MicroStrategy: The $33B Bitcoin Experiment Built on Debt and Dilution

StarPlatinum

StarPlatinum

Michael Saylor turned a dying company into a $33B Bitcoin vault.

A system built on leverage, dilution, and a single condition:

Bitcoin must never stop going up.

And most people don’t understand how dangerous this model is🧵

MicroStrategy holds 629,376 BTC.

They spent over $33 billion to get it.

And almost none of that came from actual business revenue.

It came from bonds, stock sales, and a never ending flow of capital from investors who believe Saylor will never sell.

The core of the strategy is simple on paper:

Raise money through convertible notes.

Raise more through ATM equity programs.

Use all of it to buy Bitcoin.

Repeat.

Every round adds more BTC.

Every round increases the risk.

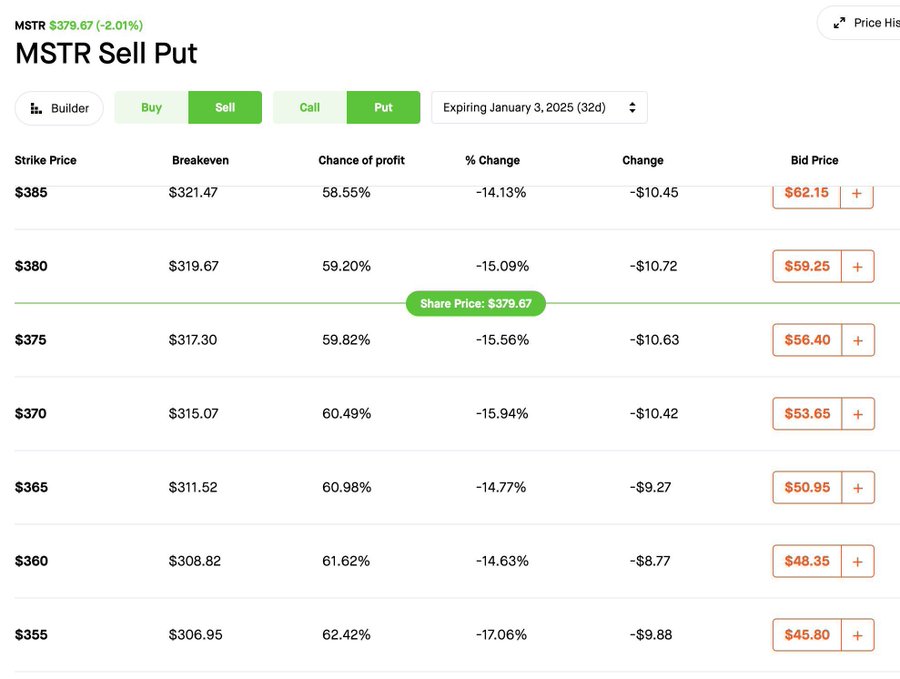

The bond deals are extreme.

MicroStrategy now has $8.2B in convertible notes.

Some have zero interest.

Some convert to stock if the price explodes.

None are backed by Bitcoin.

If the stock keeps pumping, the debt turns into shares.

If not, the debt remains.

The equity sales are aggressive.

When the stock trades above its NAV, Saylor launches new ATM programs.

Hundreds of millions get raised in days.

And Bitcoin keeps flowing in.

But every sale means more dilution.

And that dilution only works as long as the hype holds.

The software business still exists but just on paper.

$463M in annual revenue.

Flat growth.

Minimal profit.

Barely enough to cover interest.

It’s a zombie company with one job:

Give Wall Street a legal wrapper to access Bitcoin.

Saylor stepped down as CEO in 2022 and became Executive Chairman.

He said it was to focus on Bitcoin strategy.

Then came the rebrand.

MicroStrategy dropped the “Micro.”

It’s now just “Strategy.”

Because the software is dead.

Only Bitcoin remains.

On-chain data shows there has only been one sale:

704 BTC for tax harvesting in 2022.

The rest has been pure accumulation.

Some wallets are in Fidelity and Anchorage.

Others are on Coinbase Prime.

Over 400,000 BTC are in cold wallets with UTXO rotation patterns.

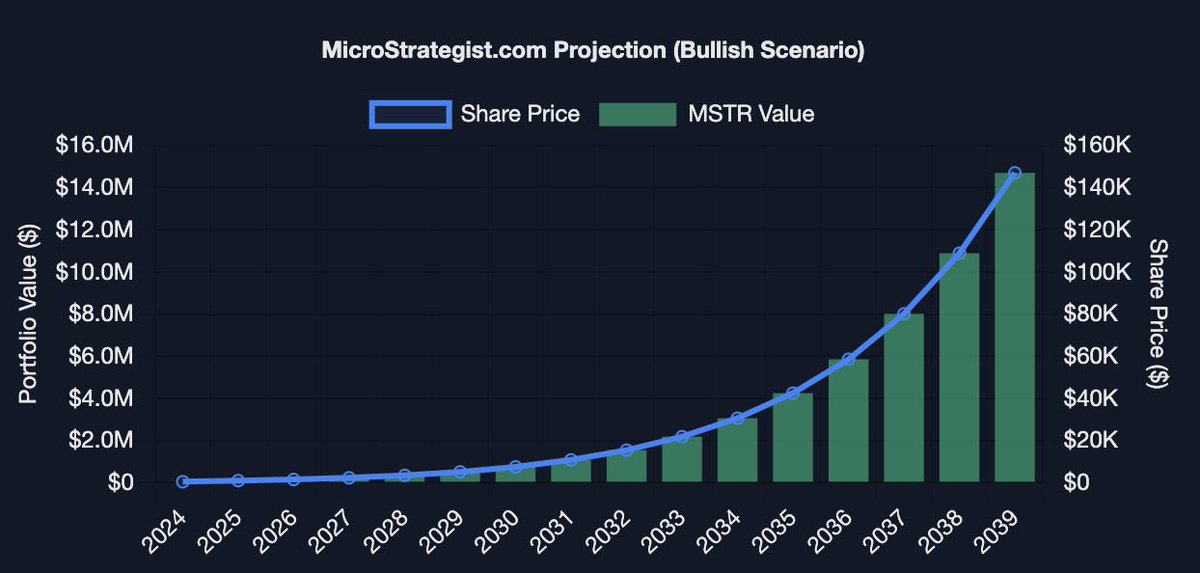

This is a high risk experiment in financial engineering.

Debt without coupons.

Equity with constant dilution.

A treasury model that only survives if BTC keeps going vertical.

And every piece depends on market confidence.

If the market crashes and Bitcoin trades below $40k for too long

The whole model could break.

And when that happens, MicroStrategy may be forced to do the one thing it promised never to do:

Sell.

Markets are misreading the Fed. Inflation risks outweigh recession fears, yet policy remains too accommodative. With Jackson Hole ahead, the key is how Fed actions transmit into flows—setting the stage for volatility in rates, equities, and crypto.

Capital Flows/1 days ago

From SushiSwap’s Chef Nomi to Terra’s Do Kwon, history shows what happens when founders leave right after TGE. Some cashed out, some collapsed, others pivoted—but nearly all tokens crashed, leaving investors with heavy losses.

StarPlatinum/2 days ago

After turning $1K into $130K in my first cycle—and watching it crash—I learned the hard way about securing profits. In my 3rd cycle, with $6M+ made, I’m selling all crypto before December. Here’s how to build a smart, risk-based exit strategy.

cyclop/5 days ago

Chainlink ($LINK) is the essential infrastructure for the RWA and tokenization boom, securing 84% of the oracle market. With a powerful tokenomics flywheel and major TradFi partnerships, its a key large-cap play for this cycle.

Miles Deutscher/6 days ago

Fueled by soaring institutional demand, record-high network activity, and a severe supply crunch, Ethereum is poised for significant growth. This analysis breaks down why these three factors are creating a path for $ETH to hit $10,000 this cycle.

Bull Theory/7 days ago

With Ethereum hitting $4,300, this analysis weighs two scenarios: a parabolic run toward a $6.6k year-end target fueled by institutional inflows, or a healthy pullback first. The author details a trading plan focused on key levels, ETH-beta altcoins (DeFi, stables), and patience for altseason.

VirtualBacon/2025.08.13

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link