Global M2 Money Supply and Bitcoin: Patience Pays Off

Colin Talks Crypto

Colin Talks Crypto

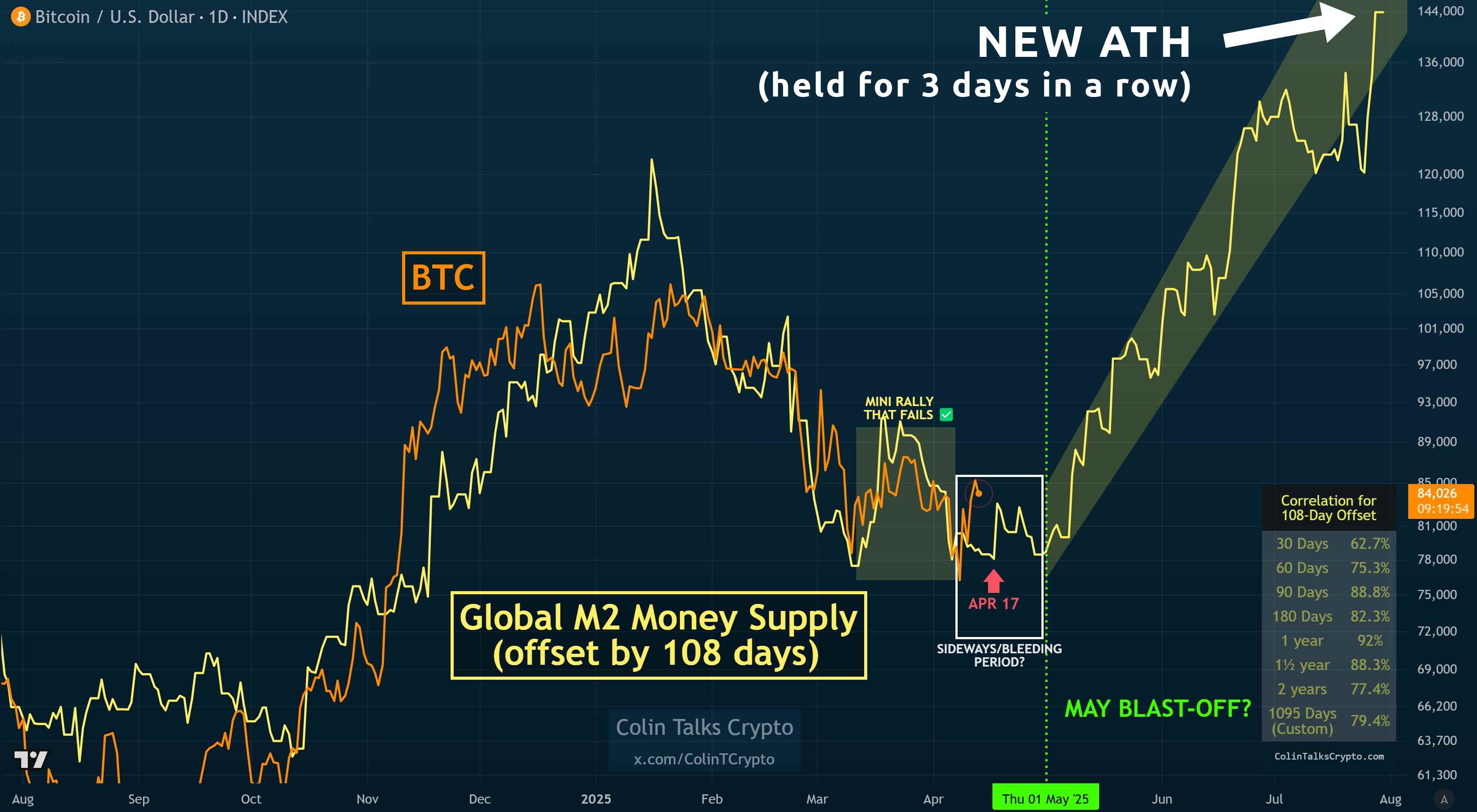

Global M2 Money Supply vs Bitcoin

🔹 CONTINUES TO BE BULLISH. Global M2 has remained at an ATH for 3 days in a row. This is a fantastic sign for what it signals will be coming into risk assets in ~108 days. (See upper-right corner of chart)

🔹 DIP BUYING OPPORTUNITY? Global M2 (with a 108-day offset) doesn't show a blast-off for another ~2 1/2 weeks, and actually shows a slow bleed into next week until around April 16th or 17th. See pink arrow.

As such, I'm wondering if next week will provide us another dip-buying opportunity.

🔹DOUBTERS AND FLIP-FLOPPERS. I see an inclination by some to shift opinion every time there is a short time frame price movement. Global M2 is a *macro* chart. Thus, it is best to view it as such and to have patience-- not to change one's analysis with each small price movement.

This is backed by the fact that Global M2 *WILL* deviate 20% of the time, by mathematical correlation— that includes deviations both to the upside and downside. This is why you must zoom out, in order to account for that 20% non-correlated period and **not be suckered into accepting it as the average**.

Furthermore, we just proved over an extended period of time (several weeks) that the 108-day offset was accurate via the "MINI RALLY THAT FAILS". That was big. Many were calling the 108-day offset wrong before that period, too. It turns out the doubters were incorrect.

I haven't seen enough proof that the 108-day offset is wrong. It's totally fine if the offset does change, and I will shift accordingly, but I'm not being too quick to jump to that conclusion. Let's give it a week or two to play out.

In summary: I wouldn't be too quick to judge the M2 offset on each short term BTC price movement.

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/1 days ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/5 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/7 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/2026.02.24

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link