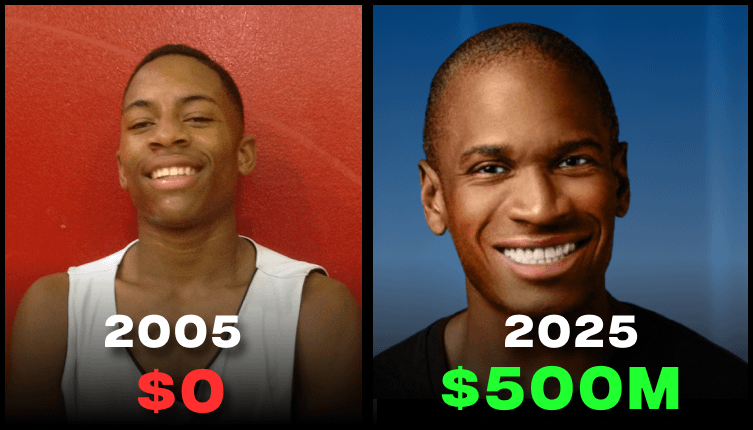

Arthur Hayes: From Zero to Crypto Billionaire – Strategy, Origins, and Bold Predictions

Tracer

Tracer

This is Arthur Hayes, richest trader ever...

he turned $0 in $500,000,000 in 6 years

He predicted tariffs and $BTC $76K dump...

here's his strategy, China insides and 5 crypto predicitons 🧵👇

(#3 will make u millions)

✜ People often try to predict the market and guess the next moves, but no one does it as accurately as @CryptoHayes

✜ From absolute zero to MILLIONAIRE and his own CEX exchange @BitMEX

✜ Biographies and predictions from such people are important for all of us – learn to make use of them:

✜ Arthur Hayes was born in 1985 in Detroit, in a middle-class family

✜ His father worked on an assembly line and his mother was a purchasing manager at General Motors

✜ After high school, Arthur Hayes enrolled at the University of Pennsylvania and in 2008 graduated from the Wharton School of Business with a bachelor's degree

✜ He then went to Hong Kong, where he worked for several years at Deutsche Bank and Citibank as an ETF market maker

✜ Hayes was just gaining momentum in his career when in May 2013 he received a notice of dismissal

✜ After that, he had to familiarize himself with the works of Satoshi Nakamoto and his new passion became cryptocurrencies

✜ He started with arbitrage and was caught up in the famous Mt.Gox exchange hack

✜ He managed to withdraw his money back then, but came to one conclusion – exchanges are the weak point in Bitcoin security

✜ Even then, he began to have ideas about creating his own exchange to close all the gaps

✜ Around that time, he met Ben Delo, a smart British mathematician and programmer

✜ Having found a developer, they began creating what they called a commodity exchange for bitcoin (BitMEX)

✜ From that moment on, Arthur's life began to change drastically for the better

✜ The exchange began offering 100x leverage, from which the company started to grow exponentially

✜ But not everything was so rosy – in 2019, a critic suggested the exchange was engaged in illegal activities

✜ A bit later, regulators brought charges against the founders of BitMEX for illegal operations

✜ Now the issue has been resolved – with the arrival of Trump, he pardoned Arthur Hayes and other BitMEX founders

✜ Arthur himself is now living his best life and owns multi-million capital

✜ He also often makes market predictions with an incredible win rate and here are a few current ones:

✜ In one of his latest interviews, he shared his opinion on Trump’s Trade War

✜ He believes the main goal is to reduce the current account deficit and bring manufacturing back

✜ This reduces demand for U.S. debt – the Fed will have to buy it themselves, which leads again to money printing and a pump in $BTC

✜ In his opinion, Bitcoin didn’t perform well in 2024, but that’s due to investors misinterpreting the situation

✜ Considering the money printing and fiscal dominance:

- Bitcoin will decouple from traditional markets

- Will grow along with gold

- Global money supply → Pump → $BTC also Pump

✜ In one of his latest updates, Arthur Hayes wrote that he is gradually accumulating $BTC

✜ His main argument was – turning on the money printer is all they have left in their arsenal

✜ The money printer will allow the Fed to inject a lot of money into the market, from which we’ll see growth

✜ On the frequent debates $ETH vs $SOL, Arthur also shared his personal opinion

✜ Ethereum is currently disliked by the market and that is usually the best time to enter – $ETH has the best risk/reward now

✜ $SOL rose on the meme coin wave and it’s unlikely the trend will repeat at such scale

✜ Hayes also believes we can forget about the catalyst in the form of the U.S. government buying $BTC

✜ People are naive and think “they’ll just print money and buy BTC” but that’s unrealistic

✜ Governments with deficit budgets can’t afford to spend money on buying $BTC when there are social issues

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/4 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/5 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/6 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/6 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/7 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/2026.02.23

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link