Japan Could Spark the Next Altseason with QE

Axel Bitblaze

Axel Bitblaze

Everyone's talking about the FED... but I think the real liquidity catalyst is coming from Japan.

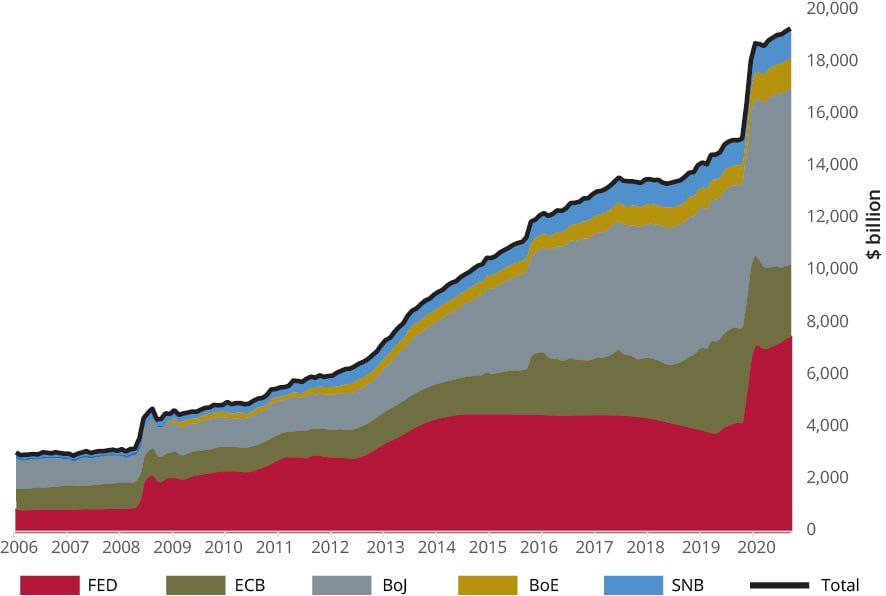

China already started printing. Now Japan's lining up its biggest QE since 2020

This could be the fuel $ETH and ALTS have been waiting for. Let me break it down. A thread: 🧵

Every Altseason needs one of these 2 things: a QE program or the FED stopping QT

This cycle, we have experienced neither so far, and this is why alts are underperforming.

But why is QE needed for an Altseason?

During a QE program, central banks (like the FED) buy assets like T-bills from banks and other financial institutions.

To buy these assets, the FED creates money electronically, basically out of thin air.

So, when the FED buys assets, it credits cash to banks and other financial institutions from whom they're buying assets.

This boosts bank reserves, which are then used to lend to businesses and consumers or invest in other assets.

Also, when the FED buys T-bills, it increases demand for bonds, which results in lower bond yields, thus lowering the borrowing cost.

Excess liquidity in the system + lower bond yields = risk-on assets go up.

This is why alts go up rapidly during QE, which most of us witnessed during the 2020–21 cycle.

But when is the next QE happening?

As I have already said before, the FED can't do QE at this moment, and there are a few reasons for it:

Rising bond yields

Risk of rising inflation due to ongoing tariffs

The FED has already said before that until the interest rate goes towards zero, they won't start the QE program.

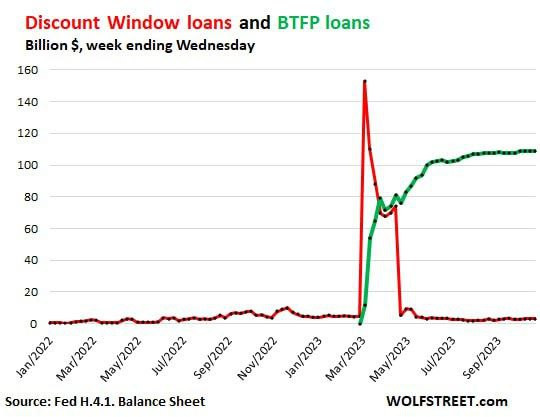

The FED could definitely inject some liquidity similar to the 2023 banking crisis, but it won't be enough for an Altseason.

So, who's going to save the day for Altcoin holders?

I think it's going to be Japan.

A few weeks ago, I wrote a thread about Asia paving the way for the next bull run through their liquidity injection.

Since then, China has already injected 500 billion Yuan into money markets.

But now, Japan could even outdo China.

https://x.com/Axel_bitblaze69/status/1910400121864433935

Right now, there are 2 things that are happening in Japan 👇

Japan's bond-yield is rising

The Japanese Yen is strengthening

And both of these are bad for Japan.

For a very long period of time, Japan had maintained zero or negative interest rates.

Due to that, investors were borrowing yen for free and using it to purchase assets.

With bond yields rising, they are now dumping assets and swapping back into yen.

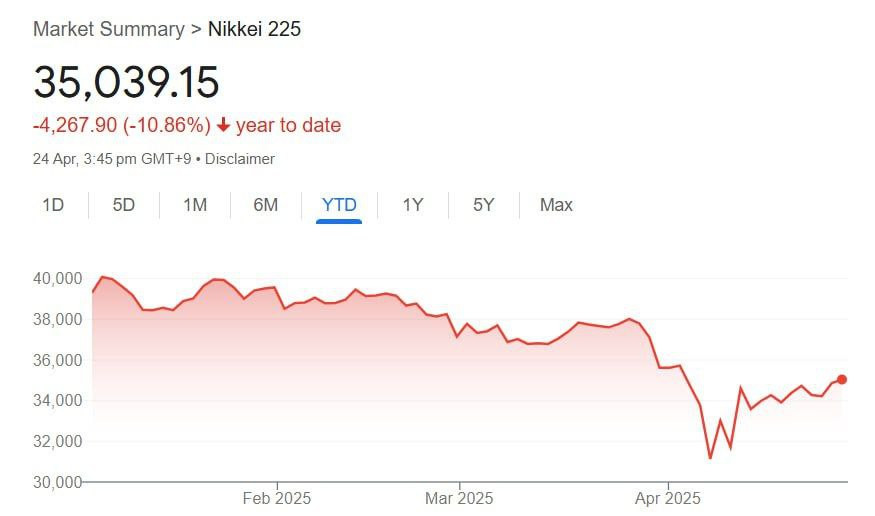

This is why the NIKKEI is down 10% YTD, causing the Japan stock market crash.

If talking about the Yen, a stronger yen is making exports harder for Japan.

Adding US tariffs on top of it, Japan is currently in a very bad situation.

So, what's the solution for it?

Devaluing the Yen.

This won't be the first time the BOJ will devalue the Yen, and it will certainly not be the last.

But how will they devalue the Yen?

The simple answer is QE, but I think Japan could do something more complex, so stay with me.

This all started back during the 2007-08 financial crisis.

During that timeframe, Japan printed a lot of Yen, thus devaluing its currency.

After that, they swapped Yen for USD in forex markets, thus devaluing it even more.

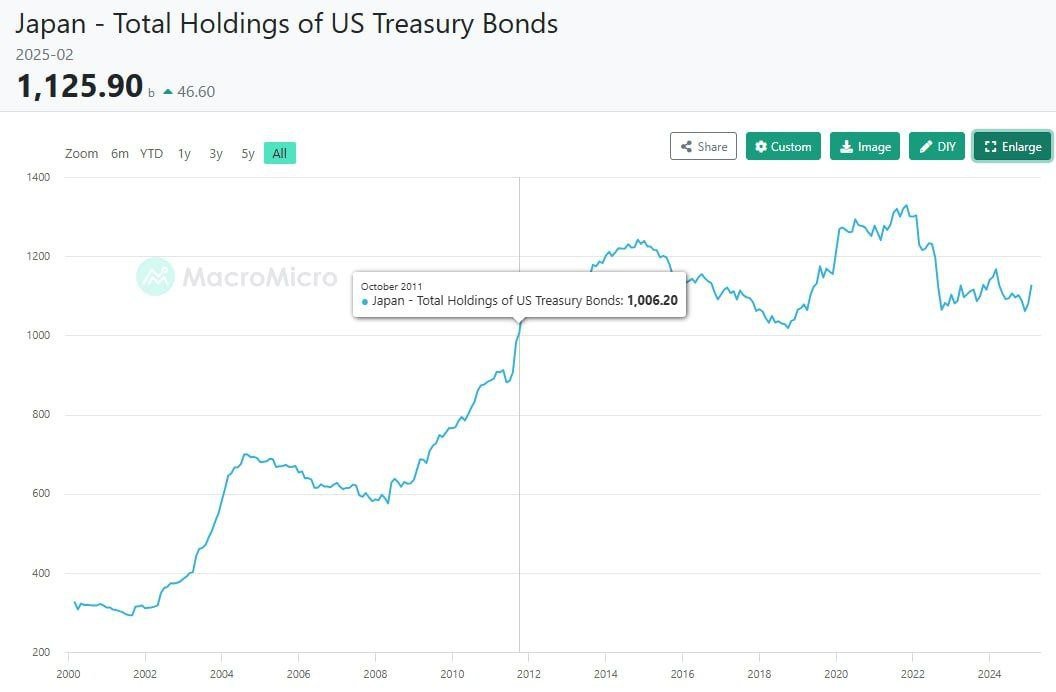

With USD, Japan started the purchase of T-bills aggressively.

This is why Japan's T-bills holdings grew from $588B in 2008 to $1T in 2011.

This consistent buying of T-bills drove yields down from 4% in 2008 to below 2% in 2011.

And how did it help Japan?

Through T-bill buying, it provided excess cash into the US banking system and also lowered yields.

Both of these factors led to more consumption, which is why Japan's exports to the US increased by 35% from 2009 to 2011.

And this time, something similar will happen.

Two weeks ago, it was reported that Japan's finance minister will meet with the Treasury Secretary to discuss foreign exchange issues.

I think very soon, Japan's intervention to devalue the Yen will start.

And what'll happen after that?

Japan's exports will go up

More liquidity will enter the US banking system

Bond yields will go down

This will be a win-win for both the US and Japan.

And most importantly, it'll pump the crypto markets.

Do you think Japan's investment conglomerate SoftBank is entering the Bitcoin space without any reason?

It's partnering up with United States Secretary of Commerce Howard Lutnick's son and Tether to back a $3B Bitcoin fund.

I also think it's the same reason Trump said the other day that he's not thinking of firing Powell.

Trump knows that yields could be brought down in a different way too.

Overall, apart from China, Japan will also be good for our bags, especially alts.

My Final Thoughts:

I know we all are waiting for an Altseason similar to 2021, and it needs a lot of liquidity.

There are 1000x more tokens than in the 2021 cycle, so without QE, an Altseason won't happen.

China has already started QE, and I think Japan will most likely start from the beginning of Q3.

This will be the return of alts, where they will outperform BTC for a few months, possibly till November/December 2025.

The author believes ETH has bottomed in the $1,500–$2,000 range, mirroring their earlier successful BTC bottom call. With BTC dominance peaking, DXY weakening, and sentiment low, ETH is seen as undervalued late in the cycle. The setup suggests ETH could reclaim $4,000, offering a strong risk-adjusted opportunity.

Astronomer/20 hours ago

A hacker stole 3,520 BTC (~$330M) from an OG Bitcoin holder and rapidly swapped it for Monero (XMR), triggering a 50% price surge. The thief used KuCoin and MEXC to make hundreds of small, high-fee swaps. Experts believe the victim lacked proper security, highlighting risks for legacy crypto holders.

Neel (Crypto Jargon)/20 hours ago

Bitcoins price has once again intersected with the average miner cost of production—a historically reliable indicator of a market bottom. Each past intersection has preceded major price rallies. With current breakeven costs near $60K, analysts expect a significant move up before the end of Q2.

Mitchell/20 hours ago

This week looks interesting with earnings reports from Meta, Amazon, and Apple, alongside crucial PCE inflation and labor market data. The trader plans to de-risk their swing long trade from $77k by taking profits in the current range. Key liquidity levels to watch are $96.8k (main) and $90k (important). The outlook suggests the potential for a third leg up toward $97k, followed by a possible retest of the 4H50EMA as support.

CrypNuevo/2 days ago

Strategy is reshaping Bitcoins scarcity with massive acquisitions, effectively halving Bitcoin supply through balance sheet firepower. By consistently absorbing up to 50% of newly mined BTC, theyre artificially creating a halving, driving Bitcoin’s scarcity ahead of schedule. This will set the global cost of Bitcoin, where access will require paying premiums, and borrowing will be a luxury for the wealthy or nations. Strategy is positioning itself as the dominant financial superpower in the Bitcoin space.

Adam Livingston/2 days ago

Ray Dalio, the worlds top investor, turned $0 into $14 billion in 9 years. He predicted the 2008 crisis and is now forecasting an even worse economic situation ahead. Dalio advises investing in Bitcoin due to its potential and warns of a deeper financial crisis. He emphasizes the importance of investing in real assets, especially as inflation and debt disrupt markets. Dalios strategy includes focusing on AI and real dollars over nominal growth.

Tracer/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link