Raoul Pal’s Crypto Playbook: Why the Next 12 Months Could Be Life-Changing

eye zen hour

eye zen hour

The macro legend @RaoulGMI's Sui Basecamp speech was pure Alpha

He laid out the most bullish case for crypto I've ever seen

It changes EVERYTHING about how you should position for the next 12 months

10 staggering revelations: 🧵

1. Raoul revealed that 90% of Bitcoin's price movements are driven by ONE factor:

Global Liquidity

This isn't speculation - it's mathematical reality with a 90% correlation

While everyone debates Fed cuts and tariffs, they're missing what ACTUALLY moves markets

2. The "Everything Code" framework exposes the greatest wealth transfer mechanism in history

8% global currency debasement + 3% inflation = 11% annual wealth erosion

It's a silent tax hurting everyone. If you don't make 11% annually, you're net negative

The only escape? Crypto

3. Bitcoin's logarithmic regression channel shows we're still remarkably cheap

At just 2 standard deviations, BTC would reach $850,000 🤯

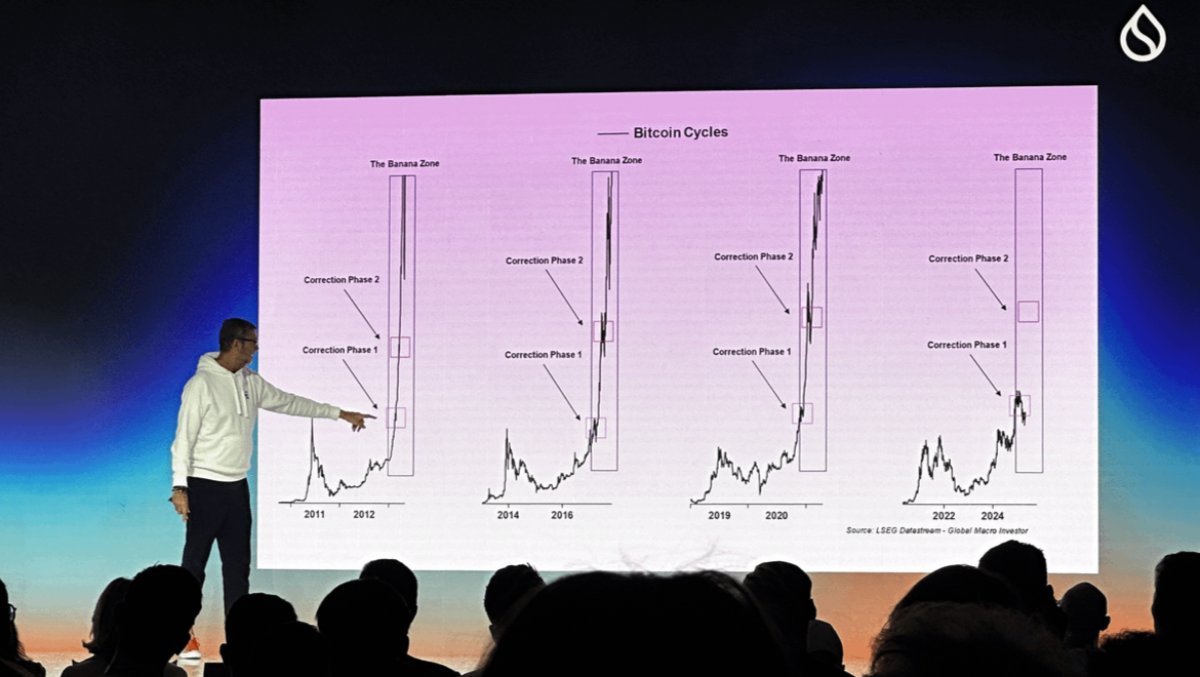

And we've barely entered what Raoul calls "The Banana Zone" - the explosive phase of the market cycle

4. Markets are OBSESSED with narratives that explain today using liquidity conditions from 3 months ago

This fundamental misunderstanding is why so many traders get wrecked

Financial conditions lead liquidity, which leads markets - with a consistent 3-month lag

5. The 12-week Global M2 liquidity chart that Raoul pioneered has been STUNNINGLY accurate

He called it "the most voodoo-like chart I've ever come across"

Look at the perfect alignment - and what it's forecasting for the rest of 2025

6. Raoul revealed he's allocated almost all his personal capital to $SUI

"I use the SOL/SUI chart as my compass for what's the strongest performing horse in the race"

This is perhaps the strongest endorsement possible from a macro legend with 35+ years experience

7. The real trigger for Alt Season isn't BTC dominance or ETF flows - it's the ISM Manufacturing Index

When ISM crosses above 50 and trends up, we enter perfect conditions for explosive altcoin growth

Forward indicators suggest we're about to see this EXACT scenario play out

8. Investor sentiment has reached historic bearish extremes:

• All-time record low bullishness in Investor Intelligence Survey

• VIX spikes in top 3 of all time

• Bear sentiment exceeded only twice in history

This level of fear has preceded EVERY major crypto rally

9. The current setup is identical to 2017's Trump tariff cycle:

• Initial market panic ✓

• Dollar strength then reversal ✓

• Economic surprise index bottoming ✓

• Liquidity expansion beginning ✓

The difference? Last time Bitcoin did 23X from this exact point

10. We've already had 7 significant corrections in this cycle (20%+)

Each time, fear convinced investors "it's over" - yet nobody remembers them just months later

These pullbacks are mathematically necessary for the larger uptrend to continue

Forward-looking indicators suggest this crypto cycle extends far longer than most expect

Raoul's models point to Q1/Q2 2026 as the potential peak

This aligns perfectly with U.S. midterm elections when maximum liquidity will be in the system

The simple playbook according to Raoul:

"Don't f*ck this up. Don't lose control of your tokens. Don't use leverage. Don't get your wallets hacked. Just sit with it."

The hardest part isn't finding the right tokens - it's managing your psychology through volatility

The most powerful insight: we're nowhere near cycle top indicators

We're at the same subdued levels seen in 2013 before the largest bull run in crypto history

The upside from here isn't just substantial...

It's potentially life-changing

This isn't just about getting rich - it's about understanding the most fundamental economic shift of our lifetime

Central banks are debasing currency at unprecedented rates, giving crypto an unstoppable tailwind

The next 12-18 months will change everything

Remain bullish frens

99% of BTC will be mined by 2040, leaving miners reliant on transaction fees. With current fees covering just 7% of costs, Bitcoin faces tough questions on security and incentives post-halving. Can it stay secure without changing its rules?

Leshka.eth/1 days ago

A Satoshi-era whale sold 80,000 BTC ($9B) through Galaxy Digital with barely a 3.5% dip. This historic holder rotation moved decade-old coins to institutional hands, tightening supply and signaling a new phase for Bitcoin’s price discovery.

Swan/1 days ago

Bitcoin shows signs of a short-term downtrend reversal after a strong bounce at $114,700. With supports at $112K and resistances at $121K-$123.25K, targets of $133K-$140K are expected soon. Mid-term top likely in Q4 before a bear market, but long-term outlook remains highly bullish.

Mr. Wall Street/2 days ago

Bitcoin remains range-bound between key liquidation clusters at $121k–$120k and $114.5k–$113.6k. While an upside move to the top cluster is possible first, the $113.8k level and unfilled CME gap at $114.3k suggest the downside cluster is the mid-term target.

CrypNuevo/2 days ago

Every historical Altseason started in August. Bitcoin dominance is slipping, and capital is rotating into alts. This could be the setup for 200x+ lowcap rallies like past cycles. Here’s my 2025 portfolio picks before the bull run kicks off.

0xNobler/5 days ago

After 3 full market cycles, 5 major indicators—Pi Cycle Top, AHR999, Puell Multiple, Rainbow Chart, and Bubble Index—show no signs of a peak. Bitcoin remains mid-cycle, and altseason hasn’t even begun.

Leshka.eth/5 days agoOriginal

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link