From $1K to $6M: My Exit Plan for the 2025 Crypto Cycle

cyclop

cyclop

In my 1st cycle, I went from $1k to $130k

Then I fell almost to $0

Most will end this cycle the same way - no exit plan.

I went through it so u don’t have to.

This is my 3rd cycle, $6M+ made – here’s my exit plan: I’m selling all crypto before December 🧵👇

1/➮ As I said, in my first cycle, I turned $1k into $130k… then watched it crash to $8k cause I didn’t secure profits

Same thing is happening to 99% of ppl every single cycle, because you don’t get one simple truth:

“Unrealized PnL is not PnL at all.”

Let’s change that now.

2/➮ To secure profits the right way, you need to consider:

- Your total portfolio size

- How exposed are you to the market

- What is your portfolio made of

- How much risk do you want to take

Let’s break down exit strategies based on these factors👇

3/➮ First, you need a rough idea of when you want to exit

✧ That comes from understanding cycles, patterns, and timings

✧ I’ve already explained how I see this cycle playing out here

In short, here’s how I see it - next tweet

Detailed thesis 🧵👇

https://x.com/nobrainflip/status/1954623236710203446

4/➮ In short, here’s how I see it:

Based on the past 2017 and 2021 cycles:

Both times, BTC grew from Apr to Dec straightforwardly with high dominance on the way up

✧ Right after, we saw a short ETH/large caps rally

✧ Only then came altseason, lasting 30-40 days both times, followed by an immediate crash too

For now, we can see repeating the timings/patterns almost week after week

✧ New BTC ATH will hit soon and we'll have an ETH rally to ATH with ~1 month to play it out

So logically, ~20-40 days of strong alt gains are left then With alts, peak will be in the same Dec-Jan

As for the numbers, I think $BTC is already close to its peak, and most of the growth will come from ETH, followed by alts.

Exact targets:

$150K $BTC

$8,000 $ETH

But you should never fully rely on these numbers, and there’s no point in hoping to guess the exact market top.

The truth is, neither I, nor GCR, nor the President of the United States, nor some random guy in your DMs - nobody will ever be able to predict the exact top with 100% certainty.

The reality is nobody truly knows what’s going on here.

Whether we go up or down is just a probability game - we bet on the most favorable outcome, but it’s never a guarantee.

So what to do instead?

Here’s the breakdown on how to exit:

5/➮ Portfolio size

Bigger size = more split exits

If you’ve got $10k in ETH, you could split your exits into 2 of 50% parts (at $4,500 and $5k)

Because it’s not a big amount for you, or at the very least it’s money you can afford to lose and start over with:

You’re ready for anything - or for nothing - and it’s easy for you to exit any alt without causing price impact with your sells.

But if you’re overexposed to the market, or holding a globally significant size, it’s at least psychologically easier to exit in parts - that way you don’t miss taking profits, and you’re not risking losing it all.

✧ But if you’ve got $1m, make it like 10% at $4k, another 10% at $4,100, etc.

This way, you lower risk and improve your avg exit

Your size allows you to exit when you feel it’s “enough,” if you’re already financially secure.

Sure, this way you might not hit a perfect 4x on your portfolio, but you’ll lock in profits and still walk away with a solid gain.

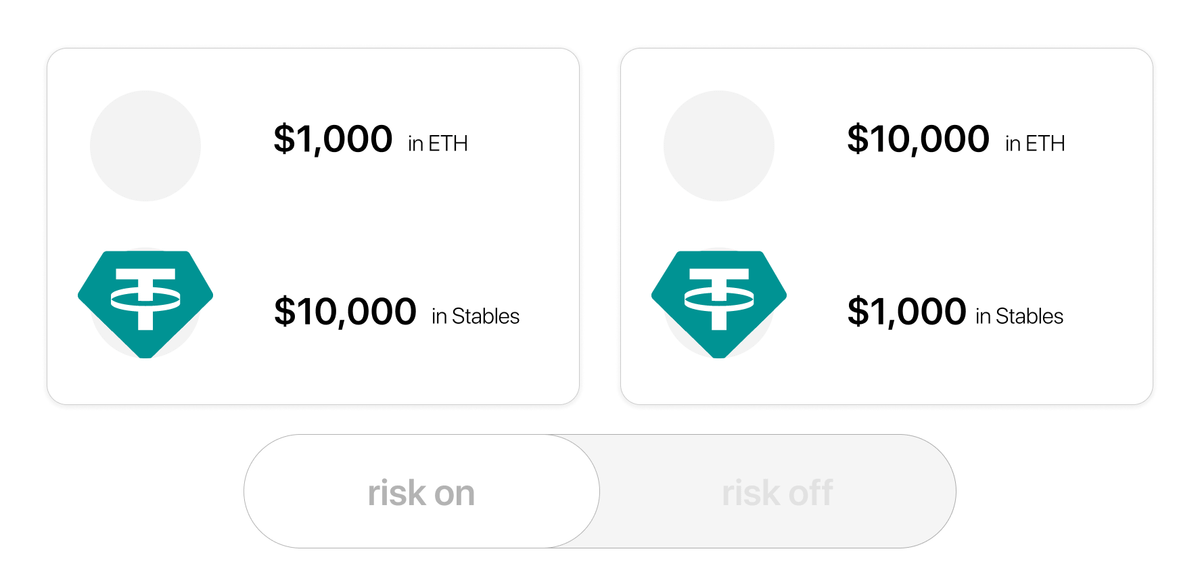

6/➮ Market exposure (how loaded are you in the market)

✧ If you’ve got $10k in stables and only $1k in ETH, you can take more risks

✧ But if you’re 100% in the market, you don’t want to take unnecessary risks

Cause you might be trapped and forced to sell lower

7/➮ Portfolio composition

✧ Big difference if you hold 10M low caps, and if it’s BTC/ETH

✧ Riskier assets will usually dump faster

✧ So at least secure body at 2x and decide what risk you're taking next

Long holder = bigger upside, but also the risk of exit too late

8/➮ Each factor changes your risk level, so combine them and find your own comfortable R/R.

✧ For example, if you’re full size in crypto, your room for risky plays is small, so you secure earlier and split exits into more parts

That's how you create your own R/R strategy

9/➮ Another important part - many ask how to understand when to sell

✧ Ask yourself:

“Would I buy this token right now at this price?”

✧ If the answer is no, you should at least start securing some profits

Last 2 things everybody needs to know about👇

10/➮ Treat profits like a paycheck, not a lottery ticket

✧ You didn’t “guess right” - you earned them for the work you did.

✧ Otherwise, you’re just gambling.

✧ But remember, slow and steady wins the race.

✧ Better to lose an extra 10% of profit than be sitting fully in the market when it dumps -70%

11/➮ Cost Averaging Strategy

✧ Strategy for both buying and selling that many ppl neglect

✧ Everyone thinks, “I’ll sell when the price is higher,” and the price really might go higher

✧ But most end up holding too long and lose

✧ So just start selling in parts - 10% after 10%

✧ Your avg selling price will only change by a couple of points

But this way, you definitely won’t be left holding a full bag during a sharp correction or crash.

As an example of an exit, you can check why I sold 30% (now 43%) of my $ETH, and logic behind it:

For reference, $ETH = 20% of my portfolio, another 20% = alts, 10% = BTC, and 50% = stables.

On top of that, I also have capital outside of crypto.

Michael Saylor turned MicroStrategy into a $33B Bitcoin vault, fueled by debt and equity dilution. The model depends on Bitcoin’s relentless rise—if BTC stalls below $40K, the structure could collapse, forcing the company to sell its core holdings.

StarPlatinum/13 hours ago

Markets are misreading the Fed. Inflation risks outweigh recession fears, yet policy remains too accommodative. With Jackson Hole ahead, the key is how Fed actions transmit into flows—setting the stage for volatility in rates, equities, and crypto.

Capital Flows/1 days ago

From SushiSwap’s Chef Nomi to Terra’s Do Kwon, history shows what happens when founders leave right after TGE. Some cashed out, some collapsed, others pivoted—but nearly all tokens crashed, leaving investors with heavy losses.

StarPlatinum/2 days ago

Chainlink ($LINK) is the essential infrastructure for the RWA and tokenization boom, securing 84% of the oracle market. With a powerful tokenomics flywheel and major TradFi partnerships, its a key large-cap play for this cycle.

Miles Deutscher/6 days ago

Fueled by soaring institutional demand, record-high network activity, and a severe supply crunch, Ethereum is poised for significant growth. This analysis breaks down why these three factors are creating a path for $ETH to hit $10,000 this cycle.

Bull Theory/7 days ago

With Ethereum hitting $4,300, this analysis weighs two scenarios: a parabolic run toward a $6.6k year-end target fueled by institutional inflows, or a healthy pullback first. The author details a trading plan focused on key levels, ETH-beta altcoins (DeFi, stables), and patience for altseason.

VirtualBacon/2025.08.13

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link