Insights from Andrew Kang: Crypto Predictions and Investments

Nonzee

Nonzee

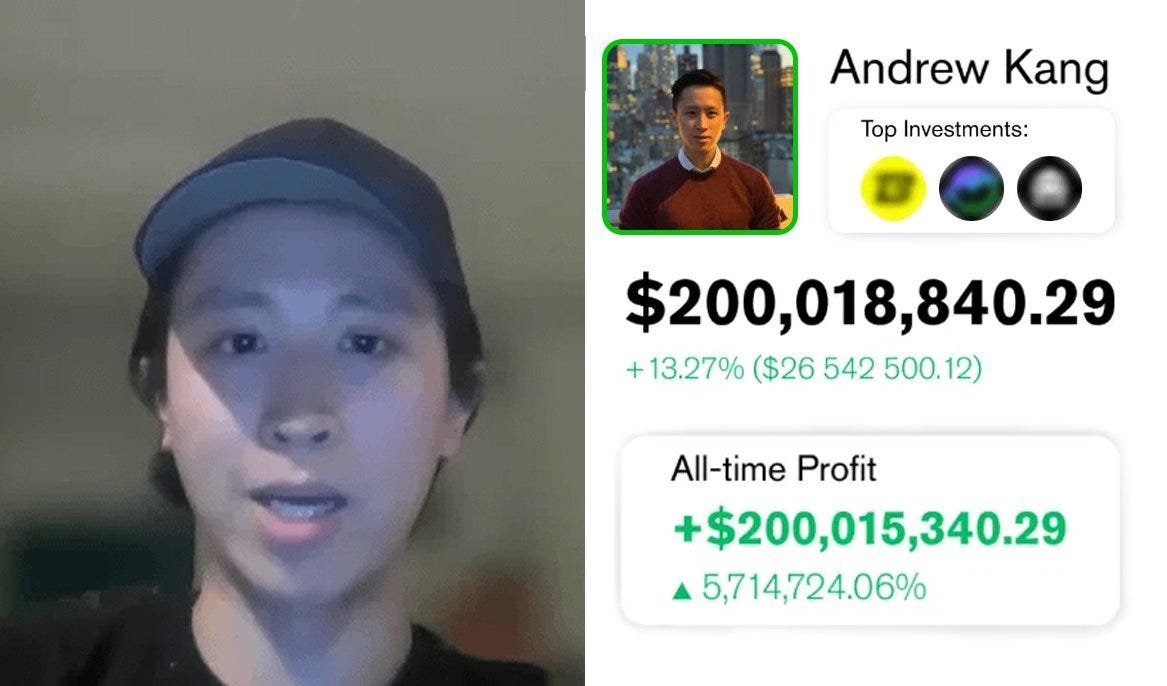

Andrew Kang, Forbes #1 crypto trader:

- Co-founder of Mechanism Capital ($300M AUM)

- Turned $0 into $200M in just 3 years

- $200M $BTC long

Here are 6 predictions from Kang you should know👇🧵

Andrew Kang, founder of Mechanism Capital, returns to crypto after a long break.

From California roots to a $500 million net worth, his journey is one of grit and brilliance.

This move reflects his confidence in Bitcoin, supported by Trump's pro-crypto policies, including the U.S. strategic reserve announced in March 2025 with $BTC, $ETH, $XRP, $SOL, and $ADA.

Kang’s predictions have a history of precision. When the Ethereum #ETF launched in 2024, $ETH was at $3,900, and most were bullish. Kang wasn’t

He claimed ETH was overvalued, predicting it would lag behind Bitcoin with only 15% of Bitcoin's institutional inflows

Today, the ETH/BTC ratio is at multi-year lows, proving him right

He predicted the meme coin trend, foreseeing Trump’s token, $TRUMP, which launched in late 2024 and crashed by early 2025 as he warned

His insight comes from his grasp of market psychology and cultural trends, honed at Digital Capital Management

https://x.com/Rewkang/status/1754644977777258637

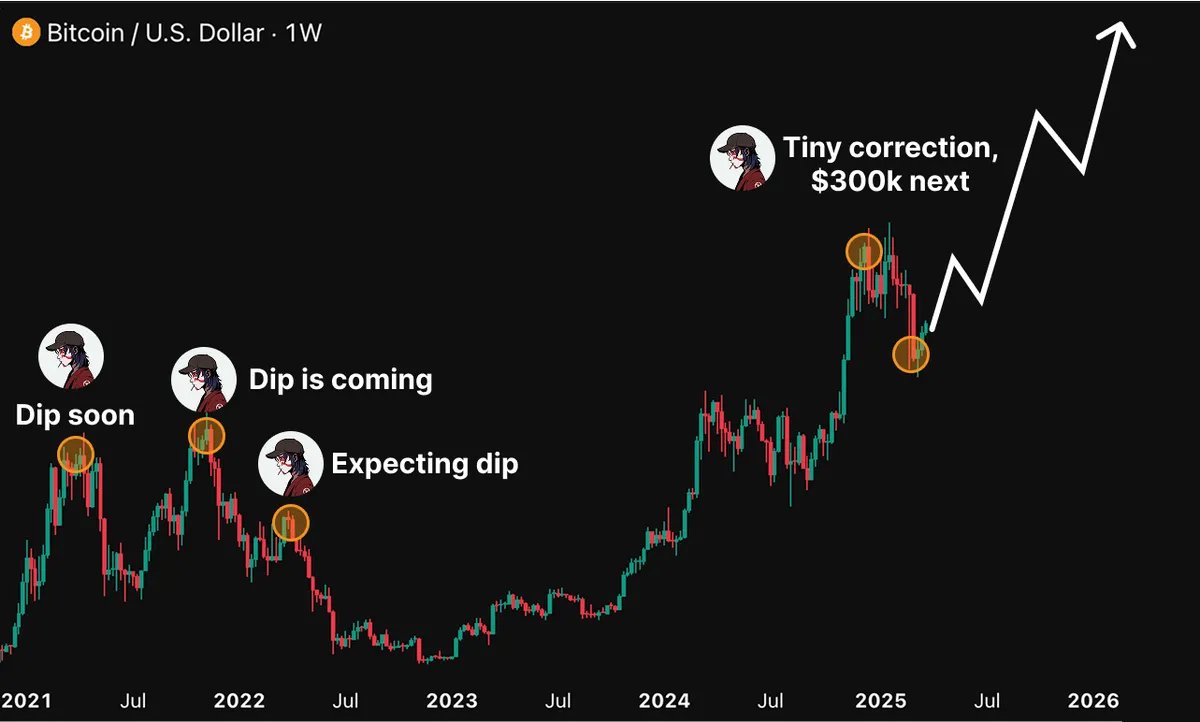

1/ Bitcoin Surge

Kang is optimistic about Bitcoin, citing Trump's April 2025 post as a potential "Trump put" that could push $BTC to $125,000 by year's end, especially with possible Federal Reserve rate cuts

Analysts like Standard Chartered’s Geoff Kendrick predict #BTC could reach $500,000 by 2029

2/ Ethereum collapse

Andrew warns $ETH could drop below $1,000 due to a 30% decline in Ethereum transactions since 2023, indicating weakness

Institutional investors preferring Bitcoin ETFs, up 20% in Q4 2024, worsen ETH's outlook

https://x.com/Rewkang/status/1909472292377067987

3/ Future in humanoid robotics

He is investing heavily in humanoid robotics after a big $15 million to $200 million win.

This aligns with a tech boom, as the humanoid market is projected to reach $13.25B by 2029 with a 45.5% CAGR

Companies like Agility Robotics are expanding, and Kang's investment could mark a new crypto-tech crossover frontier

https://x.com/Rewkang/status/1912084678867370229

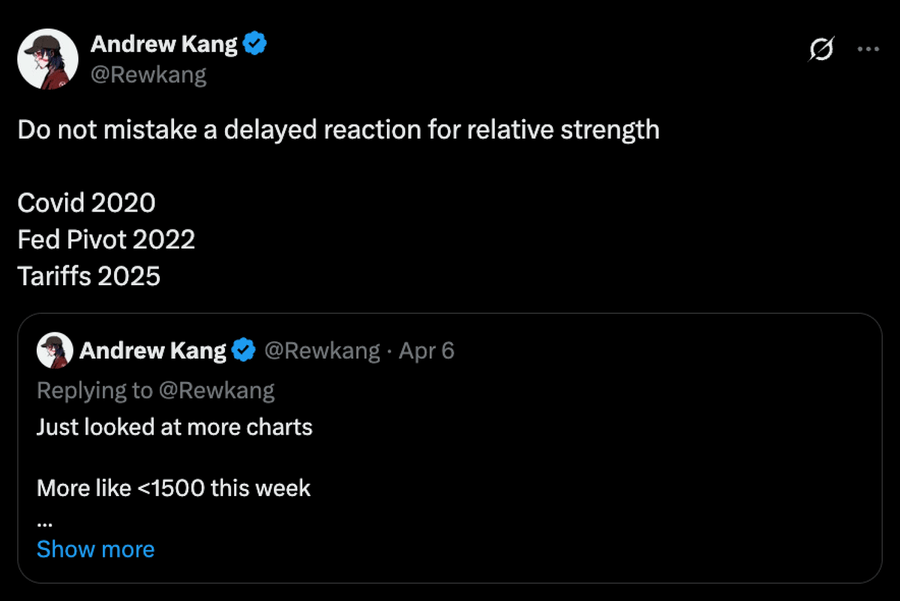

4/ Warns about tariffs

Trump's April 2025 tariff pause, which caused a 2% Bitcoin swing, led Senate Democrats to urge an SEC insider trading probe

Kang notes that market reactions might be delayed but will be significant, as seen in 2020's trade war

Expect volatility if tariffs return

5/ Kang Forecasts

Also, Kang urges skepticism of media hype, predicting crypto regulatory clarity by 2025 through the U.S. Treasury’s Exchange Stabilization Fund, bypassing Congress.

He advises traders to rely on primary sources over headlines to stay informed

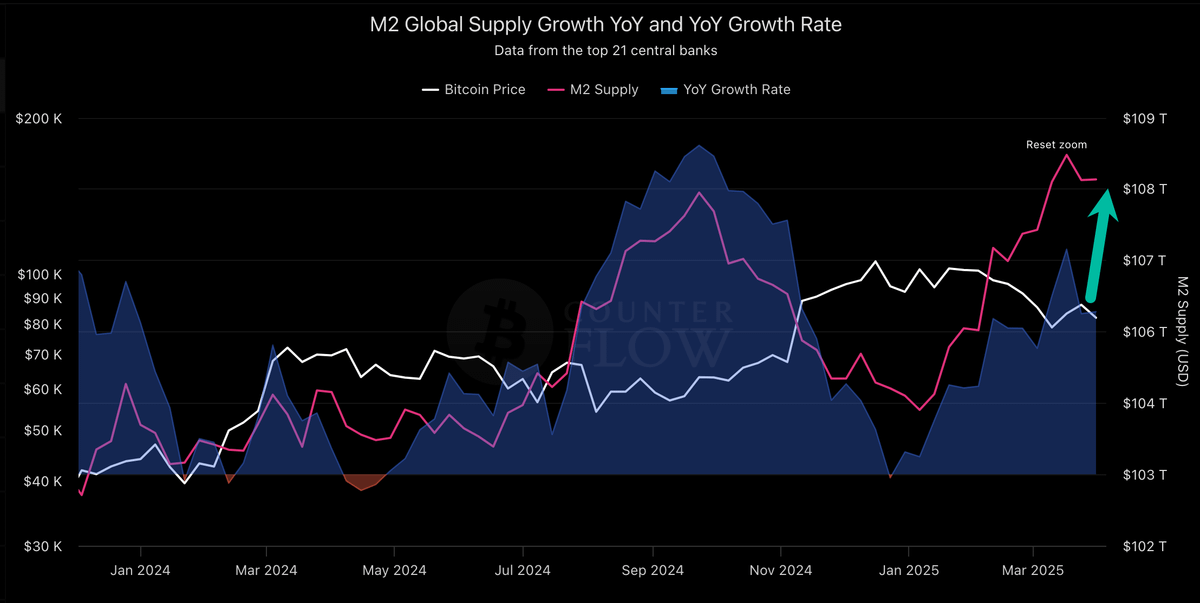

6/ Kang’s final tip: study history

He notes Bitcoin’s 2017-2021 cycles often followed global liquidity trends, a pattern reemerging with 2025 economic shifts

Pair this with his tariff and regulatory insights, and you’ve got a roadmap for navigating the year

Morgan Stanley now considers Bitcoin large enough to be a strategic reserve asset. While they still cite volatility concerns, U.S. entities already hold 35–40% of Bitcoin’s supply—far more than gold—signaling a unique national incentive to see Bitcoin succeed. The shift from legacy assets to BTC is accelerating, and the U.S. may be quietly positioning itself as the dominant Bitcoin superpower.

Swan/18 hours ago

The developer behind Zerebro staged his own suicide—complete with obituaries and tribute posts—only to be revealed alive through a letter sent to an early investor. He admitted it was a calculated move to escape without crashing the token price. The space mourned a death that never happened, marking crypto’s first known pseudocide exit.

Daniele/2 days ago

Macro investor Raoul Pal gave a wildly bullish crypto outlook at Sui Basecamp, citing global liquidity as the key driver of BTC price (90% correlation). He predicts an explosive “Banana Zone” ahead, with altseason triggered by ISM rising above 50. Pal is nearly all-in on $SUI, expecting the cycle to peak in Q1/Q2 2026. His advice: stay patient, avoid leverage, and prepare for a potential life-changing run.

eye zen hour/3 days ago

After 12 years in crypto, this trader shares brutal lessons from lost coins, scams, black swans, and missed gains. From early Bitcoin mistakes to DeFi and NFT highs and crashes, he emphasizes adaptability, taking profits, and surviving to stay in the game. The market evolves—so must you.

Pix/2025.05.01

Bitcoin exchange balances just hit a 5-year low, with large inflows into ETFs and institutional custody. Despite major buys by MicroStrategy and others, prices remain stable due to strategic accumulation and persistent sellers. However, institutional demand is compressing supply faster than miners can replenish, setting the stage for a powerful, non-linear price move.

Swan/2025.05.01

The author believes ETH has bottomed in the $1,500–$2,000 range, mirroring their earlier successful BTC bottom call. With BTC dominance peaking, DXY weakening, and sentiment low, ETH is seen as undervalued late in the cycle. The setup suggests ETH could reclaim $4,000, offering a strong risk-adjusted opportunity.

Astronomer/2025.04.29

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link