The Pick-and-Shovel of Crypto: Why Chainlink is Positioned for a Breakout Cycle

Miles Deutscher

Miles Deutscher

$LINK might be the most obvious large-cap play for this cycle (yet most people will miss it).

It’s the #1 winner from the institutionalisation of crypto and the explosive growth of stablecoins, tokenisation, and RWAs.

🧵: Why I’m betting big on $LINK - the full thesis.👇

In this thread, I'll break down:

• Why this bull run is perfectly aligning with Chainlink's narrative

• $LINK's tokenomics & flywheel

• Why there significant room for upside, and my positioning

Firstly, let's discuss the broader trend.

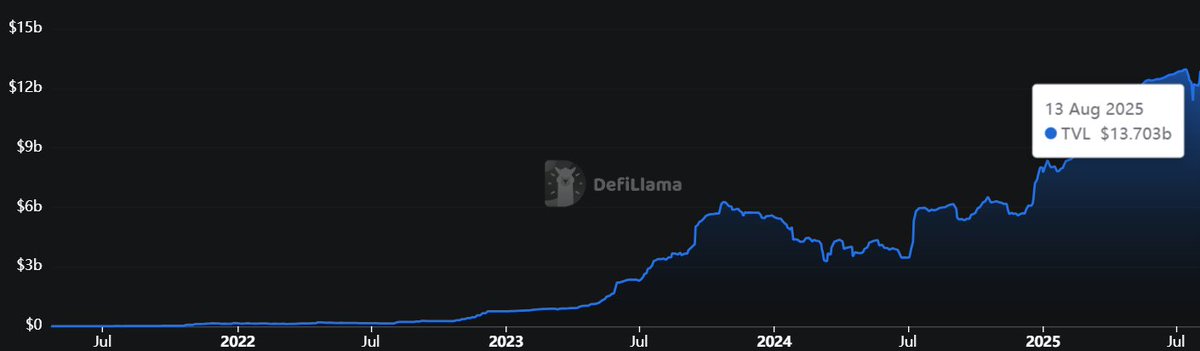

RWA TVL has exploded 13x in just two years, from ~$1B to over $13B.

It's been one of the strongest growth verticals in crypto.

Institutions recognize that the legacy SWIFT system is slow and broken.

Institutions don’t want fulfillment fragmentation.

They want to utilise comprehensive end-to-end platforms.

https://x.com/nullpackets/status/1577738482893529088

This is why Wall Street giants like BlackRock are pushing for tokenization and why corporations like Stripe (Tempo) and Circle (ARC) are building their own chains.

The fragmented, multi-chain world requires a universal translator, and Chainlink provides the solution.

Every single tokenized stock, bond, or piece of real estate needs an oracle to bring its value on-chain.

$LINK is the market leader, with 84% of the entire Oracle market on Ethereum.

They are the essential rails for this multitrillion-dollar shift.

https://x.com/CatfishFishy/status/1955393168750387257

It's hard to know what the winning L1 will be, especially with the raft of new corporate chains entering the market.

We also don't know what the winning RWA dApp will be.

But we know that Chainlink is powering it all.

It becomes the ultimate pick-and-shovel play.

https://x.com/alpha_pls/status/1955231657675591782

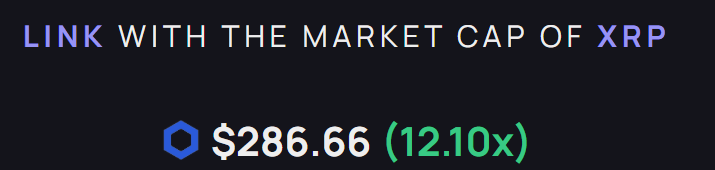

For years, many believed that XRP was destined for institutional adoption.

I would argue that LINK, in many ways, has more traction in this sphere than XRP - and is a more logical bet (given the valuation), to capture upside to this narrative.

Let's look at some stats:

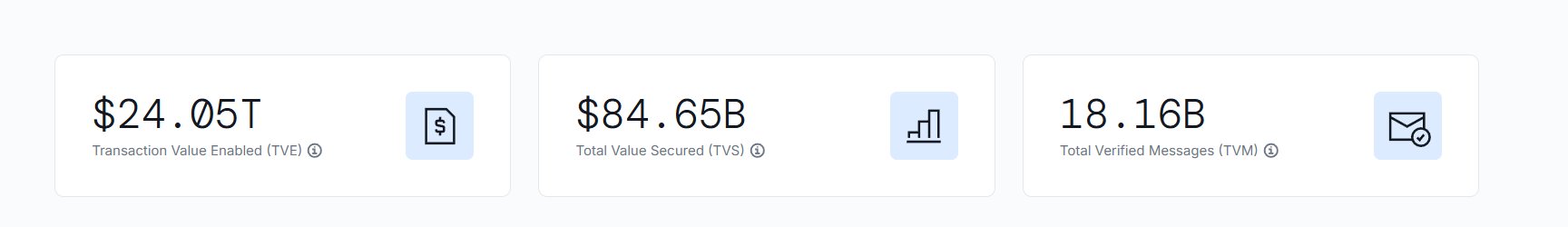

XRPL DeFi TVL: ~$85 Million

Chainlink Total Value Secured: $84.65 BILLION

Chainlink secures over 1,000x more capital on-chain, with an increasing market share that now stands at 68% across all of DeFi.

Despite this gap, XRP's market cap is ~12.10x larger.

I think that $LINK represents better value at current levels.

I think it's important to note that Chainlink is also the farthest ahead by order of magnitude on TradFi adoption of any protocol (barring BTC and ETH), having already been integrated by TradFi giants.

Including:

- SWIFT

- DTCC

- Euroclear

- JPMorgan

- Mastercard

https://x.com/ChainLinkGod/status/1954371093202173973

---- TOKENOMICS ----

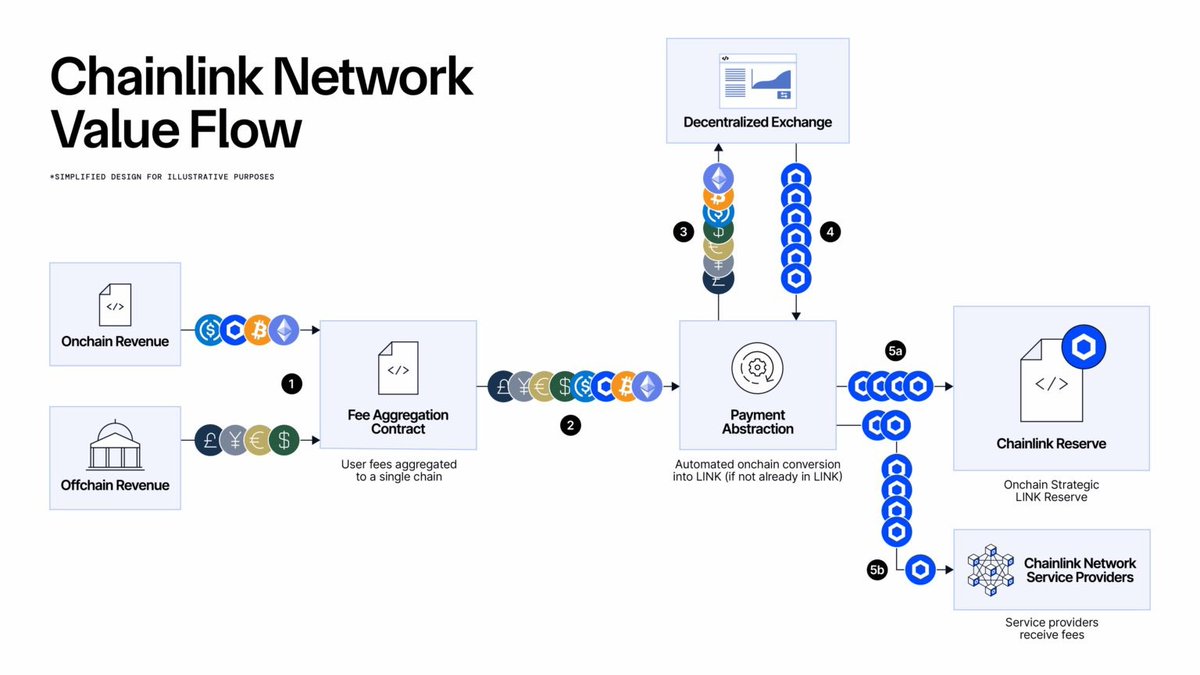

Below is an outline of how the Chainlink network's value flows.

They earn revenue in two main ways:

1. Through on-chain fees when their services are used on various blockchain networks, which helps fund their operations and buy back $LINK tokens (mapped below).

2. Deals with big companies and institutions (like SWIFT or J.P. Morgan) that pay for integrating Chainlink’s solutions, with some of this money also going toward the Chainlink Reserve to support long-term growth.

1. The Chainlink Reserve

The protocol now automatically converts all revenue, including fees paid in $ETH or $USDC from private corporate chains, into $LINK on the open market.

This revenue is then deposited into a strategic treasury.

https://x.com/chainlink/status/1955601981608767971

2. Staking

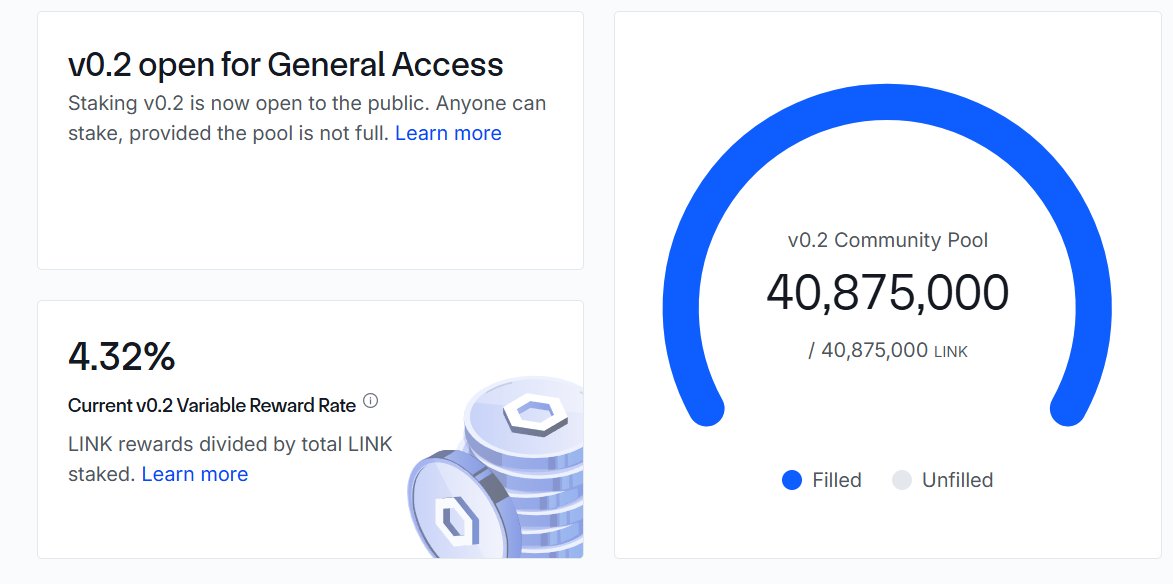

Users are locking $LINK to secure the network and earn a sustainable ~4.32% yield, acting as a persistent supply sink that removes tokens from the open market.

This creates a perpetual, automated buyback mechanism, turning adoption directly into buying pressure and forming a powerful flywheel:

Increased Adoption → Higher Revenue → More $LINK Purchased & Locked → Greater Network Security & Resources → Increased Utility.

https://x.com/ChainLinkGod/status/1953443858811085260

----TECHNICALS & SUMMARY----

$LINK has broken above the $20 weekly resistance zone. This level has acted as a significant pivot level for years.

It's essentially LINK's equivalent of $ETH's $4k level.

LINK is in my long-term portfolio (as it's one of the only coins in crypto I'm comfortable holding longer term), however, I took a new position a few days ago on this breakout.

I'm comfortable riding this position as I think it could do multiples from here, considering how strong the narrative is.

To summarise, think of it this way:

If AWS, Azure, and GCP were spun out from their parent companies, they would be worth trillions.

Chainlink is the fundamental B2B infrastructure for the entire on-chain economy.

https://x.com/CatfishFishy/status/1955394912926470242

Michael Saylor turned MicroStrategy into a $33B Bitcoin vault, fueled by debt and equity dilution. The model depends on Bitcoin’s relentless rise—if BTC stalls below $40K, the structure could collapse, forcing the company to sell its core holdings.

StarPlatinum/13 hours ago

Markets are misreading the Fed. Inflation risks outweigh recession fears, yet policy remains too accommodative. With Jackson Hole ahead, the key is how Fed actions transmit into flows—setting the stage for volatility in rates, equities, and crypto.

Capital Flows/1 days ago

From SushiSwap’s Chef Nomi to Terra’s Do Kwon, history shows what happens when founders leave right after TGE. Some cashed out, some collapsed, others pivoted—but nearly all tokens crashed, leaving investors with heavy losses.

StarPlatinum/2 days ago

After turning $1K into $130K in my first cycle—and watching it crash—I learned the hard way about securing profits. In my 3rd cycle, with $6M+ made, I’m selling all crypto before December. Here’s how to build a smart, risk-based exit strategy.

cyclop/5 days ago

Fueled by soaring institutional demand, record-high network activity, and a severe supply crunch, Ethereum is poised for significant growth. This analysis breaks down why these three factors are creating a path for $ETH to hit $10,000 this cycle.

Bull Theory/7 days ago

With Ethereum hitting $4,300, this analysis weighs two scenarios: a parabolic run toward a $6.6k year-end target fueled by institutional inflows, or a healthy pullback first. The author details a trading plan focused on key levels, ETH-beta altcoins (DeFi, stables), and patience for altseason.

VirtualBacon/2025.08.13

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link