Memecoin Tips: How to Spot Hidden Movements in the Market

lynk

lynk

Here are some simple tips about memecoins, pay attention

🧵👇

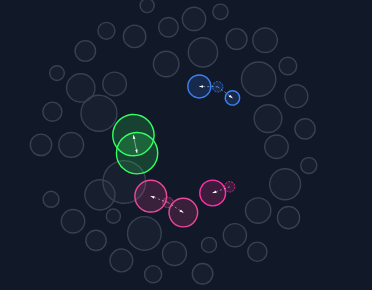

1. Bubblemaps can help, but don’t fully trust them.

They only show wallets still holding supply.

If someone had 20% and moved it to other wallets, the original wallet disappears.

That means you won’t see the connections anymore.

Also, if all bubbles are the same size, it usually means the supply was split evenly.

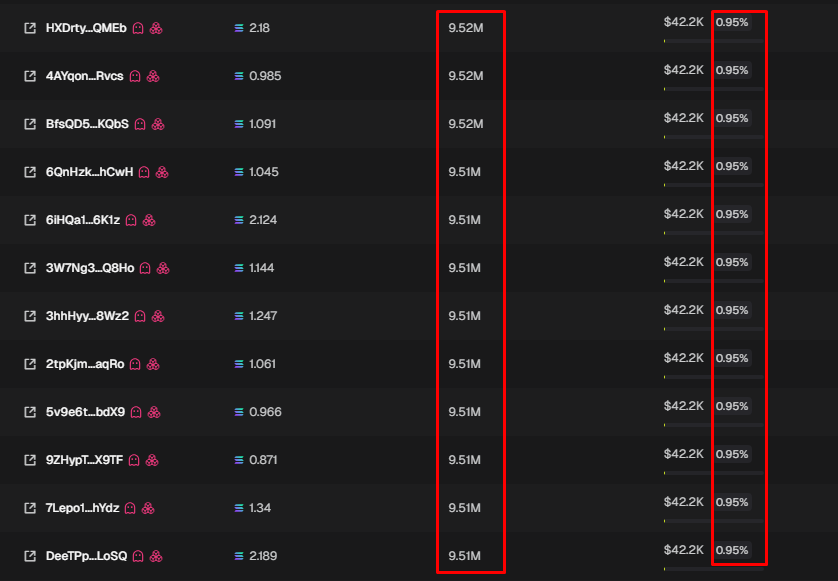

2. So, instead of just using the bubblemap — check the wallets directly.

When supply is spread, it’s often split equally between wallets.

You’ll notice multiple wallets holding the exact same amount.

That’s usually a sign they’re all linked.

See the example below. ⬇️

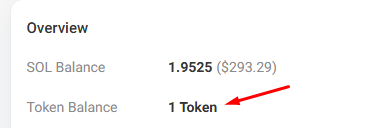

3. Supply-control

Some projects split a big chunk of the supply across many wallet, often team wallets,to control price movement.

If people sell, the price won’t drop much if these wallets still hold most of the supply.

If people buy, and those wallets don’t sell, it’s easier for the coin to go up.

These wallets usually hold 1 to 3 tokens each. They aren’t meant for trading — just for holding.

This can be good or bad depending on the team

4. Chart Snipes

Check the chart on a 1-minute or 15-second candle.

If it starts with one big green candle, it usually means a huge part of the supply was sniped right at launch.

Most times, it’s 1 or 2 wallets grabbing a large chunk, then spreading it out to others.

That main wallet might not show on bubblemap anymore, because it sold everything.

And since it’s empty, you won’t see which wallets are connected.

The author believes ETH has bottomed in the $1,500–$2,000 range, mirroring their earlier successful BTC bottom call. With BTC dominance peaking, DXY weakening, and sentiment low, ETH is seen as undervalued late in the cycle. The setup suggests ETH could reclaim $4,000, offering a strong risk-adjusted opportunity.

Astronomer/18 hours ago

A hacker stole 3,520 BTC (~$330M) from an OG Bitcoin holder and rapidly swapped it for Monero (XMR), triggering a 50% price surge. The thief used KuCoin and MEXC to make hundreds of small, high-fee swaps. Experts believe the victim lacked proper security, highlighting risks for legacy crypto holders.

Neel (Crypto Jargon)/18 hours ago

Bitcoins price has once again intersected with the average miner cost of production—a historically reliable indicator of a market bottom. Each past intersection has preceded major price rallies. With current breakeven costs near $60K, analysts expect a significant move up before the end of Q2.

Mitchell/18 hours ago

This week looks interesting with earnings reports from Meta, Amazon, and Apple, alongside crucial PCE inflation and labor market data. The trader plans to de-risk their swing long trade from $77k by taking profits in the current range. Key liquidity levels to watch are $96.8k (main) and $90k (important). The outlook suggests the potential for a third leg up toward $97k, followed by a possible retest of the 4H50EMA as support.

CrypNuevo/2 days ago

Strategy is reshaping Bitcoins scarcity with massive acquisitions, effectively halving Bitcoin supply through balance sheet firepower. By consistently absorbing up to 50% of newly mined BTC, theyre artificially creating a halving, driving Bitcoin’s scarcity ahead of schedule. This will set the global cost of Bitcoin, where access will require paying premiums, and borrowing will be a luxury for the wealthy or nations. Strategy is positioning itself as the dominant financial superpower in the Bitcoin space.

Adam Livingston/2 days ago

The next Altseason may not come from the U.S. but from Japan. While the FED cant inject liquidity, Japans looming QE program could be the catalyst for a crypto rally. After rising bond yields and a strengthening Yen, Japan may devalue its currency and pump liquidity into the market, benefiting crypto assets. With China already injecting liquidity, Japans move will likely drive altcoins higher, just as it did in 2008.

Axel Bitblaze/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link