Gold’s 5-Sigma Crash: Inside the Largest Single-Day Drop Since 2013

The Kobeissi Letter

The Kobeissi Letter

We just witnessed history:

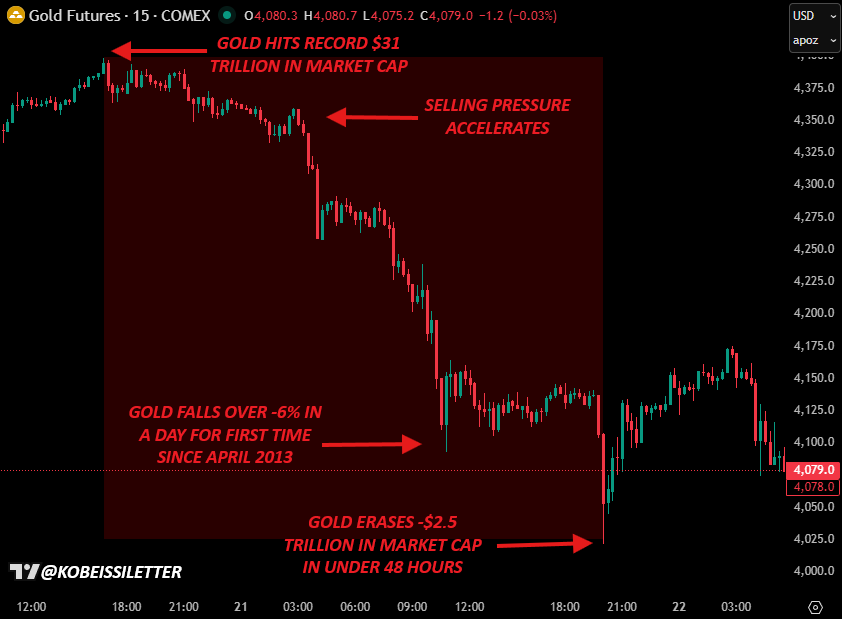

Yesterday, gold prices fell -5.7%, marking the largest 1-day drop since April 2013.

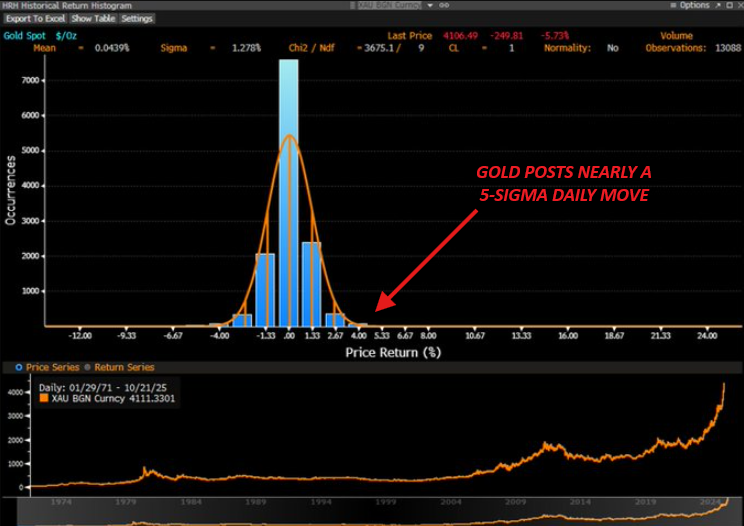

This is a ~4.5 sigma move.

In other words, such a large move only happens in 1 out of 240,000 days in a "normal" world.

What does it mean? Let us explain.

Statistically speaking, gold's move was a near 5-sigma event.

However, in reality, gold has seen a move of this magnitude only 34 times since 1971.

In other words, this occurs in 34 of 13,088 trading days or 0.26% of the time, per @BurggrabenH.

This is EXTREMELY rare.

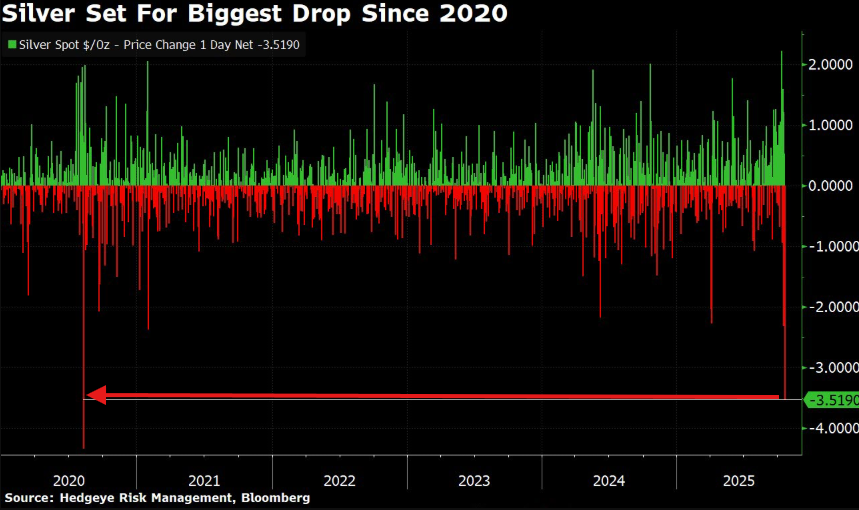

Silver prices were hit even harder.

Silver fell as much as -9% in a single-day and posted its largest daily decline since the 2020 crash.

Gold and silver neared -$3 trillion in lost market cap in just over 24 hours of trade.

But, we cannot ignore what happened BEFORE this.

Before yesterday's crash, gold and silver posted their best rally in over 40 years.

Silver was up as much as +85% YTD and Gold was nearing +70% YTD returns.

Still, Silver and Gold are up +67% and +55% respectively, more than 4 TIMES the S&P 500's return.

A drop was overdue.

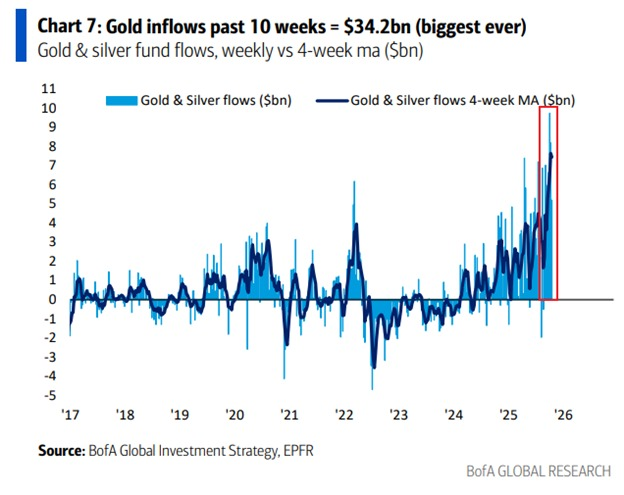

Flows were a CLEAR leading indicator that this drop was coming.

In the week ending October 10th, gold and silver funds posted +$8.2 billion in net inflows, the 2nd-largest inflow on record.

This followed a record +$9.5 billion seen in the prior week.

The trade was crowded.

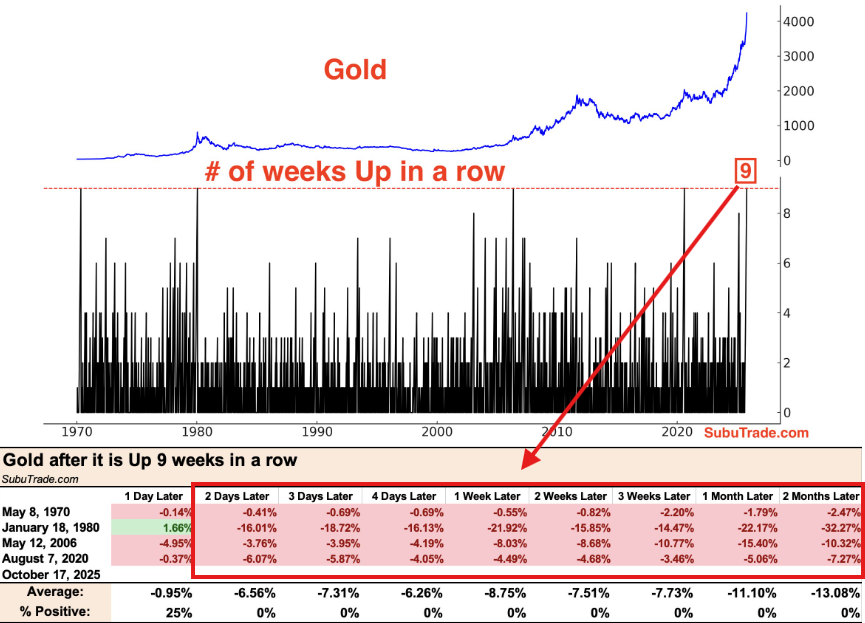

Meanwhile, gold was up for 9-STRAIGHT weeks for the 5th time in history.

Gold has never posted 10-straight weekly gains.

In the previous 4 times this happened, gold ended an average of -13% lower 2 months later.

So, what's next after the first blow to a historic run?

In our view, gold remains fundamentally strong.

In fact, it has only improved over the last few days.

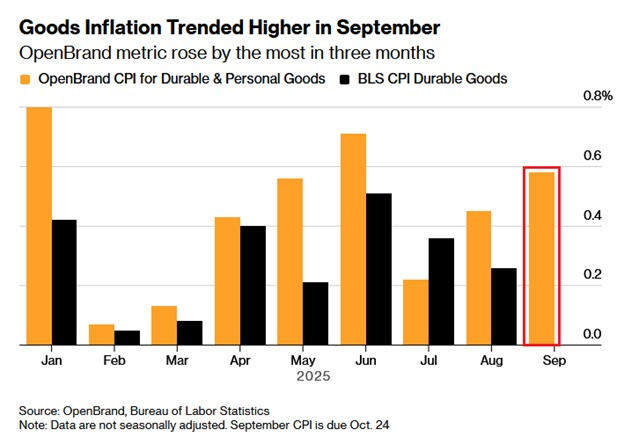

Amid the government data blackout, alternative metrics show US inflation at 2.6%.

This marks the 5th-consecutive monthly increase in these alternative metrics.

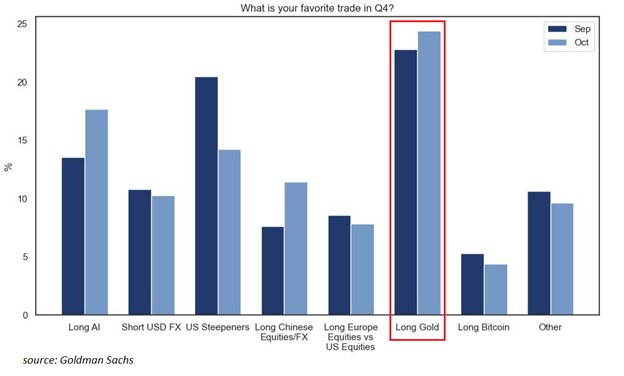

Meanwhile, institutional capital is still piling into the commodity.

~25% of investors surveyed by Goldman say their favorite trade is “long gold,” the highest reading for the 2nd consecutive month.

This is HIGHER than “long AI” stocks, which stands at ~18% of respondents.

On top of this, central banks are stocking up on gold while disregarding technicals.

On October 13th, gold posted its highest monthly RSI reading in HISTORY, at 91.8.

Physical gold demand this year has proven that buyers are ignoring technicals.

We don't see this changing.

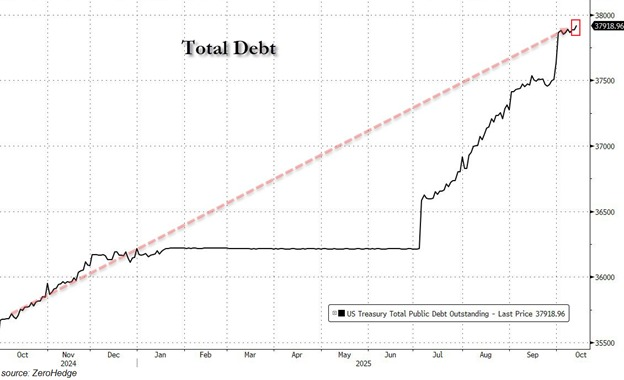

All of this is happening as the US simply keeps on printing money.

By as soon as Friday, total US debt is set to cross above $38 TRILLION for the first time in history.

This marks a +$400 BILLION jump this month, or +$25 billion per day.

Gold knows exactly what this means.

Gold's price drivers are having widespread implications on markets.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

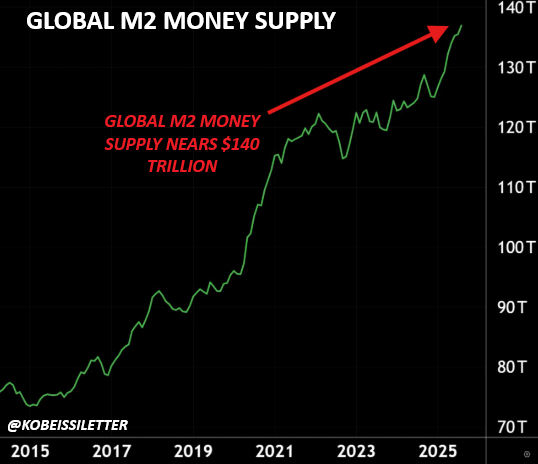

Lastly, global M2 money supply is about to hit $140 trillion for the first time in history.

In just 6 months, global M2 money supply has surged +$8 TRILLION.

Investors are losing confidence in fiat.

X402 revives the long-unused HTTP 402 “Payment Required” code by enabling crypto and stablecoin payments directly within API calls. It lets AI agents pay for data autonomously, removing middlemen and unlocking a new layer of machine-to-machine commerce.

Jarrod Watts/1 days ago

x402, known as the Payments MCP, enables AI agents to make on-chain payments. Backed by Coinbase and Cloudflare, it’s becoming core to Base, Solana, and beyond. With a16z and Ribbit predicting $30T in agentic transactions by 2030, x402 may redefine global finance.

s4mmy/3 days ago

A deep dive into how insiders allegedly manipulate crypto markets—triggering dumps, bull runs, and altseasons. From $700M Binance transfers to pre-Trump announcements, this thread exposes how big players control liquidity and profit from chaos.

Tracer/2025.10.22

After last week’s perfect projection and the biggest liquidation cascade in years, $BTC faces another volatile week. With short liquidity clustered around $116K–$117K and the CME gap near $106.7K, traders watch for either a short squeeze or a final dip to $100K.

CrypNuevo/2025.10.20

After losing over $30M in the largest crypto liquidation event ever, a top trader reflects on what went wrong, the lessons learned about leverage and risk, and why he’s staying optimistic. It’s not the end — just the start of his next chapter.

Unipcs (aka 'Bonk Guy')/2025.10.12

Crypto just experienced the largest liquidation event ever — over $19B in leveraged positions and 1.6M traders wiped out in a single day. Triggered by Trumps tariff shock, the cascade revealed extreme leverage but may set the stage for a strong rebound.

The Kobeissi Letter/2025.10.12

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link