Why Fartcoin Could Hit $10+ in This Cycle

Donny

Donny

🧵 Fartcoin can go beyond $10.

Full breakdown:

> Multi chart confluence.

> Highest global mindshare potential.

> Dilution proof.

> Comparisons to other top memes.

> Cycle context.

1/13 Important charts

FARTCOIN/BTC ≈ SOL/BTC (2021)

When a token bottoms against Bitcoin and starts trending up into macro liquidity expansion(more on this coming) — that’s your signal for an insane runner.

These are the first movers into parabola.

A rare find in todays market where the majority of tokens are still finding a bottom vs BTC.

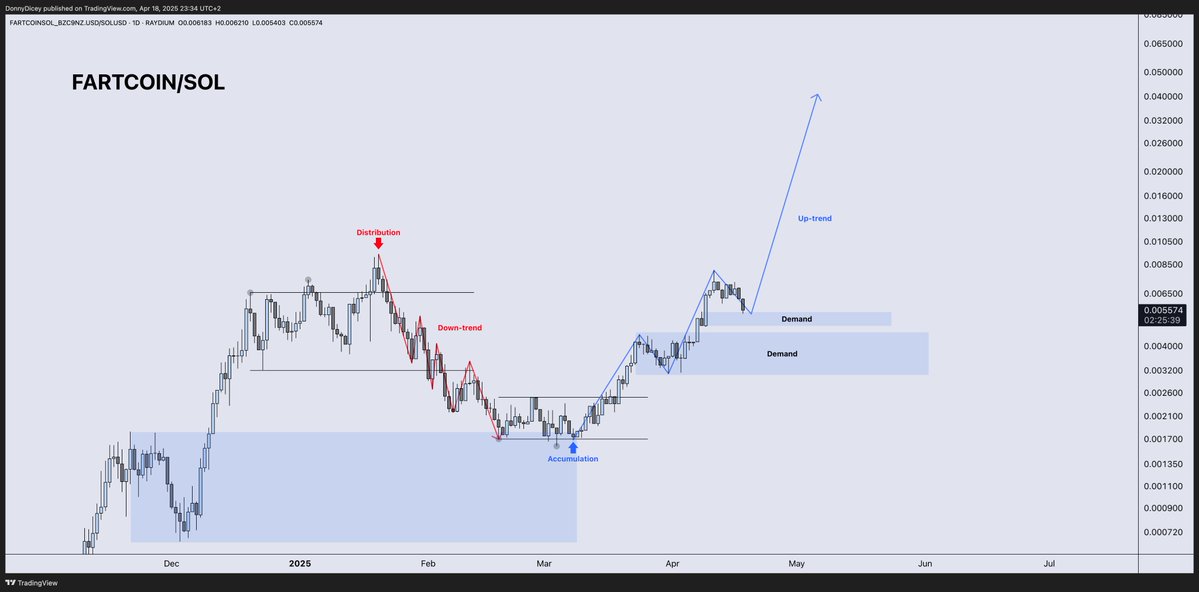

2/13 FARTCOIN/SOL: Meme vs L1

Textbook Wyckoff models on both ends of the chart.

Price broke out of an accumulation range and is now trending up vs Solana. Demand below each leg.

Chart translation: If SOL runs, Fartcoin will outrun it.

Similarly to what followed the distribution — SOL dumped and Fartcoin dumped harder, down-trending vs SOL.

Fartcoin already leading vs it's L1.

Solana hasn’t even broken out yet of it's bottoming accumulation range yet.

All of the above tells us Fartcoin will run into price discovery first.

Outpacing it's L1 means if Solana pulls a clean 3.5x move to its 1.618 Fib — and Fartcoin maintains outperformance at just a 3x relative factor — That’s a 10.5x move.

The exact ratio will be clearer once SOL confirms the breakout from this accumulation range.

On a log scale, Fartcoin has a 1.618 target around 12.35B

Fartcoin would need to outpace SOL by 4.8x to achieve that level or simply be a beneficiary of a liquidity shift after SOL hits that level to send Fartcoin even higher.

This is typically seen during an "end of cycle liquidity shift" from majors to the top plays and ultimately trickling further down the risk curve until the cycle comes to an end.

Here's an example of $LTC and $DOGE in the 2017 cycle.

There is confluence for passing the $10b mark for Fartcoin.

3/13 Stock Market Collapses — Fartcoin Rips:

This was a massive signal and another large attention grabbing moment.

The stock market down -21% during peak fear, uncertainty and doubt and Fartcoin pushing 5x off the lows.

What do we think happens when risk appetite is fully renewed?

4/13 Mindshare Capacity:

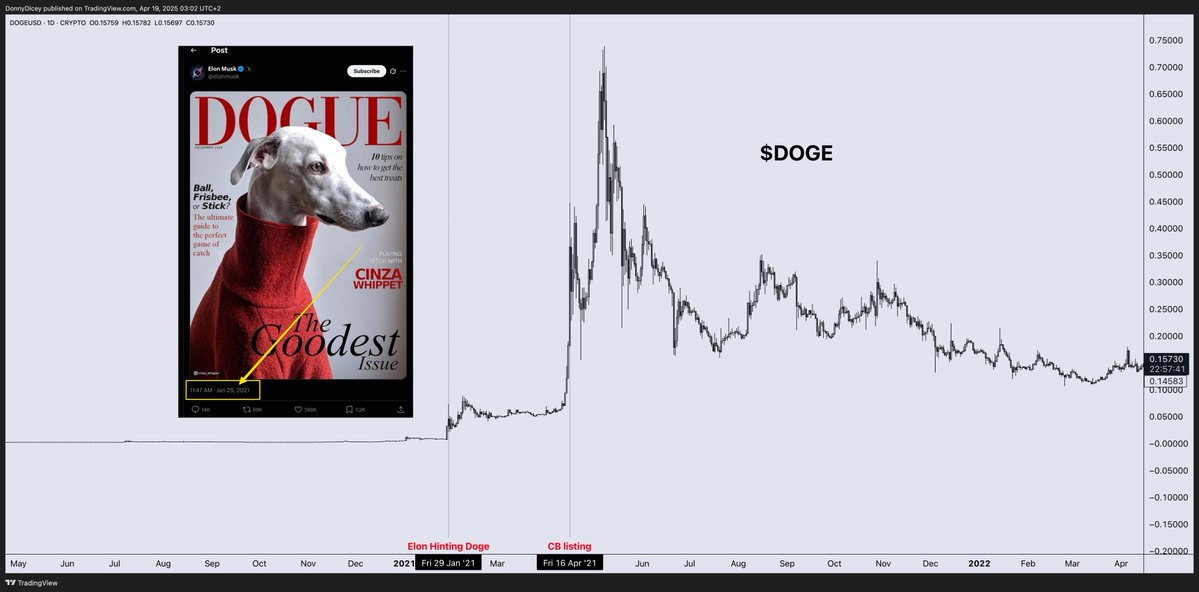

Dogecoin in 2021.

Fartcoin in 2025.

The narrative is stupid-simple — and that’s why it works.

Instantly understood phrases:

Hot Air Arises 💨

Farts go up 💨

You don’t have to explain the joke. That’s the point.

It's cross-cultural, cross-generational, and impossible to forget — whether it's hated on or loved.

Animal memes suffer from token dilution (more on this soon), and often have to be explained to understand the joke — which leads to indecision and confusion comparing to other similar tokens, again, spreading liquidity across many options.

Fartcoin is the essence of memecoin market — ridiculous, funny, triggering and the number keeps going up.

This is why it has the highest mindshare capacity of any token of this cycle.

When retail floods in, they ask what’s funny, what’s pumping — and what makes sense immediately.

Fartcoin.

5/13 The “Bid Concentration” effect:

Derivatives dilute all narratives.

But not Fartcoin. There’s only one — and maybe one other tightly linked derivative that trades 1:1 with it as a lower-cap beta. Think of it as a levered expression of the same bid.

That means when retail comes in… there’s only one or two buttons to push.

Just like Dogecoin — the first and only meme with real dominance at the time — and a single, closely tied beta (Shiba Inu) that traded as a lower-cap reflection.

But even Doge wasn’t fully derivative-proof as we can see many animal derivatives this cycle.

Not this. Every other spin off of this fart narrative is too vulgar to capture mass mindshare.

6/13 People are tired of rotating:

They don’t want to chase the next frog, cat, horse, political meme, ai agent, layer 1, RWA, you name it.

They want to buy, hold, and ride a bid with staying power.

Fartcoin is simple. The name is sticky. Instantly funny.

It’s the “HODL” coin for the next large influx of retail.

In a rotation-heavy market, that matters more than ever — and it’s arguably the most important reason this has a real shot at breaking the deca-billion barrier.

7/13 They laughed at Doge — they mocked Fartcoin:

On live TV.

On CNBC.

This was very reminiscent of Doge in Jan 2021 — before the Coinbase listing (April 16th), before the real run.

Fartcoin hit $2.7B and they clowned it on-air — "We've reached the Fartcoin stage of the market."

And just like that — they gave it mainstream legitimacy and planted the seed in everyones mind during a high attention period (not the cycle top yet).

At the January highs, it was the most mentioned coin by anyone in the space and retail chasing the highs, along with $BTC and $Trump.

Passing those same highs will blow this narrative up — and we've gone over the charts indicating this is a likely outcome.

1.) https://youtube.com/watch?v=KSeVfHphNlQ

2.) https://cnbc.com/2021/04/16/dogecoin-doge-price-meme-cryptocurrencys-rise-sparks-bubble-fears.html

3.) https://cnbc.com/2025/01/21/david-einhorn-says-we-have-reached-the-fartcoin-stage-of-the-market-cycle.html

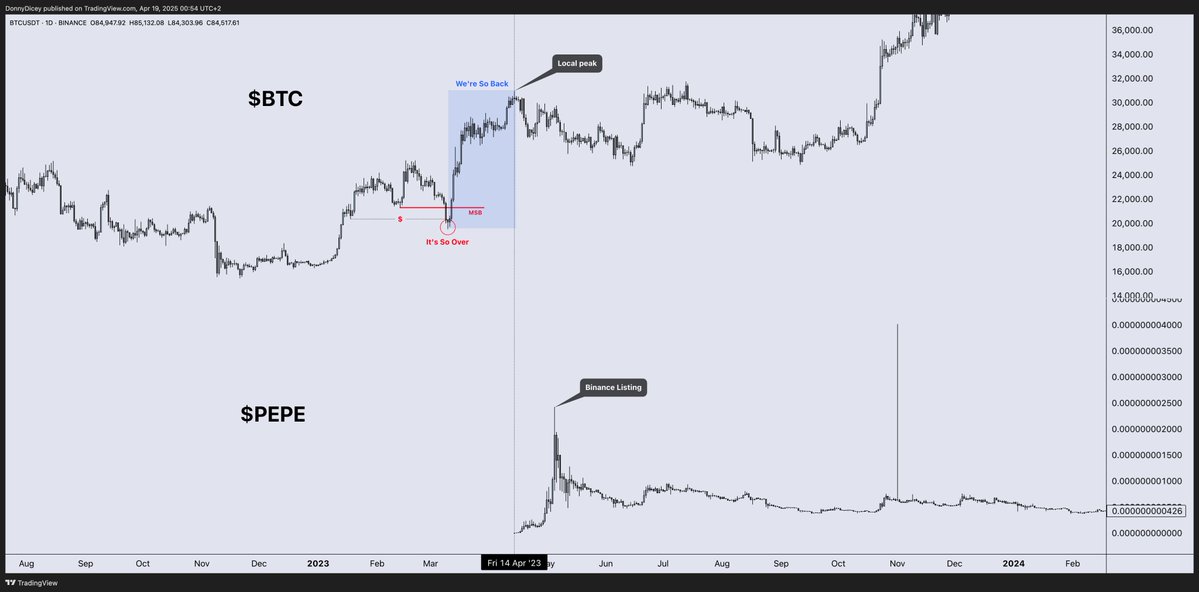

8/13 Comparison to $PEPE:

This cycle’s standout meme performer has been $PEPE.

Launched in April 2023 — right at the peak of a BTC rally — when the market had just avoided a drawdown back to bear market lows and optimism was renewed to a high level.

Pepe ripped immediately, peaking during its Binance spot listing on May 5, hitting a $1.85B market cap before entering a long digestion phase.

That consolidation lasted until BTC reignited in Q1 2024, rallying to $74K — and Pepe followed with another monster leg, sparking the "Memecoin SuperCycle" narrative.

Now look at the current setup in comparison.

Fartcoin hit an attention climax in January — live TV cope.

But, the broader market turned risk-off right after.

Now we’re in the wait phase.

The broader market is setting up another leg higher.

And Fartcoin is positioned better than Pepe was back then.

History doesn’t repeat… but it might just fart 💨

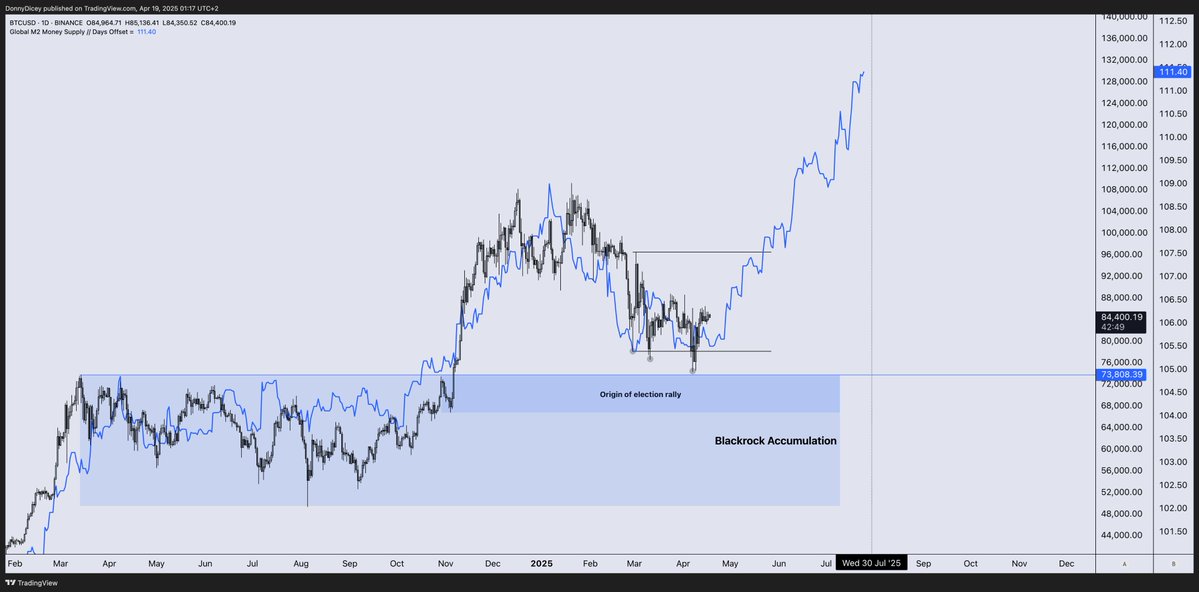

9/13 Where is our cycle headed though?

Expansion.

BTC is forming an accumulation structure above a critical demand zone — in the face of a broader liquidity cycle unfolding.

All central banks and their economies are looking to ease financial conditions and the DXY is about to trend towards 90 — unlocking the leg-room needed.

My full macro breakdown is here if you want to read:

https://x.com/DonnyDicey/status/1908703847465574765

10/13 Tier 1 Listings Still Untapped:

Major catalysts remain on the table.

Fartcoin isn’t listed on Binance, Coinbase, or Bybit — yet it’s consistently pulling hundreds of millions in trading volume, ranking among the most traded tokens daily.

That’s rare.

Most tokens need Tier 1s to get volume.

Exchanges love that.

They profit from it.

Timing is everything to amplify the upside momentum.

11/13 Cope = Fuel

Every cycle, the same critics show up:

“This is stupid.”

“Crypto needs real tech.”

“Why is this going up?”

But they always miss one thing:

Crypto is culture above all.

People don’t come here just for tech.

They come for energy. For fun. For gambling/speculating in a fast paced market. For something they can feel. Being a part of a community and feeling that rush of Euphoria when something so stupid ends up working.

And when something is funny, simple, and everywhere — they buy it, even if they don’t want to admit it.

That’s why Doge worked.

That’s why Pepe worked.

Things like SafeMoon from last cycle — outright scam, still went to the billions.

And that’s why Fartcoin can pull off something crazy.

When this market is beaming hot, these types of tokens catch fire.

The more people complain, the more attention it gets.

And in memecoins, attention and community is the asset.

Cope is just another form of engagement.

And engagement sends price higher.

12/13 Dubious speculation:

This meme is right up Elon’s alley (pun fully intended).

He could send this token to astronomical highs.

He commented with the 💨 :dash emoji on a viral post involving a statue where someone was working rear-end on the rear end.

Given Elon’s history with Doge and other memecoins like Floki, don’t rule out a mention if this token starts to move fast and the market gets boiling hot.

This might be the moment the dash emoji 💨 gets rebranded as the official fart emoji.

13/13 Final thoughts:

I put way too many hours into preparing this one guys. If you've enjoyed it and want broader market analysis + Fartcoin alpha, drop me a follow.

———

If crypto goes up here, Fartcoin has good chances to stick the landing (10b+).

It’s showing strength vs BTC and strength vs SOL when the market is still finding a bottom.

It’s derivative-proof, mindshare capacity is enormous, and still not listed on Tier 1 exchanges.

Volume is insane. Leading the market off the lows. Building momentum.

Some will laugh.

Some will cope.

But farts inevitably go up 💨

The author believes ETH has bottomed in the $1,500–$2,000 range, mirroring their earlier successful BTC bottom call. With BTC dominance peaking, DXY weakening, and sentiment low, ETH is seen as undervalued late in the cycle. The setup suggests ETH could reclaim $4,000, offering a strong risk-adjusted opportunity.

Astronomer/18 hours ago

A hacker stole 3,520 BTC (~$330M) from an OG Bitcoin holder and rapidly swapped it for Monero (XMR), triggering a 50% price surge. The thief used KuCoin and MEXC to make hundreds of small, high-fee swaps. Experts believe the victim lacked proper security, highlighting risks for legacy crypto holders.

Neel (Crypto Jargon)/18 hours ago

Bitcoins price has once again intersected with the average miner cost of production—a historically reliable indicator of a market bottom. Each past intersection has preceded major price rallies. With current breakeven costs near $60K, analysts expect a significant move up before the end of Q2.

Mitchell/18 hours ago

This week looks interesting with earnings reports from Meta, Amazon, and Apple, alongside crucial PCE inflation and labor market data. The trader plans to de-risk their swing long trade from $77k by taking profits in the current range. Key liquidity levels to watch are $96.8k (main) and $90k (important). The outlook suggests the potential for a third leg up toward $97k, followed by a possible retest of the 4H50EMA as support.

CrypNuevo/2 days ago

Strategy is reshaping Bitcoins scarcity with massive acquisitions, effectively halving Bitcoin supply through balance sheet firepower. By consistently absorbing up to 50% of newly mined BTC, theyre artificially creating a halving, driving Bitcoin’s scarcity ahead of schedule. This will set the global cost of Bitcoin, where access will require paying premiums, and borrowing will be a luxury for the wealthy or nations. Strategy is positioning itself as the dominant financial superpower in the Bitcoin space.

Adam Livingston/2 days ago

The next Altseason may not come from the U.S. but from Japan. While the FED cant inject liquidity, Japans looming QE program could be the catalyst for a crypto rally. After rising bond yields and a strengthening Yen, Japan may devalue its currency and pump liquidity into the market, benefiting crypto assets. With China already injecting liquidity, Japans move will likely drive altcoins higher, just as it did in 2008.

Axel Bitblaze/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link