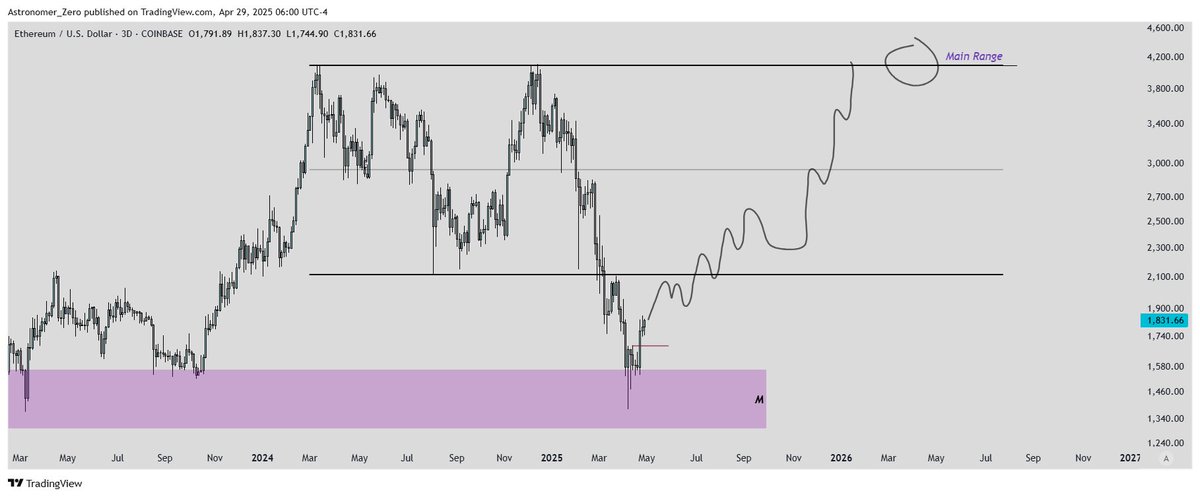

Calling the ETH Bottom: Opportunity in the $1.5K–$2K Range

Astronomer

Astronomer

And now, $ETH has bottomed, I bought more $ETH.

Alright, time for an $ETH analysis. It's been too long. But my interest faded at the time. Now I'm interested again at these prices (the glorious 1500-2000$ range).

We called the bottom on $BTC at the very day of the initial low, around 77k, which aged quite well. And after $BTC comes $ETH, that is true for tops, but also bottoms. So now, it's time to call the $ETH bottom and confirm it.

So aside from the $BTC bottom call being confirmed IMO, $ETH also has a clear range where it has performed a false breakdown into the most key initial breakout monthly POI. It also has very clear equal highs at 4000$ which are primed to get revisited.

Finally, we are in the speculative stages of the cycle, $BTC.D is topping out and $DXY has shown its weakness on the high timeframes all as discussed before, and you know my stance on $BTC and you know why I have a large long position (a breakout is coming).

So all things combined, a $BTC move up with a decreasing $BTC.D means that $ETH naturally takes up a larger share.

Sentiment is as bad as ever, and the fundamentals have been unchanged.

All things combined, this bottom call is very useful here. From a cyclical standpoint, $ETH is only up 2x from its stone cold cyclical bottom, yet we are already in the final year of the cycle.

That makes $ETH cheap at a late time, which is why these times maximize opportunity and why holding $ETH minimizes risk adjusted opportunity cost these days.

NFA, but this indeed is not a time to be bearish.

And I think this bottom call will age as well as our $BTC bottom call.

We will see.

A hacker stole 3,520 BTC (~$330M) from an OG Bitcoin holder and rapidly swapped it for Monero (XMR), triggering a 50% price surge. The thief used KuCoin and MEXC to make hundreds of small, high-fee swaps. Experts believe the victim lacked proper security, highlighting risks for legacy crypto holders.

Neel (Crypto Jargon)/17 hours ago

Bitcoins price has once again intersected with the average miner cost of production—a historically reliable indicator of a market bottom. Each past intersection has preceded major price rallies. With current breakeven costs near $60K, analysts expect a significant move up before the end of Q2.

Mitchell/17 hours ago

This week looks interesting with earnings reports from Meta, Amazon, and Apple, alongside crucial PCE inflation and labor market data. The trader plans to de-risk their swing long trade from $77k by taking profits in the current range. Key liquidity levels to watch are $96.8k (main) and $90k (important). The outlook suggests the potential for a third leg up toward $97k, followed by a possible retest of the 4H50EMA as support.

CrypNuevo/2 days ago

Strategy is reshaping Bitcoins scarcity with massive acquisitions, effectively halving Bitcoin supply through balance sheet firepower. By consistently absorbing up to 50% of newly mined BTC, theyre artificially creating a halving, driving Bitcoin’s scarcity ahead of schedule. This will set the global cost of Bitcoin, where access will require paying premiums, and borrowing will be a luxury for the wealthy or nations. Strategy is positioning itself as the dominant financial superpower in the Bitcoin space.

Adam Livingston/2 days ago

The next Altseason may not come from the U.S. but from Japan. While the FED cant inject liquidity, Japans looming QE program could be the catalyst for a crypto rally. After rising bond yields and a strengthening Yen, Japan may devalue its currency and pump liquidity into the market, benefiting crypto assets. With China already injecting liquidity, Japans move will likely drive altcoins higher, just as it did in 2008.

Axel Bitblaze/3 days ago

Ray Dalio, the worlds top investor, turned $0 into $14 billion in 9 years. He predicted the 2008 crisis and is now forecasting an even worse economic situation ahead. Dalio advises investing in Bitcoin due to its potential and warns of a deeper financial crisis. He emphasizes the importance of investing in real assets, especially as inflation and debt disrupt markets. Dalios strategy includes focusing on AI and real dollars over nominal growth.

Tracer/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link