12 Years in Crypto: Painful Lessons You Don’t Have to Learn the Hard Way

Pix

Pix

I’ve been in crypto for 12 years.

Here’s every painful mistake I made (so you don’t have to): 🧵

2013.

I’m writing for a finance blog.

One day the boss says:

“I’ll pay you 50% extra - if you take Bitcoin.”

I google: “Can I sell Bitcoin for cash?”

Looks legit.

I say yes.

Life happens. I forget about it.

Few months later, I see a headline:

“Bitcoin hits all-time high!”

I check my wallet.

It doubled.

I sell immediately and pat myself on the back.

Genius move. Right?

Fast forward 4 years…

BTC is up 10x from where I sold.

That was my first taste of crypto pain.

And it wouldn’t be the last...

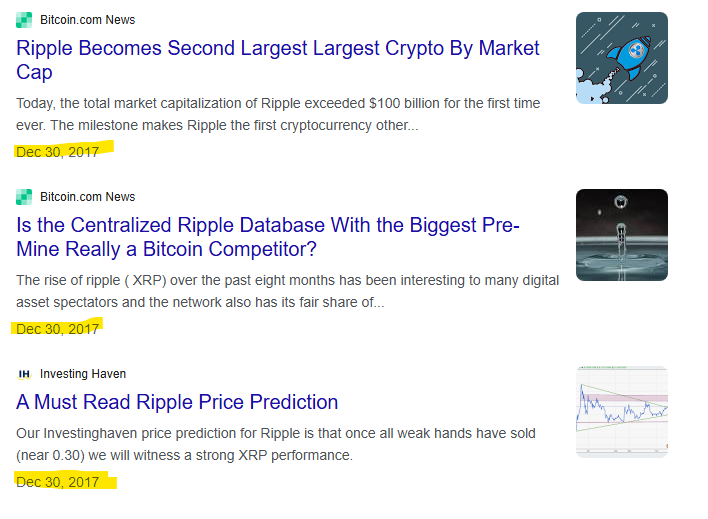

2017 rolls around.

New cycle. New me.

Time to redeem myself.

ICO season is raging.

Every altcoin is 100x-ing.

Influencers launching paid groups.

I join a few...

I start talking to one of the guys in a chat.

He sends me a few good plays.

We become “friends.”

A month later -

He social engineers me and steals $10k.

Despite all of that, I hit 6 figures for the first time.

I feel unstoppable.

So I do what any reasonable person would do -

Take profits...

Into XRP

You guessed it - I buy the top and hold all the way down.

-90% in slow motion.

Six figures turn to dust...

So I rage quit.

COVID hits

Markets nuke, I'm forced to sell my company for pennies on the dollar

Sit there with stables and no direction.

So I check CoinGecko…

BTC: $10k

ETH: $300

I buy both.

Go work in a startup to make ends meet.

Then the U.S. money printer turns on...

Portfolio doubles.

I find NBA Top Shot.

I’m back in the rabbit hole.

This time, fully.

I quit my job. Go full-time Web3.

Start flipping NFTs.

And for a while -

It works.

I’m making more money than ever.

Every week there's a new mint.

New meta.

New 5x.

It was a wild market...

I wanted to be smart this time.

"Don't put all your eggs in one basket", right?

So I diversified:

ETH. SOL. AVAX.

Gaming coins. Governance tokens. JPEGs.

A dozen different narratives.

You already know where this is going...

Yeah, it all went down 90% when the bear market hit

Diversifying within one industry never works

Then came another mistake...

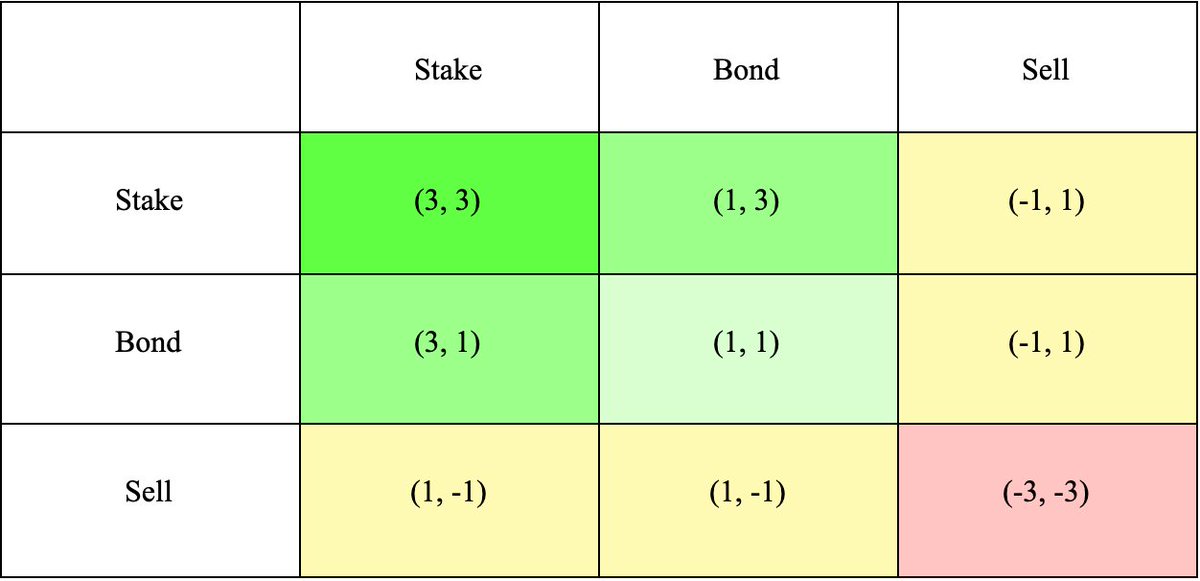

Olympus DAO.

The cult of DeFi 2.0.

I joined the (3,3) movement

Didn’t fully understand where the yield came from.

Turns out -

It came from me.

Yeah, I was that dumb...

By 2022, the lessons were stacking up.

I finally started taking profits.

Moved most to stables.

Then someone said:

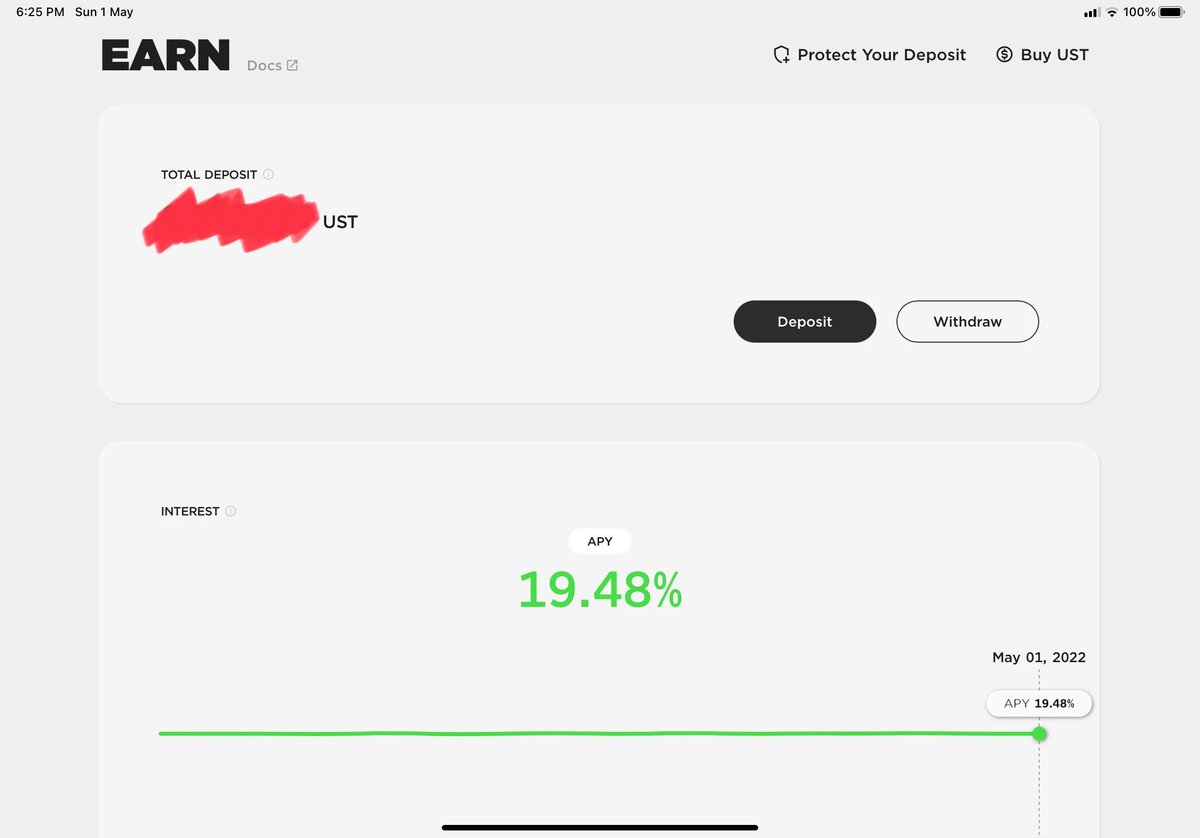

“Park them in Anchor on Luna. 20% APY on UST. Everyone’s doing it.”

$16B TVL.

One of the biggest protocols in crypto.

Should be safe, right?

So I park my stables there...

Months later, I finally dig in.

Start researching the yield mechanics.

See red flags everywhere.

I pull everything out.

A week later - UST and Luna collapse.

$40B gone.

I didn’t win.

I just didn’t lose.

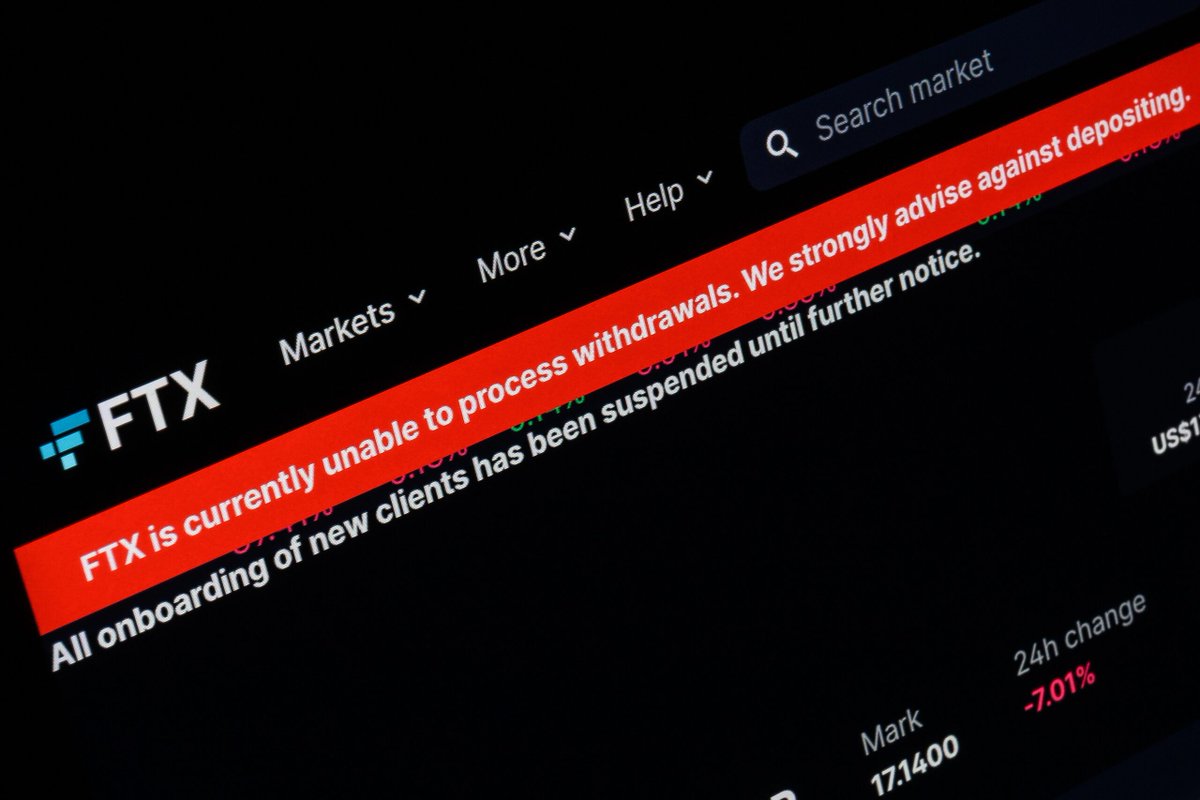

Spooked, I move funds to FTX.

“Safe” sounded nice.

Then the SBF vs CZ drama kicks off.

I test a withdrawal.

Takes 4 hours.

Panic.

I pull everything out. Takes 14 hours.

Next day: withdrawals shut down. Forever.

Now I’m feeling cursed.

But also lucky.

I split funds:

- Part on Ledger.

- Part in Solana wallet

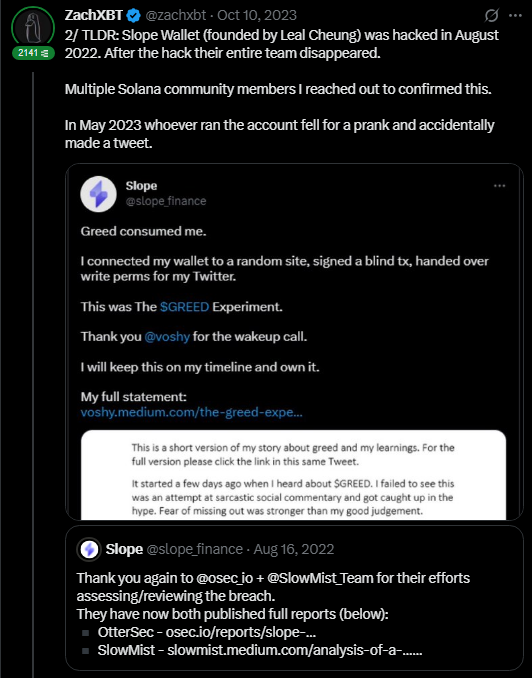

Then at 3AM:

“Bro, Solana wallets are getting drained.”

I check mine.

Gone.

Slope wallet exploit.

Another black swan.

Market was pretty slow (middle of bear)

So I start writing...

Building my personal brand was the smartest thing I’ve ever done.

It gave me leverage.

It opened doors.

It built trust.

But when the bull returned - I wasn’t just tweeting.

I was ready.

While CT was chasing memecoins,

I thought I was being clever.

I started LP farming memecoins. 2-3% returns daily.

54 profitable days in a row.

I thought I found THE strategy

Then the market slowed down.

Volatility dried up.

My “invincible” strategy starts leaking.

But I don’t adapt.

A few weeks later:

Half my profits are gone.

It was time to pivot.

Then comes the AI agent boom.

I’m early.

Catch the narrative before most people

Buy a few tokens.

CT starts catching on.

I assume the top is in.

So I sell.

Then the sector 10x’s without me.

This cycle taught me something new:

→ Even when you do everything “right,”

→ Even when you’re early, strategic, consistent…

You can still mess it up - if you don’t adapt.

Now? I don't try to be right all the time.

I focus on staying in the game.

TL;DR - 12 Years of Tuition Fees Paid:

- Being early is not everything

- Taking profit > feeling clever

- Diversifying doesn't matter if it's all in one sector

- Don’t farm the same edge after the market shifts

- If it feels off, it is

- Surviving black swans often comes down to acting fast

- Building in public pays off (longer than trades do)

- Emotion = biggest risk

- There is no “final form” - just better mistakes

BNB Chain and Binance Alpha Synergy Thrives: BSC Accounts for 40% of Alpha Trading Volume with Weekly Surge of 122.5%

Lookonchain/6 hours ago

Morgan Stanley now considers Bitcoin large enough to be a strategic reserve asset. While they still cite volatility concerns, U.S. entities already hold 35–40% of Bitcoin’s supply—far more than gold—signaling a unique national incentive to see Bitcoin succeed. The shift from legacy assets to BTC is accelerating, and the U.S. may be quietly positioning itself as the dominant Bitcoin superpower.

Swan/1 days ago

The developer behind Zerebro staged his own suicide—complete with obituaries and tribute posts—only to be revealed alive through a letter sent to an early investor. He admitted it was a calculated move to escape without crashing the token price. The space mourned a death that never happened, marking crypto’s first known pseudocide exit.

Daniele/3 days ago

Macro investor Raoul Pal gave a wildly bullish crypto outlook at Sui Basecamp, citing global liquidity as the key driver of BTC price (90% correlation). He predicts an explosive “Banana Zone” ahead, with altseason triggered by ISM rising above 50. Pal is nearly all-in on $SUI, expecting the cycle to peak in Q1/Q2 2026. His advice: stay patient, avoid leverage, and prepare for a potential life-changing run.

eye zen hour/3 days ago

Bitcoin exchange balances just hit a 5-year low, with large inflows into ETFs and institutional custody. Despite major buys by MicroStrategy and others, prices remain stable due to strategic accumulation and persistent sellers. However, institutional demand is compressing supply faster than miners can replenish, setting the stage for a powerful, non-linear price move.

Swan/2025.05.01

The author believes ETH has bottomed in the $1,500–$2,000 range, mirroring their earlier successful BTC bottom call. With BTC dominance peaking, DXY weakening, and sentiment low, ETH is seen as undervalued late in the cycle. The setup suggests ETH could reclaim $4,000, offering a strong risk-adjusted opportunity.

Astronomer/2025.04.29

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link