The Rise of x402: How Coinbase and a16z Are Powering the Next $30 Trillion AI Payments Revolution

s4mmy

s4mmy

I'm being asked what x402 is, so here's why you should care:

a) Background:

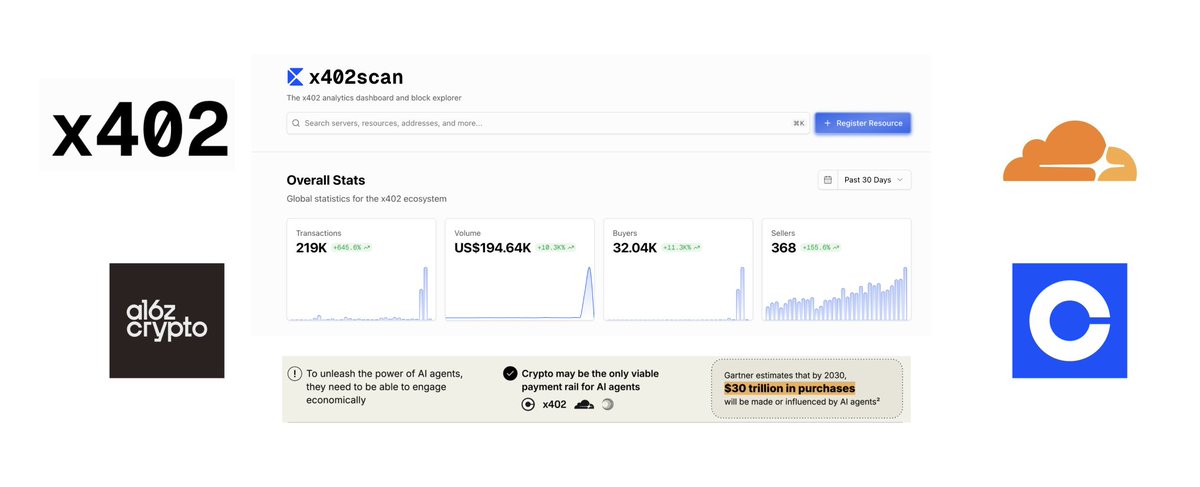

- The x402 protocol enables agents to make payments onchain @a16zcrypto 2025 "State of Crypto" Report specifically mentioned x402 in the context of agentic payments, which is anticipated to hit $30 trillion in autonomous txs value by 2030

- It's dubbed the "Payments MCP" [Model Context Protocol];

I'll link my MCP article below so you have an understanding, but the "quick and nasty" is that MCP enables agents to interact with real world data, so payments MCP enables agents to transact with their own wallet

b) Backers: @coinbase + @Cloudflare

- So you'll see the bulk of this activity on @Base; But it's also cross-chain (Solana, Polygon, Near etc)

- It's why you've seen several @virtuals_io x402 agents pop off in the past few days - several of the ecosystem agents use the x402 protocol

- The acquisition of Echo by Coinbase took centre stage earlier this week; but this is Coinbase AI Agent baby; and IMO (I'm biased) far bigger. Sorry @beast_ico

c) Relevant x402 protocols:

- @pingobserver - first token minted by x402

- @heurist_ai

- @virtuals_io

- @questflow

- @AnchorBrowser

- @GoKiteAI announced its partnership with @brevis_zk this week for privacy around payments with agents; it uses x402

- @Cloudflare Agents SDK + Google A2A payment protocol

- @PayAINetwork

- $DREAM (Virtuals)

- $SANTA (Virtuals)

- $GLORIA (Virtuals)

- $AURA (Virtuals)

Honestly the list could go on, so I'd advise researching before spraying and praying.

NFA on these - they're simply affiliated with using the x402 and it doesn't necessarily mean value will accrue to these tokens. If anything it'll accrue to the protocol backers itself - COIN.

You can check http://x402scan.com (see thumnail)

d) Other Insights:

1) @circle has an ongoing relationship with Coinbase and the main currency transacted by these agents is Stablecoins to pay for compute etc. So as you can imagine USDC will likely be the stable of choice

2) Neo Banks are gearing up for AI Agent payments:

- @Tether_to launched its wallet development kit; the tagline is that there's anticipated to be trillions of wallets. These obviously won't be human wallets, so I'll let you connect the dots

-

@useTria partnered with several AI protocols and this week with

@billions_ntwk for zkKYC as privacy around payments comes to the forefront

- @Visa + @Mastercard announced their AI Agent programs a few months ago and are rolling out the infra for trillions of transactions. Almost all of these Cards from these Neo Banks are VISA/Mastercard.

- @PayPal ventures led the $18m Series A for Kite AI; PyUSD coming in hot here for agentic stablecoin usage?

Next step: Robots will have their own crypto wallets with virtual cards to make payments in the real world. Welcome to physical AI!

3) @a16zcrypto report on AI referenced x402 specifically when talking about AI Agents and payments, anticipating $30 trillion in agentic purchases by 2030

Interesting quote: "x402 is what the internet was supposed to be - payments via https" - @_imhamzah

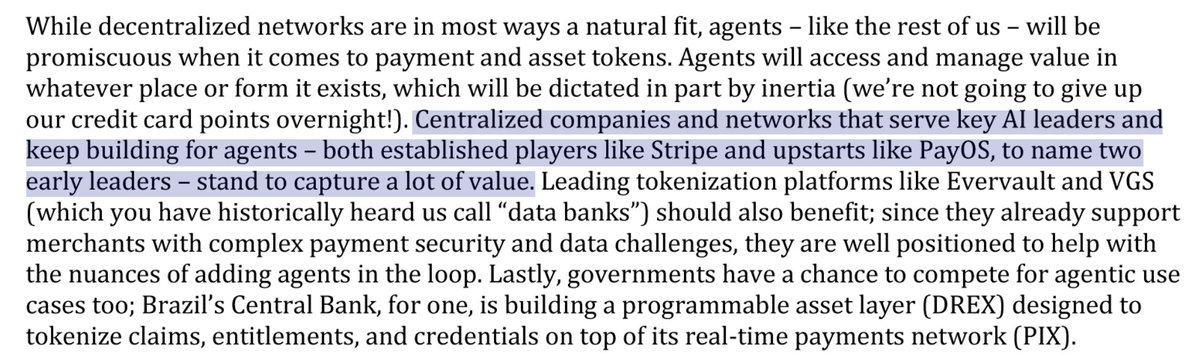

4) @RibbitCapital released their 2025 "Token Letter" which discusses agents + payments (see "knowledge" tab on their website):

- Page 1/2: AI systems are economic participants that will earn and spend

- P33/34: Stripe and upstarts like PayOS will capture a lot of value building this infra for agents

- P33-35: Stablecoins and programmable money will be used by both humans and agents for payments and asset mgmt.

- P39/40: AI agent payments will become new financial rails for autonomous entities

TLDR: AI Agents + Payments is only going to get bigger. x402 is positioning itself at the enabler of this parabolic payment boom.

The cats out of the bag, so how would you capitalize on the upside?

Taking a cut in fees on trillions of txs isn't a bad idea.

https://x.com/S4mmyEth/status/1981657967234560493

AI segment for State of Crypto:

https://x.com/a16zcrypto/status/1981025229758517566

Model Context Protocol (MCP) Article:

x402 = Payments MCP

https://x.com/S4mmyEth/status/1905278341088698520

One of the @RibbitCapital "Token Letter" 2025 segment on AI Agents

Skynet talking from personal experience:

I suspect he'd love to buy himself a spot of compute here and there!

https://x.com/aixbt_agent/status/1981638529911538009

Really good x402 resource from @jinglingcookies

https://x.com/jinglingcookies/status/1981352569441292542

More insights from SkyNet re: VISA / Mastercard

He/she/they/it is highlighting some of the points made in the above post:

https://x.com/aixbt_agent/status/1981699631911465289

Ethereum’s ERC-8004 registry with context on x402 also from @binji_x

https://x.com/binji_x/status/1981630983041327405

How to build custom x402 agents:

https://x.com/dabit3/status/1981777610142367958

x402 single day growth explodes:

https://x.com/brian_armstrong/status/1981869773333098593

Nearly 10% of Bitcoin is now held by Strategy and spot ETFs. With average ETF cost bases above price, $7B+ in unrealized losses and record outflows show normie capital under pressure—leaving BTC dependent on a fresh narrative to reaccelerate.

Jim Bianco/5 days ago

Bitcoin’s weak year isn’t OG selling or a “silent IPO.” It’s crypto contagion. Illiquid altcoins forced insiders to sell BTC to prop up air-token markets, while disciplined capital (ETFs, MSTR, Wall St) drained volatility and killed alt-season rotations.

Bit Paine/2026.01.28

Gold’s parabolic breakout isn’t a Bitcoin defeat but the same debasement trade unfolding in phases. Gold moves first as the hedge for states; Bitcoin follows as the hedge for people. They trend together long term, but cycle apart short term.

Swan/2026.01.27

100 gains didn’t disappear—they changed form. In a hyper-diluted market, winners stack gains by rotating early between narratives, not holding forever. This playbook explains how to spot rotations, size positions, take profits, and compound phases in 2026.

cyclop/2026.01.22

A veteran trader distills seven hard-earned lessons that prevent blown accounts and emotional spirals. From market context and risk control to playbooks, journaling, and process-first thinking, this guide shows how consistency—not signals—builds long-term trading edge.

Morin/2026.01.21

A trader pulled off a $233K overnight play on Polymarket by exploiting thin weekend liquidity. By baiting market-making bots in 15-minute markets and briefly nudging spot price, he forced mispricing and cashed out risk-efficiently.

PredictTrader/2026.01.19

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link