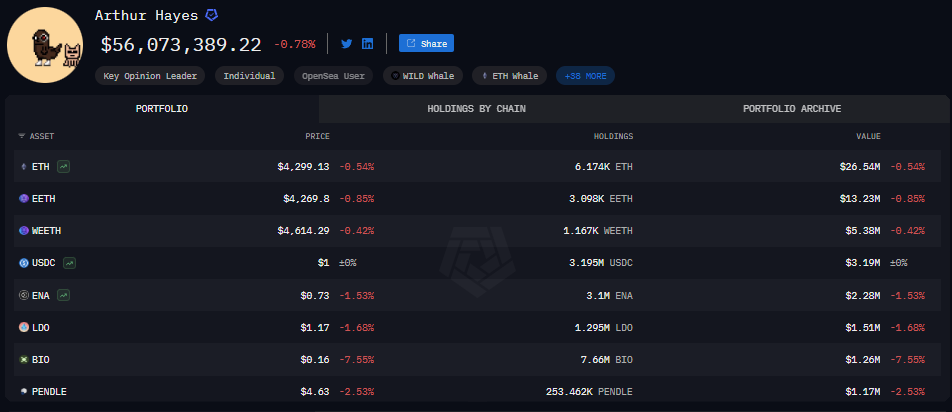

Arthur Hayes: Net worth and on-chain holdings

Arkham

Arkham

Introduction to Arthur Hayes

Arthur Hayes is the co-founder and former CEO of BitMEX, a leading cryptocurrency derivatives exchange which launched in November 2014. With his background as an equity derivatives trader for Deutsche Bank and Citibank in Hong Kong, Hayes utilized his expertise in derivatives to help design the now industry-standard perpetual swap contract, a key innovation which pushed BitMEX to market dominance in the early days of the industry.

Over the years, he has become an influential figure in the crypto space, with his sharp market analyses and often provocative essays, even with the various controversies surrounding his own actions through the years.

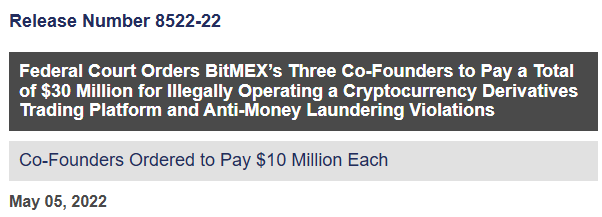

In 2022, Arthur Hayes and his fellow BitMEX co-founders were convicted for violating the Bank Secrecy Act, for which Hayes received six months of home detention, two years probation and a fine of $10 million. However, they were later pardoned by US President Donald Trump in March 2025.

Summary

- Arthur Hayes began his career in finance as a trader, before launching BitMEX and designing the now ubiquitous perpetual swap contract.

- Despite his conviction in 2022 for his violation of the Bank Secrecy Act under BitMEX, he remains a central figure in crypto with verified on-chain holdings of $57 million.

- His net worth is estimated to be between $200 million and $400 million, factoring in his verified on-chain holdings, equity in BitMEX, Maelstrom fund and potentially unverified holdings of the ENA token which he was a major backer of.

- He is a crypto whale, with on-chain evidence and industry analysis suggesting notable holdings in Bitcoin and Ethereum.

- His provocative commentary and bold predictions, published via his Substack, continue to sway market sentiment and cement his reputation as a thought leader in the industry.

Arthur Hayes Net Worth

During the 2021 crypto bull run, there was speculation in the media that Arthur Hayes was a billionaire. However, his verifiable on-chain holdings show his crypto wealth peaking at $88m near the end of 2021, some way off from $1 billion.

Hayes’ net worth, then, is composed of a lot more than just his verifiable on-chain holdings ($57 million at the time of writing). His involvement in the founding of BitMEX which, according to Hayes, had an annual trading volume of $1 trillion in 2019, is likely to be the main reason for the speculation around Hayes’ billionaire status.

To work out Hayes’ true net worth, estimates for the current value of BitMEX and Hayes’ remaining stake in the trading platform are essential.

Based on valuations of other similar crypto trading platforms, a conservative estimate of BitMEX’s enterprise value is $500 million, factoring in its current trading volume and a historical valuation of $3.6 billion in 2019 when BitMEX had a $1 trillion annual trading volume.

Hayes’ equity percentage in BitMEX is unknown but, as a founder, it is likely to be substantial. He co-founded BitMEX with two others and, assuming they had equal shares, Hayes’ maximum share is 33%. However, it is likely that over the years, through the various scandals, his equity was diluted.

Additionally, Hayes’ family office runs an investment fund by the name of Maelstrom which targets venture-stage investments, and he was an early backer of Ethena’s ENA token. It is possible that Hayes’ ENA holdings are much higher than just those currently identified on his Arkham entity.

So, our conservative estimate of Arthur Hayes’ net worth is between $200 million and $400 million.

Valuing BitMEX in 2025

BitMEX was once one of the most dominant players in the crypto derivatives market, with over $1 trillion in annual trading volume in 2019 and a private valuation of $3.6 billion.

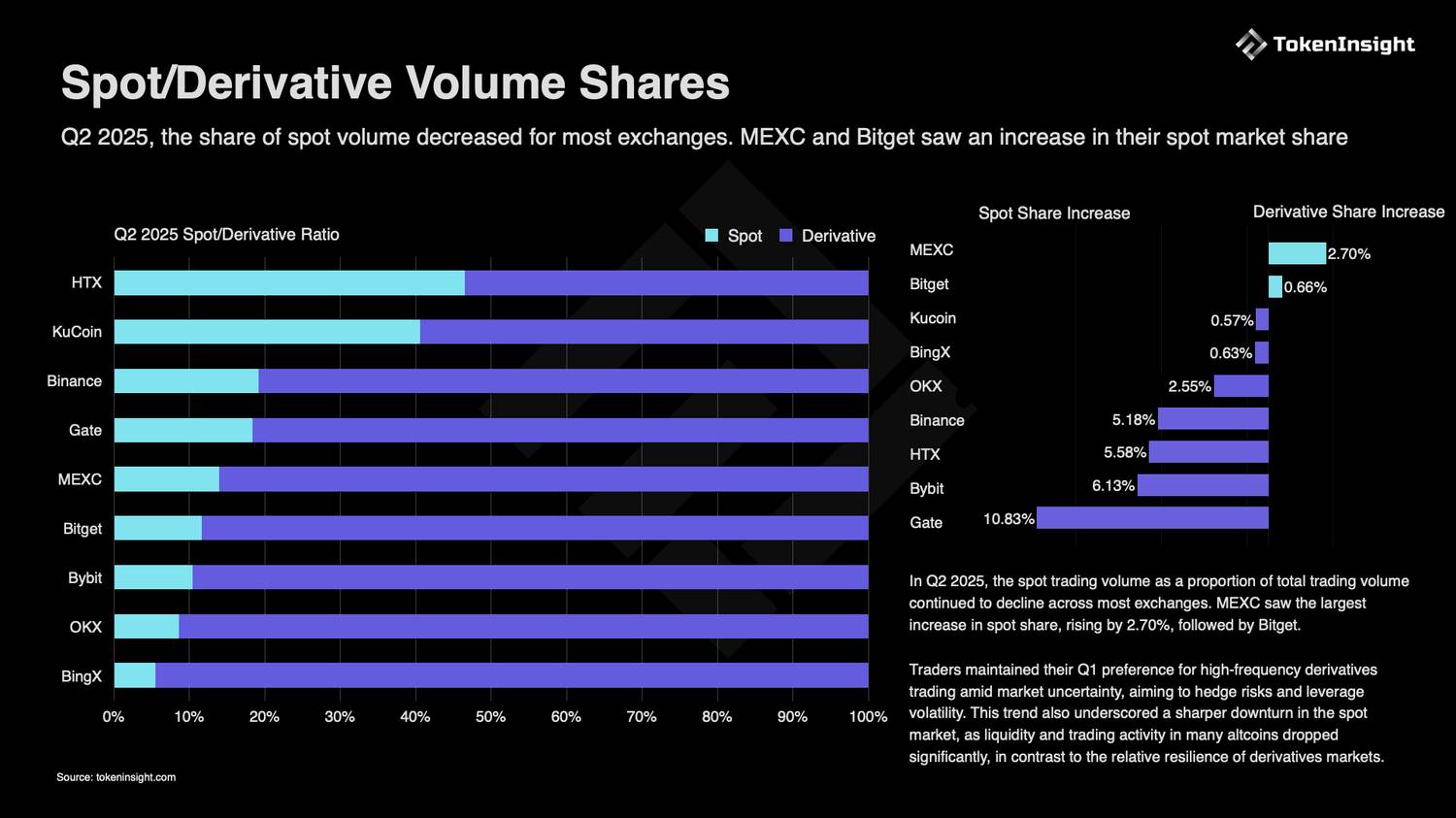

It was a pioneer of the perpetual swap, an Arthur Hayes’ innovation, and commanded a significant share of global crypto leverage trading. However, its market share has declined sharply over the past few years as competitors have captured most of the growth in derivatives trading.

Regulatory challenges and leadership changes also slowed BitMEX’s momentum, leaving it a much smaller player in 2025 than during its peak years.

Recent data shows BitMEX’s daily trading volume hovering around $677 million, which annualizes to roughly $247 billion in trading activity — about 75% lower than its 2019 peak. If we apply a similar valuation-to-volume multiple as in 2019, but adjust downward to reflect its diminished competitive position, and various legal speedbumps, BitMEX’s enterprise value comes out significantly lower than $3.6 billion.

Based on this, a reasonable estimate for BitMEX’s 2025 valuation is around $500 million. This figure reflects both its still-respectable trading volume and the reality that BitMEX is no longer the dominant force it once was. While it remains profitable and relevant within the crypto derivatives niche, its relative importance in the market has shrunk — and so has its valuation.

Billionaire Status

Public speculation has long swirled around whether Arthur Hayes has officially achieved billionaire status. At the peak of BitMEX’s success, Hayes was widely reported as one of crypto’s youngest billionaires, including by Vanity Fair in April 2021. His stake in BitMEX would have likely raked in immense earnings during the prime of BitMEX’s business. In 2019, BitMEX saw more than $1 trillion in volume on the exchange, with a 57% market share on crypto derivatives market, beating out competitors like Deribit and the CME Group.

Hayes is also known for his large holdings of Bitcoin and Ethereum, although the exact figures remain private. Additionally, Hayes established his own family office, Maelstrom fund, in 2023, of which he is the Chief Investment Officer.

During 2021, there was significant speculation surrounding Hayes' net worth, with it being widely reported that his net worth exceeded $1 billion during the peak of the bull run.

Nevertheless, due to the private nature of his finances and the volatility that his personal crypto holdings are subject to, it is hard to verify many of the claims surrounding his net worth.

How Did Arthur Hayes Get Into Crypto?

Hayes’s journey began in traditional finance. Growing up in Detroit and later graduating from the Wharton School of Business in 2008, Hayes worked as an equity derivatives trader for Deutsche Bank and Citibank, before relocating to Hong Kong. These experiences equipped him with the technical knowledge required to design complex derivatives, forming the basis of his future work at BitMEX.

In 2014, alongside Benjamin Delo and Samuel Reed, Hayes founded BitMEX, a crypto trading platform targeting professional traders through their new highly leveraged perpetual contracts. BitMEX allowed traders to access leverage up to 100x, and its flagship product, the perpetual swap contract, quickly became one of the most traded instruments in the industry. According to data from TokenInsight in 2025, volume traded on perpetual swap contracts easily dwarfs spot trading volumes by a factor of 4-6x.

The Bank Secrecy Act

Arthur Hayes stepped down from his position as CEO at BitMEX following an indictment by the U.S. Department of Justice in October 2020, along with his co-founders, Benjamin Delo and Samuel Reed, as well as Gregory Dwyer, their Head of Business Development and first employee.

The charges focused on their failure to establish and maintain an adequate anti-money laundering (AML) program at BitMEX, which is a core requirement under the Bank Secrecy Act (BSA). Prosecutors alleged that BitMEX’s lax approach made it a prime vehicle for money laundering.

Hayes pleaded guilty in 2022, eventually receiving a sentence of two years probation, six months in home detention, and a $10 million personal fine. In a fortunate twist of fate for Hayes, in March 2025, US President Donald Trump issued a full federal pardon to Hayes and his three colleagues, formally erasing their criminal records.

Hayes’ ETH Whale Status

A "crypto whale" refers to an individual or entity holding a disproportionately large amount of a particular cryptocurrency, enough to impact market liquidity or price through their trades. On-chain analytics tools such as Arkham Intelligence have repeatedly identified Arthur Hayes as a major Ethereum (ETH) holder.

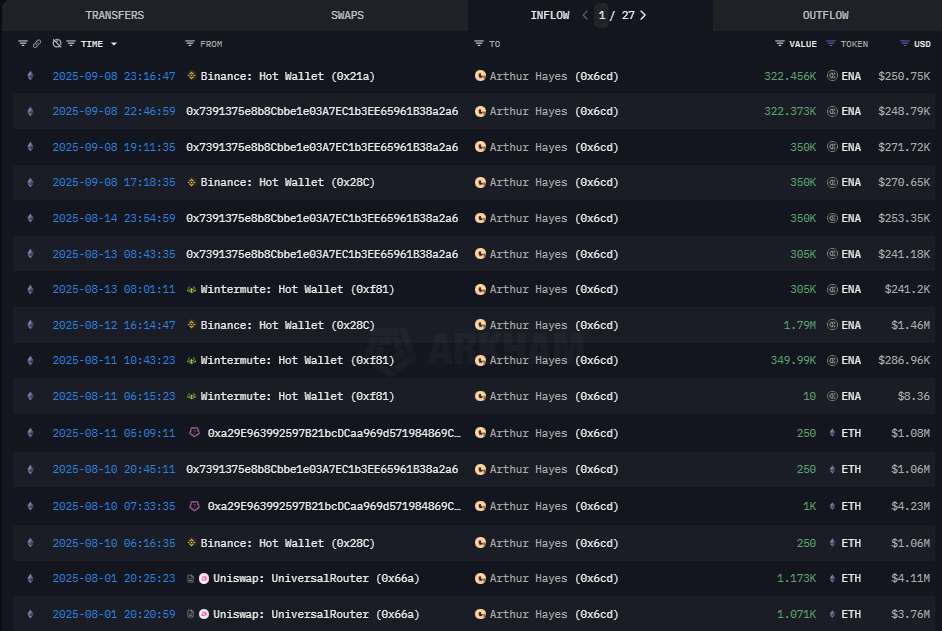

Recent data confirmed his purchases of 1,750 ETH, worth approximately $7.43 million, in early August 2025, adding to an already large holding of 4,424 ETH. The recent purchase brings his total to 6,174 ETH, which is worth over $26.5 million, at current market prices. Additionally, he holds another $18.7 million in EtherFi’s EETH and WEETH products, making ETH and ETH staking products just over 80% of his tracked on-chain net worth. Hayes also owns notable investments in Hyperliquid (HYPE), Ethena (ENA), Lido (LDO) and Pendle (PENDLE), totalling another $9M in value.

Arthur Hayes has been an outspoken supporter of Ethena (ENA), a synthetic dollar and yield-generating protocol that has gained significant attention in 2024 and 2025. Hayes was an early backer of the project and has frequently written about its potential to revolutionize stablecoin design and on-chain liquidity. His verified holdings of ENA are worth $3.9 million but it is possible Hayes' has a lot more ENA in separate, unverified holdings.

Through the scale of his purchases and their largely public nature, Hayes' on-chain movements allow him to significantly influence price sentiment surrounding specific crypto assets. Moreover, his commentary on his own holdings and transactions can also amplify short-term volatility, with his reach extending across both institutional and retail investors. His recent addition to his ETH position aligns with prevailing sentiment on improved macroeconomic trends and the growing popularity of the spot ETH ETFs, while his own tweets and commentary help to fuel further price action higher. Such influence underscores the dual impact that whales like Hayes can exert, shaping both market psychology and direct price action in the markets.

Non-Crypto Holdings

While the majority of his wealth lies in the digital asset space, Arthur Hayes is also known to be involved in other alternative investments.

In a video interview in 2025, he revealed that he recently invested into a stem cell business with clinics in Mexico and Bangkok, stating also that he is a regular customer of the business. He also joined the board of the company, which he chose not to reveal.

There is little other public information on Hayes’ non-crypto holdings. However, he did mention his preference for gold, ideally stored in a vault, after crypto and crypto-company equity, in a piece published on the BitMEX blog in late 2024.

Hayes’ Substack

With his growing influence over the years, Arthur Hayes has become a sort of celebrity in the crypto industry. In addition to his work at BitMEX and his personal investments, Arthur Hayes has also become renowned for his long-form essays.

He first began posting on Medium in early 2021, amidst the chaos of the Gamestop saga. He later also cross-posted his articles onto Substack, another content-hosting platform, in late 2022. His writing often blends macroeconomic analysis, with historical references and comedy, usually coupled with predictions which many might consider bold. Nevertheless, his content still draws in a large reader base.

Hayes is known for bold macro theses, notably forecasting extreme crypto rallies and cyclical corrections based on inflation trends, central bank liquidity, and interest rate regimes. In early 2025, Hayes accurately predicted Bitcoin’s correction to the $70,000–$75,000 range amid global monetary tightening, an event which played out in April triggered by Trump’s global tariffs. He then pivoted to a bullish stance, calling for Bitcoin to hit $250,000 and Ethereum to reach $10,000 by year-end, driven by accelerating institutional adoption and expanding global credit.

His blog regularly links price action to policy, arguing that persistent fiat debasement and rapid credit expansion will be the catalysts required for the eventual outsized move for crypto. Several price targets have come close to fruition as crypto markets surged in response to favorable rate cuts and rising inflation expectations, validating Hayes’ macro-focused approach.

While not all his predictions materialize, his contrarian stance and analytical depth have definitely cemented his role as one of the most unique perspectives in crypto.

Net Worth Over Time

As the majority of his assets are held in crypto and crypto-related companies, Arthur Hayes’ net worth has closely mirrored the rise and fall of the crypto markets since his days at BitMEX in 2014. As his wealth likely grew significantly during major bull markets, first seeing exponential gains in 2017 as Bitcoin and Ethereum reached new highs alongside BitMEX dominance in daily trading volume.

Hayes’ fortune was estimated to have surpassed $1 billion in 2021, riding the market-wide bull market driven by quantitative easing and interest rate cuts. During this period, his net worth surged, driven by trading fees from BitMEX and appreciation of his crypto holdings, primarily in BTC and ETH.

A pivotal setback came with the Bank Secrecy Act indictment and subsequent BitMEX fines in 2021 and 2022, resulting in large financial penalties and a step down from CEO, which substantially impacted his access to the exchange’s operational cash flows. Despite this, his strong exposure to BTC and ETH, likely continued to keep the correlation between crypto prices and his net worth, likely pushing his portfolio values higher in the 2024-2025 bull run.

Conclusion

Arthur Hayes’ career in crypto epitomizes both the extraordinary financial opportunities and intense volatility that define the industry. From his roots as a derivatives trader, Hayes swiftly rose to global prominence with the founding of BitMEX and popularizing the perpetual swap contract. Despite his legal struggles, including a high-profile Bank Secrecy Act conviction and multimillion-dollar penalties, Hayes’ continues to remain an influential figure in the space, through his sharp market commentary and publicly acknowledged whale status.

His net worth is estimated to be between $200 million and $400 million, factoring in his verified on-chain holdings, equity in BitMEX, Maelstrom fund and potentially unverified holdings of the ENA token which he was a major backer of. However, this estimation is based on conservative estimates of the enterprise value of BitMEX in 2025, and Hayes' remaining stake in the company. Furthermore, whilst Hayes' verified on-chain holdings are just $57 million, it is possible he has unidentified wallets which would add to his overall net worth.

The author predicts that a new altseason is starting as money rotates into Ethereum and large-cap altcoins. To prepare, the author shares a personal portfolio of top picks across the DeFi, AI, and memecoin narratives, including $PEPE, $SOL, and $ENA. The strategy is to position now before the rally, with a plan to scale out of positions at new all-time highs.

Mister Crypto/2 days ago

This article argues that a recessionary crash is inevitable, based on the historic inversion and normalization of the yield curve. Despite a longer-than-usual delay, the author maintains a firm bearish outlook and predicts Bitcoin will drop to the $90K–$94K range. The author outlines a clear plan to sell spot holdings and take short positions in anticipation of this coming move.

Doctor Profit/3 days ago

A massive supply chain attack has compromised 18 foundational NPM packages, affecting billions of weekly downloads. Hackers pushed malicious code designed to be a crypto clipper, which silently swaps wallet addresses to steal funds. The incident was quickly caught, but it highlights a critical vulnerability in the core infrastructure of the crypto ecosystem.

StarPlatinum/4 days ago

The article argues that upcoming Federal Reserve rate cuts will inject trillions in liquidity, triggering a new macro cycle for crypto. This shift in capital from traditional assets to riskier ones is expected to ignite a massive altseason. The author identifies this as the perfect setup and lists several low-cap altcoins with high potential for explosive growth.

Pepesso/5 days ago

A look into the controversial history of crypto influencer Gainzy reveals a pattern of profiting from shilling and insider moves, not trading. The story alleges his involvement in an ICO rug pull and secret token sales as a sponsored streamer. Now on PumpFun, Gainzy is accused of crashing his own memecoin live on stream, with a new wallet profiting from his followers losses.

StarPlatinum/2025.09.05

The article argues that passive, buy-and-hold crypto investing is flawed, as it offers lower returns with far greater risk than the stock market. Instead, it suggests that crypto’s true advantage lies in active trading strategies. A simple long/short strategy, for example, demonstrated vastly superior risk-adjusted returns, proving that to succeed in the volatile crypto market, you must be an active participant, not a passive one.

Pavel | Robuxio/2025.09.03

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link