Was David Schwartz Part of the Satoshi Mission?

Stellar Rippler

Stellar Rippler

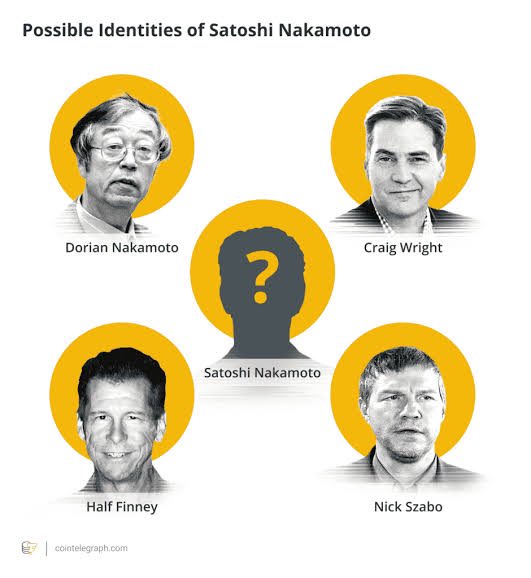

(1/🧵) Is David Schwartz… Satoshi Nakamoto? Or at least one of Bitcoin’s original architects?

The timing, the patents, the silence, it all lines up.

This thread might flip your entire view of crypto history and you might fall into a deep rabbit hole.

🧵👇

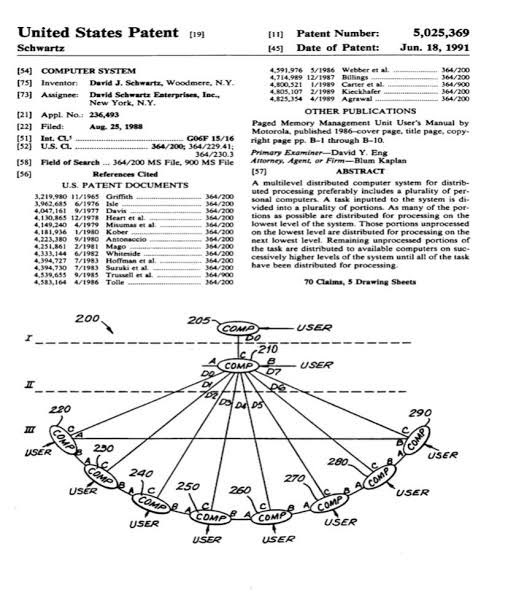

(2/🧵) The Patent That Predates Bitcoin

In 1991, David Schwartz filed a patent for a “Distributed Computer Network” that sounds eerily like a blockchain.

US Patent No. 20090119384

Years before the Bitcoin whitepaper.

Same structure. Same logic.

The same obsession with decentralization.

(3/🧵) The Language Overlaps

People have run stylometric analysis on Satoshi’s forum posts.

Guess whose writing style it closely resembles?

David Schwartz.

Even the use of terms like:

•“censorship-resistant”

•“trustless system”

•“consensus”

It’s almost like he never changed tone… just platforms.

(4/🧵) The Quiet Background

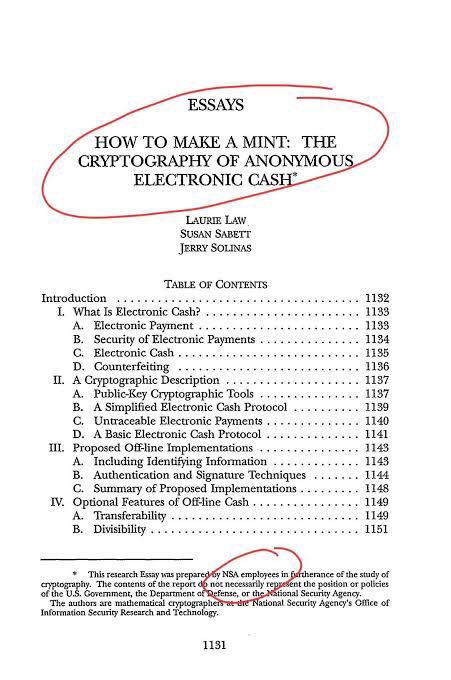

Schwartz worked on classified NSA contracts as a cryptographer.

So did other suspected Satoshi candidates like Hal Finney.

But Schwartz kept a much lower profile right until Ripple appeared, with XRP launching shortly after Bitcoin.

Too convenient? Or too perfect?

(5/🧵) The XRP Angle

Satoshi wanted Bitcoin to be “peer-to-peer digital cash.”

But over time, it became a store of value, not a payment system.

Enter XRP:

•Built for payments

•Real-time settlement

•Low energy use

What if XRP was Plan B?

A more efficient evolution built by the same mind?

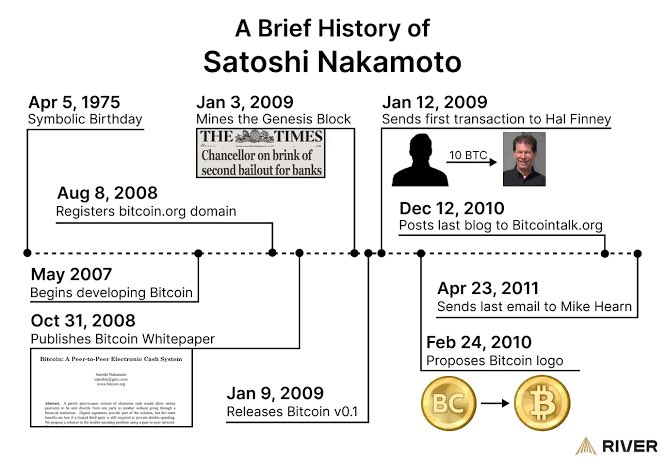

(6/🧵) Satoshi’s Disappearance in 2011 = Ripple’s Emergence

Satoshi went silent in late 2010.

Ripple began forming quietly in 2011.

Not a coincidence but a handoff.

The Bitcoin experiment had proved the concept.

XRP was designed to scale it to the real financial system.

(7/🧵) Schwartz Never Confidently Denied It

In multiple interviews, when asked about the Satoshi theory, David Schwartz never gave a direct “no.”

Instead, he leans on:

•“I was around back then…”

•“I had thoughts about proof-of-work early on…”

•And always that cryptic grin when the question comes up.

Almost like someone who knows… but can’t say.

(8/🧵) The Theory?

Satoshi Nakamoto was never just one person.

It was a team or a rotating identityof cryptographers, engineers, and forward-thinking rebels.

Bitcoin was the revolution.

XRP was the blueprint for integration.

And David Schwartz?

He wasn’t Satoshi.

He was part of the mission.

(9/9) This isn’t just about whether David Schwartz is Satoshi.

It’s about how close we might be to the truth:

That the man who created Bitcoin…

May now be leading the asset the world will actually use.

And most people are too distracted to notice.

99% of BTC will be mined by 2040, leaving miners reliant on transaction fees. With current fees covering just 7% of costs, Bitcoin faces tough questions on security and incentives post-halving. Can it stay secure without changing its rules?

Leshka.eth/1 days ago

A Satoshi-era whale sold 80,000 BTC ($9B) through Galaxy Digital with barely a 3.5% dip. This historic holder rotation moved decade-old coins to institutional hands, tightening supply and signaling a new phase for Bitcoin’s price discovery.

Swan/1 days ago

Bitcoin shows signs of a short-term downtrend reversal after a strong bounce at $114,700. With supports at $112K and resistances at $121K-$123.25K, targets of $133K-$140K are expected soon. Mid-term top likely in Q4 before a bear market, but long-term outlook remains highly bullish.

Mr. Wall Street/2 days ago

Bitcoin remains range-bound between key liquidation clusters at $121k–$120k and $114.5k–$113.6k. While an upside move to the top cluster is possible first, the $113.8k level and unfilled CME gap at $114.3k suggest the downside cluster is the mid-term target.

CrypNuevo/2 days ago

Every historical Altseason started in August. Bitcoin dominance is slipping, and capital is rotating into alts. This could be the setup for 200x+ lowcap rallies like past cycles. Here’s my 2025 portfolio picks before the bull run kicks off.

0xNobler/5 days ago

After 3 full market cycles, 5 major indicators—Pi Cycle Top, AHR999, Puell Multiple, Rainbow Chart, and Bubble Index—show no signs of a peak. Bitcoin remains mid-cycle, and altseason hasn’t even begun.

Leshka.eth/5 days agoOriginal

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link