10 Token Sale Themes Shaping Crypto Fundraising in 2026

Stacy Muur

Stacy Muur

10 Token Sale Themes for 2026

In 2026, token sale analysis became one of the main pillars of my work. Last year I introduced the Muur Score – a framework for evaluating protocols at the pre-TGE stage – and published breakdowns on the biggest sales of 2025: Flying Tulip, YieldBasis, Almanak, Lombard, Falcon, and others.

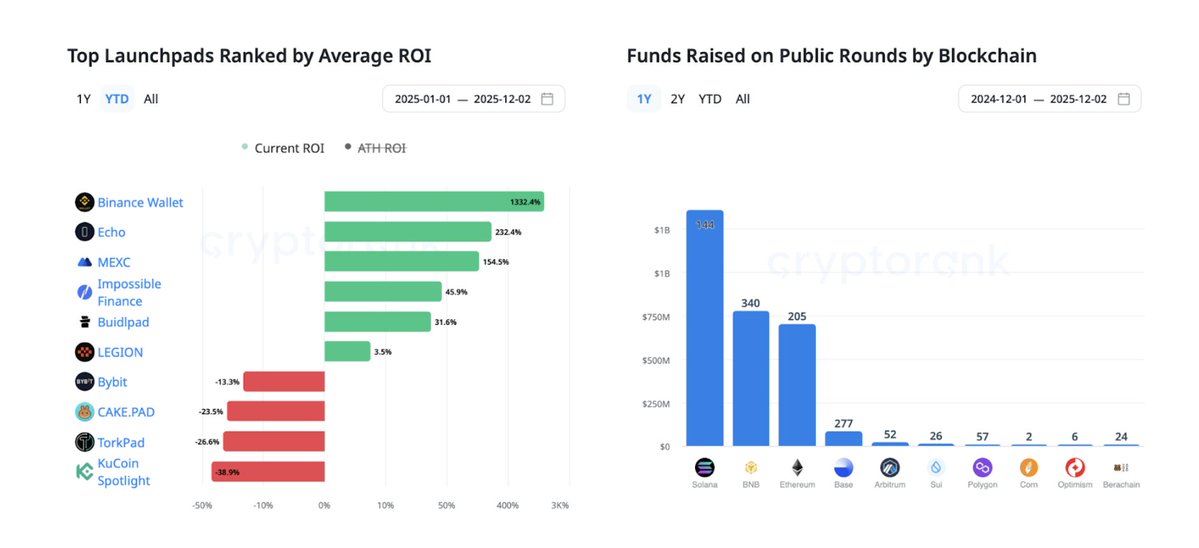

By mid-October 2025, the token sale thesis was obvious. Launches on @buidlpad, @echodotxyz, @legiondotcc, @MetaDAOProject, @BinanceWallet, @CoinList, and @MEXC_Official consistently demonstrated strong participation and post-TGE ROI. Retail attention returned, even if it arrived wearing a “gambler” badge rather than an “investor” one.

https://x.com/stacy_muur/status/1978825897432973740

For this report, I combined my first-hand research with predictions from teams at @legiondotcc, @CoinList, @Chain_GPT, and @impossiblefi. The goal is simple: describe where token sales are actually heading in 2026 – without pretending everything is “up only.”

Predictions for Token Sales in 2026

1. Continuous Clearing Auctions (CCA) move from niche to default

Uniswap v4’s CCA, popularized by Aztec’s $2.8B FDV public sale, proved that on-chain, transparent, non-custodial price discovery can work at scale. Expect 15–20 major projects to adopt similar mechanics.

CCA directly addresses:

accusation cycles around “manipulated allocations,”

off-chain order-book black boxes, and

reputational fallout like Monad’s Coinbase sale FUD.

The bigger theme: price discovery moves away from centralized exchanges and into public infrastructure.

https://x.com/aztecnetwork/status/1997375978536857678

2. Exchange-integrated launchpads consolidate market share

Kraken’s partnership with Legion and Coinbase’s $375M Echo acquisition showed where the puck is sliding. Binance, OKX, and Bybit are almost certainly next.

Expect:

60–70% of top-tier sales to run both on exchange-native platforms and standalone launchpads,

a two-tier system to form:

Tier A: exchange-backed, high liquidity, institutional allocation

Tier B: independent platforms chasing community-driven sales.

Good for distribution; bad for anyone trying to run a small launchpad in their garage.

“Recent M&A has shown a clear direction: more platforms will integrate token sales as part of broader user-acquisition funnels.

We’ll see the number of vertically integrated ‘silos’ grow, but the more interesting development will be the rise of global distribution networks. Think multi-region ecosystems spanning exchanges, partners, and channels.

A model like Legion + Kraken + our upcoming Asia CEX partner — providing chain-agnostic, platform-neutral token distribution at global scale — becomes the norm.”

– @matty_, founder @legiondotcc

3. Merit-based allocation replaces FCFS

First-come-first-served is functionally dead.

Bot armies killed it.

Legion’s merit scoring (participation, reputation, alignment) is becoming the template. Other platforms will add:

on-chain history,

long-term participation data,

social graph scoring.

This reduces sybil problems but introduces a new risk: “crypto credit scores” that reward early adopters and disadvantage newcomers.

Fairer, but definitely not equal.

“In 2026, the token sale market will polarize around two dominant models: fully regulated, professional launchpads and permissionless meme launchpads. Mid-sized, ambiguous platforms will struggle as distribution becomes the key competitive edge—projects will choose whoever can reliably deliver real users, liquidity, and secondary market support.”

– @0xr100, CMO at @impossiblefi

4. Institutional tranches become standardized

With traditional finance leaning deeper into tokenization, expect formal institutional tranches baked into token sale structures:

20–30% allocations

12–24 month lockups

structured book-building processes

Think “IPO-lite,” but on-chain.

Legion and others are already positioning themselves as crypto underwriters — and 2026 will turn that positioning into an industry norm.

“We’ll see deeper launchpad–CEX integrations and professional launchpads evolving into modular infrastructure providers, offering KYC, audited sale contracts, and embeddable sale widgets that projects can host on their own sites. At the same time, anti-Sybil filters based on onchain and social data will become standard, and lockdrops will continue to gain traction as a core distribution primitive.”

– @0xr100, CMO at @impossiblefi

5. Multi-platform launches become the norm for top projects

WalletConnect’s $10M raise across CoinList, Bitget Launch X, and Echo set the tone.

For major launches:

3–5 simultaneous platforms become standard,

distribution improves,

concentration risk decreases,

coordination headaches increase (but that’s their problem, not yours).

“I think projects will increasingly choose different launch platforms for different reasons, and often work with several at once. It's certainly not Coinbase or nothing. The ICO revival started well before Coinbase entered the game. That’s why they entered it.”

– @AlexTops1, director of marketing @CoinList

Projects refusing multi-platform launches will feel either underfunded or too centralized.

“We’re moving from isolated, one-off launches to coordinated, multi-platform raises. Launchpads and CEXs will work together more often, and the market will split into two clear categories:

– Institutional-style sales with larger checks, longer vesting, and heavy compliance, and

– Community-first sales with smaller tickets, merit-based access, and usage-driven scoring.

Buyers will also begin demanding standard guardrails: minimum liquidity and MM commitments, cleaner retail vesting, and in some cases refund or clawback mechanics when outcomes miss badly. Less ‘YOLO, list it and pray,’ and more structured raises that have to make sense for both the project and the buyer — on paper, not just on vibes.”

– @CEOGuy, CEO & Founder @Chain_GPT

6. Regulatory compliance becomes a competitive moat

Legion’s MiCA-aligned framework and ongoing SEC discussions signal a shift:

compliance is no longer optional signalling — it’s a business model.

Expect:

“regulatory-first” launchpads to emerge,

full KYC/AML as baseline,

zero tolerance from exchanges for non-compliant sales,

rising demand for ZK-based identity tech (finally a use case beyond “anonymous Discord users proving they’re human”).

Projects launching on non-compliant platforms will face faster delisting and reduced institutional demand.

“Until now, most crypto fundraising has been limited to native digital assets — gas tokens, utility tokens, and structures designed to avoid security classification.

With regulatory clarity expected in early 2026 through the SEC task force’s ‘Innovation Exemption,’ ‘Project Crypto,’ and potentially the Clarity Act, we’ll see new categories of assets experiment with on-chain distribution.

That includes early forms of tokenized equity for startup-stage companies.”

– @matty_, founder @legiondotcc

7. Bear market pressure forces “quality over quantity”

Late 2025 brought:

heavy bearish sentiment,

~$4B in ETF outflows,

lower liquidity across majors.

If this carries into 2026:

token launches drop from 500+ → 150–200,

average raise size increases 3–5x,

low-effort / meme-driven sales disappear,

infrastructure and real-product projects take over.

A classic flight-to-quality cycle — with fewer but bigger winners.

“In 2025, both extremes failed.

On one end, we saw high-FDV, high-raise launches that the underlying products simply didn’t justify — the market corrected them immediately post-TGE.

On the other end, we had low-FDV launches with weak liquidity, poor market making, and weak exchange lineups — and those collapsed for the opposite reasons.

In 2026, we shift from brute-force launches to designed ones. Serious buyers will focus on fundamentals that actually determine outcomes: FDV relative to progress, real user adoption, liquidity depth, MM quality, and platform reliability. Good projects will still raise meaningful amounts, but without trying to drain the entire pool on day one.

Launchpads and CEXs will compete on downside protection, minimum liquidity standards, clear MM commitments, and simple safety or refund mechanics — not just hype.”

– @CEOGuy, CEO & Founder @Chain_GPT

https://x.com/katexbt/status/1994644884930637970

8. Dynamic pricing replaces fixed FDVs

CCA’s success re-opened interest in fairer pricing. Expect:

Dutch auctions with soft floors,

bonding curves with circuit breakers,

demand-driven pricing informed by ML/AI systems.

The era of “Here is our $4B FDV, please clap” ends.

Price ranges replace fixed valuations — and while this reduces post-TGE dumps, it also dampens retail excitement (nobody flexes their auction clearing price at parties).

“ICOs aren’t just fundraising anymore.

They’re a way for projects to onboard new users into their products, grow mindshare, and decentralize their networks.

If buyers in Coinbase ICOs never leave the platform or just dump the token the next day, how much value does that really create for the project?

As the wildly successful Aztec token sale showed, many teams want these users inside their own apps, and their token sale mechanism and distribution to be fully onchain and decentralized.

The market is shifting toward verifiable, onchain finance where users hold their own keys, and CoinList is meeting that demand by becoming more crypto-native and closer to our users. The cypherpunk ideals are coming back. About time.”

– @AlexTops1, director of marketing @CoinList

https://x.com/milesdeutscher/status/1998116778074153038

9. Post-launch liquidity guarantees become industry standard

After the Monad spoofed-transactions FUD, platforms realized that launch mechanics don’t matter if post-launch liquidity collapses.

By 2026, expect:

mandatory 6–12 month market-making commitments,

standardized liquidity SLAs from platforms,

new post-TGE stability metrics.

Projects without professional liquidity providers will struggle to raise.

Retail now pays more attention to liquidity guarantees than to token tickers (a welcome development).

https://x.com/marcb_xyz/status/1987960174368485558

10. Community vesting replaces instant unlocks

The Coinbase “sell early → future penalty” model evolves into:

3–6 month vesting for retail,

unlock curves similar to team/seed schedules,

transferable “vesting rights” (yes, a new secondary market will appear instantly).

This reduces dump pressure but risks vesting fatigue — too many locked assets floating around with unclear pricing.

Expect half of all launches to adopt community vesting by late 2026.

Market Structure Implications

Token sales split into two ecosystems:

1. Institutional-Grade Sales

Multi-platform, exchange-integrated

$50M+ raises

Heavy compliance

12–24 month vesting

Professional market making

2. Community-First Sales

Single platform + merit scoring

$5–20M raises

Partial compliance

3–6 month vesting

Social-graph-driven participation

Both survive. They simply stop competing with each other.

Key Risks to Watch

regulatory action against non-compliant platforms may fracture the market,

prolonged bear market could cut all forecasts by ~50%,

excessive concentration around Coinbase/Kraken reduces competition,

vesting overload may create chaotic grey markets for vested rights.

What Do Token Sale Experts Say?

Which protocols will raise most efficiently?

@matty_, founder @legiondotcc: Revenue-linked consumer apps and B2B tokens continue to outperform

“We’ll see current performance trends amplified.

Consumer DeFi and applications that users genuinely like — especially those with clear revenue pathways or buyback narratives, even if modest — will continue to lead.

On the institutional side, B2B-focused tokens that generate meaningful revenue flows to token holders will remain among the strongest performers.”

@CEOGuy from @Chain_GPT: Fundamentals will matter more

“The projects that will raise efficiently are the ones that look like real businesses, not narratives wrapped in a token.

That boils down to three things:

– Real users and usage, not just a testnet and a pitch deck.

– Clear product differentiation, where the offering meaningfully improves on existing alternatives.

– Coherent token utility, with obvious and credible value capture.

Add a sane FDV, a clean sale structure, and founders with real track records — whether in big tech or prior crypto projects — and capital doesn’t drip in; it competes to get into the round, even in colder markets.”

@0xr100, CMO at @impossiblefi: Traction stars & infra solutions will dominate raises

"It will be apps with clear traction (revenue, real users, meaningful TVL) and backers with true distribution power—not just “Tier 1 VC” logos, but ecosystem giants that can move adoption. Infra will remain a strong fundraising category, but applications with real users and revenue will increasingly outperform pure narrative plays.

Hot combinations will look like “hot narrative + infra angle” across sectors such as prediction markets, AI (especially robotics), and RWAs, often wrapped in lockdrop-based, data-driven distribution."

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/4 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/5 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/6 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/6 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/7 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/2026.02.23

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link