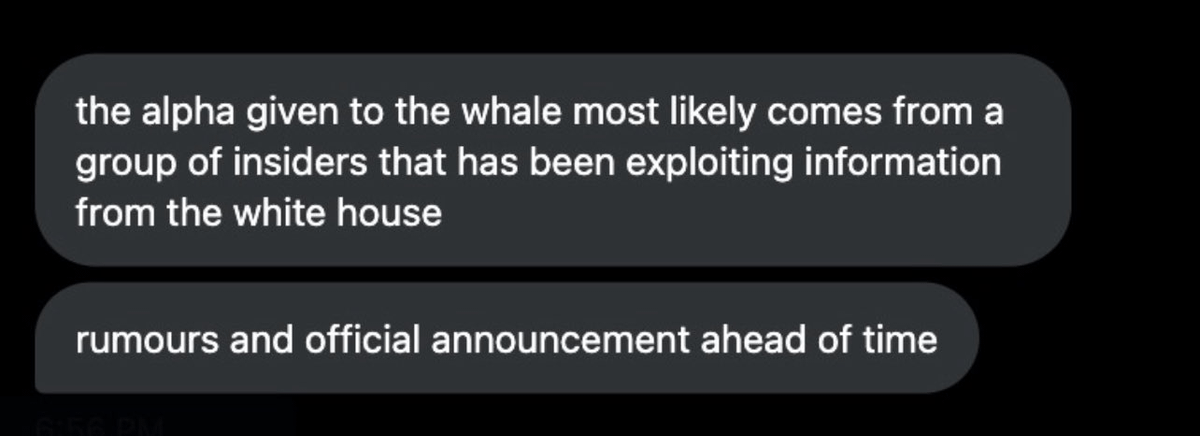

The real insider network runs way deeper

Probably straight from the White House circle

Assistants who get info before Trump posts on X

Obviously, he’s not doing that himself and he confirmed it during the $TRUMP launch

Now put all this together

It’s straight-up MARKET MANIPULATION

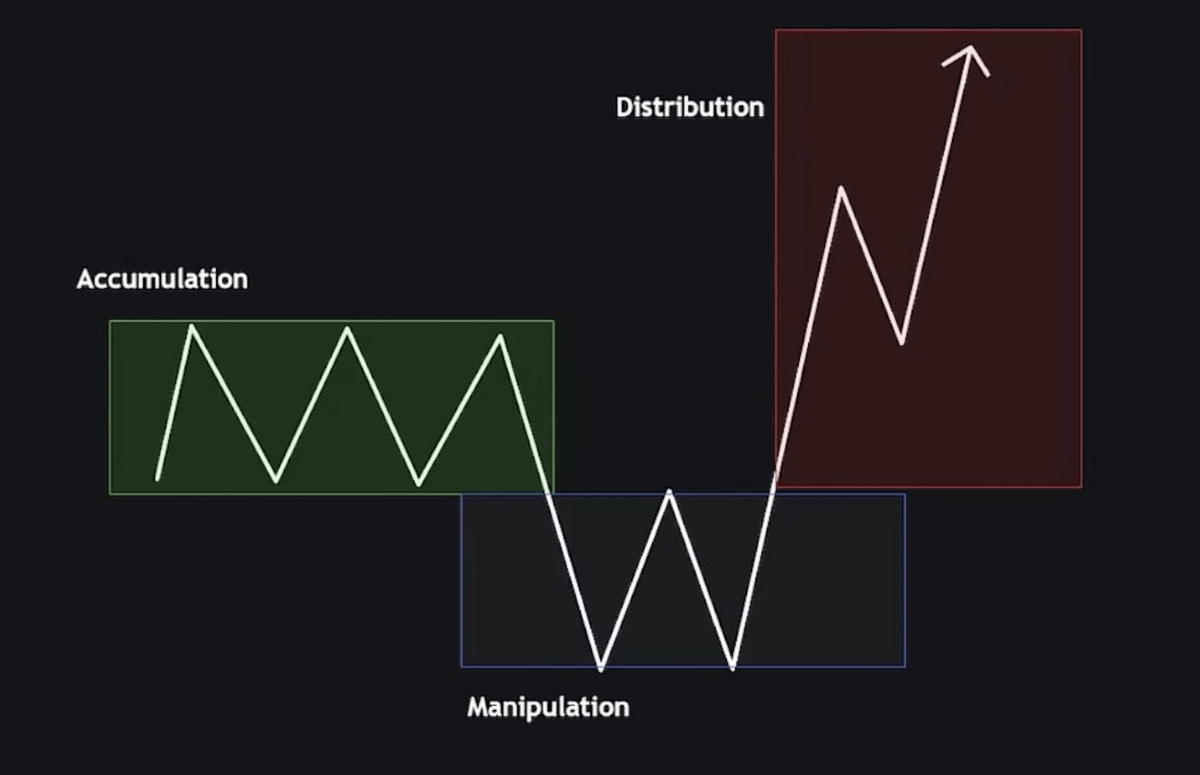

Not just on-chain data but the $BTC chart screams it too

We dumped hard and now we’re climbing back to the same zone we fell from

The real question is why was this done?

Now those “gold pump to sell and buy BTC” theories don’t sound that crazy anymore

I’m exaggerating, no one’s selling gold for real

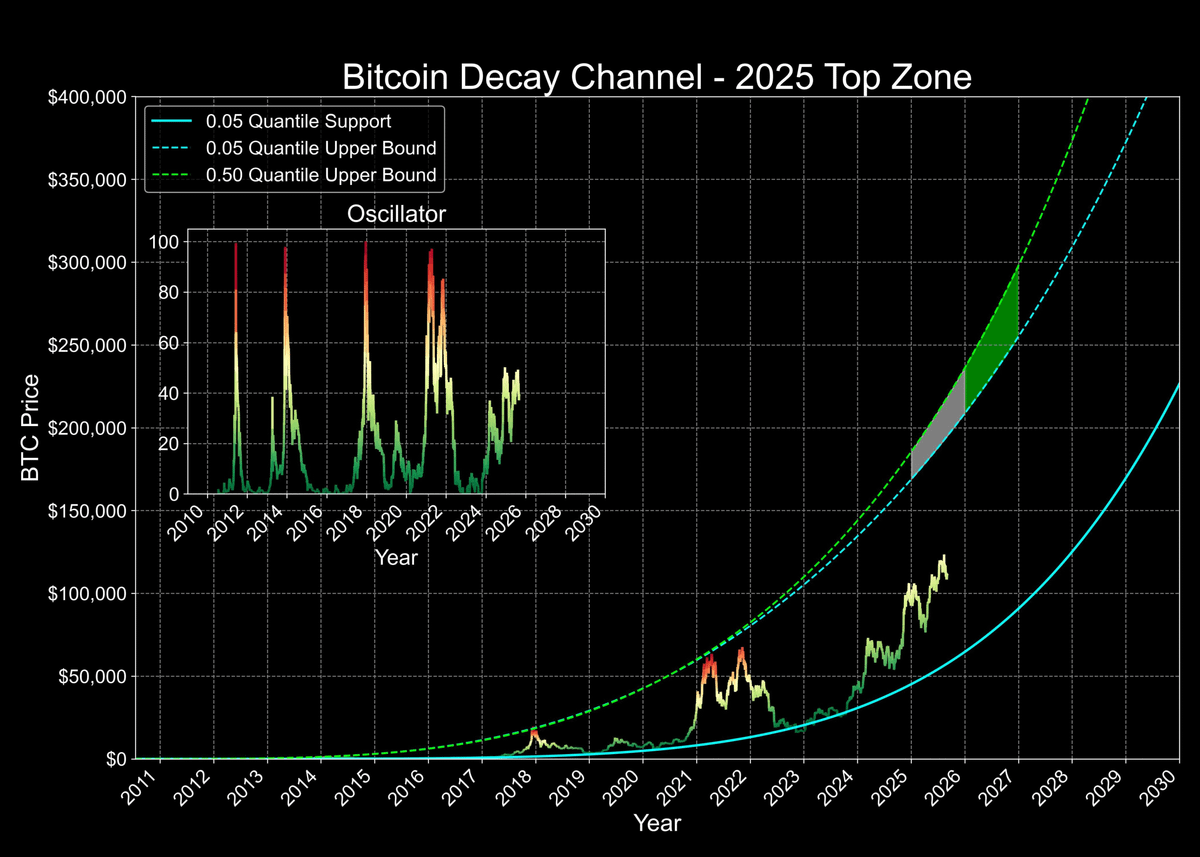

But $BTC is clearly being prepped for something massive

What happens after such crashes?

Exactly - market cleansing

Big money starts owning even more of the supply

Retail pressure on the order book drops drastically

They literally got liquidated - they’ve got nothing left to sell, $20B in liquidations, come on

And all this during Uptober, funny enough

But we’ve still got plenty of catalysts ahead

- Gold at ATHs

- 2 upcoming rate cuts by 25bps

- QT pause

- QE coming soon

And yet people still fall for the “trade war” narrative

We’re cleansed and standing right before a massive inflow of fresh liquidity

If you didn’t lose it all on Oct 10 - you already kinda won

$BTC upside is still colossal

We’re right on the edge of it - time to LOCK IN, you’ll be rewarded

After last week’s perfect projection and the biggest liquidation cascade in years, $BTC faces another volatile week. With short liquidity clustered around $116K–$117K and the CME gap near $106.7K, traders watch for either a short squeeze or a final dip to $100K.

CrypNuevo/3 days ago

After losing over $30M in the largest crypto liquidation event ever, a top trader reflects on what went wrong, the lessons learned about leverage and risk, and why he’s staying optimistic. It’s not the end — just the start of his next chapter.

Unipcs (aka 'Bonk Guy')/2025.10.12

Crypto just experienced the largest liquidation event ever — over $19B in leveraged positions and 1.6M traders wiped out in a single day. Triggered by Trumps tariff shock, the cascade revealed extreme leverage but may set the stage for a strong rebound.

The Kobeissi Letter/2025.10.12

Trump’s sudden cancellation of his China meeting and threat of “massive tariffs” wiped $1.2T from U.S. markets in minutes. But analysts argue this is a bargaining move — not the start of a trade war. With AI investment and rate cuts ahead, dips may be buying opportunities.

The Kobeissi Letter/2025.10.11

Trump’s 100% China tariff announcement sparked a historic crypto crash — $1T wiped out, $20B+ liquidated, and whales profiting $200M. But history shows: every purge resets the market. Leverage flushed, panic peaked — the next leg may just be starting.

Bull Theory/2025.10.11

Many traders woke up to closed positions due to Auto-Deleveraging (ADL) — the last line of defense in perps markets when liquidity dries up. This thread breaks down how ADL works, why it’s triggered, and why even winning traders can get forced out.

Doug Colkitt/2025.10.11

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link