BTC Sunday Update: Liquidity Levels and Market Outlook

CrypNuevo

CrypNuevo

$BTC Sunday update:

Interesting week ahead with earnings reports from Meta, Amazon & Apple, but also PCE inflation data and labour market data.

I'll keep de-risking my swing long trade from $77k by continue taking profits in this current zone. Spot bags are fine.

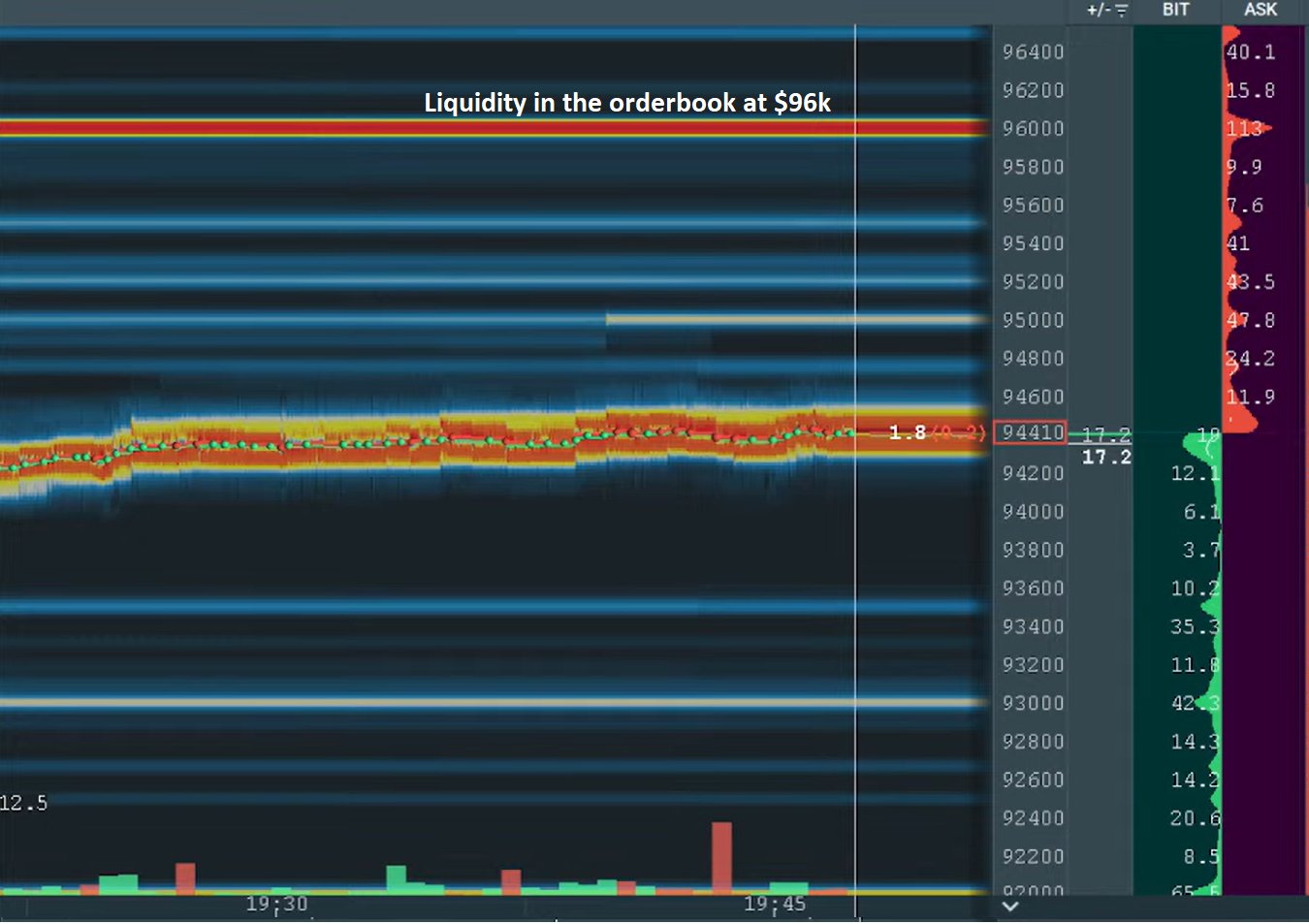

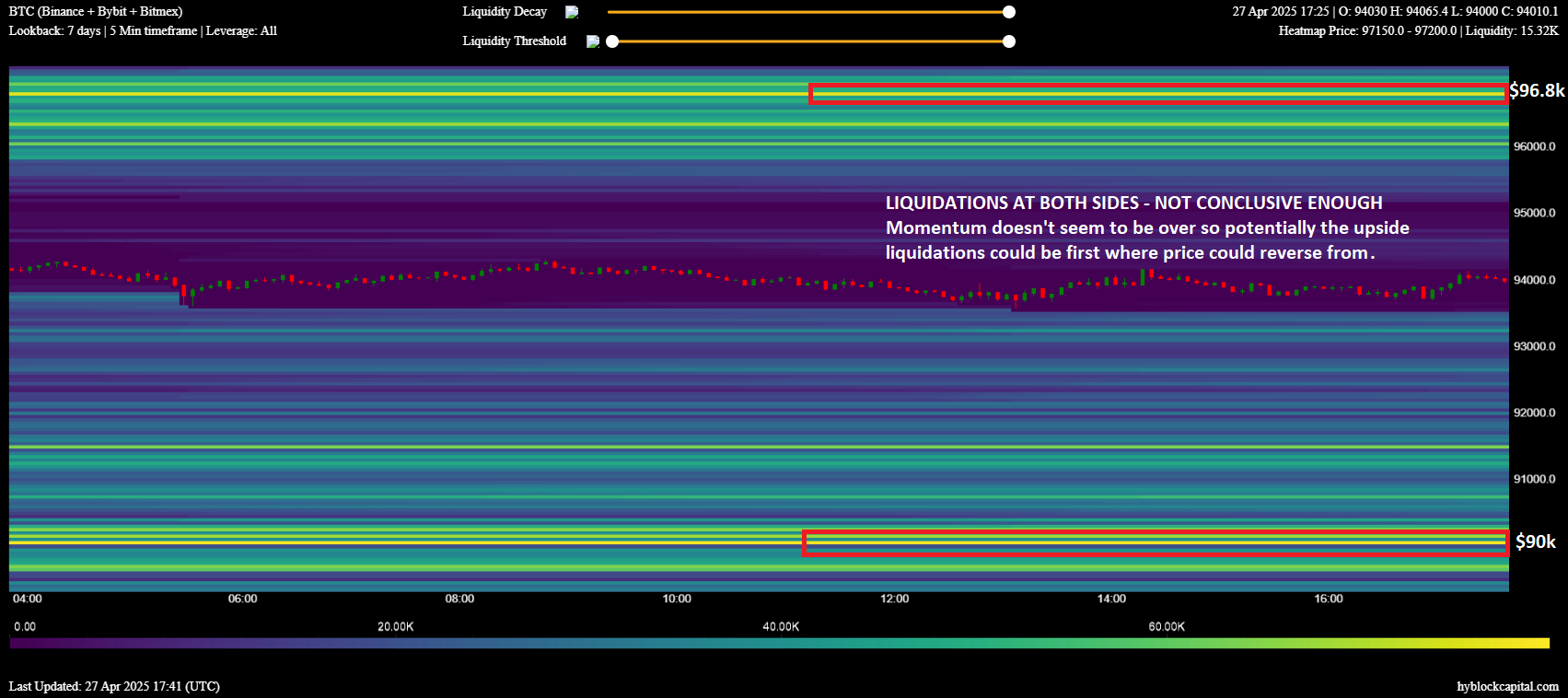

Liquidity analysis:

The weekend has slowed things down and reseted the DELTA liquidations. The current main liquidity levels are:

•$96.8k: Main level.

•$90k: Important level but some liquidations could decrease if we go to $96.8k first so we need to track this one down later.

This is my idea for this week:

Pretty simple - I don't see momentum rolling over just yet and it's possible to see a third leg up up $97k where there is some liquidity.

Eventually, we should see a 4H50EMA retest that can be a potential support.

Despite a rate cut and $40B in T-bill purchases, Bitcoin and stocks sold off as traders took profits. With expectations overextended, Powell’s cautious tone and Oracle’s weak earnings triggered a synchronized dump—driven by hype, not fundamentals.

Bull Theory/1 days ago

Token sales are evolving fast in 2026 — from Continuous Clearing Auctions and exchange-integrated launchpads to regulated tranches and community vesting. As the market matures, quality, compliance, and real user adoption will define the next wave of winners.

Stacy Muur/4 days ago

After eight years in crypto, a once-idealistic builder admits the industry has devolved into a giant digital casino. Instead of decentralizing finance, it gamified speculation. Despite the profits, he feels he helped build a machine that exploits rather than innovates.

ken/5 days ago

Crypto analyst Murad returns with 116 data-backed reasons arguing the bull run is far from over. From strong ETF accumulation and stablecoin inflows to macro liquidity shifts, he predicts Bitcoin could stay in a multi-year uptrend through 2026.

TechFlow/2025.12.06

From BONK to TRUMP, 2024–25 was crypto’s most chaotic wealth engine. Airdrops, AI coins, and celebrity rugs fueled the memecoin supercycle before collapse. What began as freedom and fun ended as a PvP casino—proof that chaos built the culture.

Adam/2025.12.04

Coinbase Ventures outlines 2026’s top crypto frontiers: RWA perpetuals, prediction market terminals, unsecured onchain credit, privacy DeFi, and AI-robotics intersections. The next breakout startups will merge finance, AI, and onchain innovation.

Coinbase Ventures/2025.12.02

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link