10 Bold Crypto Predictions for 2026 by Bitwise

Ryan Rasmussen

Ryan Rasmussen

In 2026… Bitcoin will break the four-year cycle, Polymarket open interest will set an all-time high, more than 100 crypto ETFs will launch, and more…

Here are 10 Crypto Predictions for 2026 by the team at @BitwiseInvest

🧵👇

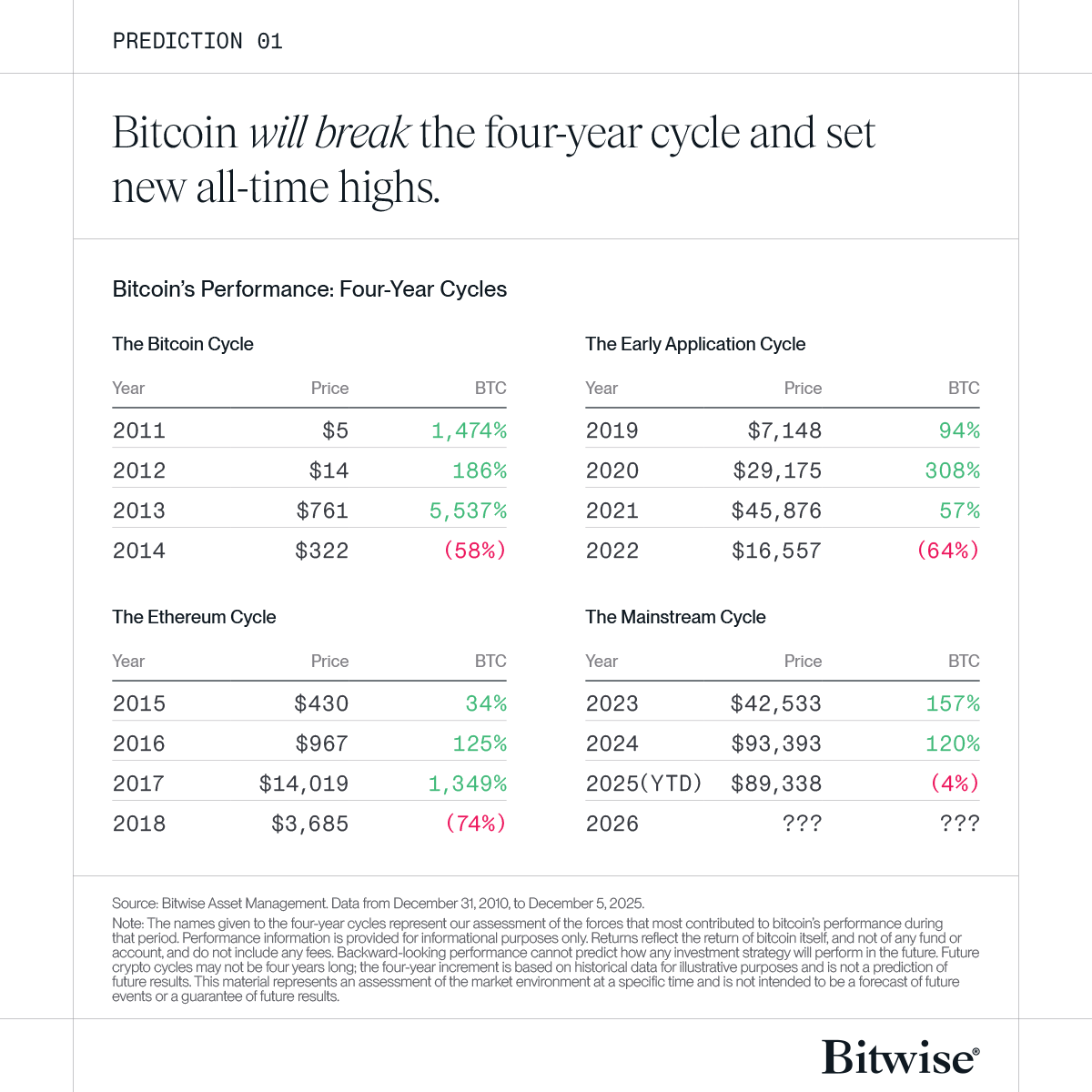

Prediction #1: Bitcoin will break the four-year cycle and set new all-time highs.

Bitcoin has historically moved in four-year cycles, with three significant “up” years followed by a sharp pullback year.

Accordingly, 2026 should be a pullback year.

We don’t see that happening.

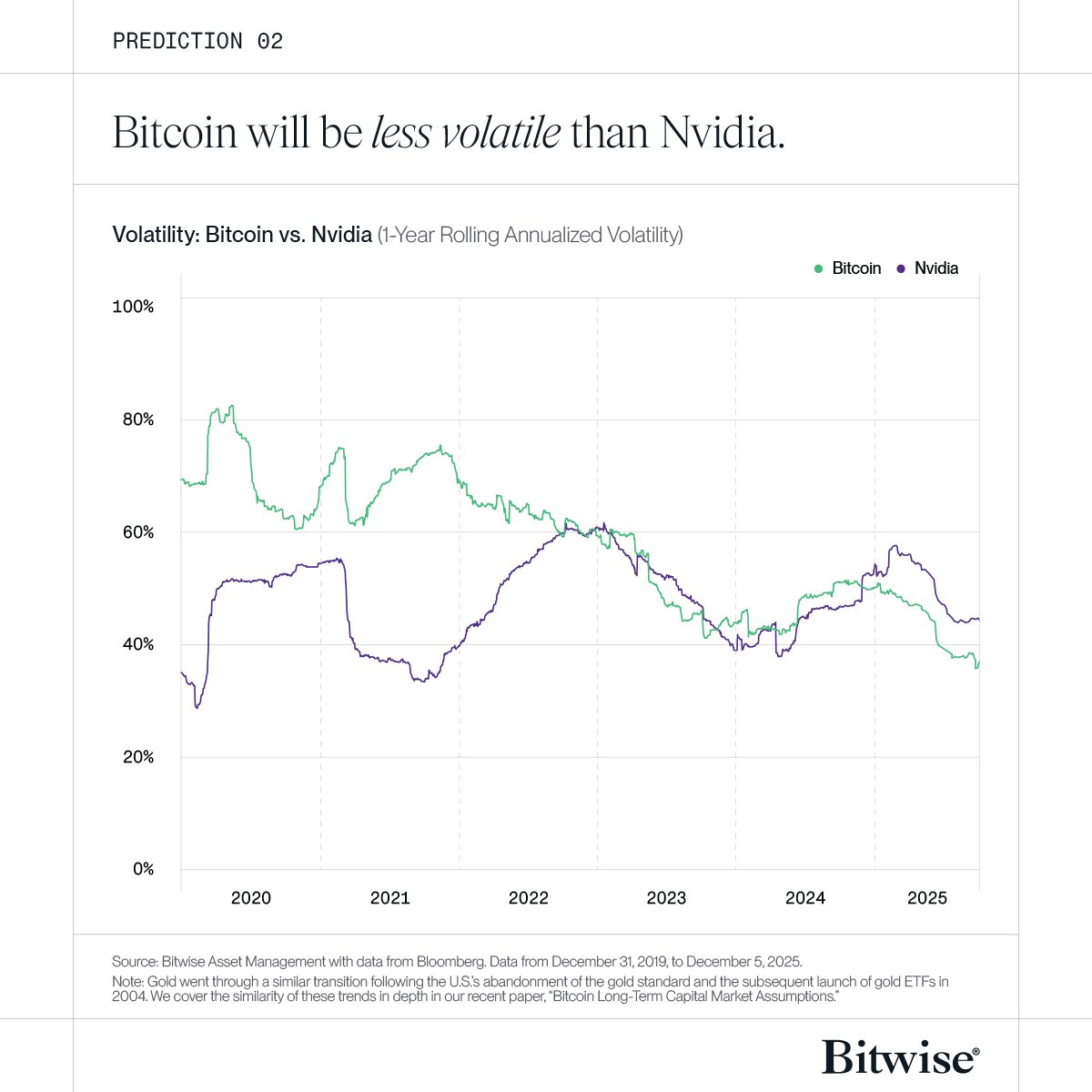

Prediction #2: Bitcoin will be less volatile than Nvidia.

Many investors say bitcoin is too volatile.

But lately, bitcoin has been less volatile than other assets investors embrace with open arms, like Nvidia.

We see that trend continuing into 2026.

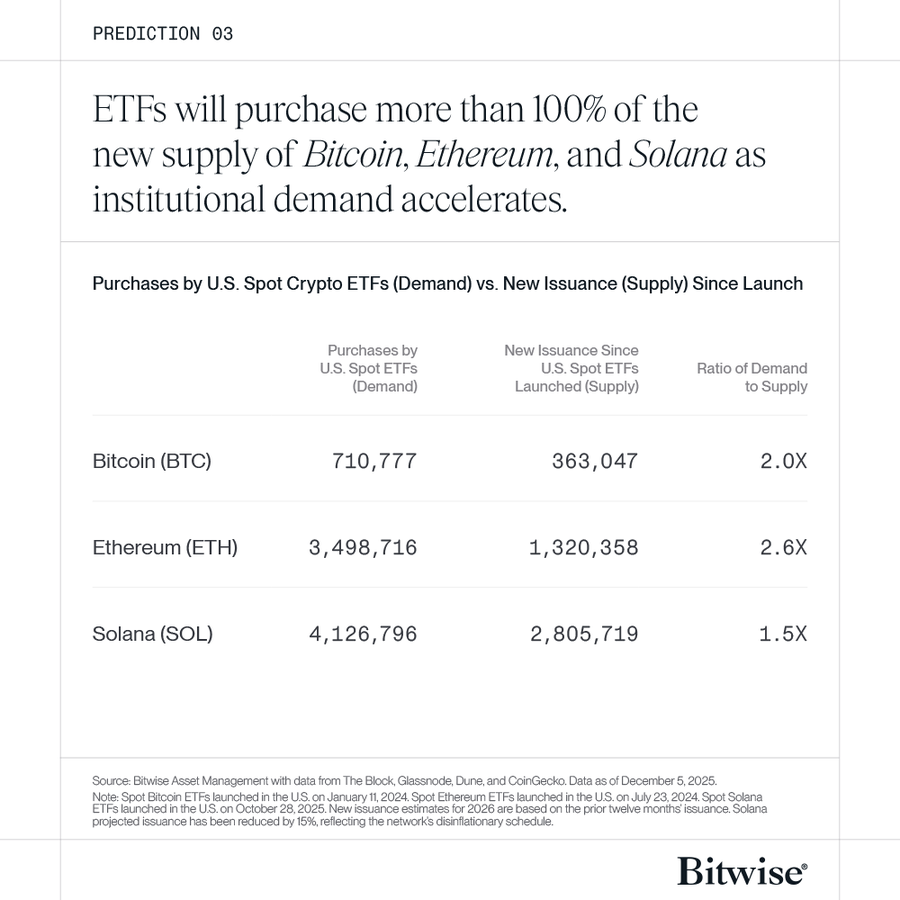

Prediction #3: ETFs will purchase more than 100% of the new supply of Bitcoin, Ethereum, and Solana, as institutional demand accelerates.

2026 will be the first year most institutional investors can access crypto ETFs.

You can imagine what that will do to demand.

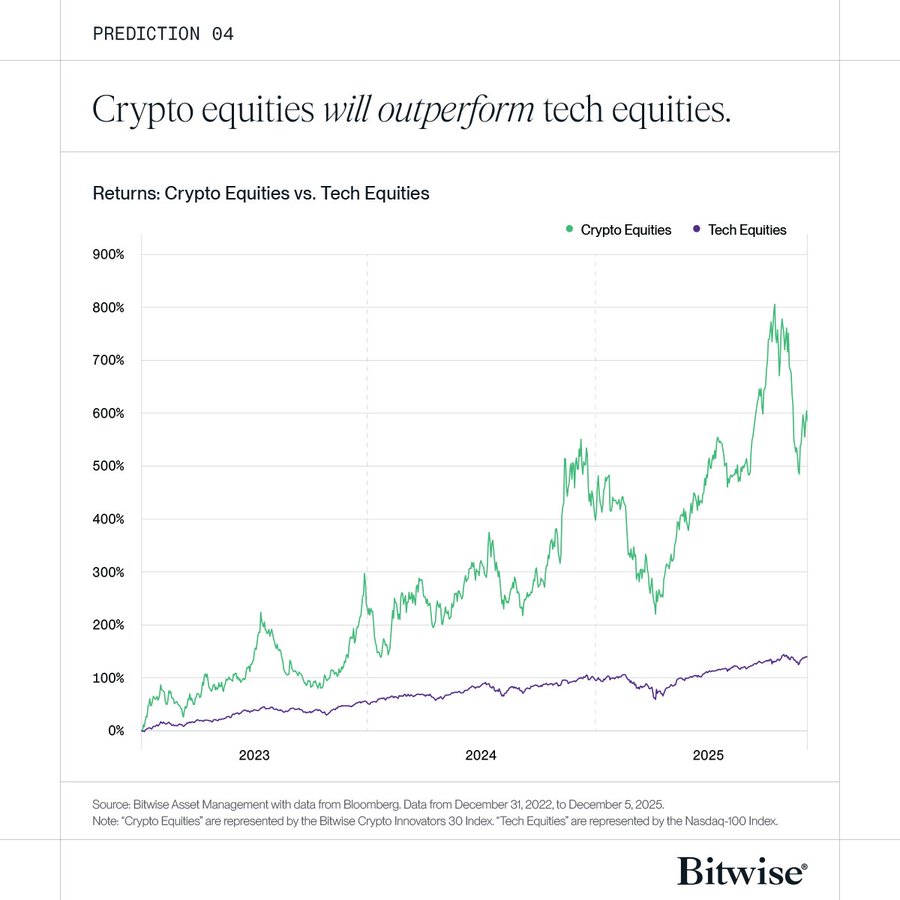

Prediction #4: Crypto equities will outperform tech equities.

It’s been happening for the past three years already.

As regulations improve and crypto companies continue to innovate, we think they’ll do well in 2026—well enough to keep Wall Street on its heels.

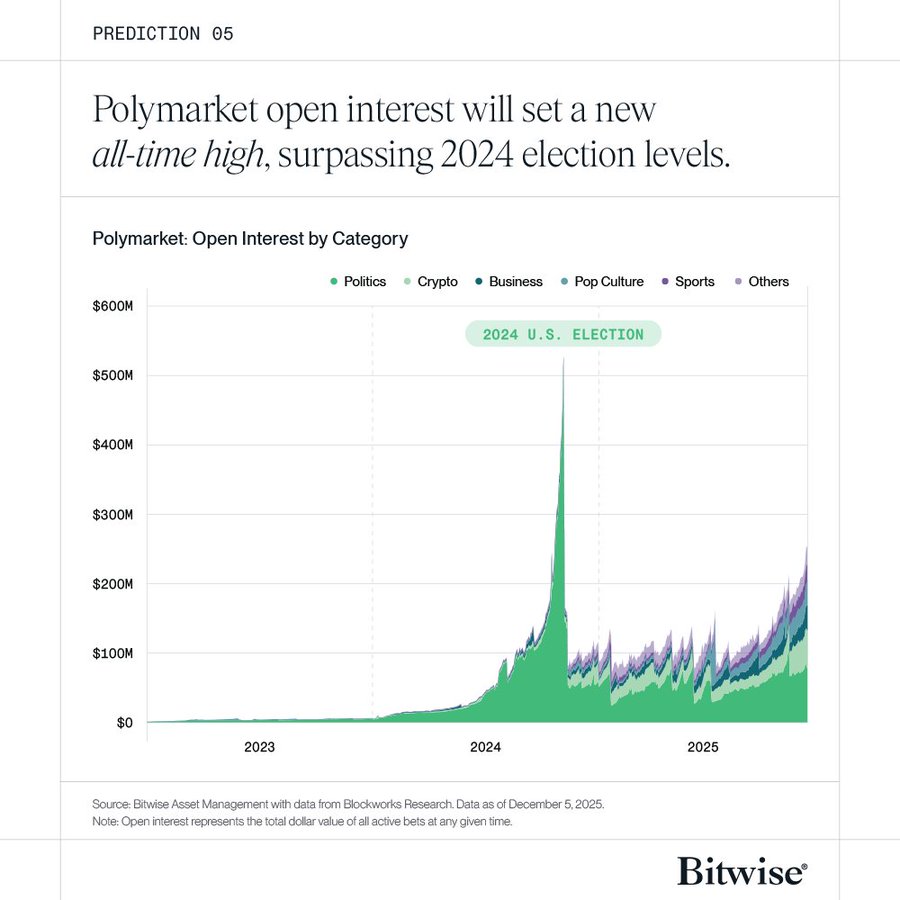

Prediction #5: Polymarket open interest will set a new all-time high, surpassing 2024 election levels.

We see a massive surge in activity due to:

— New users (opening up to the U.S.)

— New investments ($2B capital injection)

— New markets (economics, sports, pop culture, etc.)

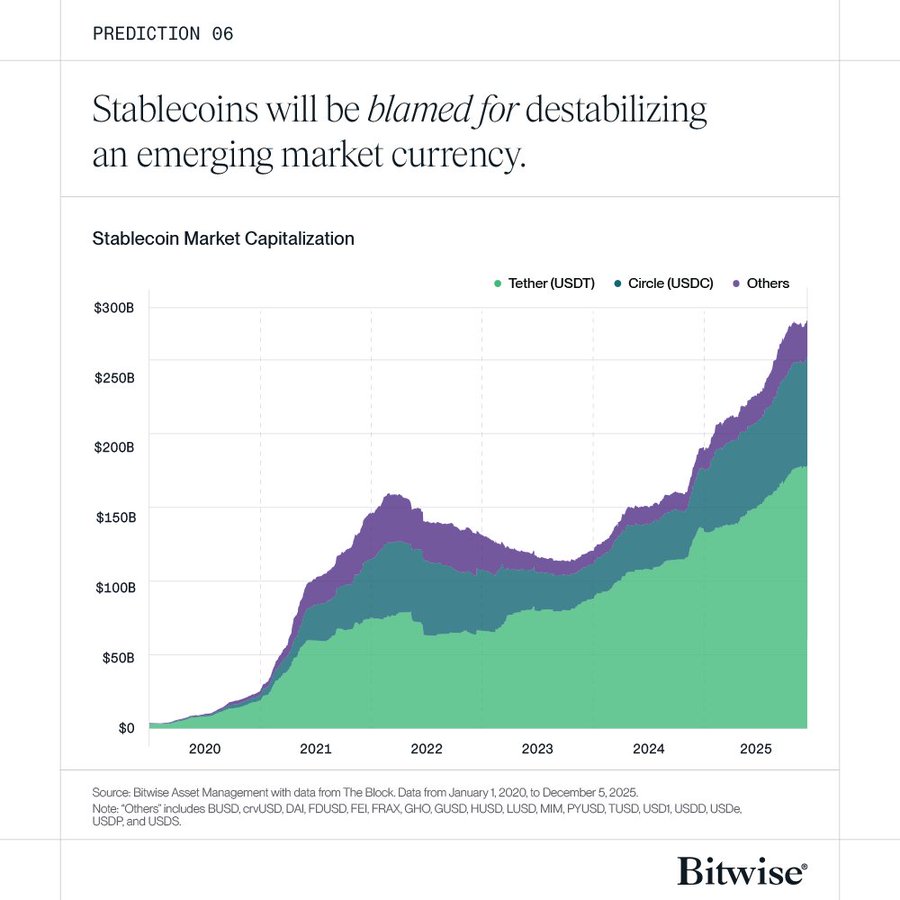

Prediction #6: Stablecoins will be blamed for destabilizing an emerging market currency.

We expect a country will blame stablecoins for their currency issues.

Of course, people wouldn’t turn to stablecoins if local currencies were sound. That won’t stop them from being blamed.

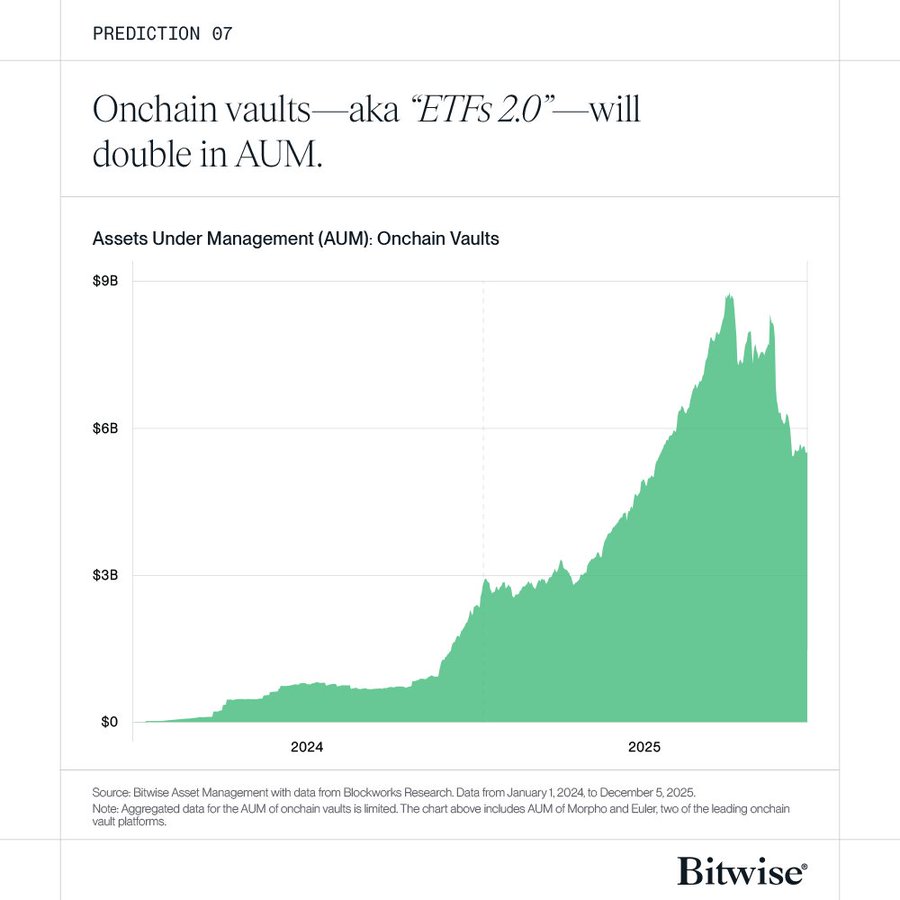

Prediction #7: Onchain vaults—aka ETFs 2.0—will double in AUM.

Vaults surged in 2025 before the Oct. volatility spike led to losses across poorly managed strategies.

We think a wave of high-quality curators enter the market in 2026 drawing billions into the vaults they manage.

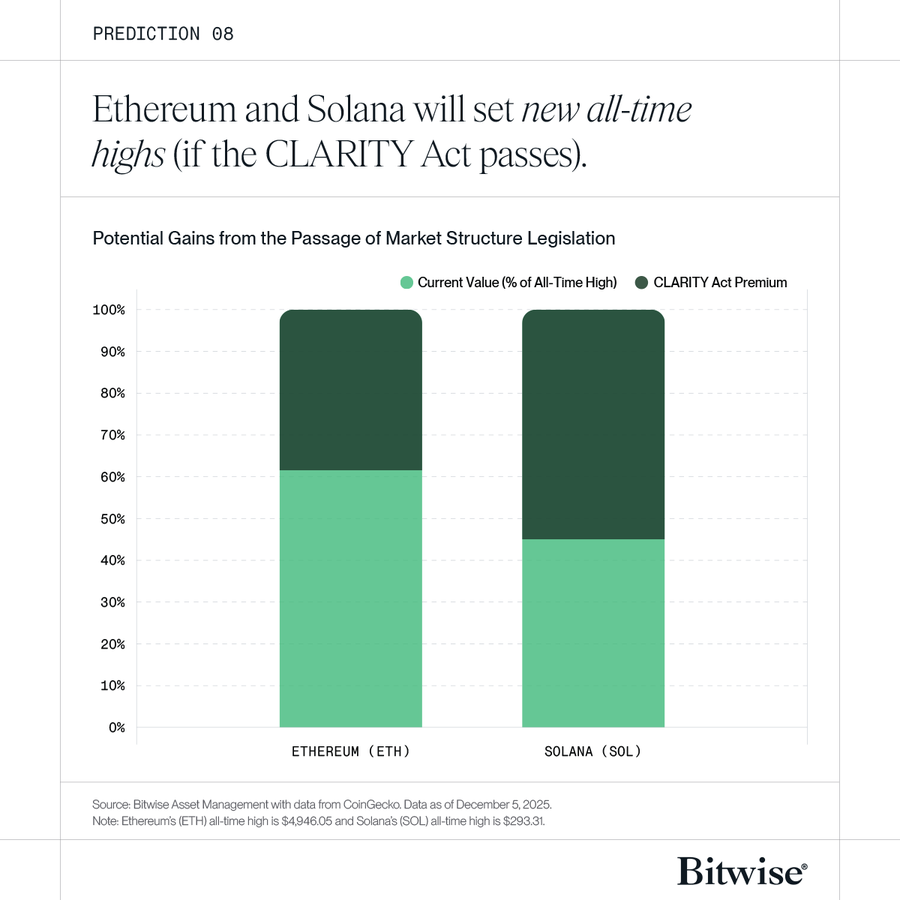

Prediction #8: Ethereum and Solana will set new all-time highs (if the CLARITY Act passes).

The outlook for the CLARITY Act passing in 2026 is mixed.

If it does, we think Ethereum and Solana will be the two primary beneficiaries, seeing their prices soar to all-time highs.

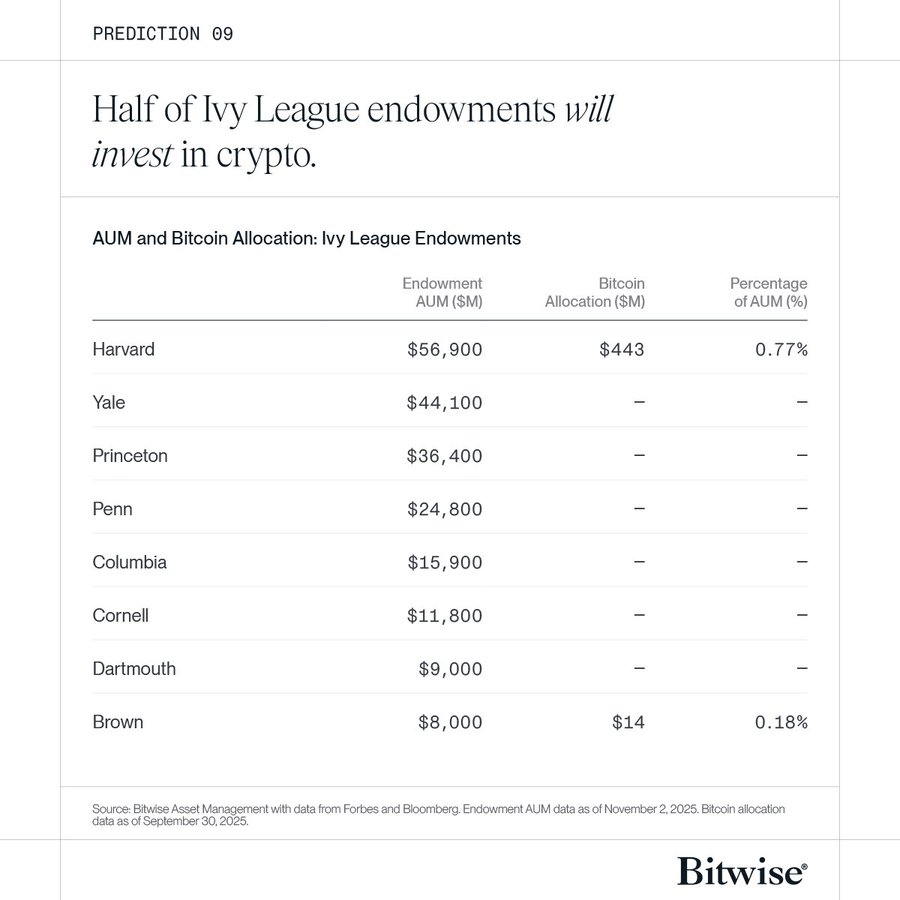

Prediction #9: Half of Ivy League endowments will invest in crypto.

Why does this matter?

1. Endowments control ~$1 trillion

2. Ivy League endowments are trend-setters

Harvard and other Ivies could bring a lot of pensions, insurance funds, and other institutions to the table.

Prediction #10: More than 100 crypto-linked ETFs will launch in the U.S.

For more than a decade, the SEC rejected crypto ETFs.

Now, the rush is on.

Heading into 2026, we think a clear regulatory roadmap and a market hungry for crypto ETFs will set the stage for “ETF-palooza.”

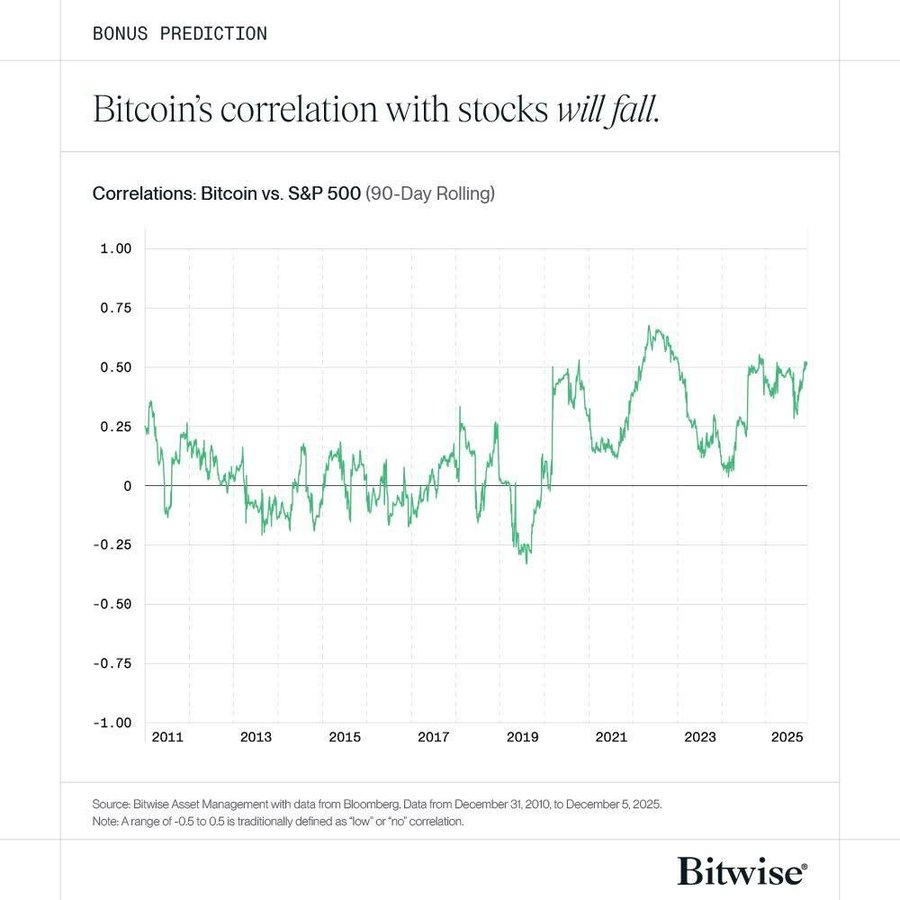

Bonus Prediction: Bitcoin’s correlation to equities will fall.

The reason?

We expect crypto-specific factors like regulatory progress and institutional adoption to power crypto higher, even as equities struggle with concerns about valuation and short-term economic growth.

Please note: As with all predictions, these are not guarantees, but represent our best informed estimate. The future is complex and conditional, and whether these pan out exactly as written will depend on many complicated factors. Nothing above is investment advice.

Nearly 10% of Bitcoin is now held by Strategy and spot ETFs. With average ETF cost bases above price, $7B+ in unrealized losses and record outflows show normie capital under pressure—leaving BTC dependent on a fresh narrative to reaccelerate.

Jim Bianco/2026.02.03

Bitcoin’s weak year isn’t OG selling or a “silent IPO.” It’s crypto contagion. Illiquid altcoins forced insiders to sell BTC to prop up air-token markets, while disciplined capital (ETFs, MSTR, Wall St) drained volatility and killed alt-season rotations.

Bit Paine/2026.01.28

Gold’s parabolic breakout isn’t a Bitcoin defeat but the same debasement trade unfolding in phases. Gold moves first as the hedge for states; Bitcoin follows as the hedge for people. They trend together long term, but cycle apart short term.

Swan/2026.01.27

100 gains didn’t disappear—they changed form. In a hyper-diluted market, winners stack gains by rotating early between narratives, not holding forever. This playbook explains how to spot rotations, size positions, take profits, and compound phases in 2026.

cyclop/2026.01.22

A veteran trader distills seven hard-earned lessons that prevent blown accounts and emotional spirals. From market context and risk control to playbooks, journaling, and process-first thinking, this guide shows how consistency—not signals—builds long-term trading edge.

Morin/2026.01.21

A trader pulled off a $233K overnight play on Polymarket by exploiting thin weekend liquidity. By baiting market-making bots in 15-minute markets and briefly nudging spot price, he forced mispricing and cashed out risk-efficiently.

PredictTrader/2026.01.19

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link