Declining Crypto Trading Volumes: Binance Gains Market Share Amid Uncertainty

Crypto Revolution Masters

Crypto Revolution Masters

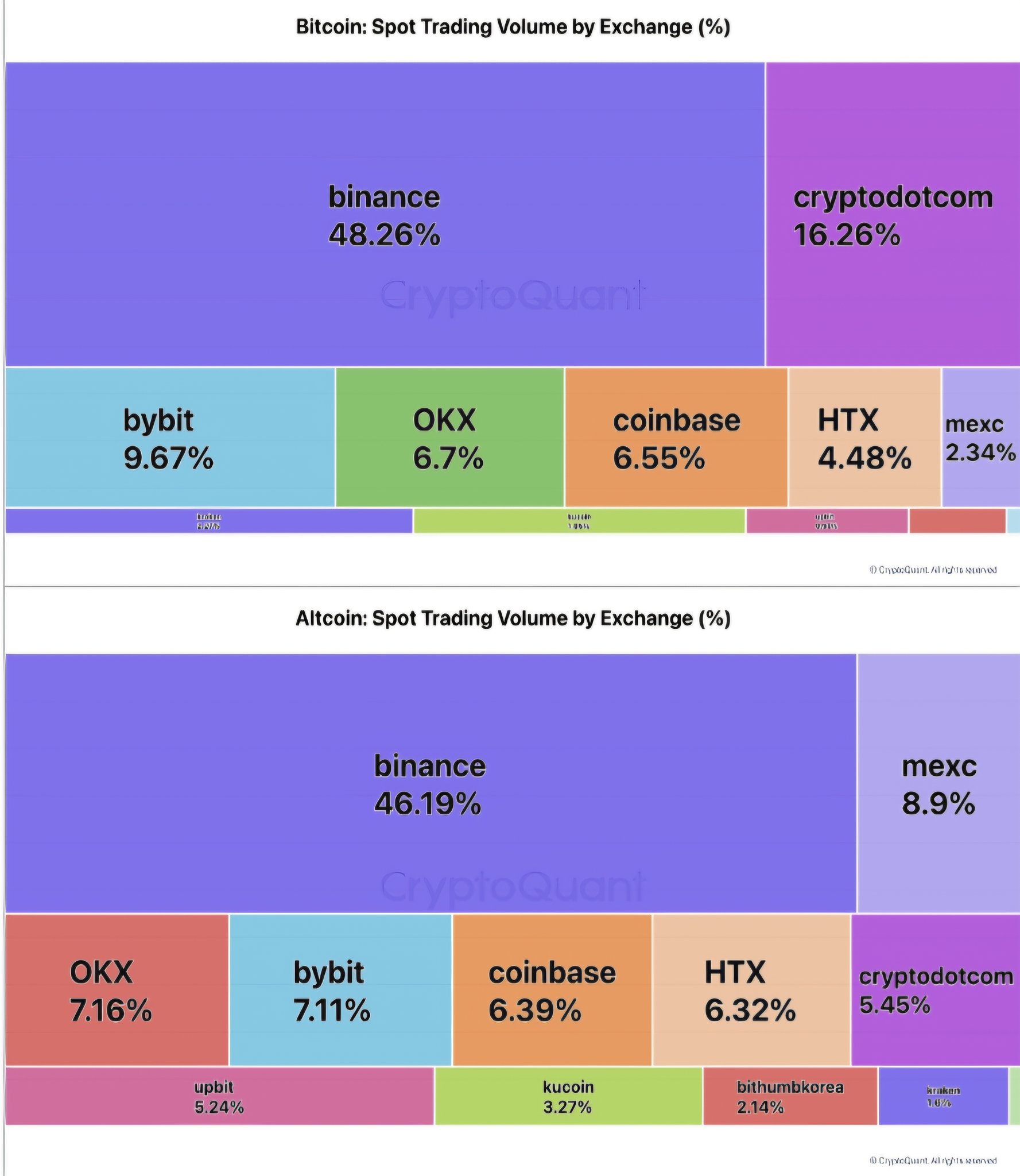

Based on an analysis by CryptoQuant, altcoin and Bitcoin (BTC) spot trading volumes have fallen over the last two months, after recent price corrections in the cryptocurrency market, with exchange Binance emerging as the trading channel of choice.

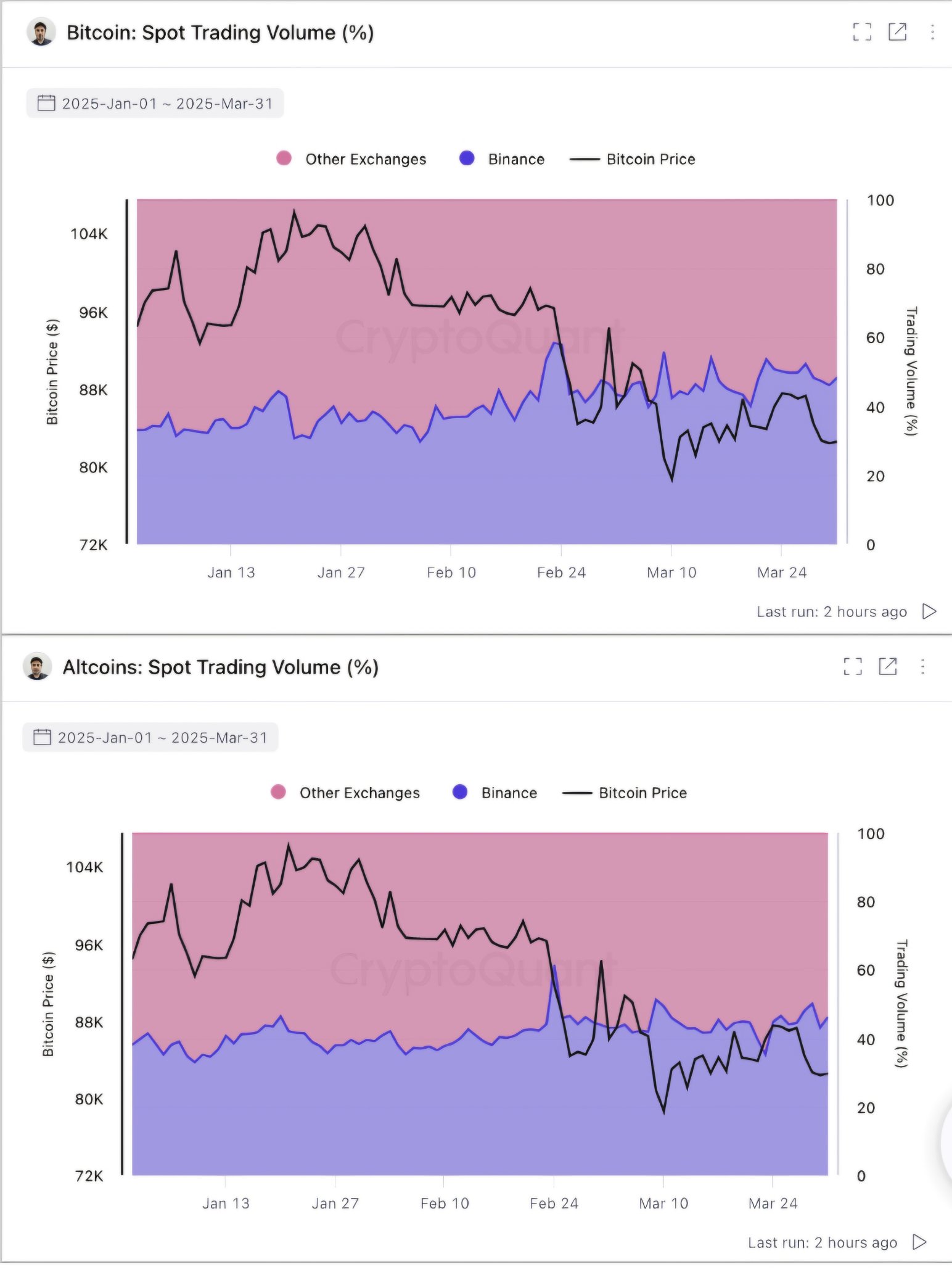

Bitcoin spot trading on crypto exchanges plummeted from an eye-popping $44 billion on February 3 to just $10 billion at the end of Q1—a 77% estimated drop, reports the analytics firm. At the same time, total altcoin spot trading on these exchanges dropped precipitously from an all-time high of $122 billion on Feb. 3 to $23 billion on the final day of Q1, an 80%-plus drop.

👉What does that dramatic decrease mean?

The dramatic decrease in volume indicates that investors and traders are losing interest or confidence, which is usually based on fear or uncertainty. Falling prices reflect the depreciation in the value of the currency and cryptocurrencies, which will discourage others from participating in trading.

As evidenced by the study, this will lead to a downward cycle through decreased trading volume and subsequent price drops.

🔥The market's loss is Binance's gain

Meanwhile, Binance entrenched its leadership among the other crypto exchanges with its control approaching 50% of the entire market trade. Towards the conclusion of the first quarter, Binance's share of total daily bitcoin spot trading jumped from 33% on 3rd February to an astonishing 49%.

This means that alternative exchange trading volumes dropped more sharply than on Binance, reaffirming the exchange's role as the liquidity source of choice amid increased market volatility.

👉Additionally, the proportion of Binance's daily trading volume in cryptocurrencies jumped from 38% on February 3rd to 44% when the first quarter came to an end.

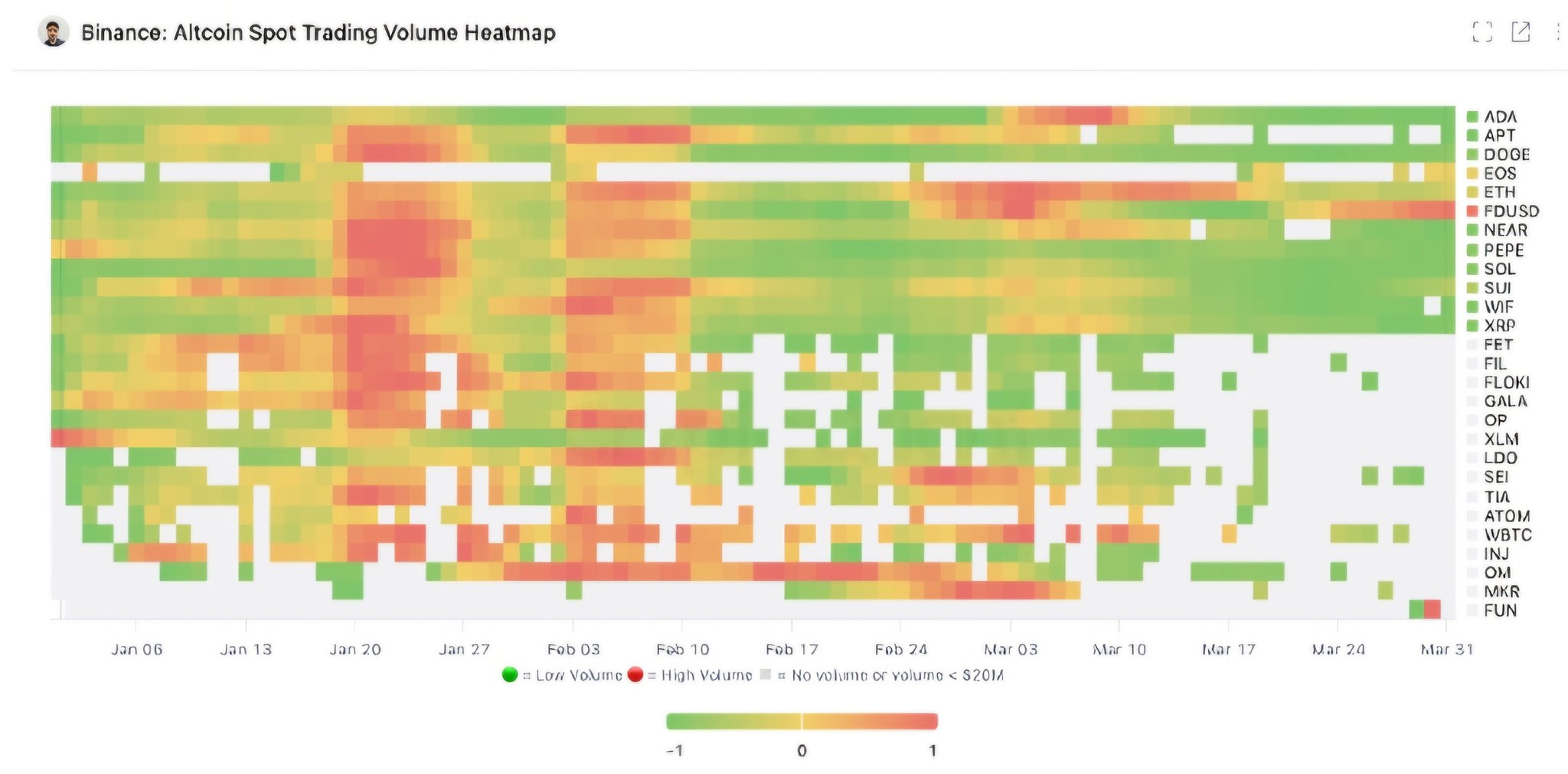

Even with the general decrease in trading volumes, some altcoins still reflect strong spot trading on Binance. Some of the major altcoins like BNB, TON, and EOS continue to see strong trading levels despite the general dip in trading volumes among cryptocurrencies.

Independent CryptoQuant analyst Martuun reported that inflows to Binance had increased in the past week.

👉In an April 9 post, CryptoQuant writer Maarten Regterschot stated that Binance's Bitcoin (BTC) reserve climbed by 22,106 BTC, worth $1.82 billion, during the last 12 days, totaling 590,874 BTC.

🔥This represents an incredible influx of BTC to Binance. Regterschot is convinced that investors are actively moving their funds to Binance with the current macroeconomic uncertainty and the upcoming CPI release on their minds.

Bitcoin’s price increase

According to CoinMarketCap, Bitcoin is trading at $81.578, up about 8% in the past days following Trump's 90-day tariff moratorium on all countries except China.

During periods of uncertainty, investors will transfer their cryptocurrency to exchanges to cash out, increasing volatility as confidence starts to disappear.

However, Pav Hundal, Swyftx's chief analyst, informed Cointelegraph that this is not necessarily an indication of a bearish signal.

"Although huge inflows may be an indication of selling pressure, the nature of this market suggests that Binance is probably just sending funds to hot wallets because of the increased demand."

👉The upcoming days will be crucial for the market.

He further stated that the upcoming days would be critical in assessing the appetite of the market for cryptocurrencies in the wake of Trump's tariffs pullback.

🔥Trump had already implemented on April 9 a 90-day pause on his administration's "reciprocal tariffs," reducing the rate to 10% on everyone else and increasing the rate on China to an unbelievable 125% , citing the country's countervailing tariffs levied against America.

Hundal briefed the journalists that tensions with the US stood ominously in the backdrop.

Bitcoin may enter a prolonged sideways phase between $57K and $87K as markets enter a relief period following a 52% drop from ATH. This consolidation could mirror the 2022 fractal, creating liquidity before a potential breakdown toward the $44K–$50K range.

Doctor Profit/11 hours ago

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/6 days ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2026.02.27

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link