Fed Rate Cuts Could Spark Altseason. Here Are 5 Alts to Watch.

Pepesso

Pepesso

The biggest altseason starts in 2 days

FED will cut rates and inject $4T in market

Right alts will pump 200-250x in next 8 days

Here are the 5 HIDDEN lowcaps that will pump 250-500x 👇

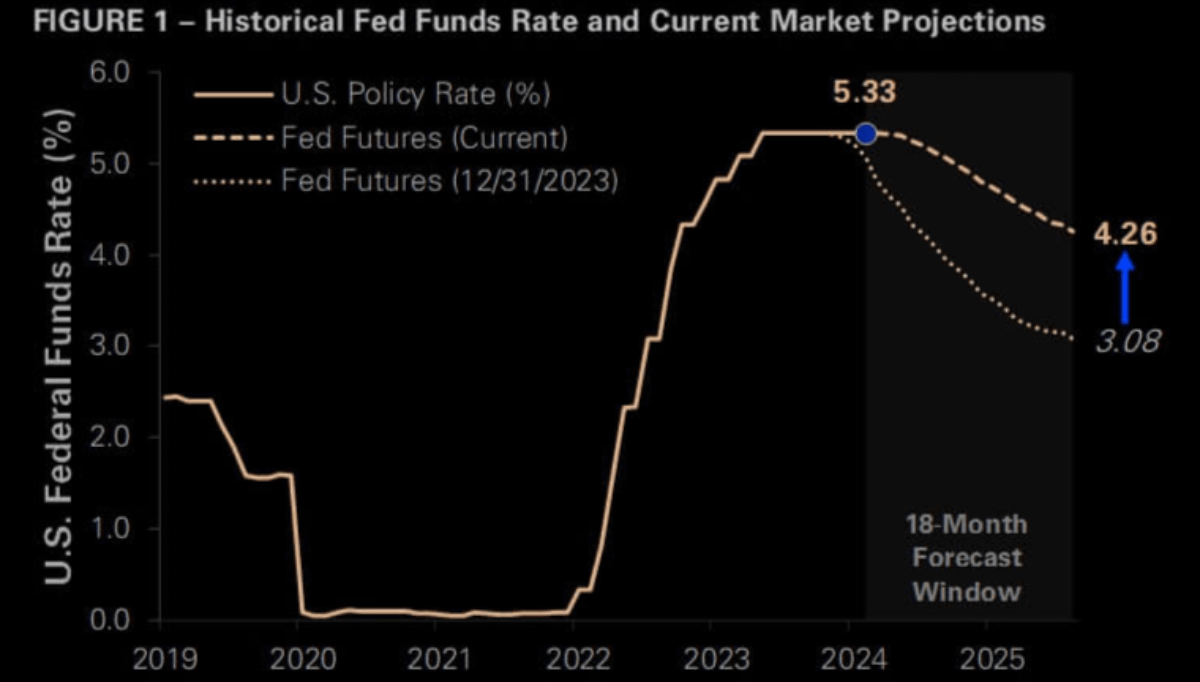

The Fed is shifting to rate cuts after years of tight policy

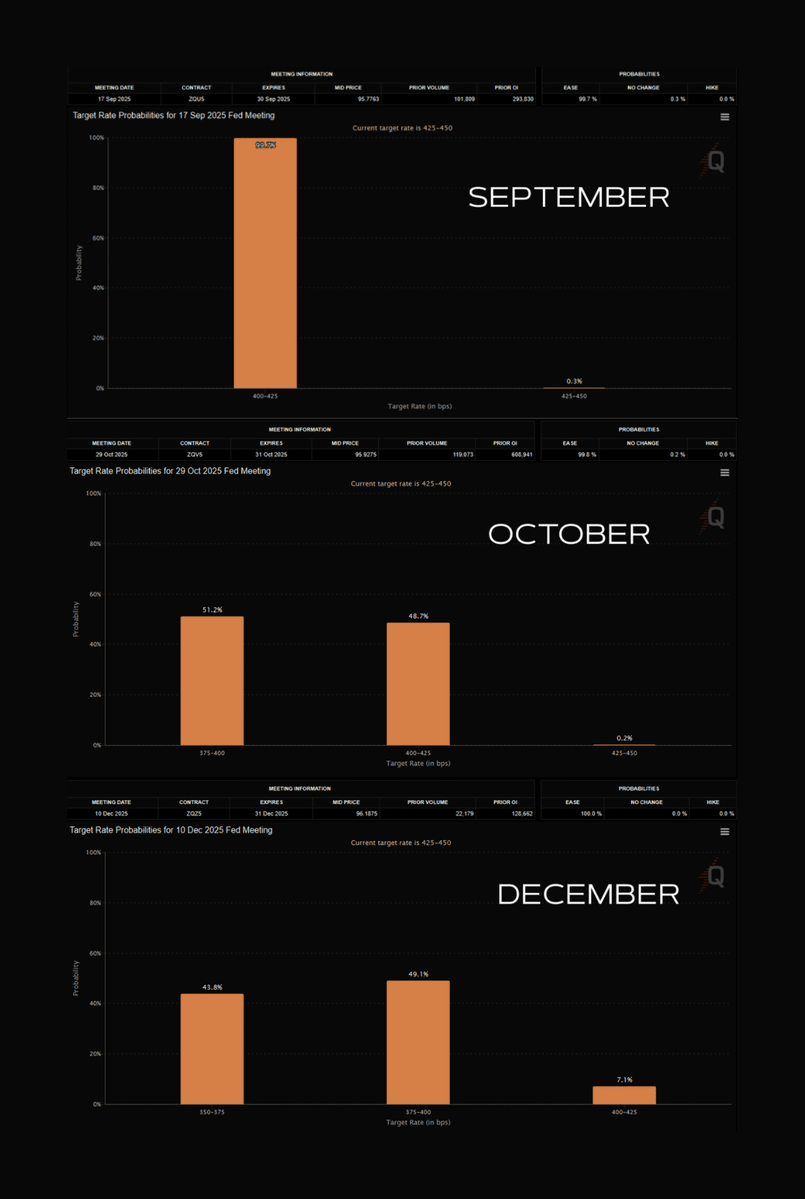

The first cut will be announced in just days - and it’s only the beginning

Capital reacts instantly to cheaper money, looking for new niches

And guess where that money flows first? That’s right - into crypto

This year the Fed is planning a double rate cut, kicking off a wave of easing

The Fed is effectively admitting: the economy can no longer bear the pressure

Each of these cuts will inject so much cash into the markets it’s hard to believe

Even conservative estimates suggest +25% to market cap after this move

When the Fed cuts rates, the cost of credit for businesses and government drops

This frees up hundreds of billions no longer needed for debt servicing

Investors see no point in holding low-yield bonds

They chase higher returns and that’s why liquidity shifts into stocks and crypto

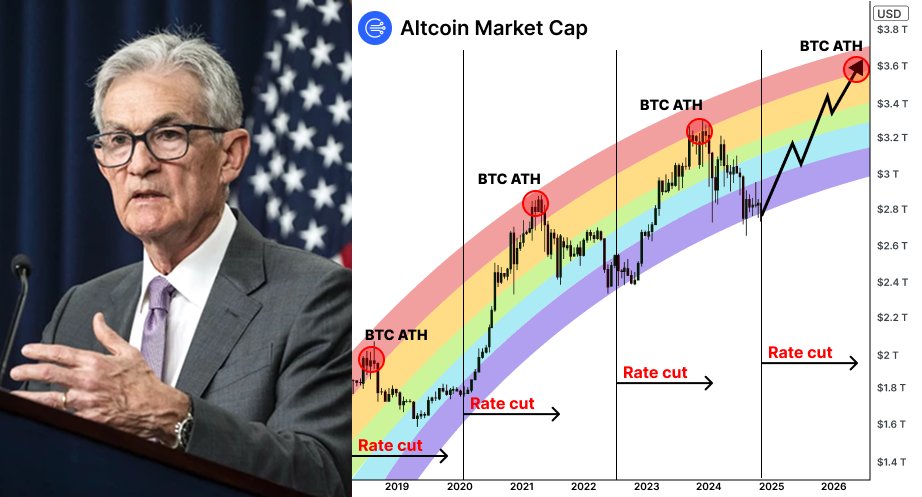

If you remember previous cycles, rate cuts always changed the game

The bond market weakened and capital started flowing into risk assets

That’s when crypto broke out, showing the fastest growth

And today’s expected rate cuts are again creating the perfect setup for alts

No one can stop Trump in his push to reshape the Fed

He started with Lisa Cook, removing her from the board and sending a clear signal

Anyone - including Powell - who goes against the White House's path will lose their seat

And more signs are pointing to Powell being replaced by Stephen Miran

So we have a clear picture - rates going down, liquidity going up

Trump controls the Fed and is pushing for the biggest easing in years

This opens a new macro cycle where risk assets are the main play

Altseason is no longer a theory but an unfolding event - here are the alts I picked

1️⃣ @maplefinance - $SYRUP

• DeFi platform for non-conservative institutional lending via smart contract pools

• Growing institutional demand could make it a leader in DeFi lending this cycle

• Price: $0.52

• Market Cap: $622M

2️⃣ @flock_io - $FLOCK

• Decentralized AI platform combining federated learning with blockchain to train models without centralized data

• With unique tech and strong marketing, this token could lead the AI narrative this cycle

• Price: $0.28

• Market Cap: $60.79M

3️⃣ @ethena_labs - $ENA

• Synthetic dollar protocol offering a crypto-native alternative to traditional banks via Internet Bond

• With massive liquidity and stablecoin demand, Ethena could grow into a global Web3 financial tool

• Price: $0.66

• Market Cap: $4.6B

4️⃣ @zora - $ZORA

• Decentralized platform on Ethereum L2 Base for minting and monetizing NFTs and tokens

• Thanks to speed and low fees, it could become the top hub of the creator economy in Web3

• Price: $0.07

• Market Cap: $239M

5️⃣ @wormhole - $W

• Wormhole is a universal connection layer linking over 20 blockchains and unlocking new capital and audiences

• As core infrastructure, it could become central to DeFi, NFTs and cross-chain governance in Web3

• Price: $0.07

• Market Cap: $365.42M

6️⃣ @cookiedotfun - $COOKIE

• The largest index of AI agents and data layer aggregating the market via http://cookie.fun, simplifying research and eliminating chaotic investing

• With 7TB of live data and $COOKIE token as utility, this project could become core infrastructure for the agent economy and AI narrative

• Price: $0.11

• Market Cap: $71.76M

Arthur Hayes is best known as the former CEO of BitMex. However, he is also an influential and provocative essayist and crypto commentator who was convicted, then pardoned, for violating the Bank Secrecy Act

Arkham/1 days ago

The author predicts that a new altseason is starting as money rotates into Ethereum and large-cap altcoins. To prepare, the author shares a personal portfolio of top picks across the DeFi, AI, and memecoin narratives, including $PEPE, $SOL, and $ENA. The strategy is to position now before the rally, with a plan to scale out of positions at new all-time highs.

Mister Crypto/2 days ago

This article argues that a recessionary crash is inevitable, based on the historic inversion and normalization of the yield curve. Despite a longer-than-usual delay, the author maintains a firm bearish outlook and predicts Bitcoin will drop to the $90K–$94K range. The author outlines a clear plan to sell spot holdings and take short positions in anticipation of this coming move.

Doctor Profit/3 days ago

A massive supply chain attack has compromised 18 foundational NPM packages, affecting billions of weekly downloads. Hackers pushed malicious code designed to be a crypto clipper, which silently swaps wallet addresses to steal funds. The incident was quickly caught, but it highlights a critical vulnerability in the core infrastructure of the crypto ecosystem.

StarPlatinum/4 days ago

A look into the controversial history of crypto influencer Gainzy reveals a pattern of profiting from shilling and insider moves, not trading. The story alleges his involvement in an ICO rug pull and secret token sales as a sponsored streamer. Now on PumpFun, Gainzy is accused of crashing his own memecoin live on stream, with a new wallet profiting from his followers losses.

StarPlatinum/2025.09.05

The article argues that passive, buy-and-hold crypto investing is flawed, as it offers lower returns with far greater risk than the stock market. Instead, it suggests that crypto’s true advantage lies in active trading strategies. A simple long/short strategy, for example, demonstrated vastly superior risk-adjusted returns, proving that to succeed in the volatile crypto market, you must be an active participant, not a passive one.

Pavel | Robuxio/2025.09.03

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link