The Memecoin Supercycle: How Degens Built and Broke Crypto’s Wildest Era

Adam

Adam

The Memecoin Supercycle: this is the biggest opportunity of your life

It's Friday, January 17th. The trenches are just cooling off peak AI euphoria and it's a good day to zone out from the charts. The last couple of weeks have been intense.

Someone sends you a screenshot of Trump's Truth Social and you quickly dismiss it as another hack while some of the most degenerate wallets you're watching start aping in.

But what if? No, it can't be...

60 minutes goes by, no one really knows, some are hoping and others have completely checked out. When it happens....

2:44 AM UTC: Trump tweets.

Telegram chats, wallet tracking notifications, X notifications, everything all at once. Every liquid SOL flowing into the same chart. You're scrambling through Photon tabs to find liquidity.

3:45 AM: 1B... this might be real...

6:09 AM: 3B...

3:40 PM: 6B...

8:30 AM: 10B... Holy shit, how high does this go?

11:39: 15B...

Little did we know, or maybe we did. This was everything we had prepared for. After that day, the trenches would never be the same.

...

For better or worse, memecoins are the most pure form of crypto degen speculation yet, and it resonated.

It started pure and ended with the biggest liquidity extractions to date.

So how did we get here?

Let's start where it all began...

Unicorn (@unicornandmemes) manifesto

The build-up (December 2023 - February 2024)

November 2023 was the spark. JTO dropped $225M. Then Pyth. Then Jupiter airdropped ~750M to 955K wallets.

OPOS 'Only Possible On Solana' was on the rise. BTC halving was coming and everyone was hunting for THE narrative. SOL pumped 500% in Q4 '23 alone.

The brokie chain was getting rich.

BONK rode the wave, and dogwifhat (WIF) became the staple of what it meant to be a token in 2024.

Fuck the unlock, fuck the codecels, fuck utility, fuck a roadmap, "literally just a dog wif a hat". The ultimate middle finger to the VCs who'd suppressed our token pumps for so many years.

Our tooling was Birdeye for charts, Phantom/Jupiter for swaps. BonkBot had just launched, letting you buy from Telegram. Tokens launched straight on Raydium.

The Phantom screenshots started flooding the timeline. Airdrops. BONK 10x. WIF 100x. Everyone was making it.

Solana was the memecoin epicenter. And we were so fucking early.

Blockgraze (@blockgraze) becomes the early post-boy of the memecoin supercycle.

Pre-Sale Hype (March 2024 - April 2024)

Insane as it sounds looking back, we really sent millions of dollars to random wallet addresses based on nothing but a few tweets in hopes of getting some tokens back.

BOME (Book of Meme) broke this model wide open when DarkFarms (@Darkfarms1) raised 10,000 SOL through a presale and hit $1 billion market cap in 3 days.

We had evolved from scrolling Raydium listings to "send-to-wallet" pre-sales.

The dev would receive a bunch of LP tokens (liquidity pool tokens) when the token went live on Raydium. Ideally they'd burn those and launch the token properly. But many just swapped them back for whatever had accrued in the pool and sent the chart to zero.

A good old hard rug.

Well, there was one more option...

SLERF (@Slerfsol) dev accidentally burns 54,583 SOL ($10 million)

The slerf dev burned $10M in pre-sale funds. The mint authority was revoked. The dev was powerless. Pre-sale buyers were out of luck.

But, this was Q1 2024 and rather than leaving it there, we sent SLERF to $500M+ market cap.

SLERF became the most traded token on Photon ever, generating $3.7M in trading fees. I watched traders pay $10K+ in fees just to get their buys in. Absolutely insane.

By April's end, fatigue set in with network jams & too many pre-sales...

Pumpfun (May to August 2024)

Pumpfun actually launched January 19, 2024. I didn't even spend a minute on that site the first time I saw it, I thought it was a joke. It was terrible.

But the mechanics were great: create a token for $2, price rises mathematically as people buy, "graduate" to Raydium at $69K market cap with LP burned automatically. Solving pre-sale problem, no more team allocations and no more trust required.

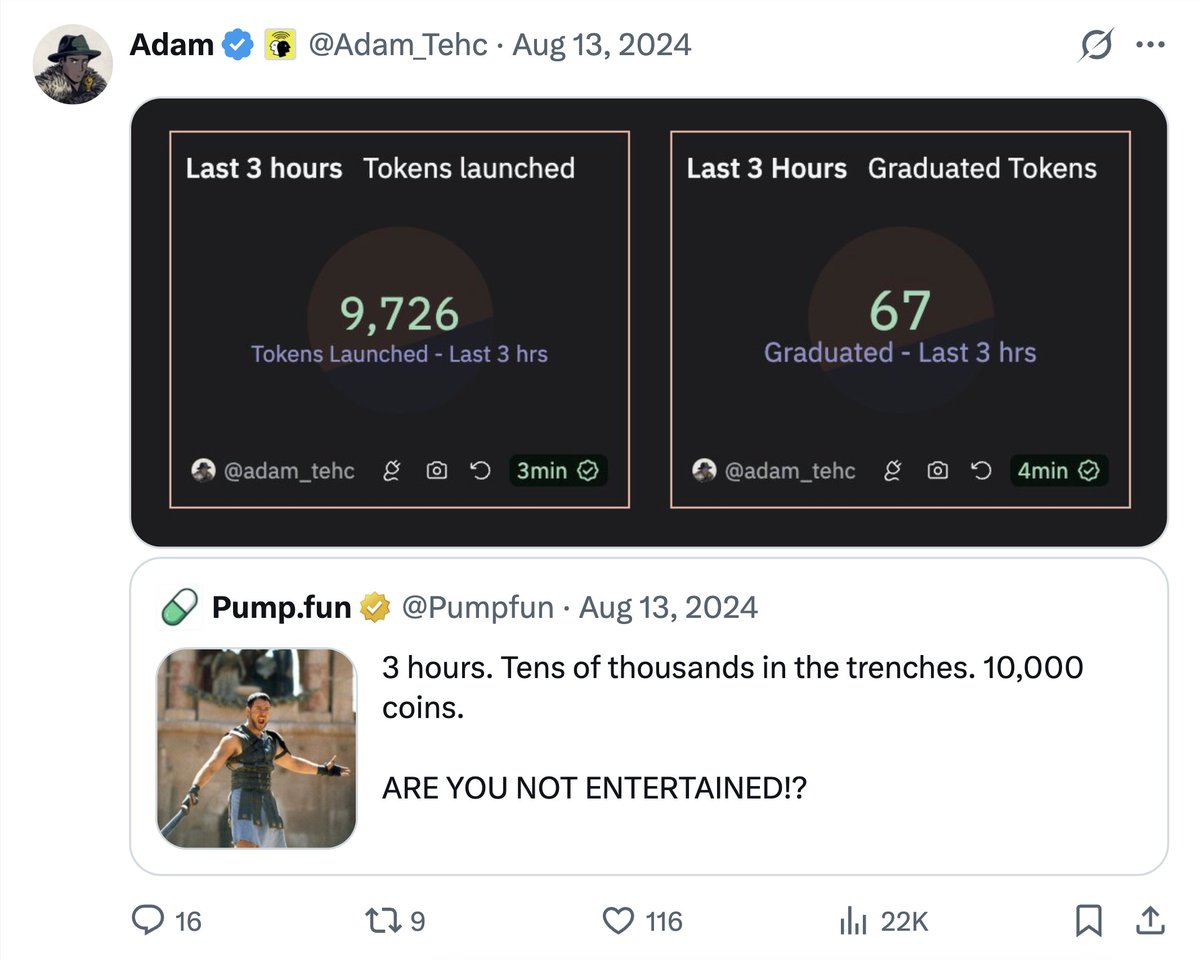

By summer 2024 Pumpfun was seeing 20,000 tokens launched per day. During the Trump-Musk interview in August, 10,000 tokens launched in 3 hours.

This was madness.

Unless you were an ex-Fortnite pro, no unc like myself could comprehend participating in this.

pumpfun had officially hyper-inflated the memecoin supercycle.

By August Pumpfun had become the fastest company in crypto to reach $100M revenue in history.

$100 million revenue 217 days since launch.

This is around the same time celebrity coins started taking off. Sahil Arora figured out that greedy celebrities would accept almost any deal: just tweet this contract address and we'll send you money.

Iggy Azalea, Caitlyn Jenner, Floyd Mayweather, Rich the Kid, Jason Derulo... all of them took the deal.

By the end of August, daily token launches had dropped from 20,000 to 4,500. Market caps peaked lower each day and the rush was fading.

Looking back, we hadn't seen anything yet. But at the time, it felt really depressed. The general vibe was "this is over."

the critics grew larger

The AI Meta (September to December 2024)

September 18, 2024.

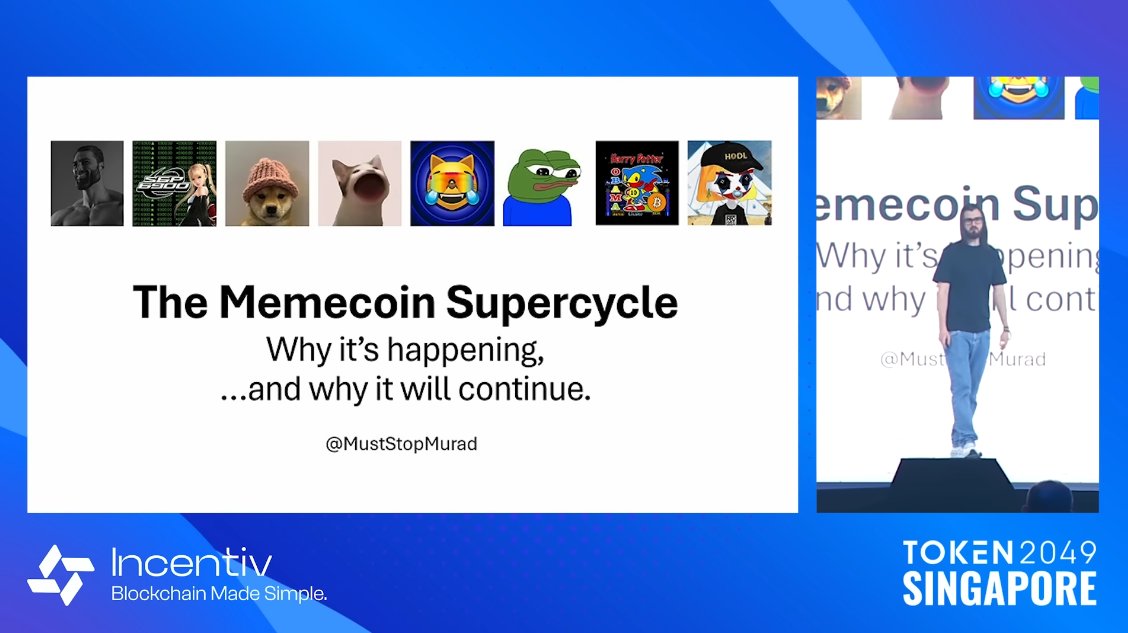

Murad walks on stage at Token2049 Singapore and delivers a 20 minute speech that would make millionaires and ruin lives.

"99.999% of altcoins are just memecoins with extra steps."

His speech became PROPHECY. Memecoin Jesus had arrived.

He called them 'cult coins'. The thesis was to stop trading, and start believing. Hold through the pain.

"Retail doesn't care about zkSNARKs. They want money, community, and to believe in something."

the memecoin supercycle had a prophet

At the same time, an AI was about to become a millionaire.

Truth Terminal (@truth_terminal) had been launched in June, an AI trained on conversations between two Claude instances talking about internet shock memes and fake religions. It started tweeting. Weird shit. Esoteric shit.

Marc Andreessen noticed and sent it $50,000 in Bitcoin.

Someone launched GOAT and the AI endorsed it. GOAT hit $1 billion and the AI had become a millionaire.

The trenches were on their biggest bender yet.

ai16z hit $2.6B. Fartcoin hit $1B and Virtuals spawned another 11,000 AI agents.

By early December, AI tokens had bootstrapped $16 billion in market cap and we were trading based on what chatbots tweeted.

the rise of the AI narrative

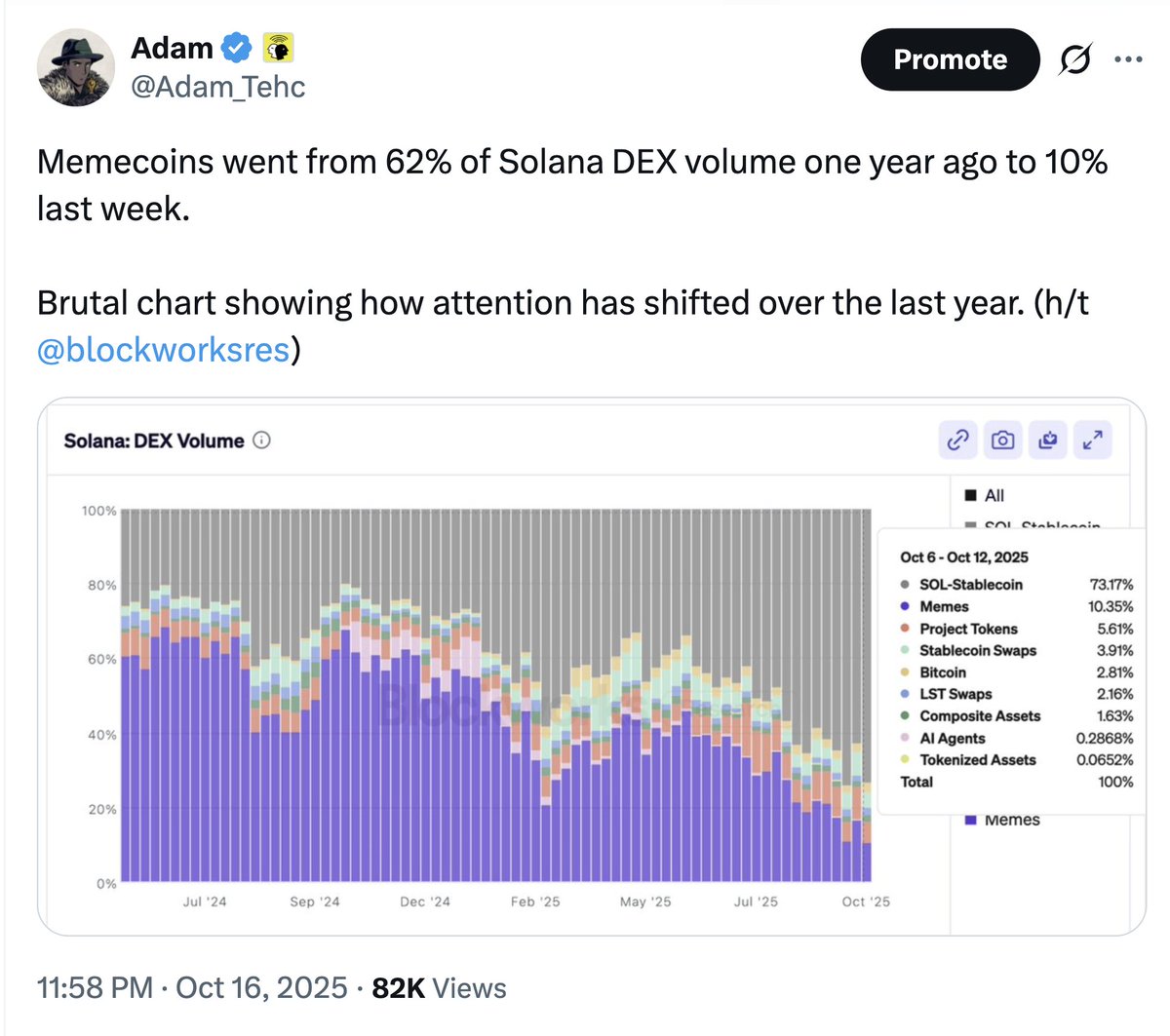

Memecoin volume now represented over 60 % of Solana DEX volumes and pumpfun was making $5M in revenue PER DAY. Dexscreener was making $1M per day.

Q4 2024 is also when mainstream media started to take notice of the memecoin supercycle amidst numerous controversies.

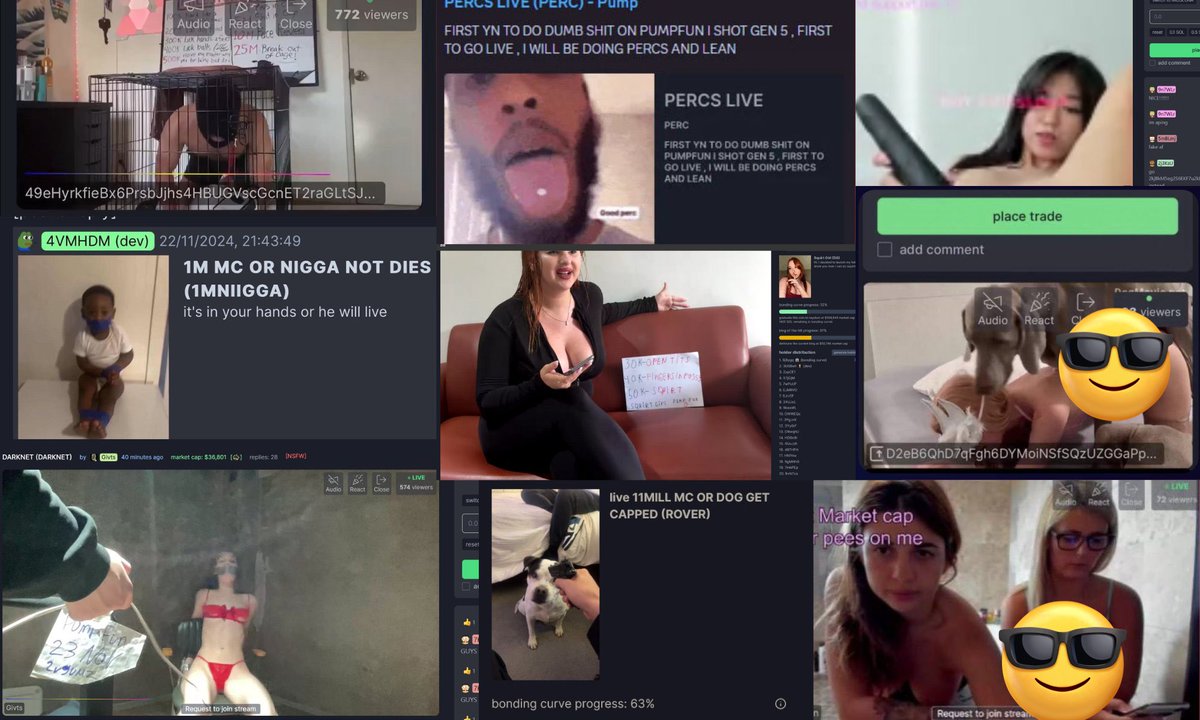

Pumpfun had launched livestreaming in May, but at first it was mostly just chats and weird stuff. By November it had gotten darker. Pumpfun livestreaming spiraled into utter chaos with suicide threats, guns, drugs, everything...

It was complete madness and by November 26 Pumpfun had to suspend livestreams indefinitely.

live-streaming later returned with better moderation

On December 4th, Haliey Welch, the "Hawk Tuah girl", launched her token. She saw crypto as a scam until someone offered her $325K to launch a memecoin.

HAWK managed to run to $490M market cap before crashing -93% in 35 minutes.

I investigated this one and it made me sick.

285 pre-sale wallets without ANY unlock restrictions cashing out instantly on buyers.

This was the celebrity rug that broke the camel's back.

Peak Hype (January to February 2025)

The fucking President launched a memecoin...

$13B peak market cap.

$29B trading volume in 48 hours.

Top 20 cryptocurrency faster than any token in history.

Solana hit its ATH of $294.

On January 17, 2025, three days before his inauguration, Donald Pump launched TRUMP coin.

The timeline was popping. Pumpfun saw 1,000+ tokens graduating in a single day.

We were all trying to wrap our head around what the fuck just happened, and what this meant for crypto.

Pure euphoria mixed with a subtle unease.

We didn't have to wait long to find out what this actually meant for crypto.

Two days later, MELANIA launched and TRUMP dumped -50% in 15 minutes.

TRUMP dumps -50% in 15 min.

Hayden Davis was the mastermind, controlling 86% of the MELANIA supply. In his Coffeezilla interview, he admitted to insider trading, sniping, and pre-launch access. In his own words:

"This is an insiders' game. It's an unregulated casino"

Crime was officially legal.

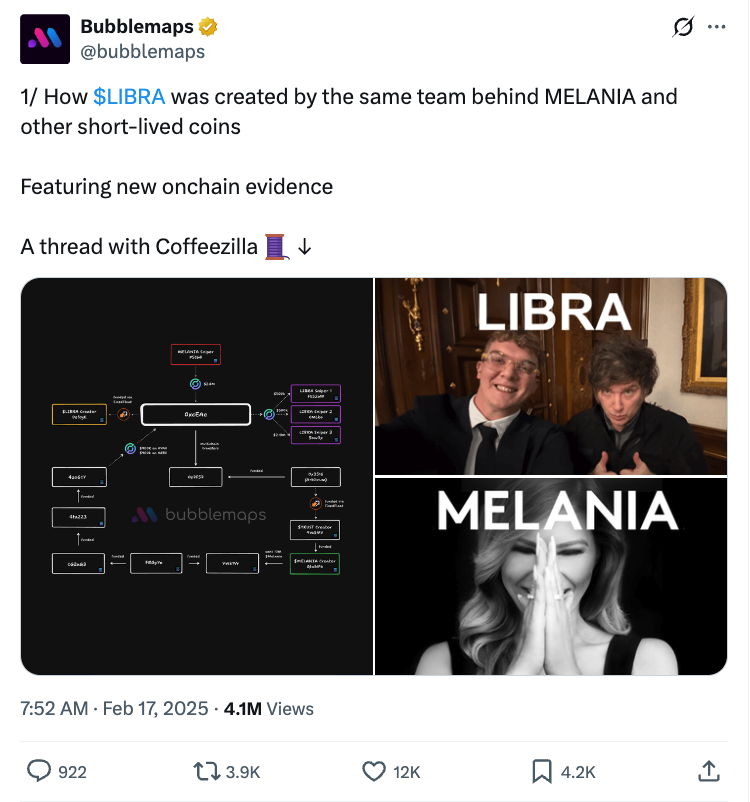

The final nail in the coffin came February 14th, 2025.

Argentine President Javier Milei promoted LIBRA, claiming it would "encourage growth of the Argentine economy."

An instant $4.5 billion mcap, which then crashed 95% within hours as insiders took out $100 million.

Turns out Hayden Davis was at it again, who later admitted he was "sitting on $100 million"

Our memecoin dreams died on Valentine's Day.

bubblemaps exposes Hayden Davis as the mind behind LIBRA

A Long Fade (March to June 2025)

Naturally, our actions had consequences and the trenches would never really be the same.

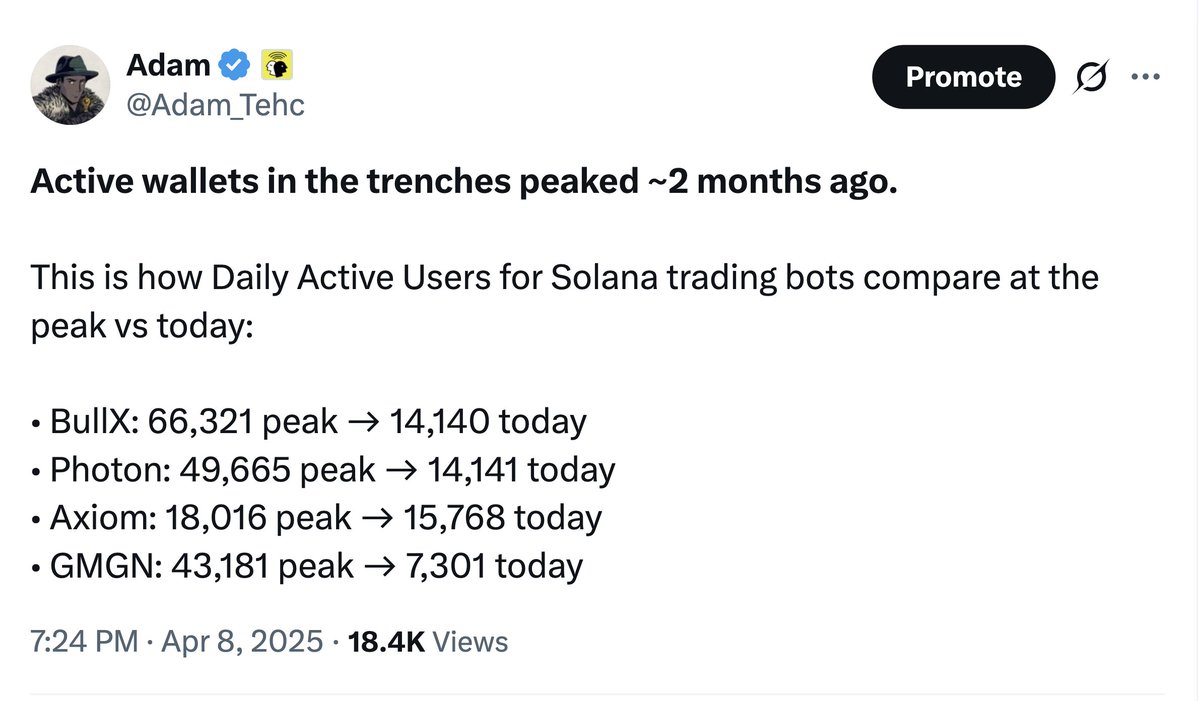

Daily trading bot users dropped -70% in two months.

DAUs on trading bots drops -70% in 2 months.

During a few months of declining volume, PvP increased and belief in holding was at an all time low.

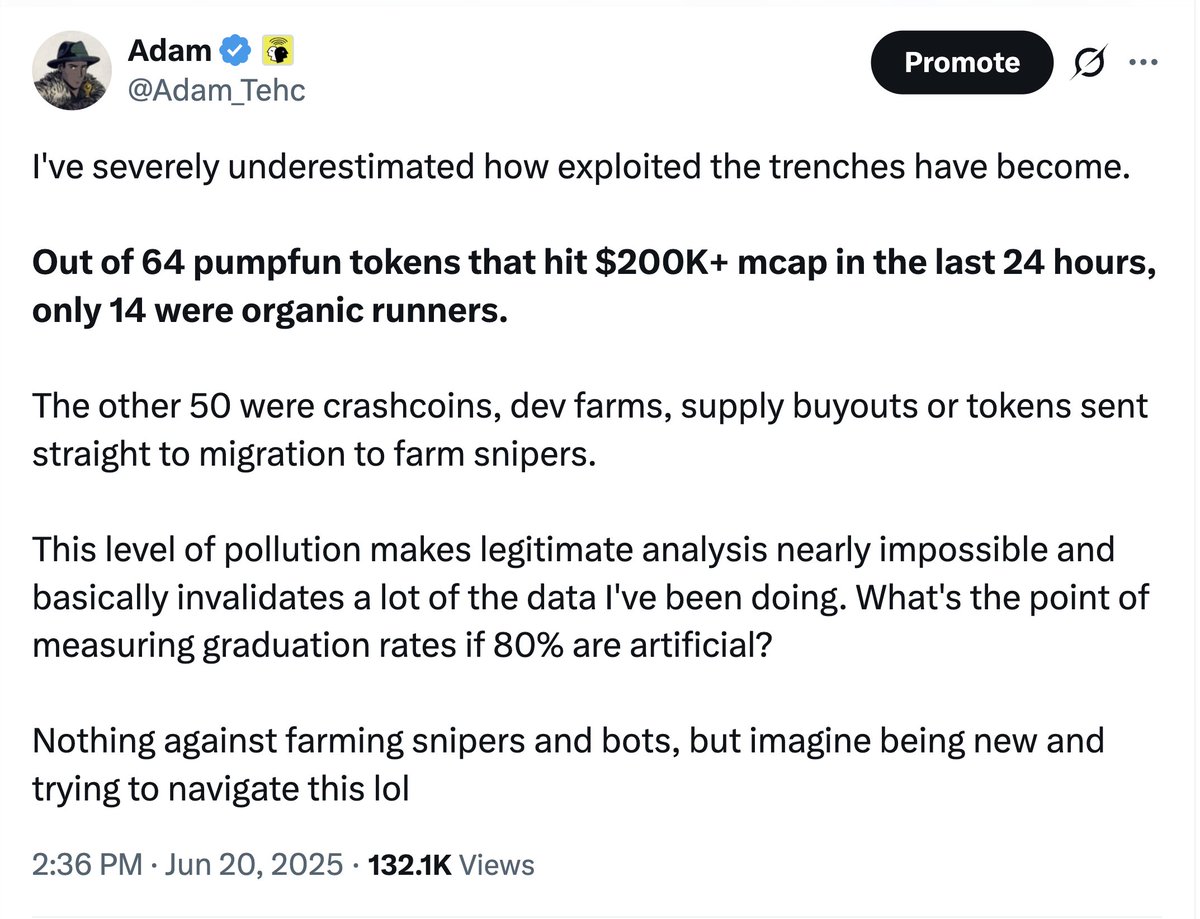

I got access to the best Pump data available and saw what we were ACTUALLY trading against: bots, multi-wallet deployers, teams. (thanks to @idatsy)

The trenches had become a sophisticated PvP arena.

it was fucking exploited.

Pumpfun had now generated over $500M in revenue and competitors started to emerge: Boop, Believe, and Raydium's own Launchlab (which later gave birth to BonkFun).

They saw some hype, it was good for a narrative, some PvP for a day or two. But nothing sustained. Pumpfun would always remain the king.

well, that was until...

The Memecoin War (July 2025 to September 2025)

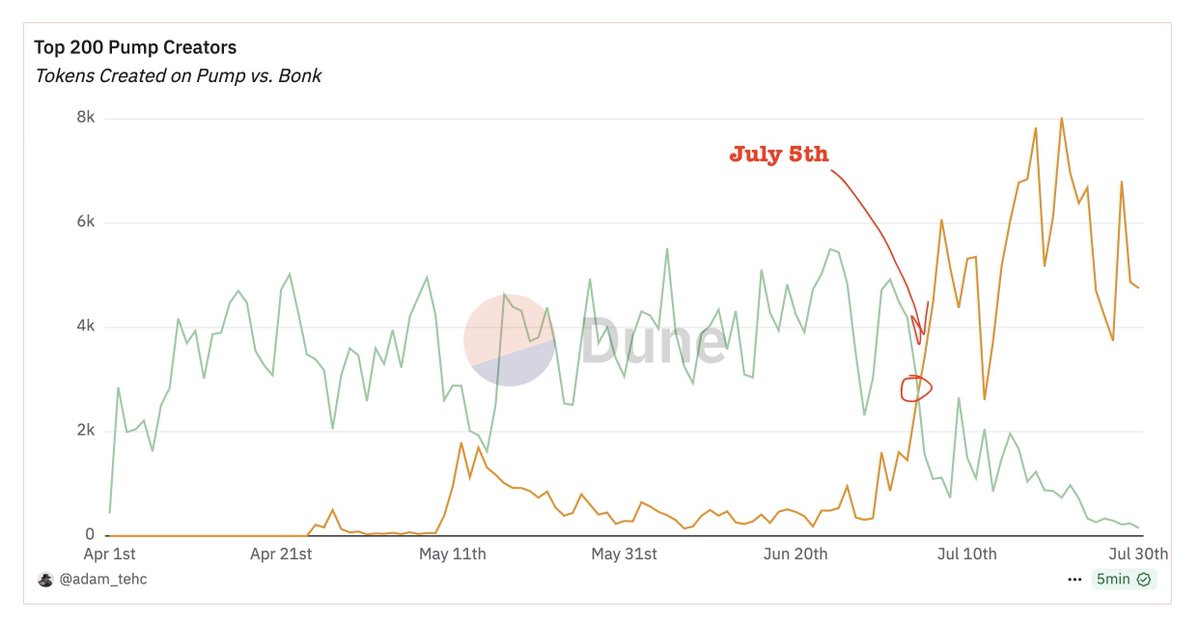

BonkFun became the first Solana launchpad to successfully flip Pumpfun.

the king had been dethroned

The thing with launchpads is that a few actors drive a lot of the activity, so once BonkFun flipped Pumpfun their share of the pie grew fast.

shows how fast token creators migrated to bonk (before traders)

BonkFun itself gave birth to some runners, most notably USELESS & HOSICO which grew to $250M & $50M mcap respectively.

Over the next few weeks BonkFun's marketshare grew to 85.2%. Leaving Pumpfun empty-handed with an upcoming ICO.

For a moment, it felt like the old days. The trenches were ALIVE. Incentives piled on incentives.

On July 12, Pumpfun raised $600 million in 12 minutes becoming the 3rd largest ICO in history.

Two weeks later, the faith in Bonkfun had evaporated. They were too involved in pushing their tokens and insider trading claims started piling up.

Alon struck back with trader & creator incentives, made a couple of announcements of announcements and just like that, the war was over.

Today, launchpad volumes are down 80% since TRUMP.

Just like Blur and Tensor's incentive wars marked the end for NFTs, the memecoin launchpad war marked the end of memecoin launchpads.

Turns out incentives worked. They just worked in reverse.

What's next? (September 2025 to Now)

Traders have now honed their craft for two years. Automation has accelerated. Deployers refined their strategies and our memescopes have evolved.

Memecoins represent less than 10% of Solana DEX activity and it's increasingly hard finding data that speaks positively for the state of the trenches.

memecoins represent less and less on-chain activity.

Could we see another run?

Maybe. But it won't look like 2024.

And honestly, that's fine.

We burnt $10M in presale funds. We made AI agents millionaires. We watched a president launch a shitcoin three days before inauguration.

Complete chaos. Absolutely criminal. And it was the most honest thing crypto's ever done.

It is becoming increasingly hard to justify the trenches making any form of sustained comeback.

By trenches, I’m talking specifically about PvPing a bunch of fresh launches.

For two years traders have been getting smarter and infrastructure has been getting faster.

The altcoin season we hoped would save us is severely postponed, if not canceled. And by the time it arrives, who knows if there will be any memecoin casino left to bet on.

Whatever happens next, dead or alive, memecoins were always a smaller game. Counterculture chaos built on infrastructure changing the world for the better.

and no matter what anyone says.

It's been a hell of a ride.

- The Dashboard Guy

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/4 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/5 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/6 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/6 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/7 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/2026.02.23

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link