Jackson Hole and the Fed’s Policy Error: Why Flows, Not Just Rates, Will Drive Markets

Capital Flows

Capital Flows

Everyone has become a Fed watcher, but no one understands HOW the flows of capital are happening

As we move into Jackson Hole this week, we are very likely to see a shift in monetary policy, but the key will be understanding HOW this is transmitted into markets

If you understand the macro context for flows and how positioning is set up, then you will understand how Jackson Hole will be transmitted into markets.

This will frame all of the changes we see in interest rates, equities, and crypto.

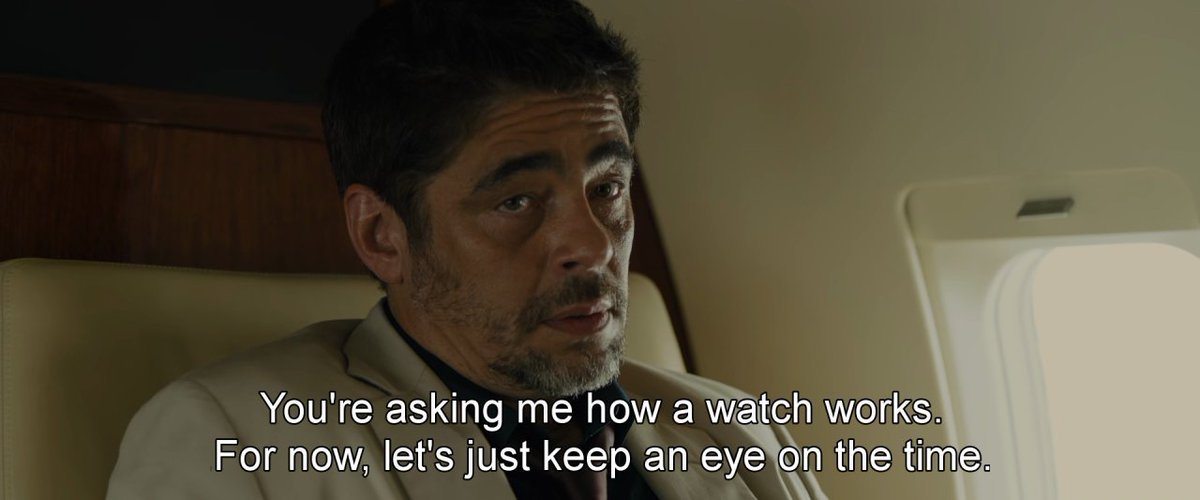

First, we are in a period of time where growth AND inflation are accelerating.

The Atlanta Fed nowcast is running at 2.5% and long end rates have retraced the entire move they made from the NFP print.

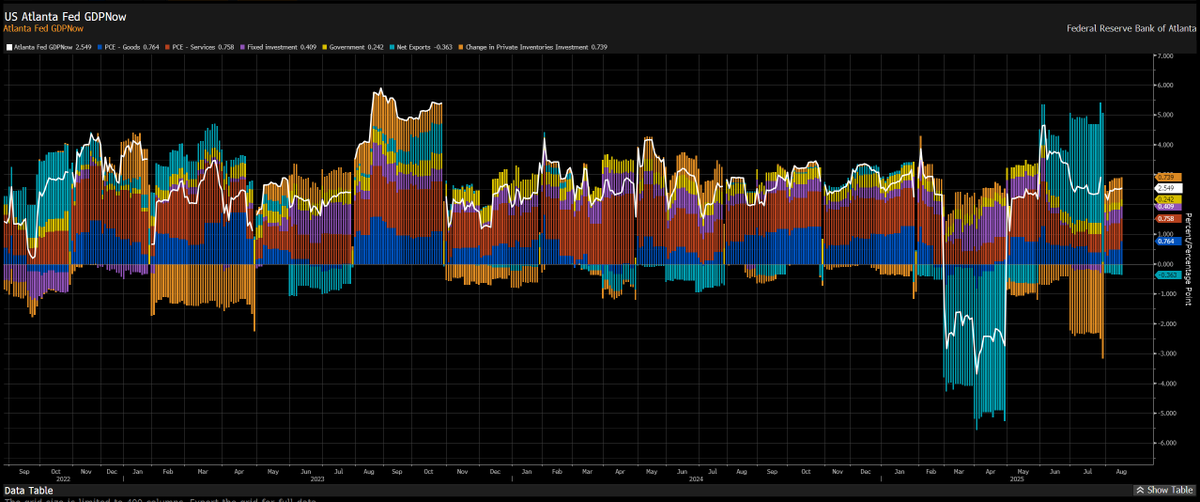

The 3 month trend of NFP remains positive and we are adding jobs to the economy every single month. More jobs = more money being added to the underlying system.

Notice that UB has already retraced the entire rally from the NFP print. What does this mean? If we were truly at risk of a recession right now, UB would have made a new high or been flat, not retraced the entire move on such a violent NFP print.

The underlying data and market expectations are both confirming the views I have been laying out for a while: Inflation risk is greater than recession risk. You can see the full report here:

https://x.com/Globalflows/status/1956404293948633522

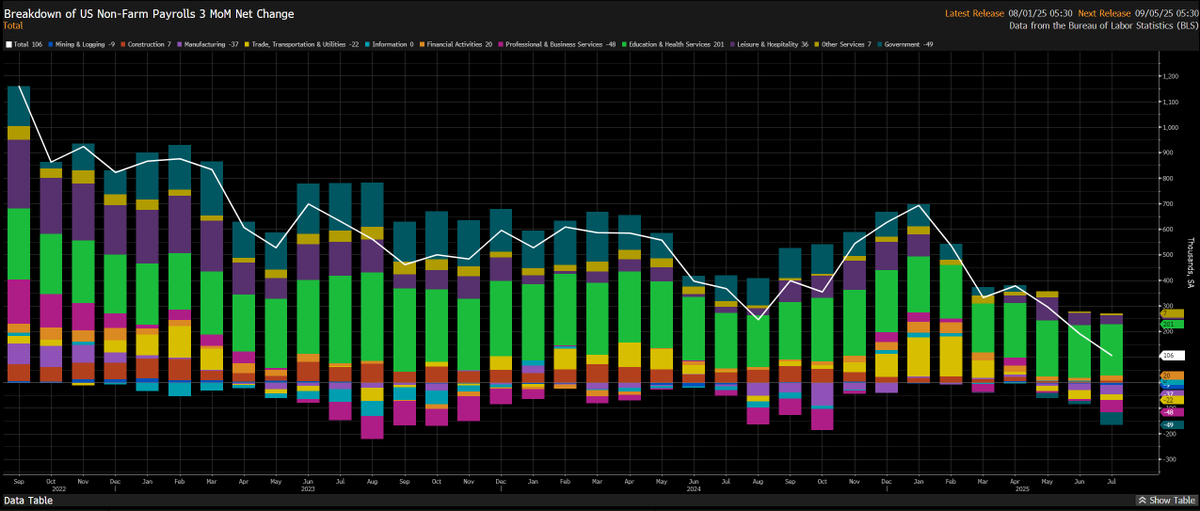

And notice that inflation swaps are sitting well above 3% with credit spreads at cycle lows. This means that inflation risk is clearly higher than recession risk right now. On top of this, the last PCE, CPI, and PPI inflation prints all came in above expectations.

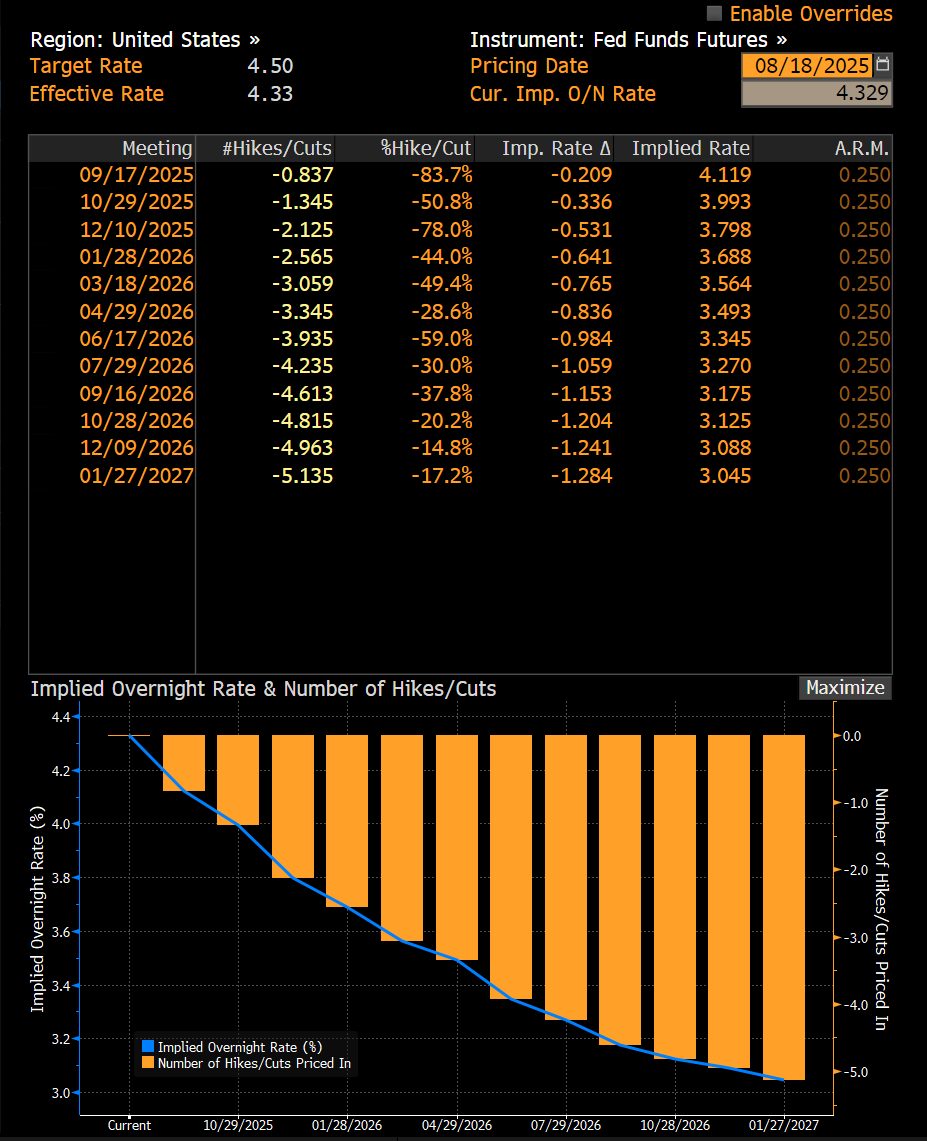

But what is the Fed doing? They are still allowing 50bps of cuts get priced on the forward curve. This is why there is a positive liquidity impulse pushing asset prices higher

https://x.com/Globalflows/status/1955320999068700677

This is a blatant policy error by the Federal Reserve in being too accommodating as growth and inflation rise.

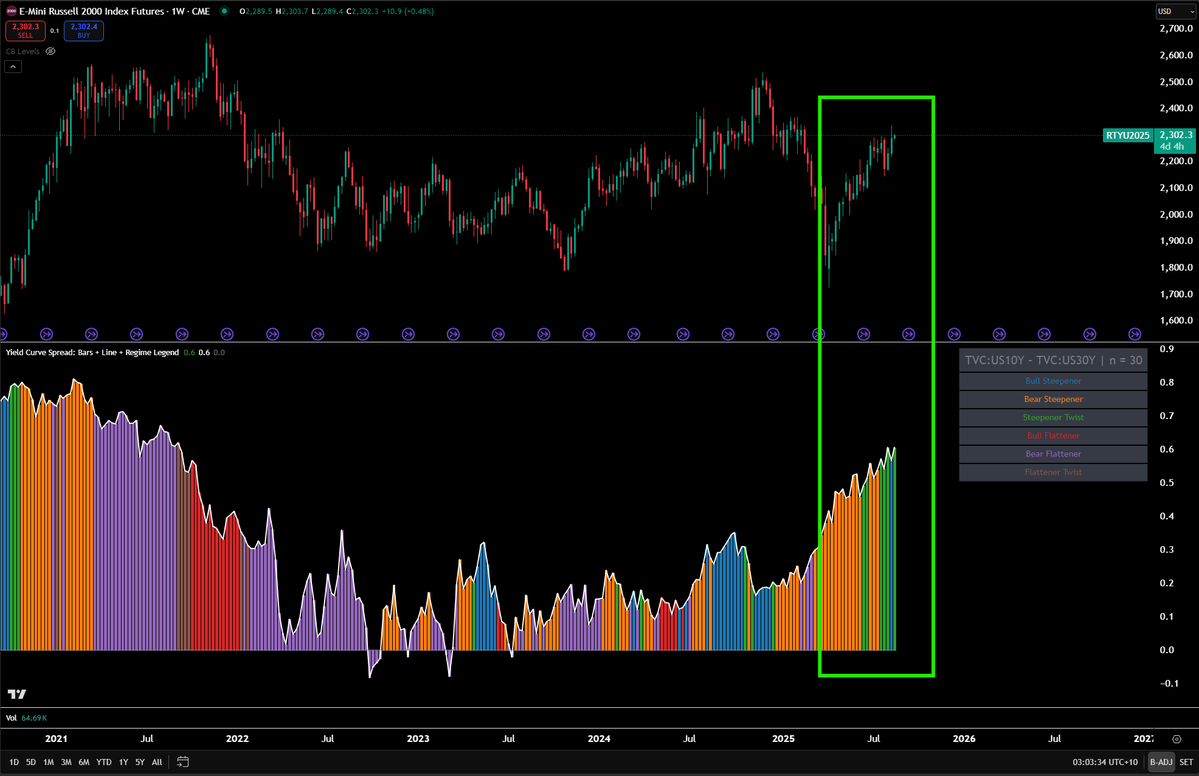

This is why the Russell has rallied as 10s30s curve has been steepening.

If some of these concepts are new for you, then there is an entire educational playbook on every single aspect of it laid out here. 100% free.

https://x.com/Globalflows/status/1955806585680486866

Here is the deal with the Fed right now, as long as inflation swaps are sitting above 3% and the Fed is allowing 50bps of cuts to be priced for this year, they are being to accommodative and actually increasing the probability of inflation and lowering the probability of a recession.

Everyone is so laser focused on the Sept cut happening or not that they are missing the fact that the larger context is one of the Fed being to accomadative.

This matters because if one of the major drivers of this rally has been driven by the Fed being to accommodative, what do you think happens when they shift their stance? All of the AI narratives and factor rotations will get smacked with macro volatility and cause a black hole in markets as people rush for the exit.

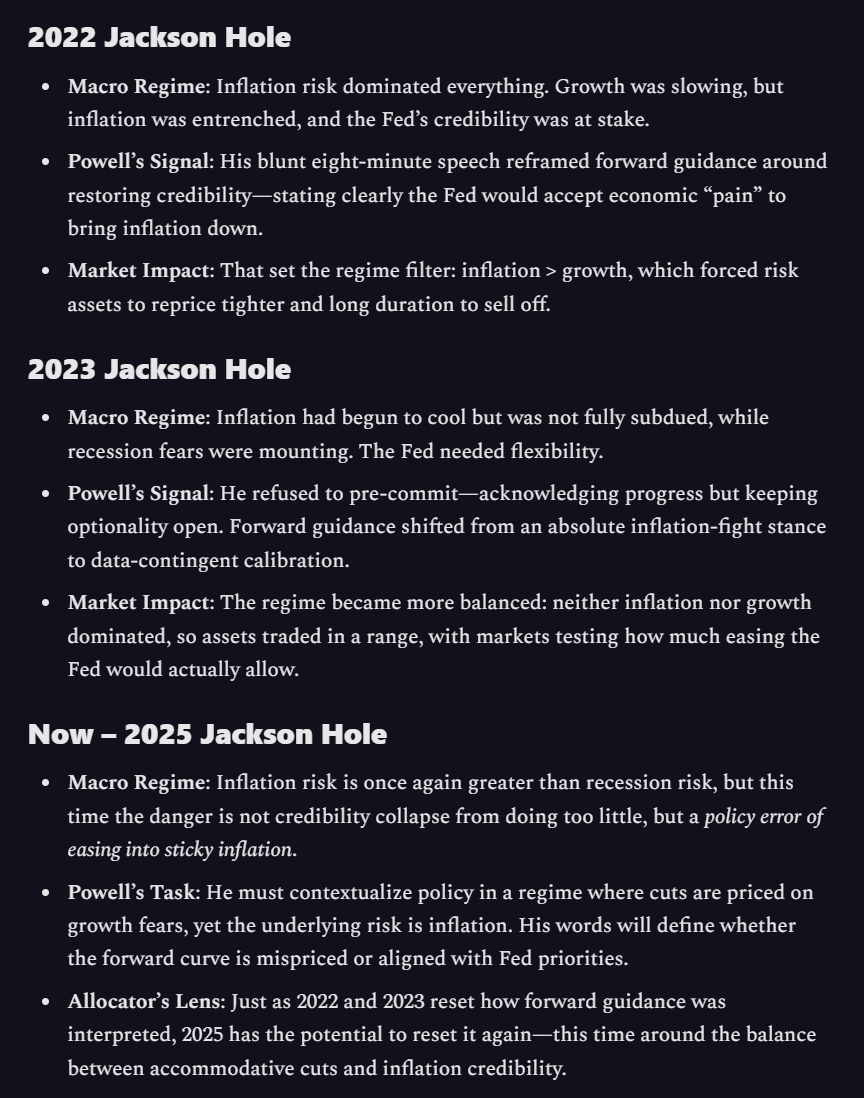

This is WHY Jackson Hole is such a critical step this week in the progression of the Fed's cycle.

The main idea is that the Fed is already operating in a tension where they are trying to manage the policy error they are making.

Like I said here, any error by the Fed will be priced by the long end of the curve and the currency. It doesn't matter who the Fed chair is; there are always constraints.

https://x.com/Globalflows/status/1957473364911735182

If the Fed continues on this path, we are almost certainly going to end with long end rates being higher. Read the entire report on this dynamic here:

https://x.com/Globalflows/status/1954751662662590820

The entire question is HOW FAST do we progress toward the inevitable end game of long-end rates dragging equities down.

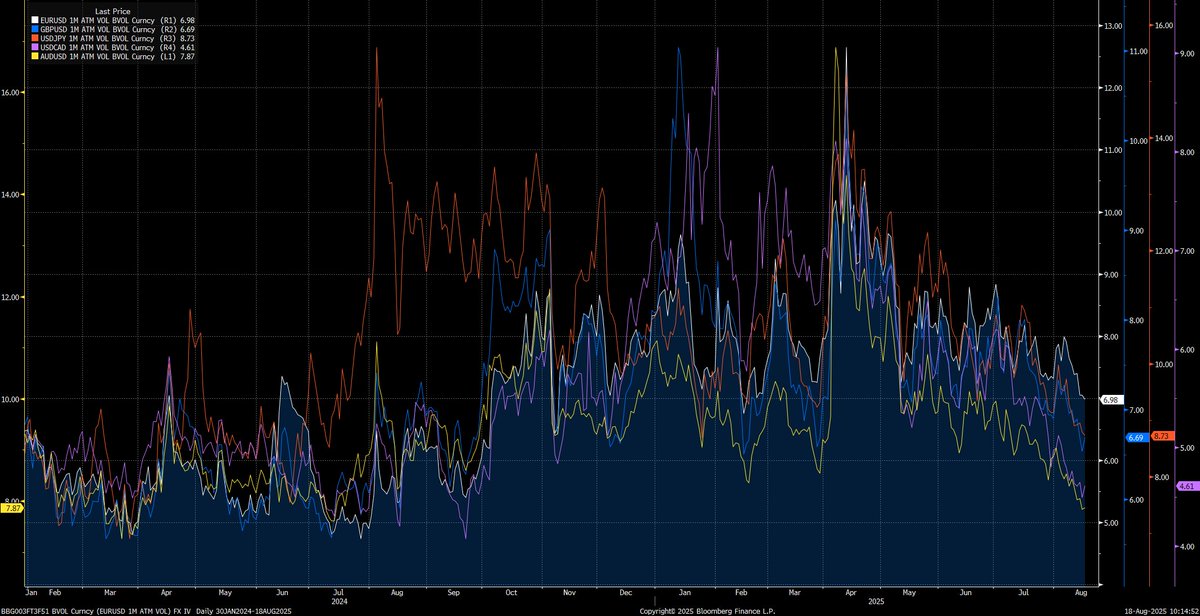

Volatility is still compressing in a range which is why Im still long risk assets.

And FX volatility continues to collapse:

https://x.com/Globalflows/status/1956922615668326439

So we aren't seeing macro volatility and long end rates cause this credit cycle to collapse. HOWEVER, if Powell comes out to dovish or to hawkish in this meeting, it would be easy for either extreme to cause volatility to spike.

Think about it like this, if they try to recontextualize the monetary policy framework for more dovish decisions, this could actually cause long end rates to rise because it is to accomadative relative to the inflation risk we are seeing.

Inversely, a stance that is to hawkish could begin to reprice how the 2026 pricing of the forward curve. This has been one of the primary drivers in the weaker dollar. See the Z5Z6 sofr contract below overlaid with the DXY.

In simple terms, for the credit cycle to continue and not undergo a shock, they CANNOT have a dramatic change to their monetary policy framework. The thing is, Jackson Hole has consistently been a place where they reframe things. The wild card is the fact that Powell is going to get booted next year and so in one sense no one really cares what he has to say.

This goes back to understanding the actual constraints of the Fed and Powell. The Fed is NOT exerting its force in markets which is why the curve has been steepening as they fall behind.

So while everyone focuses on Powell, the more important thing will be watching for how theyre just keeping things constant and the larger macro constraints function.

https://x.com/Globalflows/status/1953099622748131819

Positioning in the forward curve is already pricing a relatively dovish outcome. All we need is the absence of change. If you have not read them yet, I wrote full reports on the forward curve and Jackson Hole here:

https://x.com/Globalflows/status/1957297835906658310

And here:

https://x.com/Globalflows/status/1956906665137279223

Everything is setting up for a larger macro move but for now, I remain bullish risk assets and bearish bonds until macro volatility spikes and begins to drag on risk assets. There will be a moment to exit the train but we are not there yet. Jackson Hole will be a critical signal in this progression.

You can find all of the free educational playbooks on interest rates, the credit cycle, and macro here:

https://x.com/Globalflows/status/1955806585680486866

Michael Saylor turned MicroStrategy into a $33B Bitcoin vault, fueled by debt and equity dilution. The model depends on Bitcoin’s relentless rise—if BTC stalls below $40K, the structure could collapse, forcing the company to sell its core holdings.

StarPlatinum/13 hours ago

From SushiSwap’s Chef Nomi to Terra’s Do Kwon, history shows what happens when founders leave right after TGE. Some cashed out, some collapsed, others pivoted—but nearly all tokens crashed, leaving investors with heavy losses.

StarPlatinum/2 days ago

After turning $1K into $130K in my first cycle—and watching it crash—I learned the hard way about securing profits. In my 3rd cycle, with $6M+ made, I’m selling all crypto before December. Here’s how to build a smart, risk-based exit strategy.

cyclop/5 days ago

Chainlink ($LINK) is the essential infrastructure for the RWA and tokenization boom, securing 84% of the oracle market. With a powerful tokenomics flywheel and major TradFi partnerships, its a key large-cap play for this cycle.

Miles Deutscher/6 days ago

Fueled by soaring institutional demand, record-high network activity, and a severe supply crunch, Ethereum is poised for significant growth. This analysis breaks down why these three factors are creating a path for $ETH to hit $10,000 this cycle.

Bull Theory/7 days ago

With Ethereum hitting $4,300, this analysis weighs two scenarios: a parabolic run toward a $6.6k year-end target fueled by institutional inflows, or a healthy pullback first. The author details a trading plan focused on key levels, ETH-beta altcoins (DeFi, stables), and patience for altseason.

VirtualBacon/2025.08.13

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link