Ray Dalios Predictions and Crypto Bets: What You Need to Know

Tracer

Tracer

This is Ray Dalio, best investor in world...

he turned $0 in $14,000,000,000 in 9 years

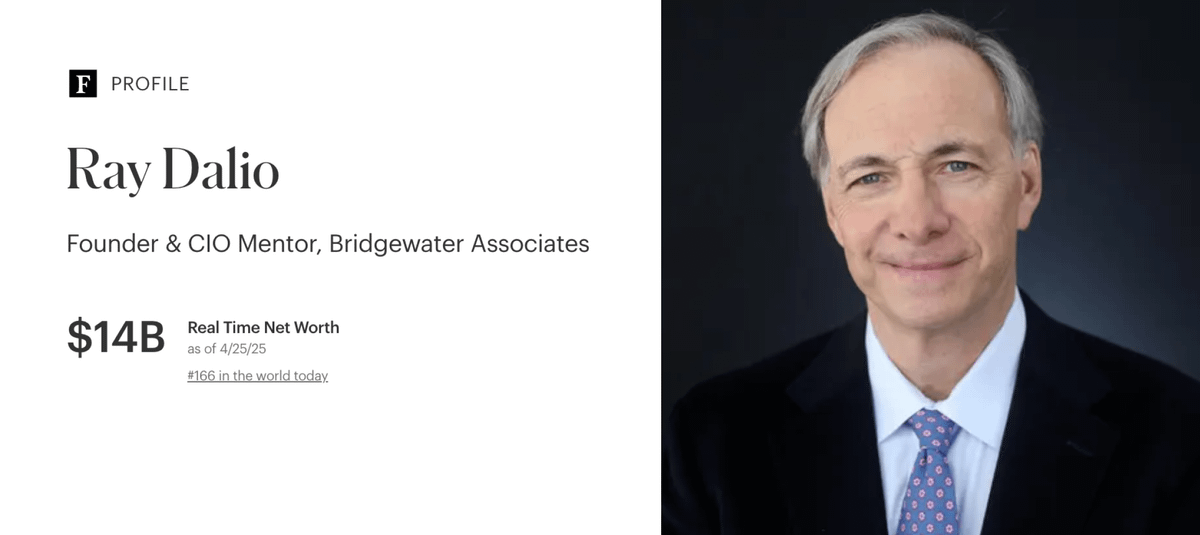

Forbes ranked him as #1 investor in the world...

here's his strategy, China insides, 5 crypto predictions and bets 🧵👇

(#4 will make u millions)

✜ Billionaire, precise analyst and truly a LEGENDARY figure in the world of finance - all of this describes Ray Dalio

✜ He is known for his talent in predicting economic trends

✜ His thoughts and advice always perfectly describe the future state of affairs - and this time is no exception

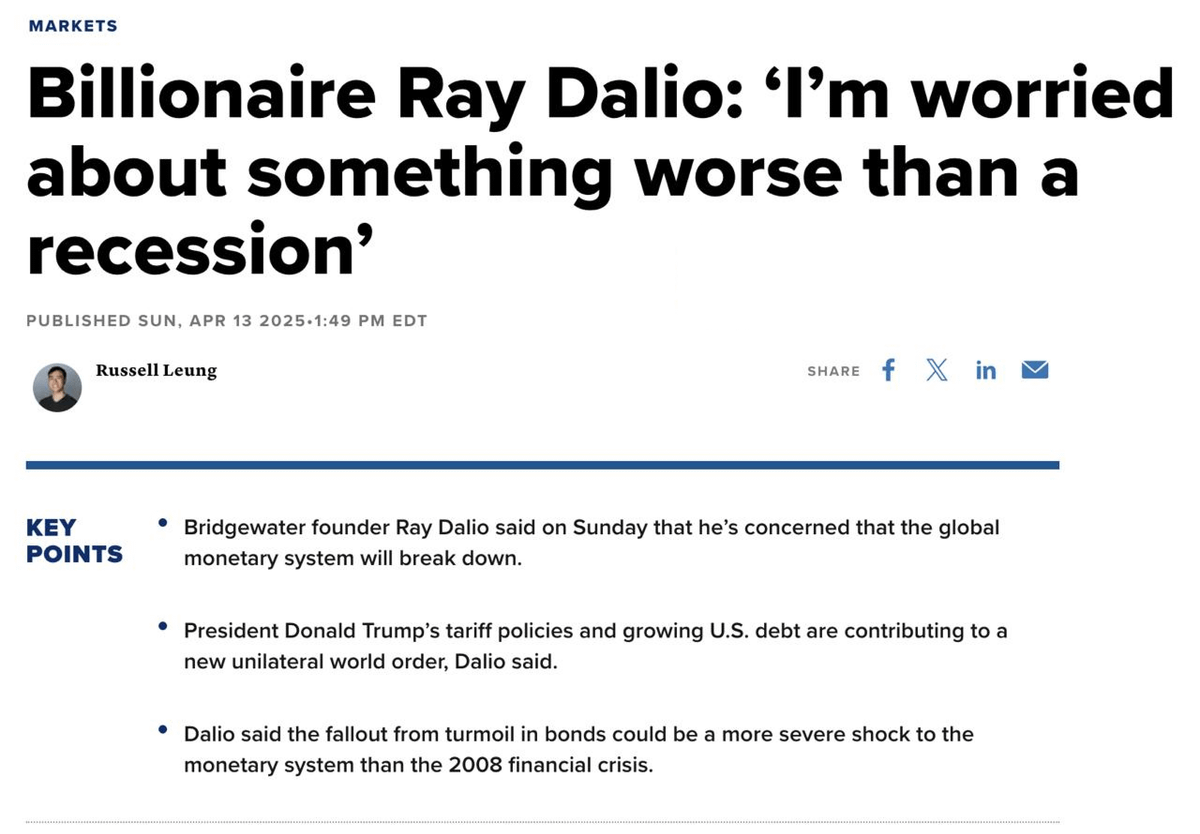

✜ In 2008 he predicted the crisis and made BILLIONS from it - now he’s doing the same with the tariff war

✜ Recently, he released a whole article dedicated to this, where he described his opinion in detail

✜ The article mentions both the positive and negative scenarios for the markets

✜ A bit earlier, he expressed the opinion that the markets are heading toward something worse than a recession - a deep crisis

✜ US tariffs against China are just a symptom of deeper problems

✜ But this will be the perfect time for Ray Dalio to multiply his capital by several BILLIONS - but it all started small:

✜ Born to a jazz musician and a housewife in Queens, New York

✜ In school, he didn’t do very well and wasn’t a model student

✜ But despite all this, he succeeded in investing from an early age

✜ As a teenager, he worked as a golf caddy, where he got investment tips

✜ His first stocks were shares of Northeastern Airlines, bought for $300

✜ Even before entering college, his portfolio was worth several thousand dollars

✜ After working at several companies, in 1975 he founded his own firm - Bridgewater Association

✜ Believe it or not, his apartment was the first office - everyone starts small

✜ Now we know this company as the largest hedge fund in the WORLD

✜ Now Ray Dalio denies himself nothing - all because he once took the risk to start his business

✜ His fund manages $112B in assets and plans to invest in $BTC

✜ The advice and opinions of such successful people are clearly worth considering:

✜ Ray Dalio directly urges EVERYONE to actively invest in $BTC due to its great potential

✜ If you ever doubted buying it - please, your doubts should clearly disappear

✜ If such major institutions believe in $BTC - you have no reason not to believe

✜ In the near future, he foresees the collapse of the monetary system and complete political upheaval

✜ Based on this, we can easily see a crisis worse than a recession

✜ Because of this, inflation, debt supply disruptions and extreme market volatility are possible

✜ In current times of market difficulty, it’s important to understand where to store wealth during devaluation

✜ Bonds have long since lost their function in this respect - it’s worth looking into $BTC

✜ Real estate also isn’t a great option since it’s heavily taxed

✜ In one of his interviews, he also emphasized the importance of AI technology - which is the root of the US-China war

✜ This technology is something about the future and the beyond-imaginable

✜ In fact, this can be interpreted as a direct call to reevaluate promising AI projects

✜ His latest and quite relevant advice - evaluate income in real dollars, not nominal ones

✜ People see the market growing and rejoice but don’t realize that everything is measured in dollars and the dollar is depreciating

✜ What you can buy with those dollars - that’s real profitability

The author believes ETH has bottomed in the $1,500–$2,000 range, mirroring their earlier successful BTC bottom call. With BTC dominance peaking, DXY weakening, and sentiment low, ETH is seen as undervalued late in the cycle. The setup suggests ETH could reclaim $4,000, offering a strong risk-adjusted opportunity.

Astronomer/19 hours ago

A hacker stole 3,520 BTC (~$330M) from an OG Bitcoin holder and rapidly swapped it for Monero (XMR), triggering a 50% price surge. The thief used KuCoin and MEXC to make hundreds of small, high-fee swaps. Experts believe the victim lacked proper security, highlighting risks for legacy crypto holders.

Neel (Crypto Jargon)/19 hours ago

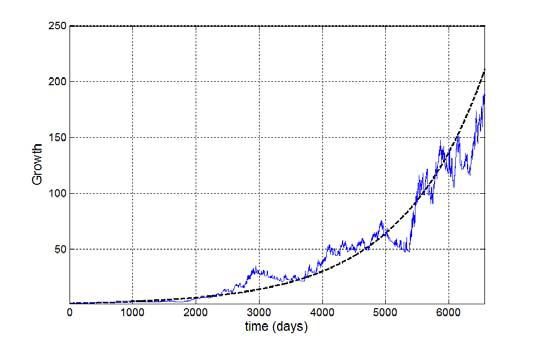

Bitcoins price has once again intersected with the average miner cost of production—a historically reliable indicator of a market bottom. Each past intersection has preceded major price rallies. With current breakeven costs near $60K, analysts expect a significant move up before the end of Q2.

Mitchell/19 hours ago

This week looks interesting with earnings reports from Meta, Amazon, and Apple, alongside crucial PCE inflation and labor market data. The trader plans to de-risk their swing long trade from $77k by taking profits in the current range. Key liquidity levels to watch are $96.8k (main) and $90k (important). The outlook suggests the potential for a third leg up toward $97k, followed by a possible retest of the 4H50EMA as support.

CrypNuevo/2 days ago

Strategy is reshaping Bitcoins scarcity with massive acquisitions, effectively halving Bitcoin supply through balance sheet firepower. By consistently absorbing up to 50% of newly mined BTC, theyre artificially creating a halving, driving Bitcoin’s scarcity ahead of schedule. This will set the global cost of Bitcoin, where access will require paying premiums, and borrowing will be a luxury for the wealthy or nations. Strategy is positioning itself as the dominant financial superpower in the Bitcoin space.

Adam Livingston/2 days ago

The next Altseason may not come from the U.S. but from Japan. While the FED cant inject liquidity, Japans looming QE program could be the catalyst for a crypto rally. After rising bond yields and a strengthening Yen, Japan may devalue its currency and pump liquidity into the market, benefiting crypto assets. With China already injecting liquidity, Japans move will likely drive altcoins higher, just as it did in 2008.

Axel Bitblaze/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link