The Downfall of a Crypto Influencer: The Story of Gainzy

StarPlatinum

StarPlatinum

One of the earliest influencers to promote FTX

Now the main streamer on PumpFun

The story of Gainzy is darker than you think🧵

Before crypto, he was a process analyst.

A chess teacher.

A software engineer.

But in 2017, he quit everything and entered crypto full-time

Right at the peak of the ICO boom.

He joined a project called Obsidian as a dev.

It later became one of the most infamous ICO rugs of the cycle.

Even Cardano’s name got dragged into it years later.

That was the first time Gainzy’s name got linked to controversy.

After that, he focused on trading.

He built a bot that gave him a steady income through referral links.

The Gainzy Bot

And ended up selling it in 2018 but that wasn’t his last attempt with trading bots

He became one of the earliest influencers to promote FTX.

At his peak, he was making $50K month just from users trading under his code.

Even Cobie was using it

But when FTX collapsed, he lost a big part of his stack.

He went from supporter to critic overnight

Later, he joined Rollbit as a sponsored streamer.

And this is where things turned dark.

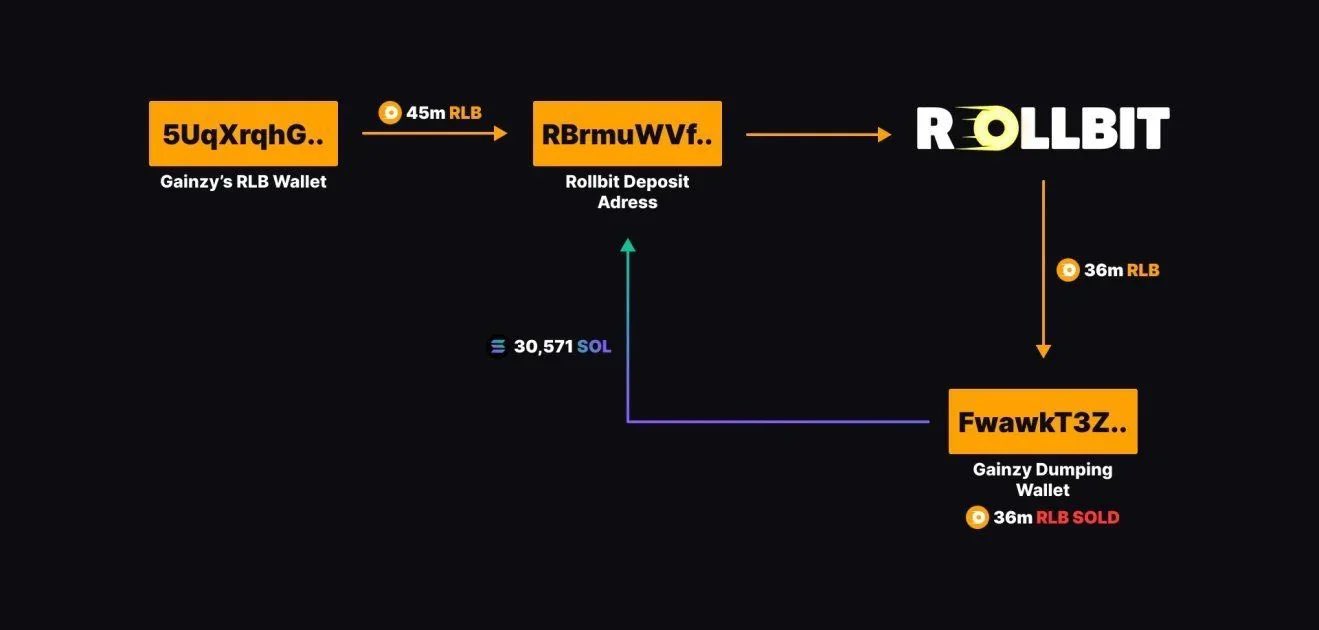

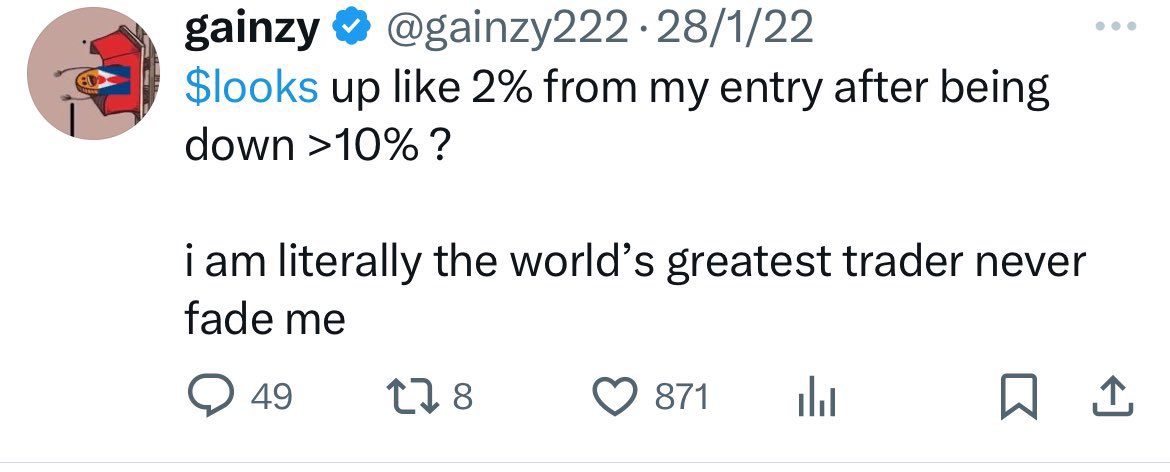

He shilled $RLB while secretly selling millions worth of tokens.

On-chain data linked him to wallets mixing funds through Rollbit itself.

ZachXBT and others called him out.

Gainzy left Rollbit and joined Stake.

But the controversy stayed

Especially after more undisclosed shills surfaced.

He denied most of it.

Now, he’s one of the main streamers for PumpFun.

He’s gone viral for his meltdown during an ETH crash.

He launched his stream memecoin.

And he’s back in the spotlight but not for good reasons today

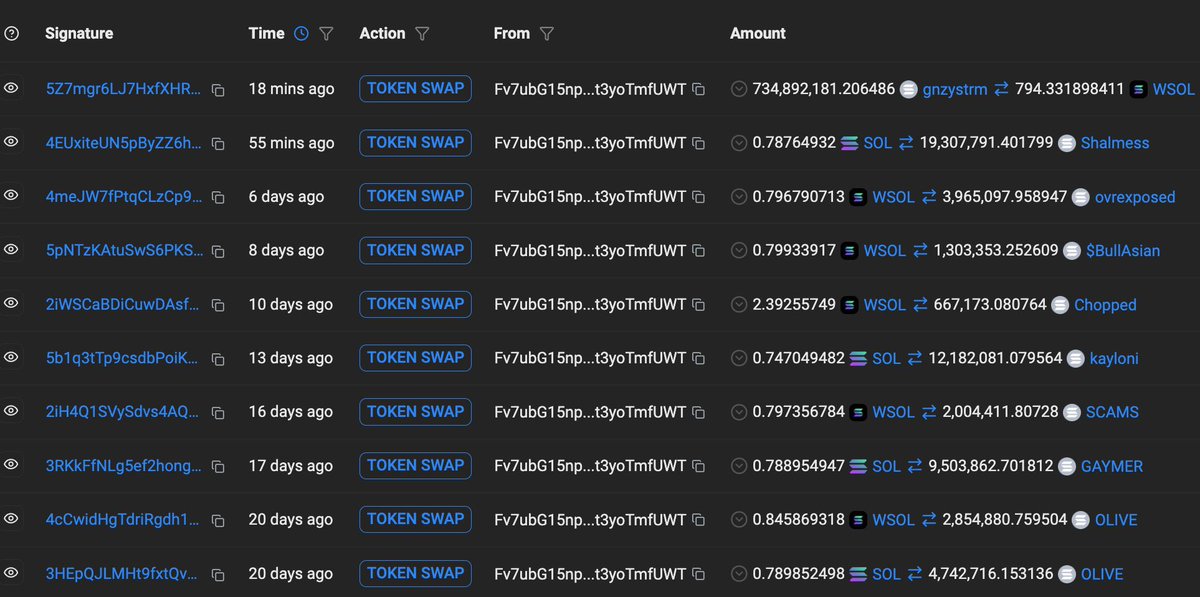

Today Gainzy crashed his own token live.

Selling $169,000 of his token $GNZYSTRM

But minutes later, a new wallet, created only 24h ago, started buying the bottom

That wallet made $400,000 profit

The wallet has no other trades only Gainzy’s token

Was this coincidence?

Arthur Hayes is best known as the former CEO of BitMex. However, he is also an influential and provocative essayist and crypto commentator who was convicted, then pardoned, for violating the Bank Secrecy Act

Arkham/1 days ago

The author predicts that a new altseason is starting as money rotates into Ethereum and large-cap altcoins. To prepare, the author shares a personal portfolio of top picks across the DeFi, AI, and memecoin narratives, including $PEPE, $SOL, and $ENA. The strategy is to position now before the rally, with a plan to scale out of positions at new all-time highs.

Mister Crypto/2 days ago

This article argues that a recessionary crash is inevitable, based on the historic inversion and normalization of the yield curve. Despite a longer-than-usual delay, the author maintains a firm bearish outlook and predicts Bitcoin will drop to the $90K–$94K range. The author outlines a clear plan to sell spot holdings and take short positions in anticipation of this coming move.

Doctor Profit/3 days ago

A massive supply chain attack has compromised 18 foundational NPM packages, affecting billions of weekly downloads. Hackers pushed malicious code designed to be a crypto clipper, which silently swaps wallet addresses to steal funds. The incident was quickly caught, but it highlights a critical vulnerability in the core infrastructure of the crypto ecosystem.

StarPlatinum/4 days ago

The article argues that upcoming Federal Reserve rate cuts will inject trillions in liquidity, triggering a new macro cycle for crypto. This shift in capital from traditional assets to riskier ones is expected to ignite a massive altseason. The author identifies this as the perfect setup and lists several low-cap altcoins with high potential for explosive growth.

Pepesso/5 days ago

The article argues that passive, buy-and-hold crypto investing is flawed, as it offers lower returns with far greater risk than the stock market. Instead, it suggests that crypto’s true advantage lies in active trading strategies. A simple long/short strategy, for example, demonstrated vastly superior risk-adjusted returns, proving that to succeed in the volatile crypto market, you must be an active participant, not a passive one.

Pavel | Robuxio/2025.09.03

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link