Ethereum Hits $4,300: Is a Parabolic Run or a Pullback Ahead?

VirtualBacon

VirtualBacon

🚨#Ethereum Hits $4,300, Parabolic Run Next or Pullback Ahead?🚨

$ETH just ripped to $4,300. Is it too late to buy?

I’ve broken down price targets, key levels, ETF flows, and the ETH-linked alts most likely to move next.

Here’s my full game plan for ETH, altseason, and the key plays🧵👇

$ETH is in its strongest uptrend vs $BTC since 2021.

We haven’t even touched the $4,850 ATH yet.

The question is: do we go parabolic now, or get a healthy pullback before the real breakout?

Let’s map both scenarios.

Ethereum’s rally to $4,300 has opened the door for much higher prices into year-end.

If #Bitcoin pushes toward $150K and ETH/BTC climbs to 0.044, $ETH could hit $6,000–$7,000 this year. My conservative target? $6,600.

I’m positioning to capture that upside while protecting against a pullback.

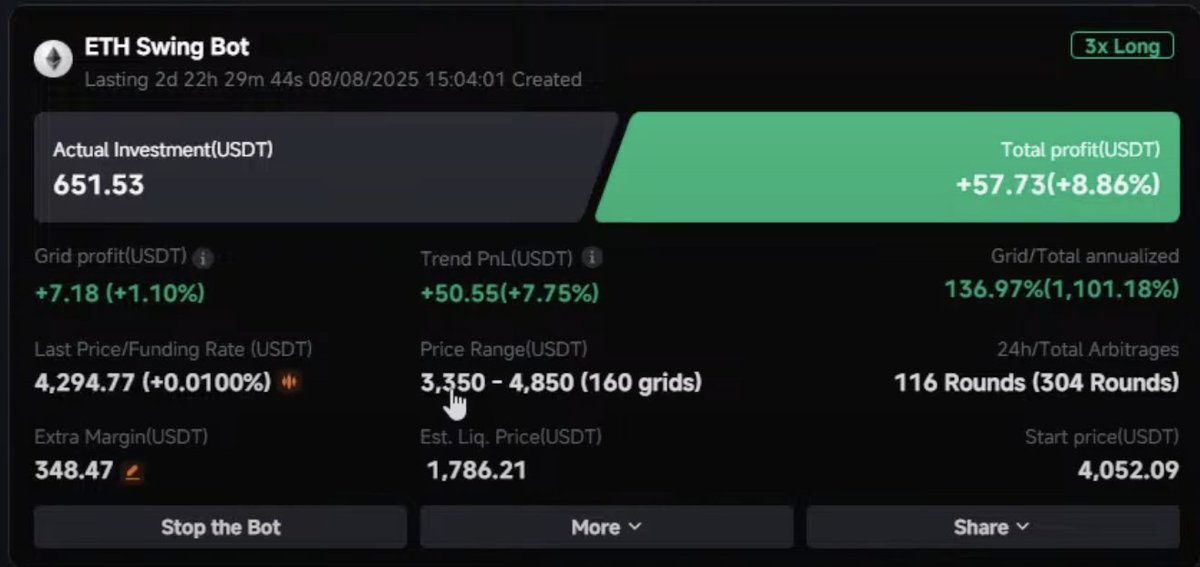

My trading setup:

Swing bot range: $3,350-$4,850

🔹$3,350 - key higher low from July & uptrend support

🔹$4,850 - previous ATH

The bot buys dips, sells rips, and accumulates without you needing perfect timing.

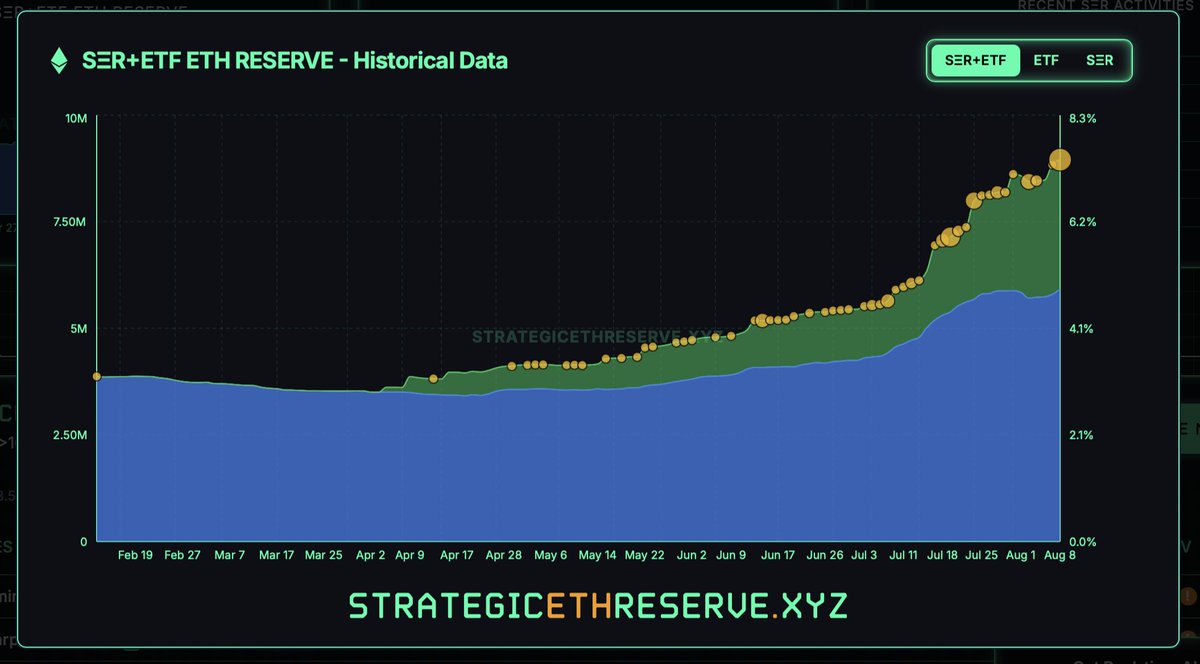

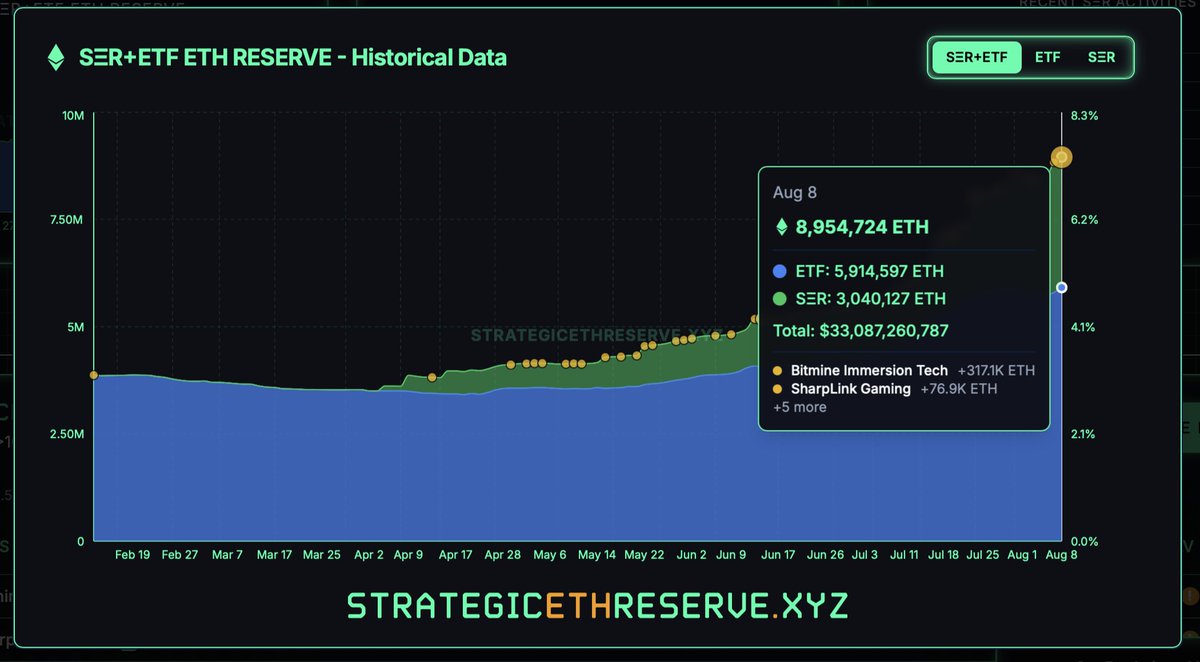

Institutional flows are flipping bullish for $ETH.

In July, ETFs + treasuries held 7.1M ETH (~$24B).

Today, that’s $33B. On Aug 8th, ETH ETFs saw $460M inflows, more than BTC’s $400M that day.

ETH’s smaller market cap means each institutional $ has more price impact than BTC.

I see $3,350 as the floor unless $BTC itself dumps hard.

The real battle: clearing $4,850. If that happens in Q4, $6K+ is in play fast

$BTC dominance tells us altseason is starting but not confirmed.

We dipped from 60.5% to 59.7%, the first sign of a possible downtrend since 2021.

Confirmation = weekly close < 60.5% & lower high under 62.5%.

Until then, patience is key.

The $ETH linked alts I’m watching:

Core DeFi:

🔸 $UNI - flagship AMM, still flat.

🔸 $LINK - essential oracle, still cheap.

🔸 $CRV - stable swap king.

🔸 $COMP - OG lending market.

New DeFi:

🔸 $AERO - up 40% last week.

🔸 $PENDLE - yield trading for RWAs & stables.

🔸 $ENS - pure $ETH beta play.

🔸 $HOME - on-chain DeFi super app.

I'm still avoiding most layer 2s & restaking

Adoption isn’t there yet. Institutions stick to #Ethereum mainnet and fork proven protocols.

A great example is World Liberty Financial forking Aave for its own lending & stablecoin platform.

Stablecoins are ETH’s stealth bullish driver. Nearly all USDC/USDT supply sits on ETH.

Beyond those, I’m watching three plays:

🔸USD1 (World Liberty Financial) - Targets treasuries & sovereign funds. One deal could send supply from $2B → $100B.

🔸 @PlasmaFDN & @stable - Tether founder–backed chains with USDT as native gas. Gasless transfers, big Bitfinex support.

While valuations aren’t public yet, these have far greater upside than smaller-scale DeFi-native stables like USDE or DAI.

The World Liberty ecosystem offers multiple ways to gain exposure:

🔸 $WLFI - governance token (TGE soon)

🔸 $BLOCK - led by WLFI’s CIO

🔸 $DOLO - founded by WLFI’s CTO

🔸 $ALTS stock - NASDAQ-listed, holds 7.5% of WLFI supply.

The recent $1.5B raise from @ALT5_Sigma valued $WLFI at $20B FDV.

If $WLFI hits $100B, ALTS’ holdings would 5x, and the stock could run hard.

This is an asymmetric bet that ties directly into ETH’s DeFi rails.

https://x.com/EricTrump/status/1954881801551548839

So what is my game plan?

🔹Hold $ETH above $3,350 support.

🔹Focus on ETH-beta DeFi & stablecoin plays.

🔹Rotate into alts that have lagged when #Bitcoin dominance confirms breakdown.

🔹Stay patient, Q4 is when the big moves likely hit.

$ETH is leading now. If BTC.D breaks down, altseason will follow.

Until then, hold strength, accumulate dips, and let institutions do the heavy lifting.

Michael Saylor turned MicroStrategy into a $33B Bitcoin vault, fueled by debt and equity dilution. The model depends on Bitcoin’s relentless rise—if BTC stalls below $40K, the structure could collapse, forcing the company to sell its core holdings.

StarPlatinum/17 hours ago

Markets are misreading the Fed. Inflation risks outweigh recession fears, yet policy remains too accommodative. With Jackson Hole ahead, the key is how Fed actions transmit into flows—setting the stage for volatility in rates, equities, and crypto.

Capital Flows/2 days ago

From SushiSwap’s Chef Nomi to Terra’s Do Kwon, history shows what happens when founders leave right after TGE. Some cashed out, some collapsed, others pivoted—but nearly all tokens crashed, leaving investors with heavy losses.

StarPlatinum/2 days ago

After turning $1K into $130K in my first cycle—and watching it crash—I learned the hard way about securing profits. In my 3rd cycle, with $6M+ made, I’m selling all crypto before December. Here’s how to build a smart, risk-based exit strategy.

cyclop/5 days ago

Chainlink ($LINK) is the essential infrastructure for the RWA and tokenization boom, securing 84% of the oracle market. With a powerful tokenomics flywheel and major TradFi partnerships, its a key large-cap play for this cycle.

Miles Deutscher/6 days ago

Fueled by soaring institutional demand, record-high network activity, and a severe supply crunch, Ethereum is poised for significant growth. This analysis breaks down why these three factors are creating a path for $ETH to hit $10,000 this cycle.

Bull Theory/2025.08.13

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link