BNB Chain and Binance Alpha Synergy Thrives: BSC Accounts for 40% of Alpha Trading Volume with Weekly Surge of 122.5%

Lookonchain

Lookonchain

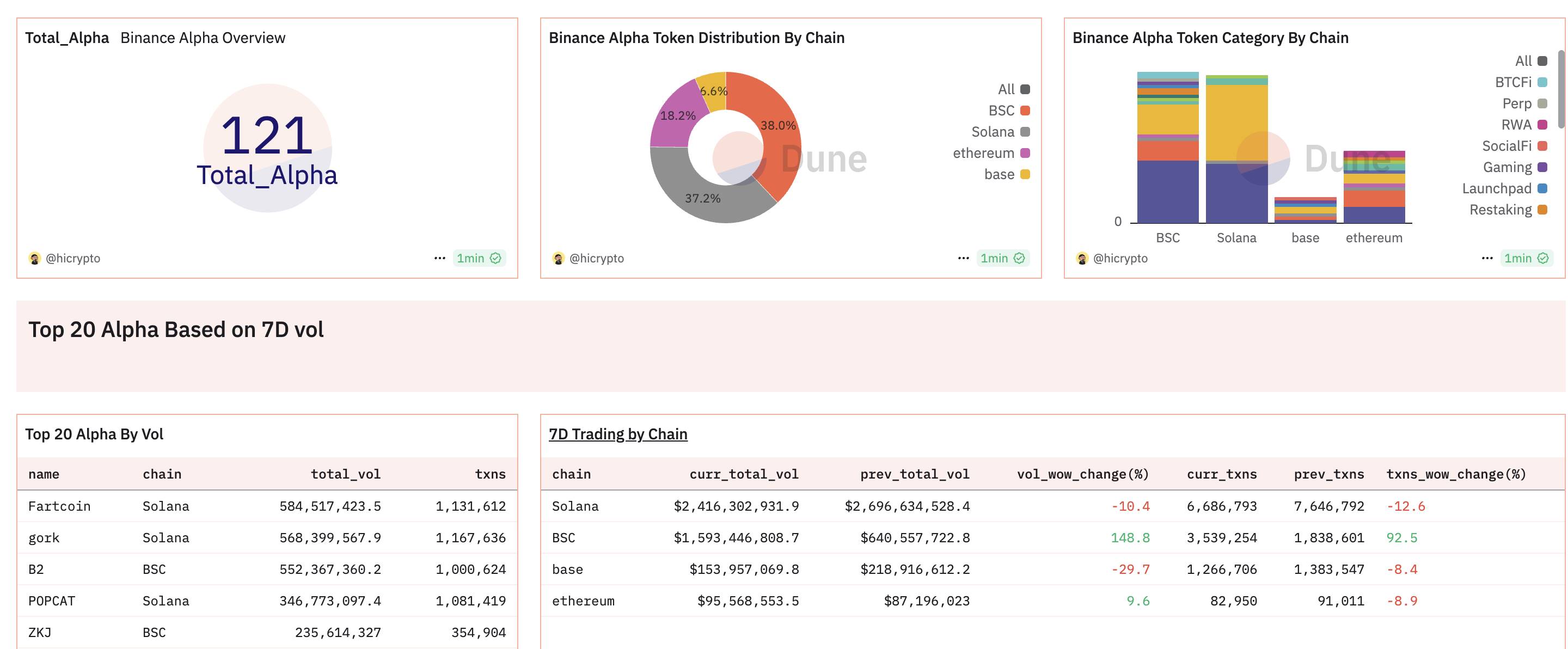

According to data from Dune and BscScan as of May 9, BNB Chain’s tokens in Binance Alpha has demonstrated remarkable growth:

Dominance in Alpha Projects: Over 70% of the 121 Alpha projects are BSC-based tokens, with 38% being BSC-native projects across trending sectors like AI, Meme, and DeFi.

Trading Volume Leadership: BSC tokens account for ~40% of total Alpha trading volume, with weekly trading volume surging 122.5% and weekly transaction value rising 78%, underscoring robust ecosystem momentum.

Key Highlights:

Top Alpha Tokens: Half of the top 20 Alpha tokens by 7-day trading volume are BSC-native.

User Growth Surge: Among the top 10 Alpha tokens by new active users, 90% are BSC-based, with 6 projects seeing over 20% new user adoption.

On-Chain Metrics: BSC added ~4.3 million new addresses last week, hitting 1 million+ daily new addresses for two consecutive days. Active addresses exceeded 2 million daily, while total unique addresses reached 552 million.

12 BSC projects have launched on Binance Spot via Alpha; Incentive Programs: The ongoing BSC Alpha Trading Competition offers rewards, with BSC token trading volumes double-counted toward Alpha Points for IDO eligibility. Binance also announced airdrops for holders of several BSC-native Meme tokens.

Powered by ultra-low gas fees (now 0.1 gwei), high throughput, and massive user base, BNB Chain has emerged as the go-to hub for project launches, user acquisition, and wealth creation. Its deep integration with Binance Wallet and the Alpha Program continues to drive cross-chain innovation and value capture.

Despite a rate cut and $40B in T-bill purchases, Bitcoin and stocks sold off as traders took profits. With expectations overextended, Powell’s cautious tone and Oracle’s weak earnings triggered a synchronized dump—driven by hype, not fundamentals.

Bull Theory/1 days ago

Token sales are evolving fast in 2026 — from Continuous Clearing Auctions and exchange-integrated launchpads to regulated tranches and community vesting. As the market matures, quality, compliance, and real user adoption will define the next wave of winners.

Stacy Muur/4 days ago

After eight years in crypto, a once-idealistic builder admits the industry has devolved into a giant digital casino. Instead of decentralizing finance, it gamified speculation. Despite the profits, he feels he helped build a machine that exploits rather than innovates.

ken/5 days ago

Crypto analyst Murad returns with 116 data-backed reasons arguing the bull run is far from over. From strong ETF accumulation and stablecoin inflows to macro liquidity shifts, he predicts Bitcoin could stay in a multi-year uptrend through 2026.

TechFlow/2025.12.06

From BONK to TRUMP, 2024–25 was crypto’s most chaotic wealth engine. Airdrops, AI coins, and celebrity rugs fueled the memecoin supercycle before collapse. What began as freedom and fun ended as a PvP casino—proof that chaos built the culture.

Adam/2025.12.04

Coinbase Ventures outlines 2026’s top crypto frontiers: RWA perpetuals, prediction market terminals, unsecured onchain credit, privacy DeFi, and AI-robotics intersections. The next breakout startups will merge finance, AI, and onchain innovation.

Coinbase Ventures/2025.12.02

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link