Dumb Money Wealth Cycles: Why Crypto Twitter Feels Miserable in Q4 2025

IcoBeast.eth

IcoBeast.eth

Dumb Money Wealth Creation Cycles (and why CT is miserable in Q4 2025)

For nearly a decade, the hallmark of crypto (not bitcoin specifically) has been the ability for any random person with internet access, some free time, and like 6 functioning brain cells to turn a small amount of money into a very large amount of money pretty quickly.

There have been 3-4 MAJOR broad-sweeping gold rush seasons like this dating back to 2016-17. The key hallmark of all of these seasons was a very cheap major that had immense compounding capacity onchain and then the major rapidly appreciated in value.

Each time, the dumbest person you know in crypto made stupid amounts of money and told their friends and they brought even more people in (because "hey if that idiot can make $100k from $100 then why can't I?").

Let's take a brief walk down memory lane...

A Brief History

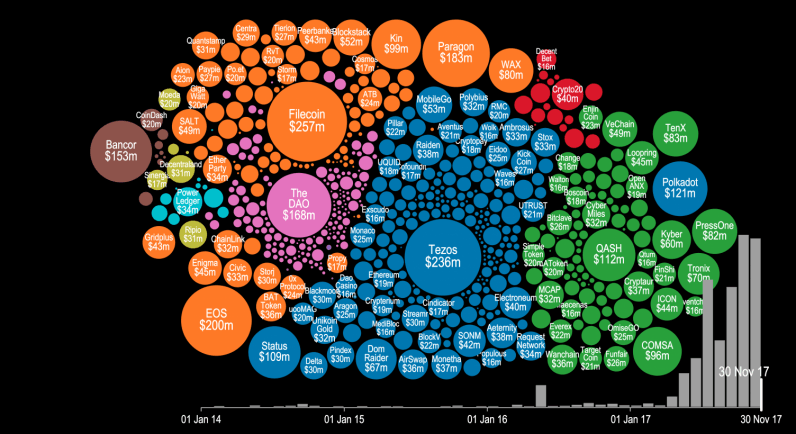

2017 - ICOs (after the Ethereum ICO).

I'm biased, but this was basically the golden age. Literally every few days there was some random new shitter with a whitepaper and a cool color-gradient logo that did absolutely nothing, but would get released and everyone would pile their ETH into it to get allocation and then it would launch and tons of people would buy the new tokens and they'd moon hard and then you'd make a bunch of money and swap it back to ETH.

It was awesome. There were like 100-200 total coins in existence. None of it actually worked. There was no point. Literally just ape ETH into ICOs and get tons of money back - it was super dumb but it was free money. Everyone traded the same few coins and the goal was to get more ETH...and it was really simple...and everyone told their friends...who all piled in...and eventually we all got obliterated and the market bled out for 2 years.

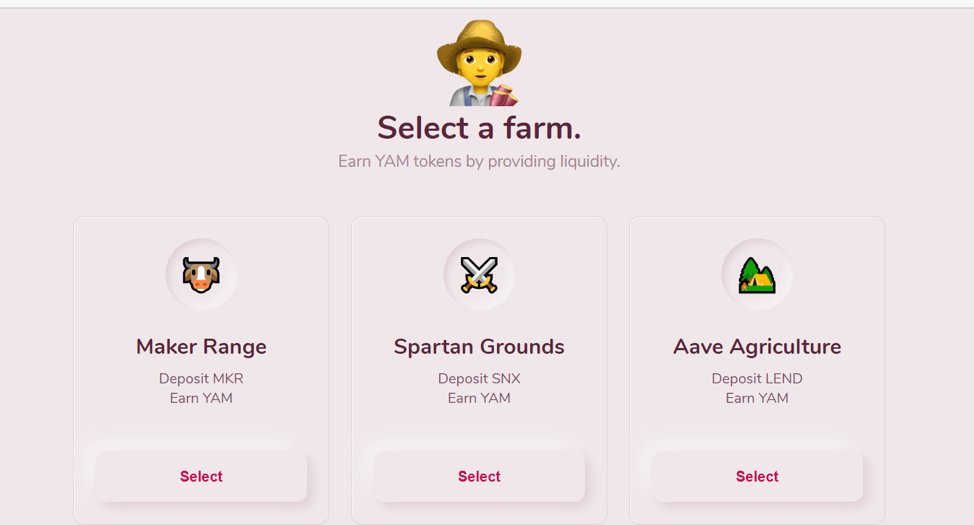

2020-21 - DeFi (yield farming food ponzi coin) Summer

I didn't really do much here due to IRL/life, but basically you had the first few "real" DeFi products launch (kicked off by Compound's COMP token distribution) and it allowed for all sorts of liquidity mining games and ponzis...again with everyone piling into a small/select number of tokens with the goal a to maximize their ETH stack.

Many of the "OG" CT names were made by capitalizing during this time period. Again this attracted insane levels of new capital as no one knew exactly how to play the game and tools to maximally extract simply didn't exist for broad distribution. ETH also started rapidly appreciating in value adding fuel to everyone's PnL and attracting even more degen capital.

2021-22 - NFT bubble

Once upon a time Covid shut the world down and people got stimulus checks from the government and they lost their jobs (or had their businesses shut down) so they sat online on clubhouse and twitter spaces all day.

A bunch of these people minted NFTs. Bored Apes in particular were the kingmaker (although the mint was open long enough that anyone could have gotten in) and then the floodgates opened. You'd mint the shittiest looking picture you've ever seen for 1e and then wake up the next day and sell it for 20e....and then it would run to 50e and none of it made sense and nobody actually wanted the jpegs or actually believed they were worth these insane valuations, but everyone wanted to make money and keep playing the game.

So you had this crazy wealth generation effect where people were able to take a very small portion of ETH and flip a few pictures and end up with LOTS of ETH...basically without any skill or anything, just being there. This obviously attracted insane attention and NFTs went completely mainstream...and then the bubble popped and most participants got slaughtered.

This effect was mostly replicated in early 2023 with Ordinals as BTC price had gone in the shitter and the early Ordinals were an insane cook where you could flip a super tiny amount of BTC into a large amount of BTC in a very short time...and then bitcoin went parabolic. (and then everyone bagholding the jpegs got obliterated).

2023-Jan 25 Meme Season

Arguably the longest wealth generator in the history of crypto dumb money cycles - ETH and Solana memes. Technically you could say it started w/ BONK in late 2022 (in the wake of FTX collapse), but I prefer to think of the real start as PEPE (April 2023 on ETH) and WIF (Nov 2023 on SOL) kicking off over a year of the most insane token runs you've ever seen.

Literal vaporous shitters with no point, no gameplan, and nothing but vibes running to multiple billions. Especially early on you could just buy a thousand dollars of some random coin and be basically guaranteed to wake up to a 10x...and you could do this for weeks at a time.

The game gradually got harder as bots got smarter, extraction tools got more efficient, rugger devs got better bundling capacity, and the overall skill floor rose and people started taking money *out* of the casino rather than shoveling it in after seeing their buddies print 20 grand on pepefartsockinu69420 in 17 minutes. And every single day you were stacking more ETH or SOL by trading the new pairs.

And then 9/11 for memes hit. TRUMP, MELANIA, and the final Hayden Davis nail in the coffin LIBRA. Nothing was the same. Everyone kinda implicitly knew the game was cooked. When a single party can steal over a hundred million dollars from the group pot in a single second it no longer seemed like a game worth playing...after all what could possibly be bigger than the literal President of the United States launching a coin in stealth and sending it to $70bn FDV overnight.

So yeah...that leads us to where we are today. It's been ~9 months since we took the killshot straight in the dome. Sure there have been pockets of outperformance since then (and in particular the majors ran really well since April), but there hasn't been one of these wealth compounding events where you can rapidly multiply your native token/major and then watch it appreciate substantially.

And honestly I'm not sure how that happens again. NFTs? They're solved - there's like 17 people still on the planet that want to trade/flip NFTs. Memes? They're solved - it's way safer and simpler to just be a 24/7 serial deployer. You make gains with no risk. Onchain ponzis? People largely understand these now...and only the sharks play, so you have to be extremely precise with your exits or you get smoked. Maybe it's the return of ICOs? Monad has done well. We shall see.

We haven't had a dumb money, easy wealth generator in almost a year. That's why everyone is mad. They got so used to almost always having one of these crazes and we've just had straight dirt for the last 9 months (unless you hold a sizable stack of majors - particularly bitcoin).

I recently spoke on the timeline about not really being very inspired by what is available onchain and how a lot of what is out there feels stale. A few teams building interesting "new" things reached out, and I'm going to be exploring their primitives and writing about what I find/test/discover (in addition to loads of Kalshi crypto updates).

One of those teams was @zigchain - who wanted to sponsor this article that I had been planning on writing for a few weeks now.

They're building what they describe as effectively an onchain version of Wall Street...tokenized RWA-yield-enabled products allowing retail access to higher yield opportunities without the usual non-friendly-to-retail ticket sizes.

While I'm long-term bullish RWAs (equity perps + tokenized stocks/etc), I'm generally pretty skeptical of the RWA-related projects we've seen come to market so far. The team claims to have over 400k real users as part of their first app (Zignaly), so I'm going to try it out and see.

Who knows if RWA products end up giving that extreme upside wealth creation we're missing, but I'm ready to get back in the (theoretical) trenches and try new sht again and write about my experiences. It's been too long. We need more engaging exploratory content on the timeline.

If you got this far, thanks for reading. I really mean that - I still think it's the coolest thing in the world that there's a bunch of people online that take time out of their day to read what I write. Hopefully this provided some value (entertainment or otherwise) for you, and we'll have more soon.

much luv,

-ico

Nearly 10% of Bitcoin is now held by Strategy and spot ETFs. With average ETF cost bases above price, $7B+ in unrealized losses and record outflows show normie capital under pressure—leaving BTC dependent on a fresh narrative to reaccelerate.

Jim Bianco/9 hours ago

Bitcoin’s weak year isn’t OG selling or a “silent IPO.” It’s crypto contagion. Illiquid altcoins forced insiders to sell BTC to prop up air-token markets, while disciplined capital (ETFs, MSTR, Wall St) drained volatility and killed alt-season rotations.

Bit Paine/5 days ago

Gold’s parabolic breakout isn’t a Bitcoin defeat but the same debasement trade unfolding in phases. Gold moves first as the hedge for states; Bitcoin follows as the hedge for people. They trend together long term, but cycle apart short term.

Swan/7 days ago

100 gains didn’t disappear—they changed form. In a hyper-diluted market, winners stack gains by rotating early between narratives, not holding forever. This playbook explains how to spot rotations, size positions, take profits, and compound phases in 2026.

cyclop/2026.01.22

A veteran trader distills seven hard-earned lessons that prevent blown accounts and emotional spirals. From market context and risk control to playbooks, journaling, and process-first thinking, this guide shows how consistency—not signals—builds long-term trading edge.

Morin/2026.01.21

A trader pulled off a $233K overnight play on Polymarket by exploiting thin weekend liquidity. By baiting market-making bots in 15-minute markets and briefly nudging spot price, he forced mispricing and cashed out risk-efficiently.

PredictTrader/2026.01.19

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

3 days ago

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link