The 10 Rules for Investing in Memecoins

Alex Mason

Alex Mason

Memecoins made me millions.

But only because I followed these 10 rules.

Here is the full list: 🧵

1. Picture Dogecoin or Shiba Inu—tokens that started as jokes but moved billions.

The memes are loud, but the mechanics matter.

If you understand what drives them, you stop chasing pumps—and start spotting them early:

2. Here’s the truth: Memecoins might start as jokes, but they follow real market rules.

Tokenomics, community strength, and timing drive the gains—or the collapse.

Ignore them, and you’re gambling. Understand them, and you’re early.

3. What separates a one-day chart spike from a long-term runner?

A loyal community, clear tokenomics, and some kind of vision—even if it’s wrapped in memes: ⏬

4 . Community is everything.

A loud, loyal group of holders can send a token flying—no utility needed:

Watch for active Telegrams, nonstop memes, and viral energy.

If the community’s obsessed, the chart usually follows.

5. Tokenomics decide who gets rich—and who gets dumped on.

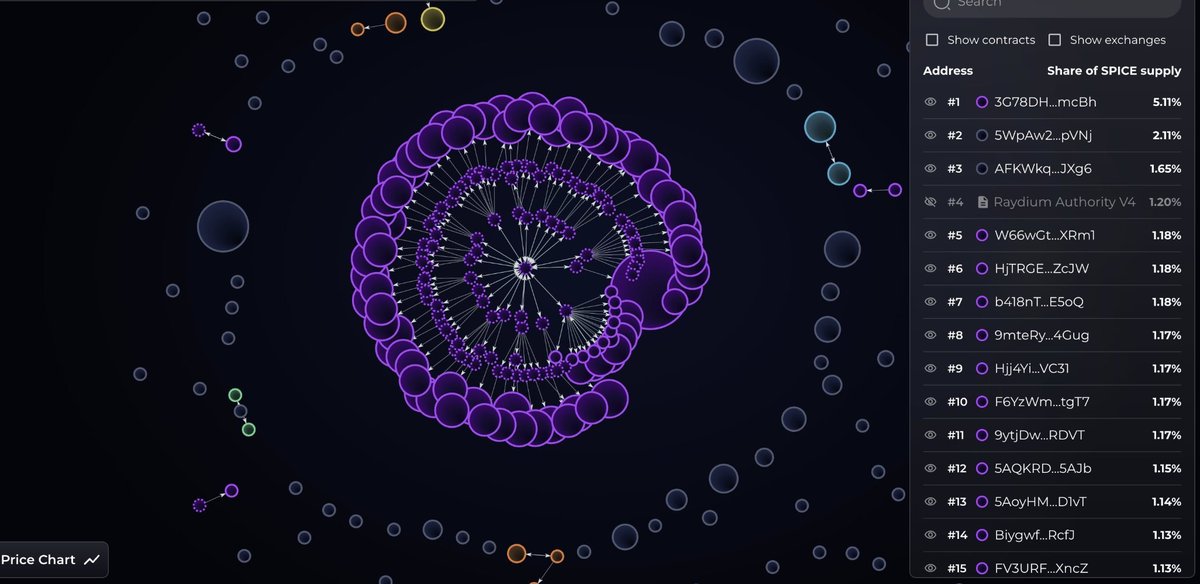

Check total supply, how tokens are distributed, and whether whales can nuke the chart.

If one wallet controls everything, you’re not early—you’re exit liquidity. This is where smart research pays off.

6. Memecoins live and die by the meme.

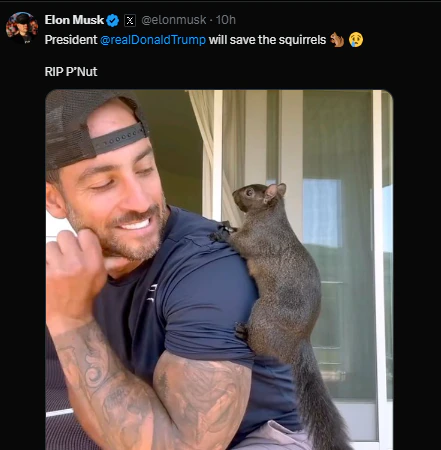

One viral post or influencer mention can light the fuse—but that spark fades fast if there’s nothing behind it.

Ride the wave, but always ask: is this just noise, or is something real brewing underneath?

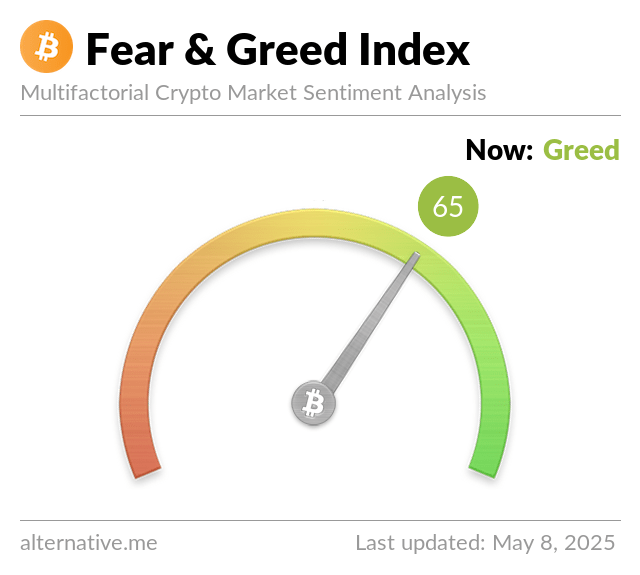

7. Timing is everything:

- Pay attention to Twitter chatter, meme velocity, and market mood.

- Too early, and you're stuck waiting.

- Too late, and you're exit liquidity.

Catch the wave—not the crash.

8. Due diligence is survival:

- Always verify contract addresses.

- Check if the devs are doxxed—or completely silent.

- Look at wallet distribution on Solscan, Etherscan, or BSCScan.

If it smells off or whales run the show, walk away. No meme is worth a rug.

9. Memecoins can 100x overnight—or nuke just as fast.

Set your entry and exit targets before you ape in. Treat every trade like it could go to zero.

If you can’t stomach the downside, you’re not ready for the upside.

10. For every Dogecoin that makes it, there are hundreds that vanish overnight.

Memecoins are pure high-risk, high-reward.

Never let FOMO drown out logic 👇

11. Follow a golden rule: never risk more than 10% of your bankroll on a single trade.

Protect your capital so you’ll always have firepower ready for the next opportunity.

Nearly 10% of Bitcoin is now held by Strategy and spot ETFs. With average ETF cost bases above price, $7B+ in unrealized losses and record outflows show normie capital under pressure—leaving BTC dependent on a fresh narrative to reaccelerate.

Jim Bianco/9 hours ago

Bitcoin’s weak year isn’t OG selling or a “silent IPO.” It’s crypto contagion. Illiquid altcoins forced insiders to sell BTC to prop up air-token markets, while disciplined capital (ETFs, MSTR, Wall St) drained volatility and killed alt-season rotations.

Bit Paine/5 days ago

Gold’s parabolic breakout isn’t a Bitcoin defeat but the same debasement trade unfolding in phases. Gold moves first as the hedge for states; Bitcoin follows as the hedge for people. They trend together long term, but cycle apart short term.

Swan/7 days ago

100 gains didn’t disappear—they changed form. In a hyper-diluted market, winners stack gains by rotating early between narratives, not holding forever. This playbook explains how to spot rotations, size positions, take profits, and compound phases in 2026.

cyclop/2026.01.22

A veteran trader distills seven hard-earned lessons that prevent blown accounts and emotional spirals. From market context and risk control to playbooks, journaling, and process-first thinking, this guide shows how consistency—not signals—builds long-term trading edge.

Morin/2026.01.21

A trader pulled off a $233K overnight play on Polymarket by exploiting thin weekend liquidity. By baiting market-making bots in 15-minute markets and briefly nudging spot price, he forced mispricing and cashed out risk-efficiently.

PredictTrader/2026.01.19

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

3 days ago

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link